Grain Express 1/30/23

Posted: Jan. 30, 2023, 9:11 a.m.

Watch us on RFD-TV, today at 9:45am CT! |

|

|

|

Brazil As of last Thursday, Brazil was estimated to be only 5% through soybean harvest, nearly half of last year's pace. Brazil remains relatively wet, which will likely keep harvest pace slow in the near term. Due to the delay in soybean harvest, we are seeing a delay in Brazil's safrinha corn planting progress (second corn crop) is 5% complete, 9% behind last year's pace.

Argentina Argentina is expected to receive some additional moisture this week but forecast turn drier by the back half of the week and into next week.

A Look at the Outside Markets Equity markets are under pressure in the early morning trade, after surging higher last week. Crude oil has traded on both sides of unchanged overnight, currently down a quarter. The US Dollar |

Corn (March)

Managed Money Position

Updated each Friday with the weekly CoT Report

- Managed funds were net buyers of 9,660 futures/options contracts expanding their net long position to 201,797 contracts. Broken down that is 266,783 longs VS 64,986 shorts.

Seasonal Trend in Play: May corn futures have traded higher from January 13th to February 6th for 12 of the last 15 years. Looking at the historical data, this isn't a seasonal that we would label as "high conviction." The average profit during this time period is only about 8 cents.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

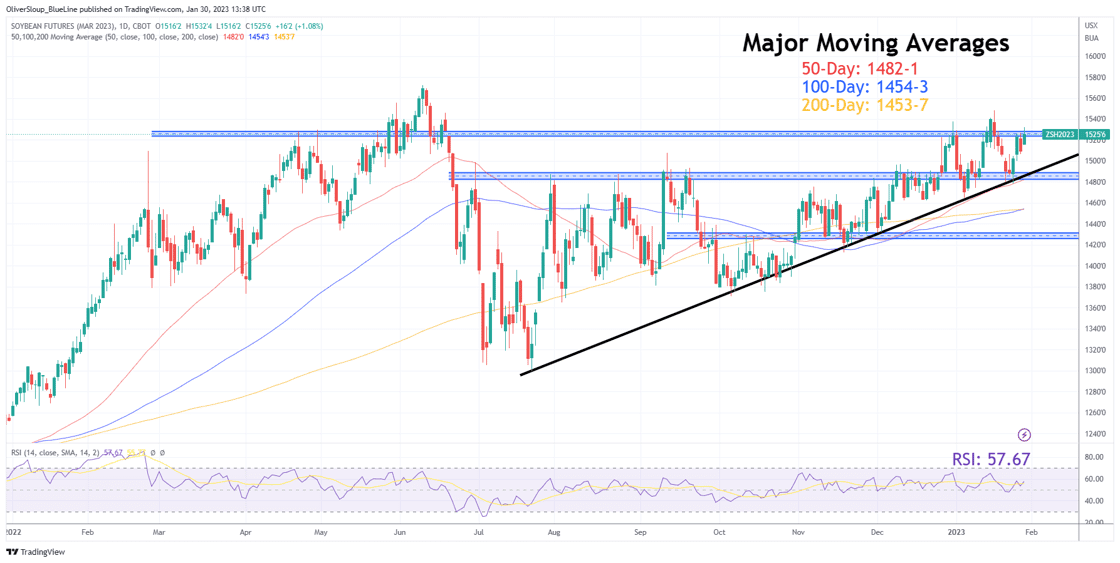

Soybeans (March)

Managed Money Position

Updated with the weekly CoT Report

- Funds were net sellers of 22,036 futures/options contracts, shrinking their net long position to 146,261 contracts. Broken down that is 172,806 longs VS 26,545 shorts.

Seasonal Trend in Play: None

Next Seasonal Trend Start Date: January 31st

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

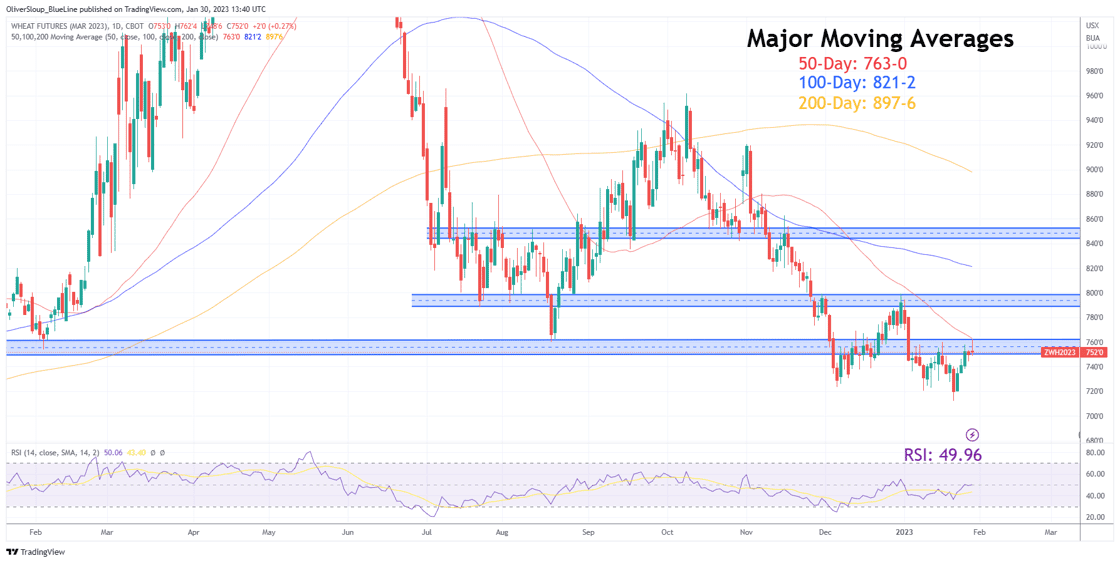

Wheat (March)

Managed Money Position

Updated with the weekly CoT Report

- Funds were net sellers of 8,843 futures/options contracts, expanding their net short position for the third straight week, now sitting net short 73,933 contracts, the largest net short position since May of 2019. Broken down that is 53,302 longs VS 127,235 shorts.

Seasonal Trend in Play: None

Next Seasonal Trend: February 7th

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial