Grain Express 11/29/22

Posted: Nov. 29, 2022, 7:15 a.m.

Crop Progress Delayed

To no one's surprise, we have more delays from the USDA due to another reporting system outage

Export Inspections

Weekly export inspections for corn were disappointing at 302,350 metric tons, below the low end of estimates. Soybeans inspections were reported at 2,022,443, within the range of expectations. Wheat inspections came in at 198,519 metric tons, a hair below the low end of estimates.

Mexico GMO Ban

The United States on Monday threatened legal action against Mexico's plan to ban imports of genetically modified corn in 2024, saying it would cause huge economic losses and significantly impact bilateral trade.

-Reuters

Rail Strike

President Joe Biden on Monday called on lawmakers to quickly approve a labor deal that would avert what he called a “potentially crippling national rail shutdown” as early as Dec. 9.

“As a proud pro-labor President, I am reluctant to override the ratification procedures and the views of those who voted against the agreement,” Biden said in a statement. “But in this case — where the economic impact of a shutdown would hurt millions of other working people and families — I believe Congress must use its powers to adopt this deal.”

-CNBC

A Look at the Outside Markets

Equity markets are steady to firm in the early morning trade. Oil futures have rebounded as much as $6 off yesterday's low. Much of this rally came on the back of headlines suggesting that OPEC+ is considering supply cuts. Last week there were headlines suggesting an output increase. Welcome to the 2020's, where contradicting headlines seem par for the course.

Corn

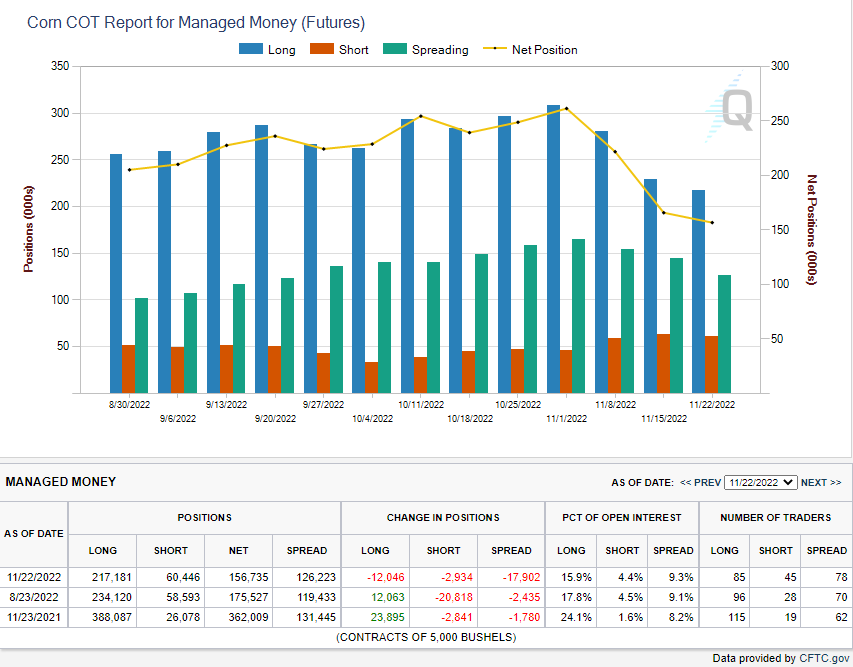

Below is an updated look at how the funds are positioned

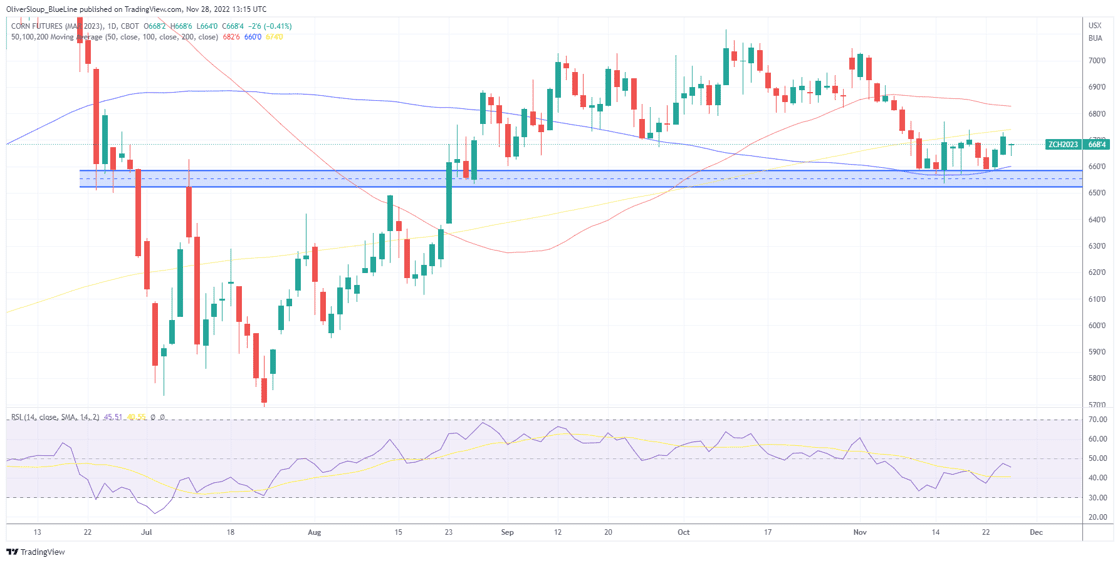

Seasonal Trend in Play: March corn futures have trended higher from November 16th to January 4th for 13 of the last 15 years.

Technicals: March corn futures are continuing their attempt at carving out a near term low. First resistance comes in from 672 3/4-674. This pocket represents the upper end of the recent range and the 200-day moving average. If the Bulls can chew through this pocket, we could see an extension towards 680-682 3/4. This pocket represents previously important price points that date as far back as the Spring, along with the 50-day moving average.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Soybeans

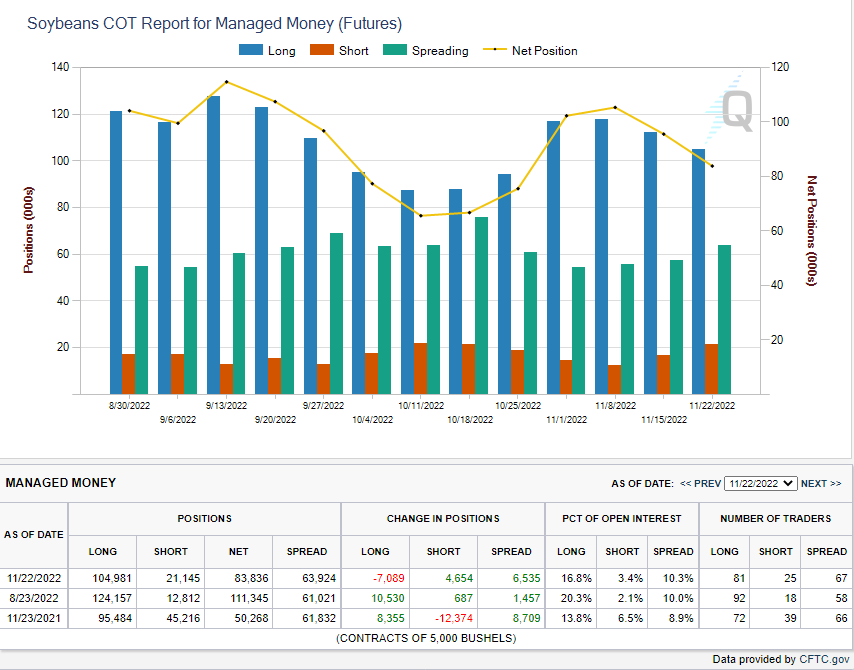

Below is an updated look at how the funds are positioned

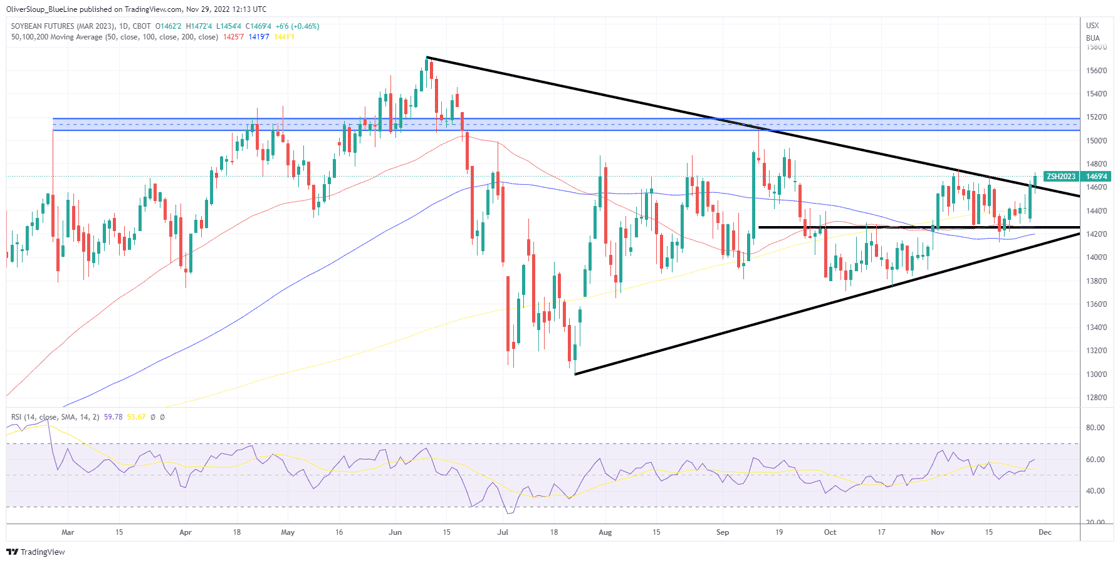

Seasonal Trend in Play: March soybeans have trended higher from November 16th to January 9th for 14 of the last 15 years.

Technicals: March soybeans rebounded well yesterday, which has carried over into some overnight/early morning strength. That has taken prices out above technical resistance. If this price action is confirmed through the floor open, it may be the start of a move back towards $15.00.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Wheat

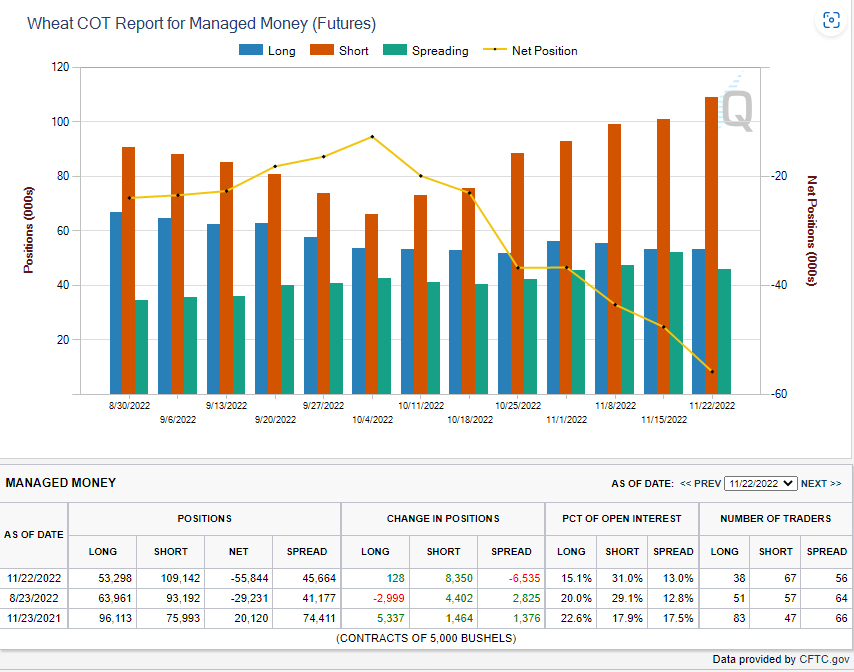

Below is an updated look at how the funds are positioned

Seasonal Trend in Play: None

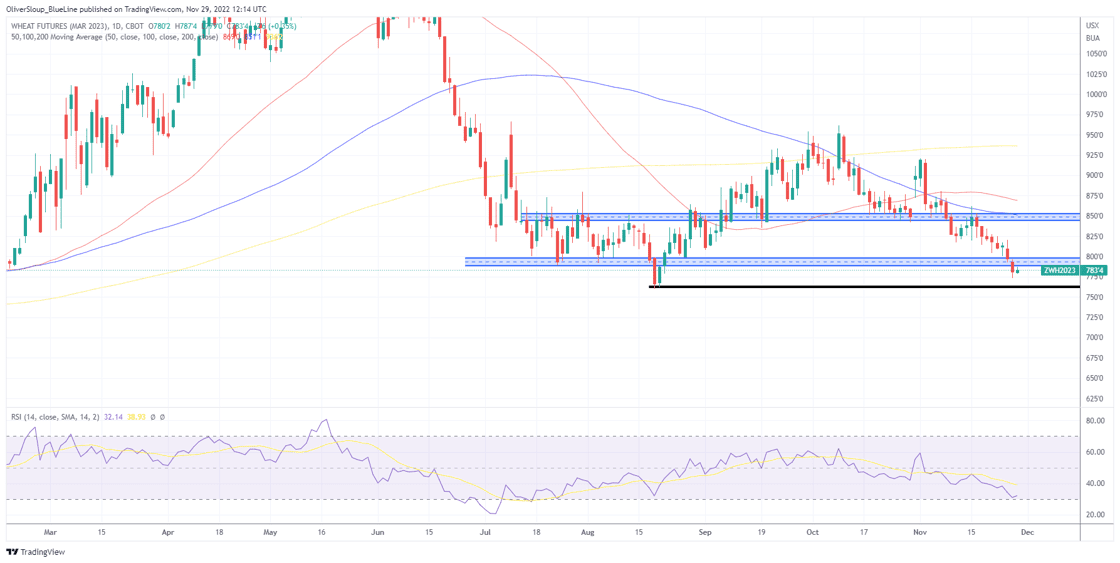

Technicals: There's some green on the chart this morning, but it's far from enough to put the Bulls at ease. The Bulls will want to see consecutive closes back above $8.00 to start neutralizing some of the technical damage that has taken place through the month of November. Our bias will remain in bearish territory until that happens.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial