Grain Express 11/23/22

Posted: Nov. 23, 2022, 8:47 a.m.

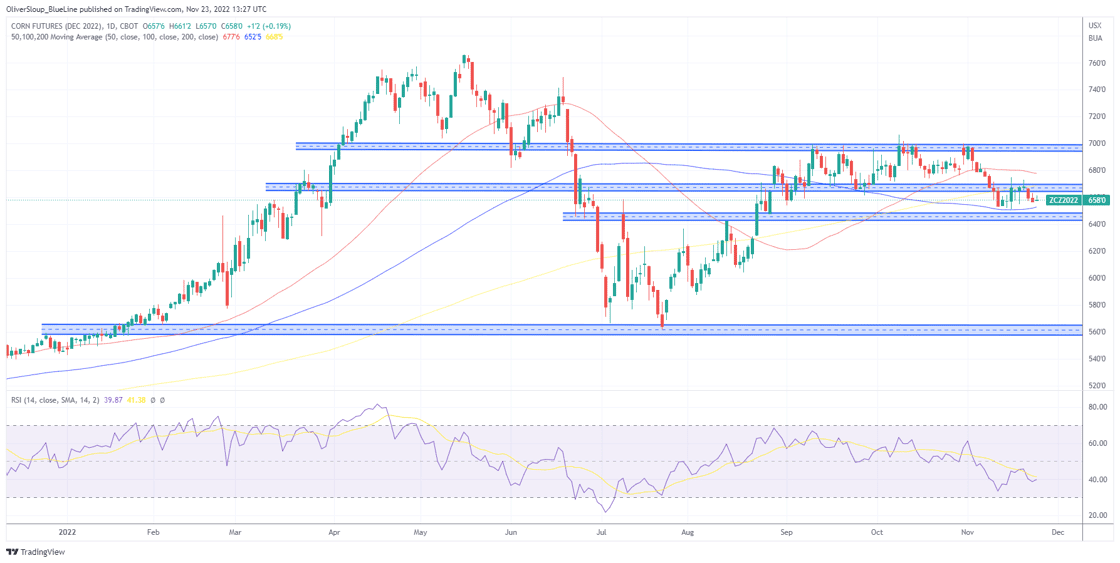

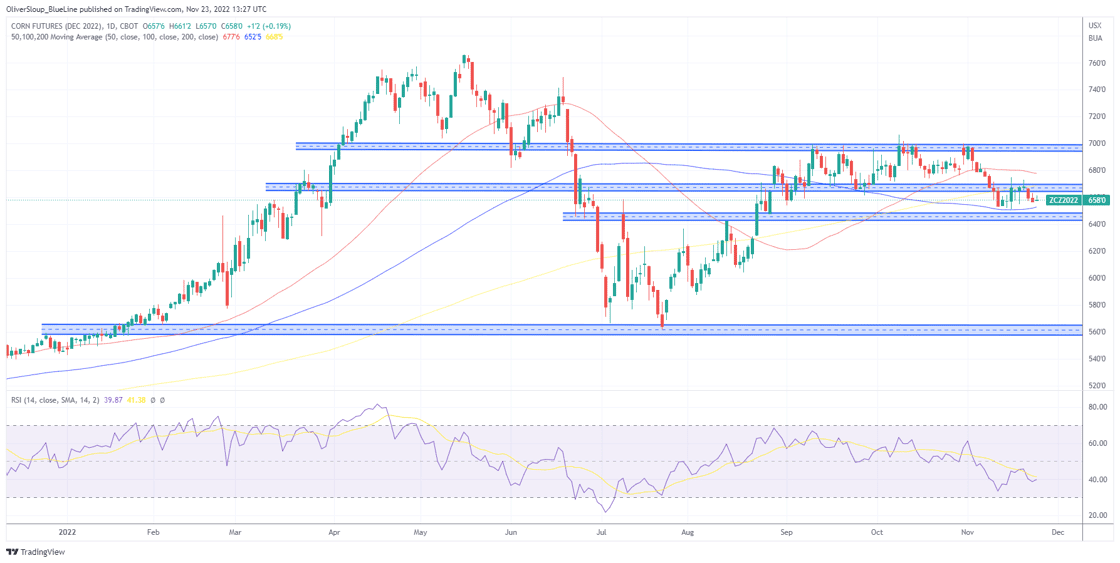

Corn

December corn futures were under minor pressure yesterday, but it wasn't enough to change the technical landscape. Support and resistance levels remain intact. We see significant support from 647 1/4-652 3/4. A failure here could spark additional long liquidation from funds who hold a net long position of 165,847, as of November 15th. Keep in mind that December options expiration is Friday, so March futures will be the most actively traded month.

Seasonal Trend in Play: March corn futures have trended higher from November 16th to January 4th for 13 of the last 15 years.

Managed Money Position: 165,847

For more information or ideas of how to trade this trend, contact our trade desk: 312-837-3938 or email Seasonals@BlueLineFutures.com

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Soybeans

January soybean futures were on the verge of a nice rally yesterday but stalled out just before resistance from 1448-1450. The market then reversed to finish the session lower, which has spilled into weakness in the early morning trade. Prices are now below yesterday's low, which if confirmed through the floor open could take us to retest the 50 and 100 day moving average, 1419 3/4 and 1413 7/8. We remain upbeat on prices, but a break and close below $14.00 would neutralize that near-term bias.

Seasonal Trend in Play: March soybeans have trended higher from November 16th to January 9th for 14 of the last 15 years.

Managed Money Position: 95,579

For more information or ideas of how to trade this trend, contact our trade desk: 312-837-3938 or email Seasonals@BlueLineFutures.com

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

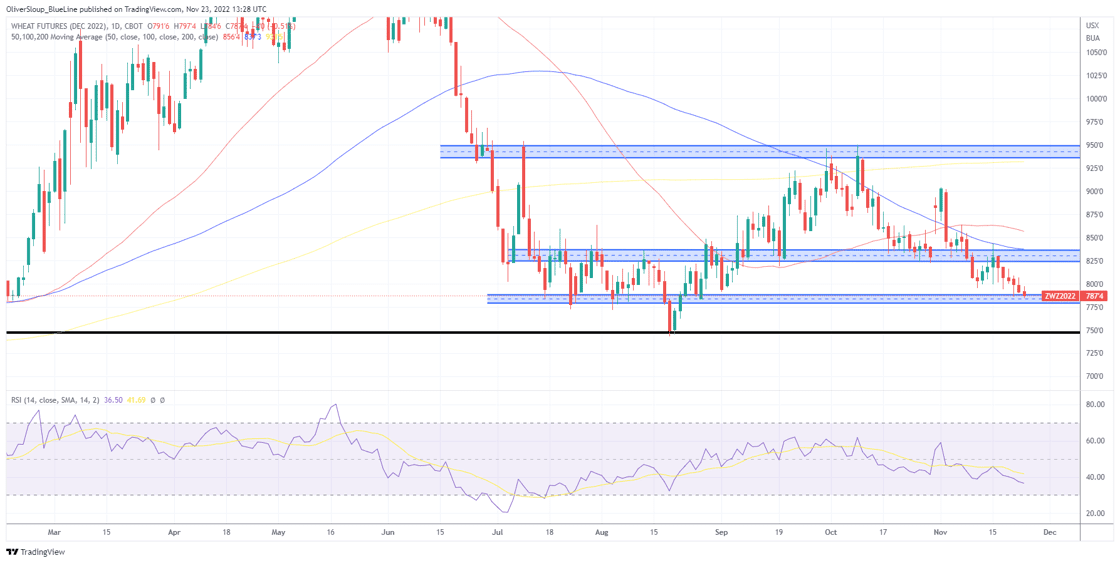

Wheat

December wheat futures are making new lows for the move yet again, testing the lows from the end of august, 783 1/4. A close below here could keep the pressure on, with little meaningful support until you get to the August lows, 743 1/4-745 1/4.

Seasonal Trend in Play: None

Managed Money Position: -47,622

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial