Upbeat Despite China Headwinds | 11/28/2022

Posted: Nov. 28, 2022, 7:46 a.m.

- Protests and lockdowns in China are seen as a headwind to start the week. Hang Seng – 1.57% today, but still +17% on the month.

- We continue to believe that the domestic economy is not as bad as many make it out to be.

- Atlanta Fed GDPNow Q4 estimate is 4.3%.

- Black Friday sales hit a record $9.1 billion, rising 2.3% versus 1% expected, Reuters and Adobe Analytics

- Even before Black Friday, according to Visa volume of credit and debit card transactions is very robust and has been all year; +11% in Q3 y/y, +9% in November y/y, and +146% in Q3 versus 2019, +147% in November v 2019. According to Goldman Sachs data.

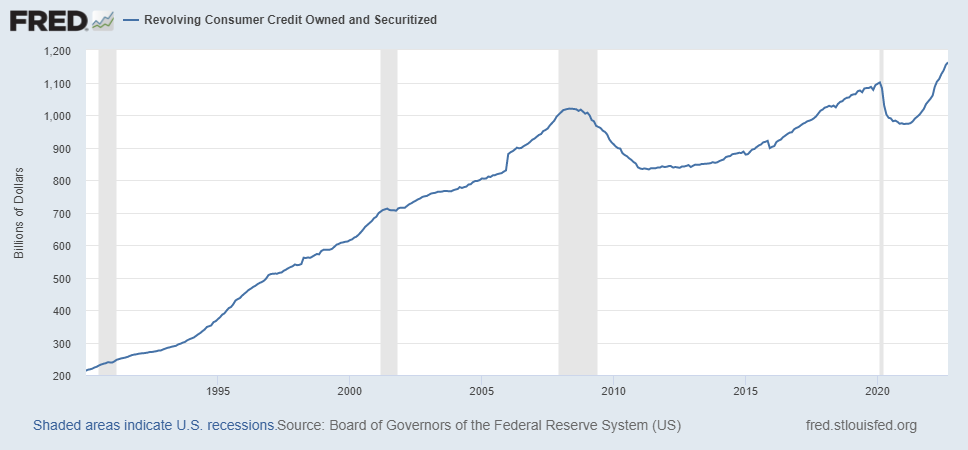

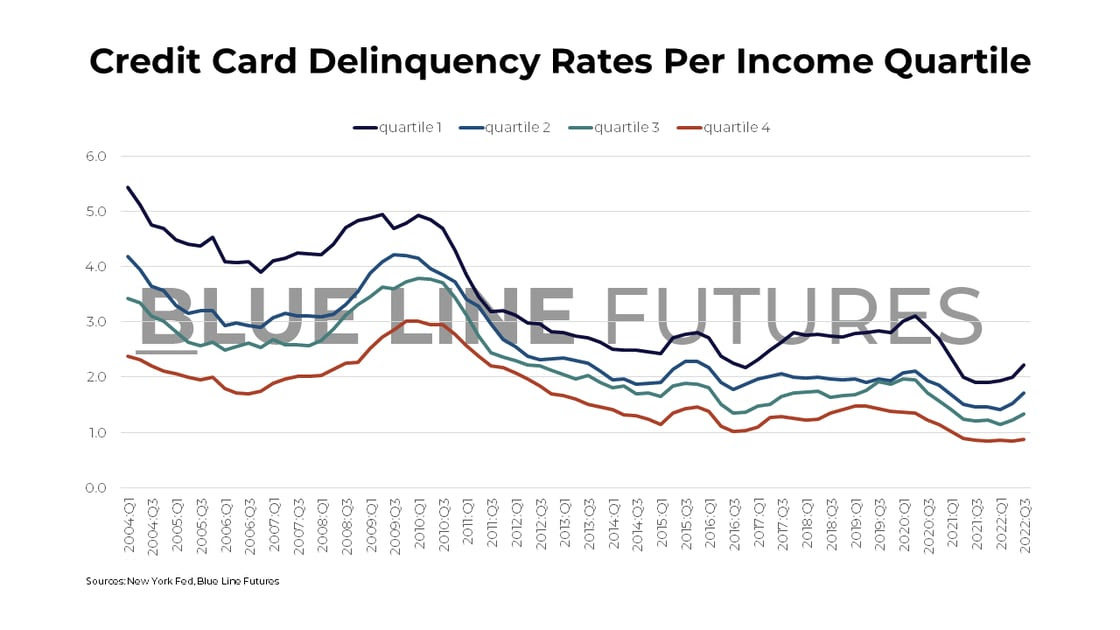

- Credit usage at a record high does signal individuals are becoming exhausted, but we don't find it the precursor to a steep recession that many doom and gloomers are calling for. In fact, delinquencies remain very low. Seen in the chart below.

- Broader investing public acknowledges the Fed's tightening, but does not acknowledge recession precursors are also engineered

- Odds favor 50bps hike in each December and February, slower will stoke bullish tailwinds.

- Regardless, the 2s10s spread broke hard into Wednesday to -0.80bps, a record.

- 3m10yr hit a new low of -0.72bps, only December 2000 was lower. Seen in chart.

- Light at the end of the tunnel, many inflation components have peaked and begun to roll over

- Earnings may compress in the coming two quarters, but we believe estimates have overcompensated, now a lower bar to beat.

- Excessive negativity is a bullish tailwind, institutional Put-Call ratio is at a record.

- 90% of S&P stocks are above the 50-dma, not a sign to chase strength, but a sign that stocks are not going down like many believe.

- Portfolio management side, we remain active, fully invested, and trimming some on this rally, downside protected with Puts ahead of the holiday

- Commodity fund is short stocks for a trade in the near term from post-FOMC Minute’s strength.

- U.S. Dollar Index back to 11/15 low, lowest since 8/15.

- A bludgeoning across the energy complex is helping to underpin strength in the Euro, lifting their growth prospects. At the same time, a slower pace of Fed hikes is being discounted.

- Economic calendar has a slow start to the week, with only Fed speak in focus, which leads into Nonfarm Payrolls Friday. Today, St. Louis Fed President Bullard and New York Fed President Williams speak at 11:00 am CT.

.png?width=1120&upscale=true&name=fredgraph%20(45).png)

E-mini S&P (December) / NQ (December)

S&P, yesterday’s close: Settled at 4032.50, down 0.50 on Friday and up 58.50 on the week

NQ, yesterday’s close: Settled at 11,782.75, down 80.00 on Friday and up 74.75 on the week

- Bull-flag-like breakout played out through Friday, and both the S&P and NQ struggled at critical levels of resistance.

- Battleground of support around the recurring 4000 mark, now aligning with Tuesday’s pattern breakout, brings major three-star support at 3997-4003.25.

- Similarly, the NQ is again hugging the slightly readjusted and narrowed but recurring 11,729-11,747 level.

- Multiple levels of support are highlighted below.

- Close below, or decisive break intraday of, this major three-star support opens the door to major three-star support in the S&P at 3962.75-3968.25.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

NQ (December)

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Crude Oil (December)

Yesterday’s close: Settled at 76.28, down 1.66 on Friday and down 3.83 on the week

- A surge in virus cases in China has deteriorated its growth prospects, bludgeoning the energy complex.

- January WTI is trading at its lowest since January and continuous front-month lowest since December.

- Precipitous drop felt the most in front-month, removing backwardation and reestablishing contango in front-end of the curve.

- Massive level of rare major four-star support down at 68.50-69.00, aligns with the 50% retracement from Russia-Ukraine high of 130.50 high back to Covid low of 6.50

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Gold (February) / Silver (March)

Gold, yesterday’s close: Settled at 1760.4, up 5.6 on Friday and down 0.2 on the week

Silver, yesterday’s close: Settled at 21.609, up 0.083 on Friday and up 0.413 on the week

- U.S. Dollar Index is down, but Dollar 0.37% stronger versus the Chinese Yuan. Off its best levels of the day, helping to underpin the rebound in metals from session lows.

- Yields edging lower with U.S. 10-year at 3.67%, helping to stave off added weakness in precious metals.

- Big week of economic data to unfold, culminating with Nonfarm Payrolls on Friday, will move the Fed expectations meter.

- Cleansing of December contract roll-off taking place. A consolidation is healthy.

- Washout low of 1733.5 in February Gold helped clean stops and brings a line in the sand.

- Though price action has been in rebound mode, thick resistance persists overhead in the near-term.

- Pivot and point of balance for each is crucial in holding ground, coming in at 1765 in Gold and 21.35 in Silver.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Silver (March)

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial