A Swiss Save and an Action-Packed Chartbook | Morning Express | 3/20/2023

Posted: March 20, 2023, 9:08 a.m.

- UBS to buy Credit Suisse for $3 billion, brokered by Swiss authorities who ignored laws requiring a shareholder vote. The move wipes out $17 billion of junior debt known as Additional Teir-1 debt (AT1), although shareholders receive payments, the move rattles institutional investor confidence.

- Six central banks, including the Federal Reserve, announce a coordinated effort to improve U.S. Dollar liquidity by enhancing the frequency of swap line operations form weekly to daily. A similar coordinated effort was established in March 2020.

- China’s President Xi landed in Moscow early this morning for a three-day visit with Russia’s President Putin.

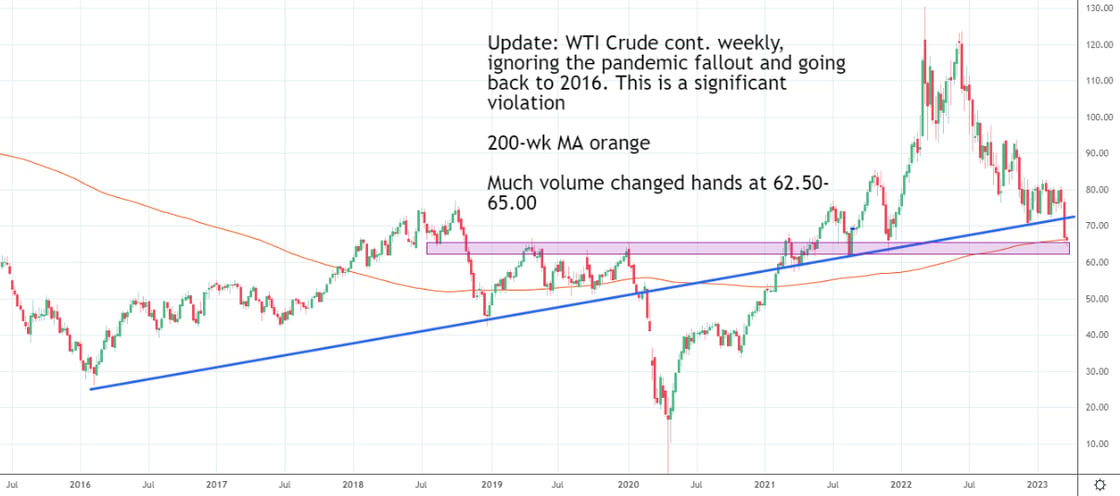

- Gold highest since March 2022 and Crude Oil lowest since November 2021.

- German PPI data was firmer than expected at 15.8% y/y versus 14.5%, but still disinflationary -0.3% m/m versus -0.5%.

- ECB President Lagarde speaks this morning, scheduled for 9:00 and 11:00 am CT.

- The Federal Reserve begins their two-day policy meeting tomorrow, with a decision on Wednesday at 1:00 pm CT.

- The CME’s FedWatch Tool signals a 25bps hike with a 65.7% probability, with the remaining 34.3% favoring no action.

- Rates are currently 450/475bps (before Wednesday) and there is a 70.1% probability they are cut by 50bps to 400/425bps by September.

Click here to get our (FULL) daily reports emailed to you!\

E-mini S&P (June) / E-mini NQ (June)

S&P, yesterday’s close: Settled at 3947.00, down 47.50 on Friday and up 49.50 on the week

NQ, yesterday’s close: Settled at 12,644.75, down 70.75 on Friday and up 675.75 on the week

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

NQ (June)

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Crude Oil (May)

Yesterday’s close: Settled at 66.93, down 1.59 on Friday and 9.85 on the week.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Gold (April) / Silver (May)

Gold, yesterday’s close: Settled at 1973.5, up 50.5 on Friday and 106.3 on the week

Silver, yesterday’s close: Settled at 22.462, up 0.770 on Friday and 1.956 on the week

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Silver (May)

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial