Grain Futures Gain Ground

Posted: Aug. 18, 2023, 7:20 a.m.

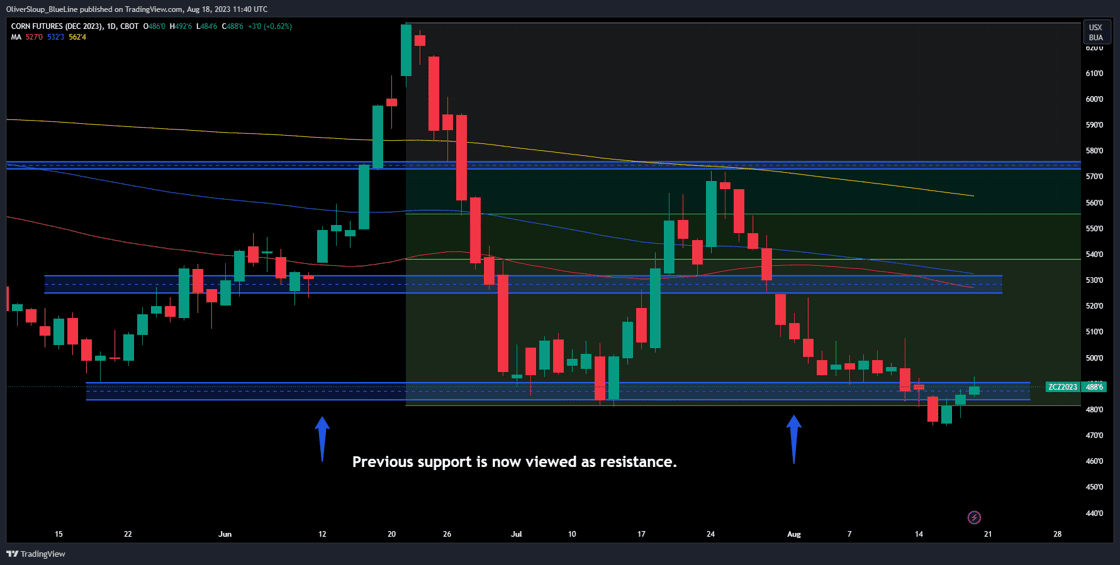

CornTechnicals (December) December corn futures were able to put together another day of gains which has spilled over into overnight and early morning strength. We haven't seen three consecutive days of gains since the middle of June. As mentioned, several times this week, we remain optimistic so long as we can see the market continue to close above 480-482. The upside objective would be closer to the technically and psychologically significant $5.00 level. Volatility is at its lowest levels since May, making options more attractive as a way to gain limited risk long exposure in what would be a counter trend trade. News We will be on the eastern leg of the Pro Farmer Crop Tour next week. Be sure to follow us on YouTube, Twitter, and Facebook for the most up to date information. Bias: Bullish/Neutral Previous Session Bias: Neutral/Bullish Resistance: 502-506 1/2***, 518-525 3/4**** Pivot: 480-482 Support: 472-476** |

|

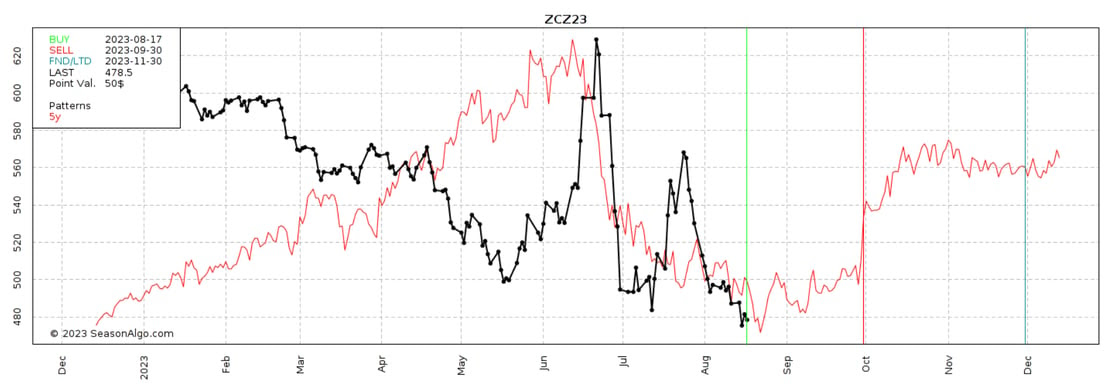

5-Year Average TendenciesOver the last 5-years, this is a time of year where we've seen the corn market attempt to carve out a near term low. Whether or not that plays out this year is still TBD. |

|

Soybeans |

|

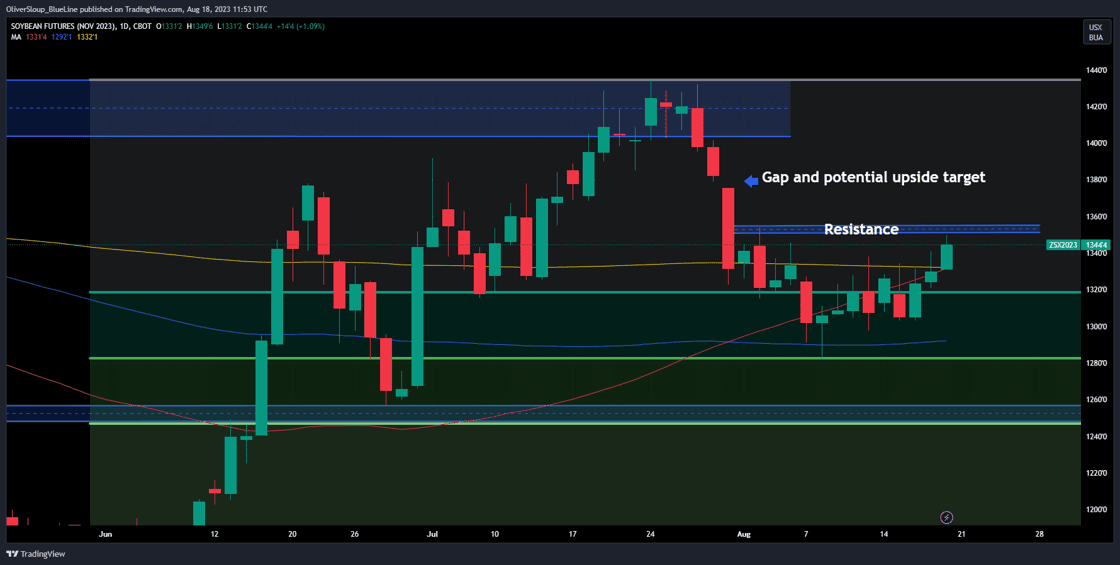

Technicals (November) The market had a nice rally yesterday but finished nearly 11 cents off the high, rejecting last week's highs and the 200-day moving average for the 4th time in 5 sessions. The market has shrugged off yesterday's failure, taking out yesterday's high in the overnight trade which has opened the door for a run at our next resistance pocket, 1350-1355. If the Bulls can chew through this pocket, we could see continued buying take prices back into the July 31st gap, 1375 1/2-1379. We talked about both these levels in recent reports as well yesterday's "2-Minute Drill": Watch Now! News Above normal temperatures coupled with below normal precipitation levels could keep the market firm. The Pro Farmer Crop Tour will hit the road next week. Although it will be too early to get an estimated soybean yield it will give us a better look at the prospects. We will be on the eastern leg of that tour, providing multiple updates a day on our YouTube channel. Bias: Bullish/Neutral Previous Session Bias: Bullish/Neutral Resistance: 1324-1334***, 1350-1355** Pivot: 1291-1300 Support: 1282**, 1256-1260*** |

|

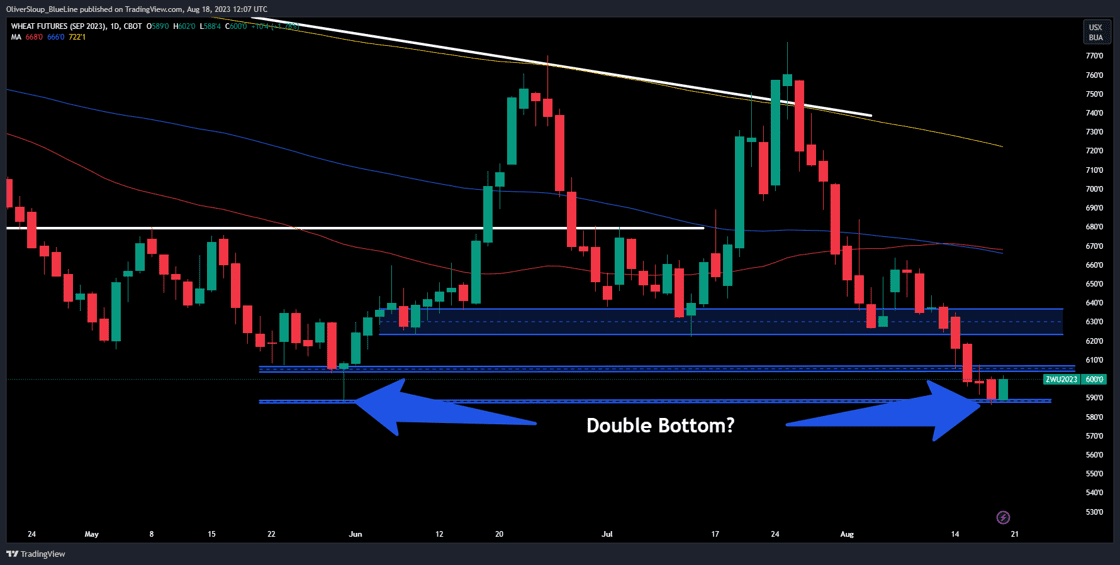

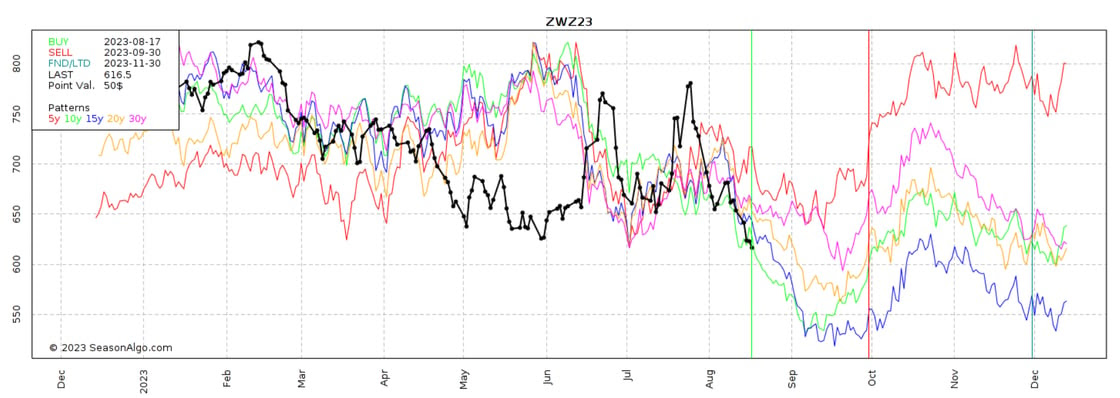

WheatTechnicals (September) We triple checked the quotes this morning to make sure that this is accurate, but wheat is indeed positive in the early morning trade. The market may be trying to attempt a double bottom against the May 31st lows which we talked about all week, that was at 587 3/4. Seasonally this is a bearish time of year, but a decent risk/reward setup may be there for a counter trend trade. If the Bulls can get back out above our pivot pocket from 603-607, we could see an extension back towards 622-632. The US Dollar has been on an unbelievable rally, if that strength starts to stall, perhaps that could act as a tailwind for wheat futures. News India is in talks with Russia to import wheat at a discount to surging global prices in a rare move to boost supplies and curb food inflation ahead of state and national elections next year, according to four sources. Bias: Neutral/Bullish Previous Session Bias: Neutral/Bullish Resistance: 622-632***, 669-673*** Pivot: 603-607 Support: 587 3/4-591 1/2**** |

|

Seasonal TendenciesThough the wheat market may be due for a relief rally, longer term averages for this time of year indicate potential for seasonal weakness into the first half of September. |

|

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial