Livestock Roundup 11/11/22

Posted: Nov. 11, 2022, 8:57 a.m.

|

Oliver Sloup shared some of the fundamental headlines that may be moving the cattle market, in his weekly commentary for CME Group. |

WATCH NOW

Cattle Summary

Daily Cutout Values

Choice: 263.27, Down 1.40 from the previous day.

Select: 236.83, Up 1.61 from the previous day.

Choice/Select Spread: 26.44

5 Area Average Cattle Price

Live Steer: 151.86

Live Heifer: 151.53

Dressed Steer: 241.12

Dressed Heifer: 242.00

Daily Slaughter

Estimated at 129,000. 1,000 more than last week and 13,000 more than the same week last year.

Feeder Cattle Index

11/09/2022: 175.51

11/08/2022: 176.30

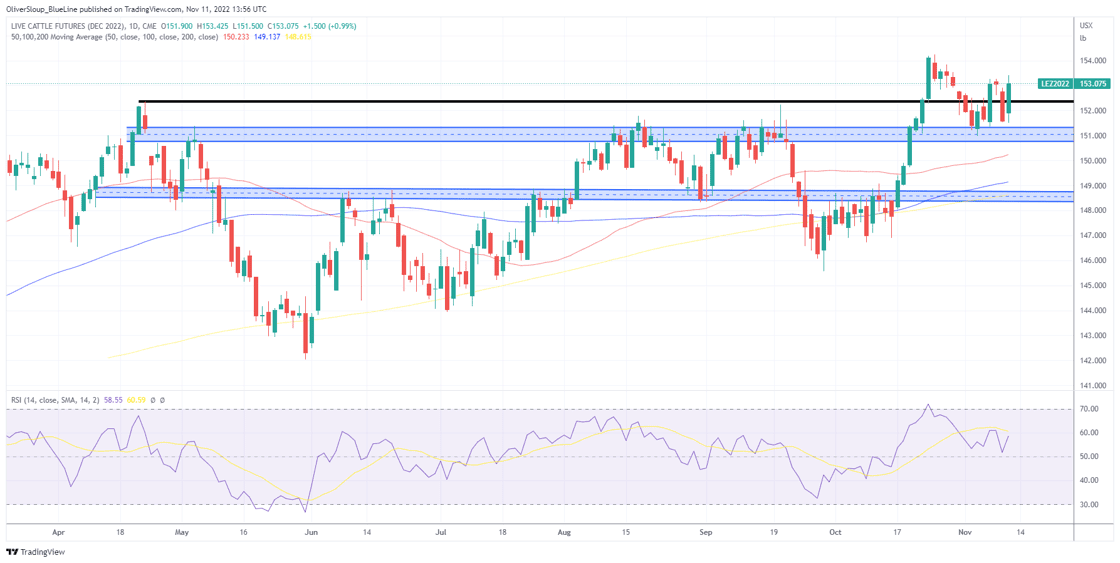

Live Cattle

Today is the last day of the bullish April live cattle seasonal. Baring a technical failure, that seasonal will make it 14 out of the last 16 years that it has played out. The next seasonal starts at the end of the month and will be for February futures. We remain upbeat on live cattle futures, especially if we continue to see the outside markets build a longer term low.

Seasonal Trend in Play (Last Day): April live cattle have been higher from October 5th-November 11th for 13 of the last 15 years.

Coming Soon: Seasonal Trend Alert for February Live Cattle that starts on November 27th. Contact us for more information.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Feeder Cattle

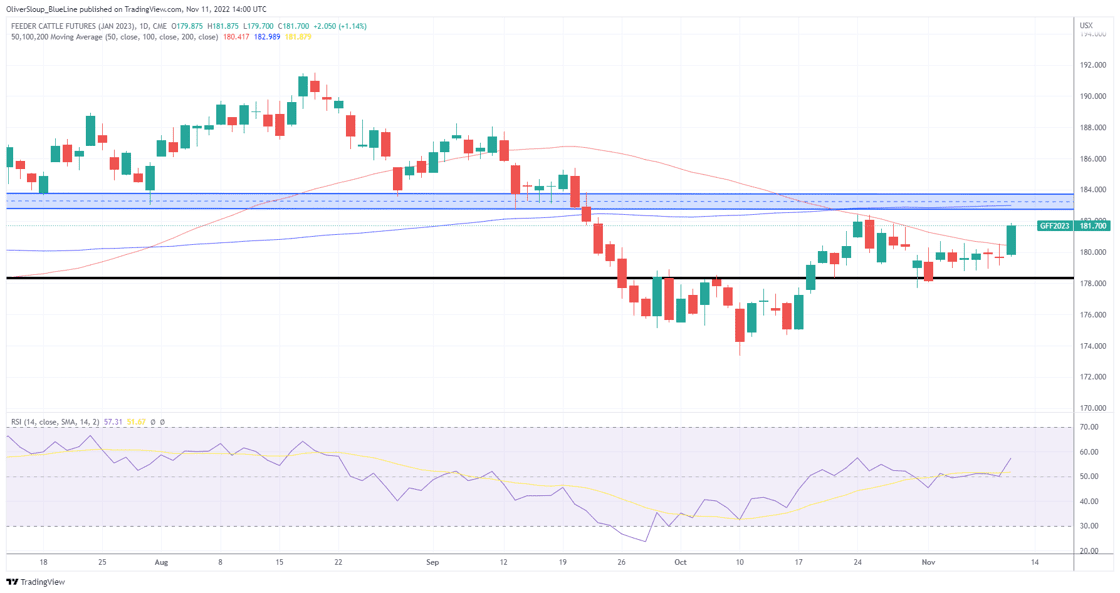

January feeder cattle had been coiling, building up energy for a bigger directional move. That move yesterday was to the upside, with some help from a corn market that made multi-month lows. Resistance comes in from 182.435-182.825. The Bulls need to achieve consecutive closes above this pocket to encourage a bigger rally.

Coming Soon: Seasonal Trend Alert for January Feeder Cattle that starts on November 27th. Contact us for more information.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Hogs Summary

|

Lean Hogs

December lean hogs were mixed in yesterday's session as they continue to linger near the 100 and 200 day moving average, 84.60-85.17

Coming Soon: Seasonal Trend Alert for December Lean Hogs that starts on November 9th. Contact us for more information. We like leaning on the Bullish side, but the conviction isn't super high.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial