Introducing CME Event Contracts!

Trading Event Contracts are as simple as making a binary choice: “Yes” or “No”.

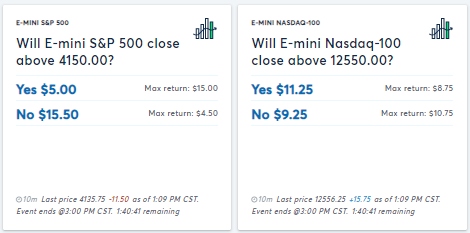

Trade your daily market bias on 10 of the most actively traded futures markets by deciding if you think a

market will close above or below a set price.

For each contract, your max risk and reward range from $0.25 - $19.75. That risk is dependent on where

the market is trading and what the probabilities are of it closing above or below a certain place. To

determine the probability of a “Yes” or “No” position occurring, multiply the cost of the position by 5. As the market moves throughout the day, so will the probabilities.

Tradable Markets

Equity Indices

E-mini S&P (ES), E-mini Nasdaq (NQ), E-mini Russell (RTY), E-mini Dow (YM)

Metals

Gold (GC), Silver (SI), Copper (HG)

Energy

WTI Crude Oil (CL), Natural Gas (NG)

Currencies

Euro/USD (6E)

Trade your prediction

Trade your prediction on whether a market will close above a certain price. Each product has a variety of prices from which you can choose, depending on how bullish or bearish you are on that market.

Choose a side

Choosing a ‘Yes’ or ‘No’ position on a predicted closing price will cost $0.25 - $19.75 to trade. This value will vary throughout the trading day as the likelihood of the product closing above the predicted price changes with market movements. Once you choose a side, you can rest easy knowing what you paid is the most you can lose.

Know what you will earn or lose

You will be credited $20 if your prediction is correct, and $0 if your prediction is incorrect. So, if you paid $13 for a ‘Yes’ position that closed in your favor, your profit would be $7*.

*Less applicable fees and commissions

Understand the probabilities

To determine the probability of a ‘Yes’ or ‘No’ position occurring, just multiply the cost of the position by 5. For example, if you pay $15 to take a ‘Yes’ position on a price prediction, the market is suggesting that there is a 75% chance (5x15) of the product closing above the listed price.