Grain Express 1/18/23

Posted: Jan. 18, 2023, 8:48 a.m.

Private Exporters

Private exporters reported the following sales activity yesterday morning:

- 150,000 metric tons of corn (5,905,237 bushels) for delivery to Colombia for 2022/2023.

- 119,000 metric tons of soybeans (4,372,500 bushels) for delivery to unknown destinations for 2022/2023.

Weekly Export Inspections

Yesterday's weekly export inspections came in better than what we've seen in weeks, particularly for corn. They are as follows:

- Corn: 774,461 MT (30,489,174 bushels)

- Soybeans: 2,075,197 MT (76,250,416 bushels)

- Wheat: 320,473 MT (11,775,363 bushels)

Russia

Russian President Vladimir Putin said on Tuesday that Russia needed to maintain stable food reserves, if necessary by restricting some exports, but did not provide specific details. -Reuters

Crush

The National Oilseed Processors Association (NOPA) crushed 177.5 million bushels of soybeans in December. This was down 1.7 million bushels from November and well below the average analyst estimate of 183 million.

A Look at the Outside Markets

Equity markets are in positive territory, albeit very slightly. Crude oil is up over 2%, trading just shy of $82. The US Dollar is under slight pressure, trading down .25% to 101.87.

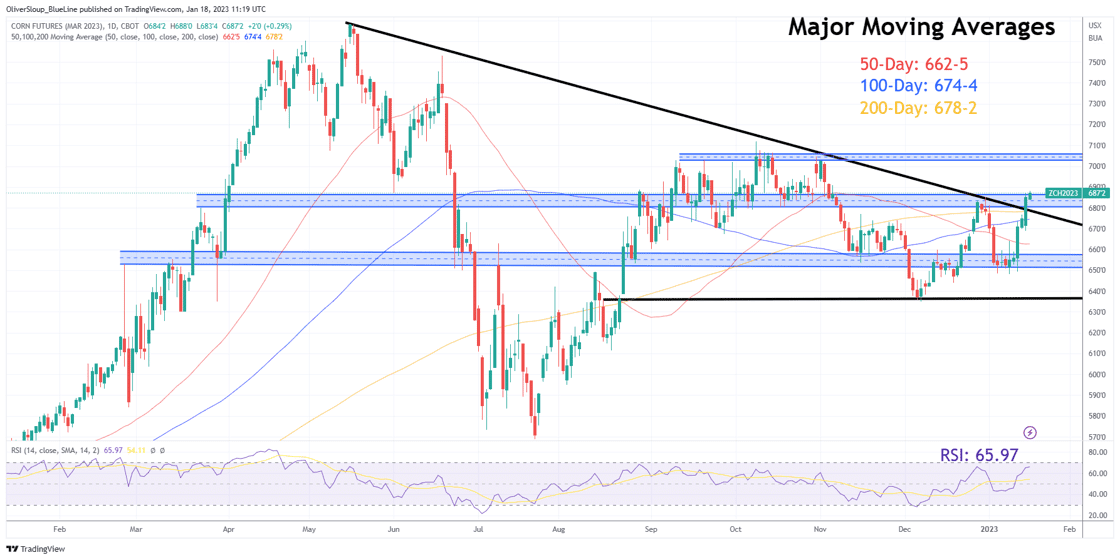

Corn (March)

Managed Money Position: 137,697

(Updated with the weekly CoT Report)

Seasonal Trend in Play: May corn futures have traded higher from January 13th to February 6th for 12 of the last 15 years. Looking at the historical data, this isn't a seasonal that we would label as "high conviction." The average profit during this time period is only about 8 cents.

|

Below is a daily chart of March corn futures |

|

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

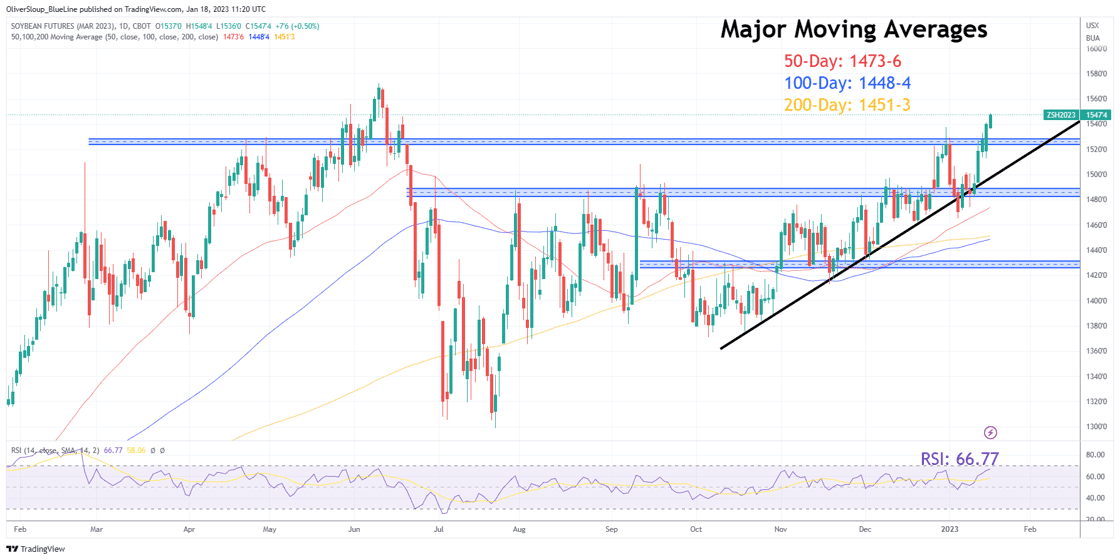

Soybeans (March)

Managed Money Position: 131,704

(Updated with the weekly CoT Report)

Seasonal Trend in Play: None

Next Seasonal Trend Start Date: January 31st

|

Below is a daily chart of March soybean futures |

|

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Wheat (March)

Managed Money Position: -63,134

(Updated with the weekly CoT Report)

Seasonal Trend in Play: March KC Wheat has rallied from January 10th-January 26th for 12 of the last 15 years.

|

Below is a daily chart of March wheat futures |

|

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial