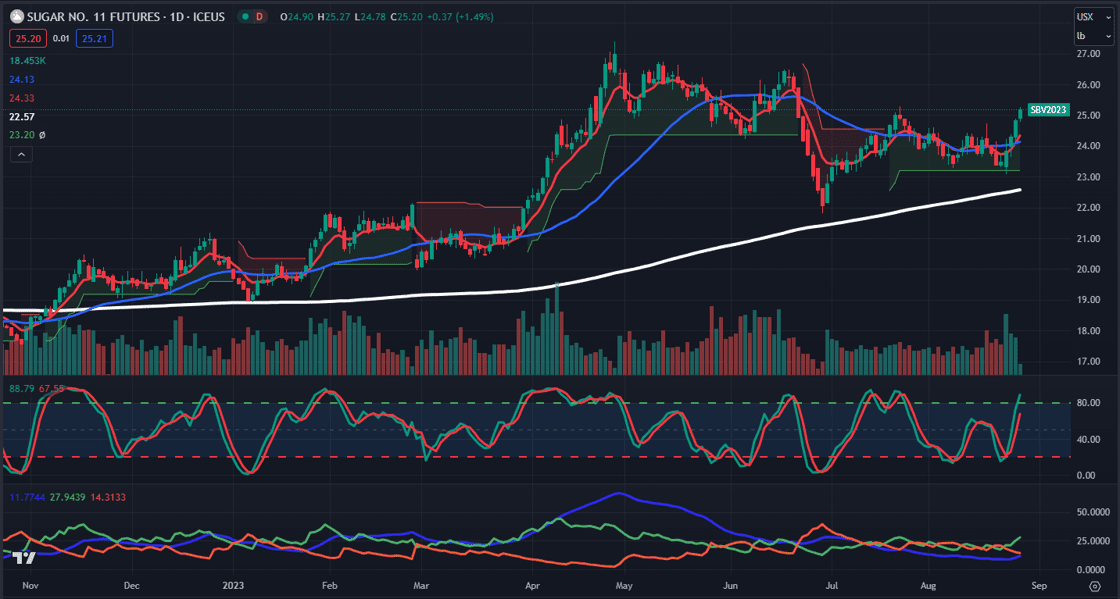

Breakfast Report (week of 8/30)

Posted: Aug. 30, 2023, 8:06 a.m.

|

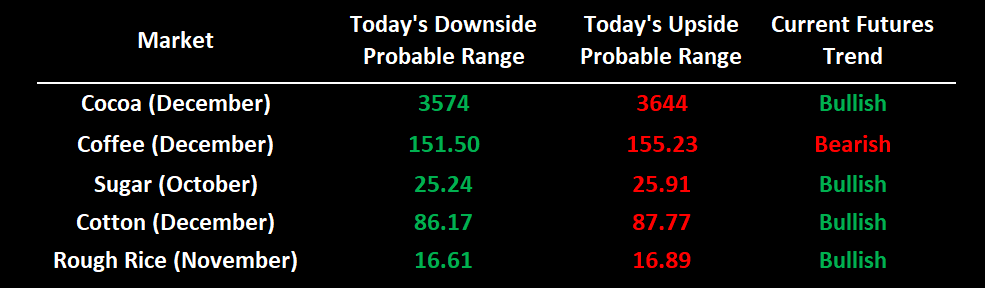

CocoaTechnicals (December)Cocoa futures surge to new contract highs! Cocoa has traded with a Bullish trend since August 17 at 3512. Only a breakdown below 3391 will shift traders to the sidelines. Bias: Bullish/Neutral Previous Session Bias: Bullish/Neutral Resistance: 3625*** Pivot: 3400 Support: 3391**, 3300-3250*** |

|

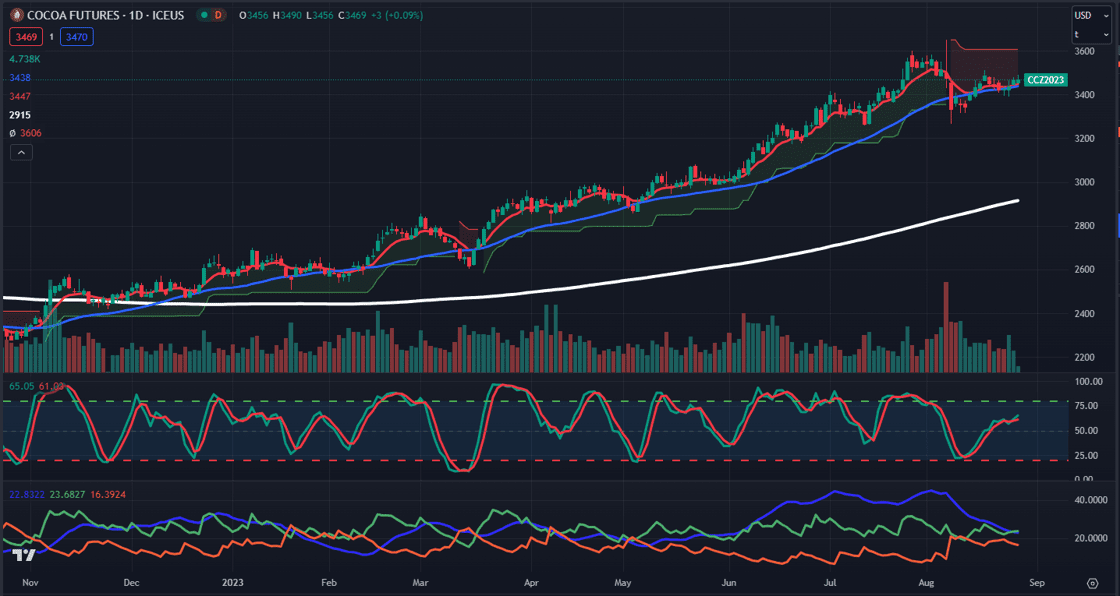

CoffeeTechnicals (December) Coffee futures are starting to grind higher. Only a close above 160.00 switches from a Bearish to a Neutral trend. Overhead resistance at the 200- DMA near 169.33 will also provide headwinds. Bias: Neutral/Bearish Previous Session Bias: Neutral/Bearish Resistance: 160.00**, 163.58**, 165.34-166.00****, 170.50*** Pivot: 150.00 Support: 145.00*** |

|

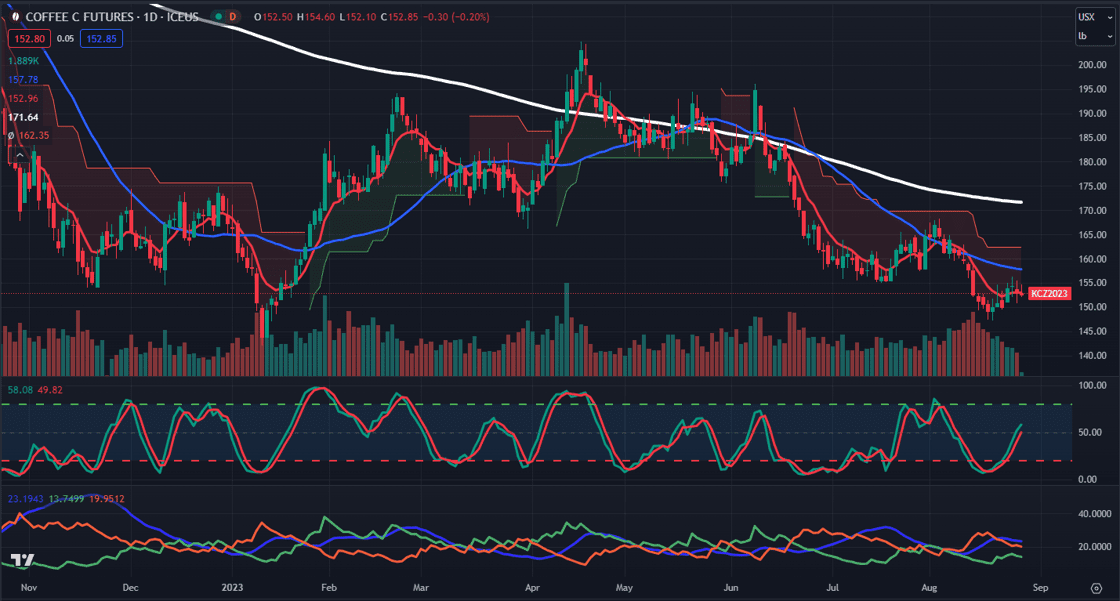

SugarTechnicals (October) Sugar futures ripped higher this week with a clear breakout! The market quickly shifted to a bullish trend on August 28, and only a breakdown below 23.84 will take it back to a neutral trend. Bias: Bullish/Neutral Previous Session Bias: Neutral Resistance: 26.25*** Pivot: 24.50 Support: 23.84*** |

|

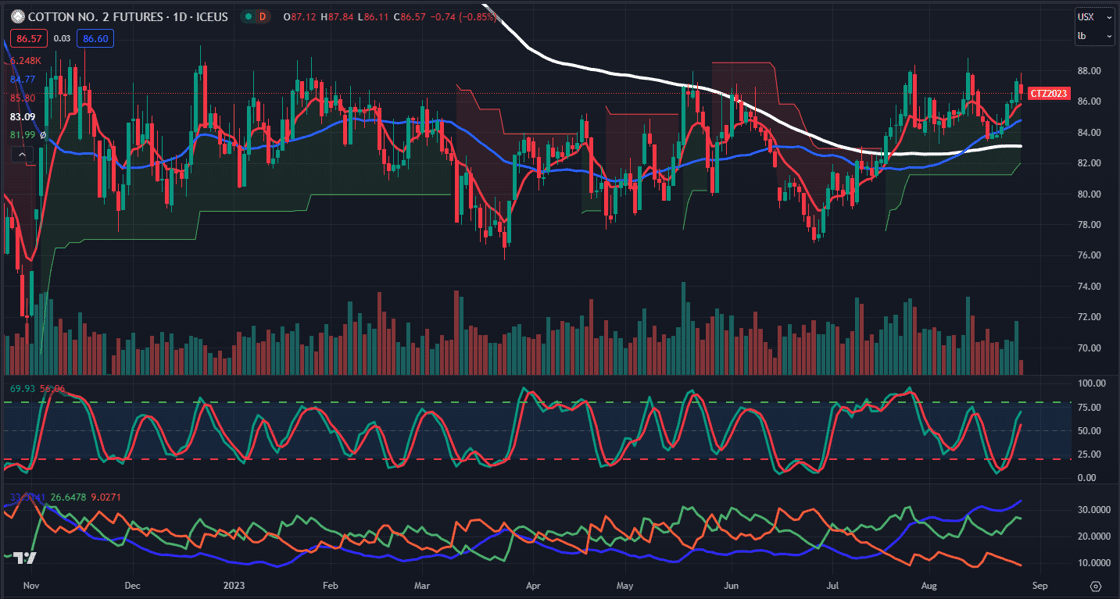

CottonTechnicals (December) Cotton futures continue to regain bullish momentum. Critical support continues to rise to 84.79 and only a close below will shift traders to the sidelines. Cotton futures captured bullish trade momentum on July 19 at 83.75 and promptly traded up to recent contract highs, which were tested again on August 11. Bias: Bullish/Neutral Previous Session Bias: Bullish/Neutral Resistance: 87.50-88.00**, 89.00**** Pivot: 84.79 Support: 82.00-81.90**, 81.67*** |

|

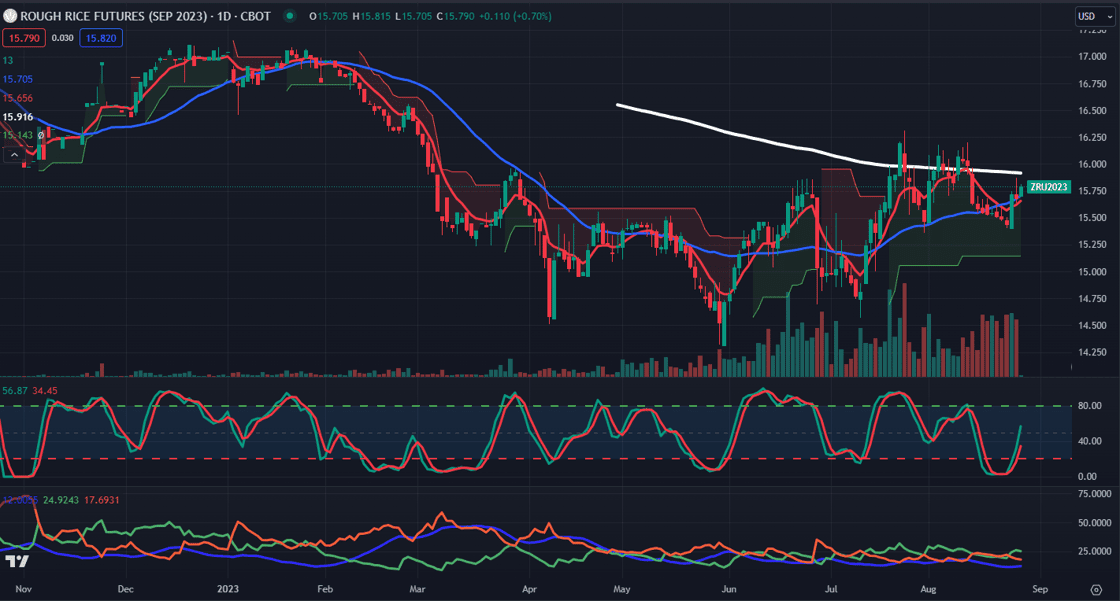

Rough RiceTechnicals (November) Rough Rice futures breakout with support rising to 16.01, where any breach on a closing basis will shift the Bullish trend back to Neutral and could signal a larger washout down to 15.00. Bias: Bullish/Neutral Previous Session Bias: Bullish/Neutral Resistance: 16.31**** Pivot: 16.01 Support: 15.00**, 14.75*** |

|

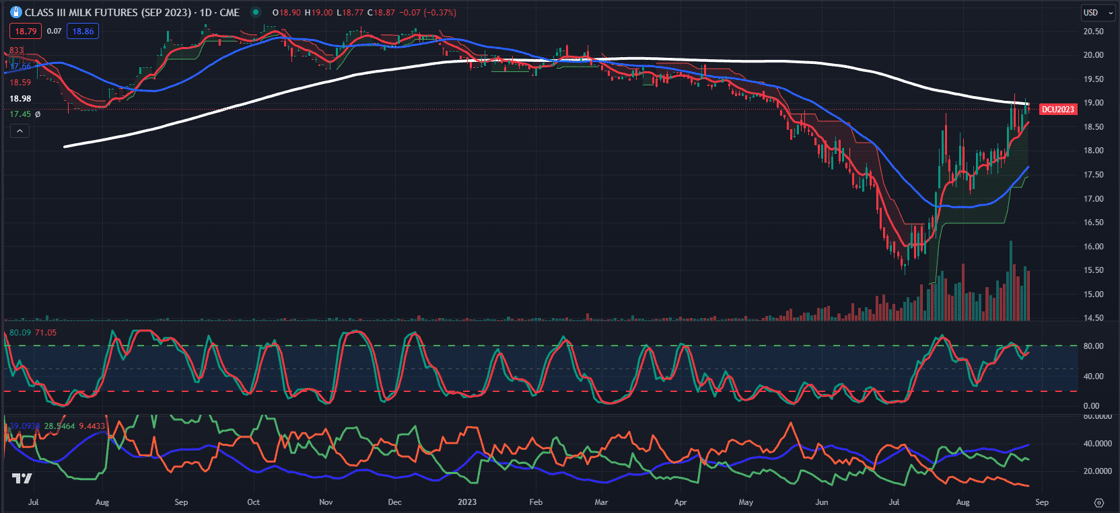

Milk Class IIITechnicals (September) Milk futures have been on a tear since July 21 when our proprietary trend analyzer flipped to a bullish trend at 17.27. Only a close below 17.88 will shift traders to the sidelines. Bias: Bullish/Neutral Previous Session Bias: Bullish/Neutral Resistance: 19.00*** Pivot: 17.88 Support: 17.00** |

|

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial