Livestock Roundup 11/30/22

Posted: Nov. 29, 2022, 8:31 a.m.

Cattle SummaryDaily Cutout Values Choice: 254.74, Up .21 from the previous day. Select: 225.82, Down 2.71 from the previous day. Choice/Select Spread: 28.92 5 Area Average Cattle Price Live Steer: 153.50 Live Heifer: N/A Dressed Steer: N/A Dressed Heifer: N/A Daily Slaughter Estimated at 128,000. 1,000 less than last week but 4,000 more than the same week last year. Feeder Cattle Index 11/28/2022: 178.85 11/25/2022: 177.19 |

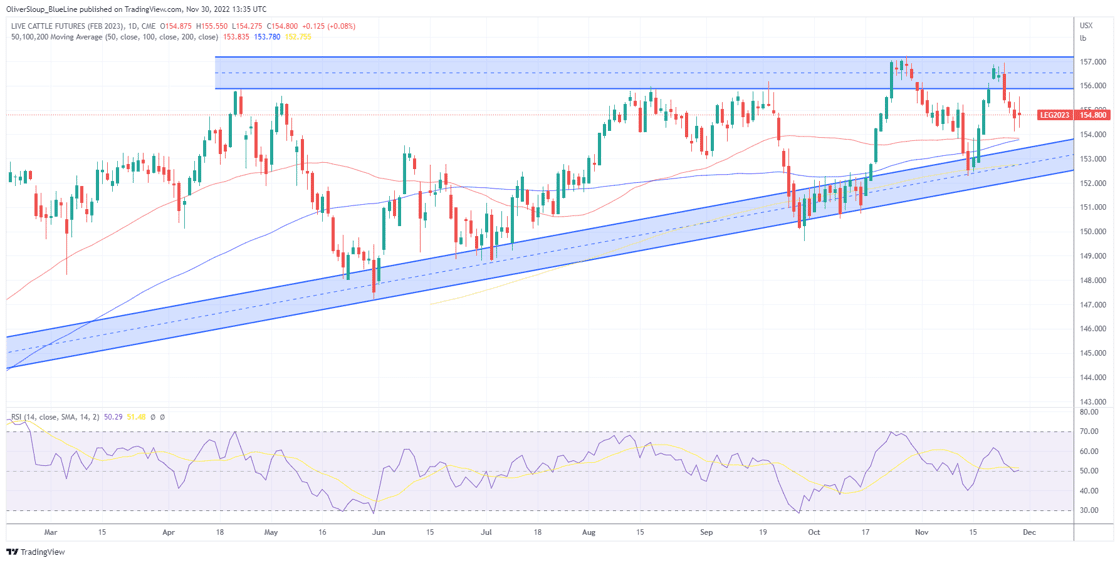

Live Cattle (February)

Managed Money Position: 60,850

Seasonal Trend in Play: February live cattle have pulled back from November 27th to December 9th for 14 of the last 15 years, with the average pullback being roughly 3.00.

Techncials: February live cattle futures were choppy yesterday, trading on both sides of unchanged. Our near-term bias remains in bearish territory with the targets coming in from 153-154. This pocket represents several major moving averages and is mart of the trendline support pocket that comes in from the December lows. A pullback to the low end of this risk range may flip our bias back to bullish. The same day that the bearish seasonal for February live cattle ends, a bullish seasonal starts fot the April contract.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Feeder Cattle (January)

Managed Money Position: -4,066

Seasonal Trend in Play: January feeder cattle have pulled back from November 29th to December 9th for 14 of the last 15 years, with the average pullback being roughly 3.00.

Technicals: January feeder cattle have pulled back from November 29th to December 9th for 14 of the last 15 years, with the average pullback being roughly 3.00.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

|

Lean Hogs

Managed Money Position: 51,747

Seasonal Trend in Play: Coming Soon, December 6th!

Technicals: February lean hogs continued their descent yesterday. First support comes in from 83.025-83.65, which may be able to offer some support on the first test. The RSI is at 34.70, not yet in what is considered "oversold" territory, but it's close and it is the lowest since the first week of October. There is a bullish seasonal trend that starts for the August contract on December 6h, so this pullback coupled with a strong seasonal trend may set up for a good risk/reward opportunity.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial