Grain Express 12/08/22

Posted: Dec. 8, 2022, 8:39 a.m.

Watch us on RFD-TV, today at 12:45 PM CT!

Weekly Export Sales

Corn

Net sales of 691,600 MT for 2022/2023

Soybeans

Net sales of 1,716,200 MT for 2022/2023

Total net sales of 30,000 MT for 2023/2024

Wheat

Net sales of 189,900 MT for 2022/2023

Private exporters reported the following activity

- 118,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year

- 718,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

Total: 30,717,733 Bushels of Beans

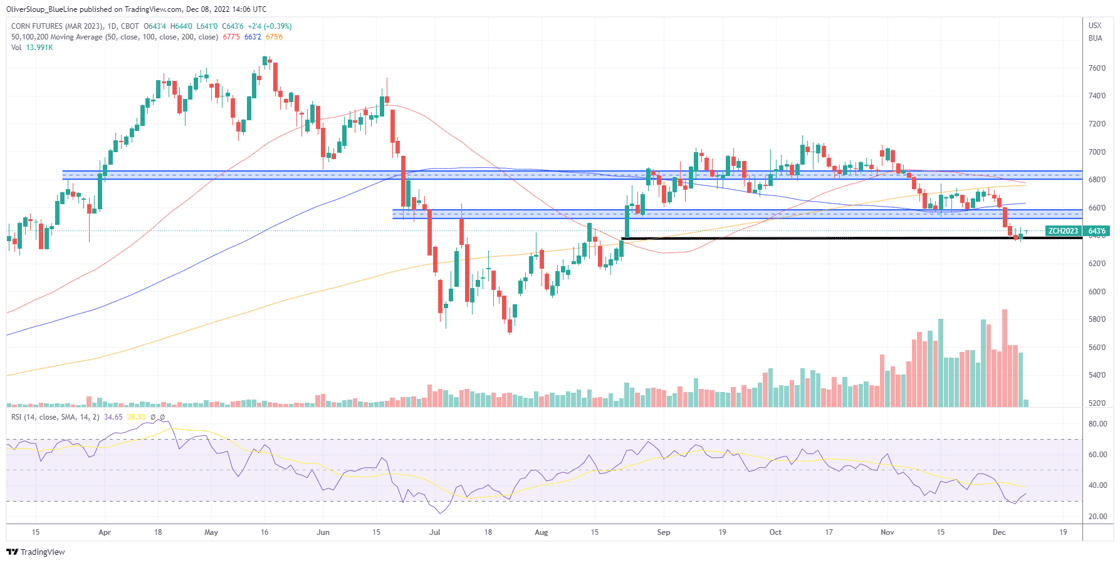

Corn (March)

Managed Money Position: 193,989 (Updated with the weekly CoT Report)

Seasonal Trend in Play: March corn futures have trended higher from November 16th to January 4th for 13 of the last 15 years.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

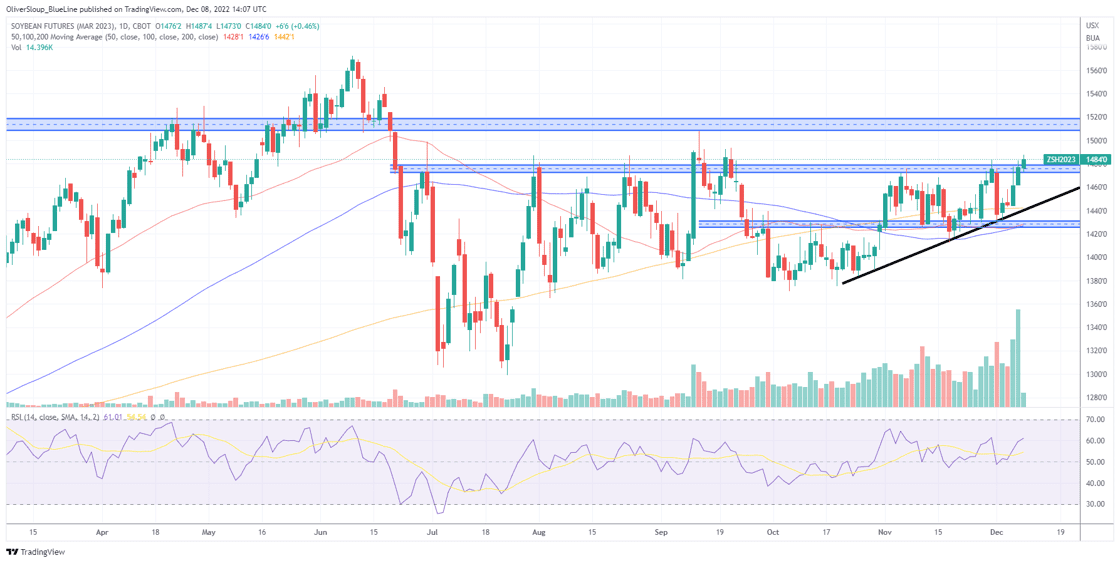

Soybeans (March)

Managed Money Position: 103,196 (Updated with the weekly CoT Report)

Seasonal Trend in Play: March soybeans have trended higher from November 16th to January 9th for 14 of the last 15 years.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

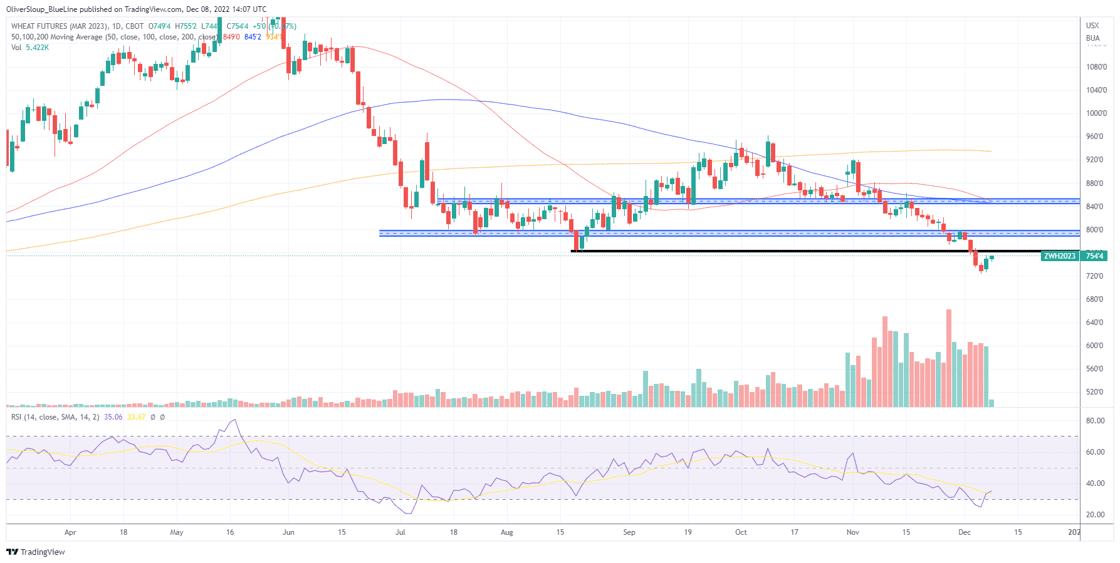

Wheat (March)

Managed Money Position: -53,058 (Updated with the weekly CoT Report)

Seasonal Trend in Play: None

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial