Grain Express 11/02/22

Posted: Nov. 2, 2022, 7:54 a.m.

|

Grain Deal On? Wheat prices plunged after Russia agreed to resume the deal allowing safe passage of Ukrainian crop exports, reversing a weekend announcement that sowed chaos through agricultural markets and sent prices soaring. Russia’s Defense Ministry confirmed Moscow is resuming its participation in the Black Sea grain-export deal, after receiving written guarantees from Ukraine that the safe-passage corridor will only be used for grain exports. Ukraine has said repeatedly it would not use the corridor for military purposes. -Bloomberg A Look at the Outside Markets Equity markets have traded on both sides of unchanged overnight, crude oil has also been mixed, and the dollar is slightly lower. All eyes are on this afternoon's Federal Reserve meeting (1:00pm CT). Expectations are for another 75-basis point hike. Much of that is baked in, the important part will likely come in the press conference (1:30pm CT) where we may get a look at forward guidance. |

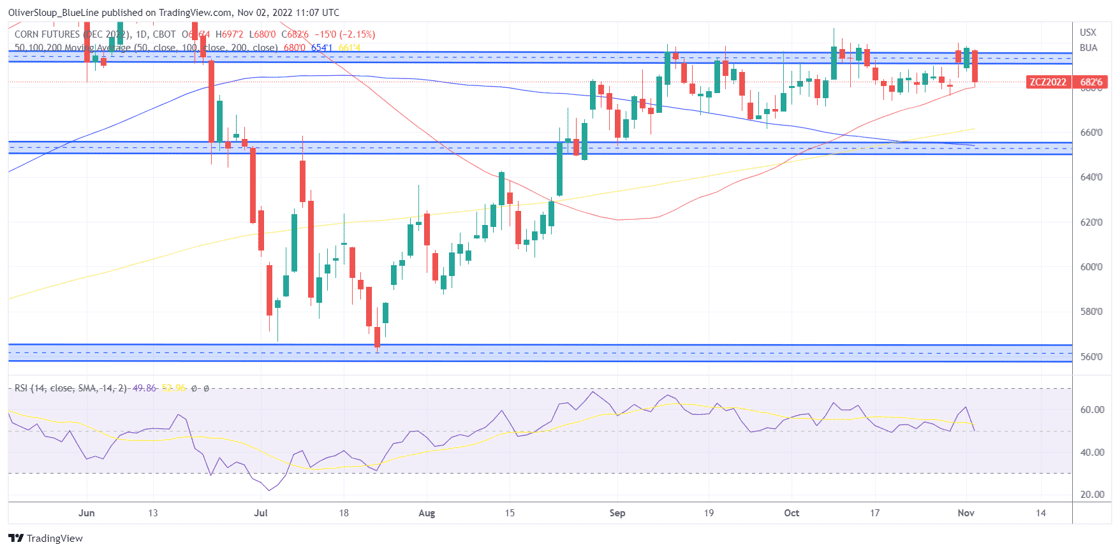

Corn

December corn futures appeared to be on the verge of taking out the Sunday night high yesterday but fell just short. The market fluttered around in a narrow range for much of the overnight session, the rolled over around 5am when news broke that grain would still be moving out of Ukranian ports. The market is right back to where we started the week, which is an interesting point on the chart. If the Bulls fail to defend the 680 area, we could see technical selling trigger long liquidation.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

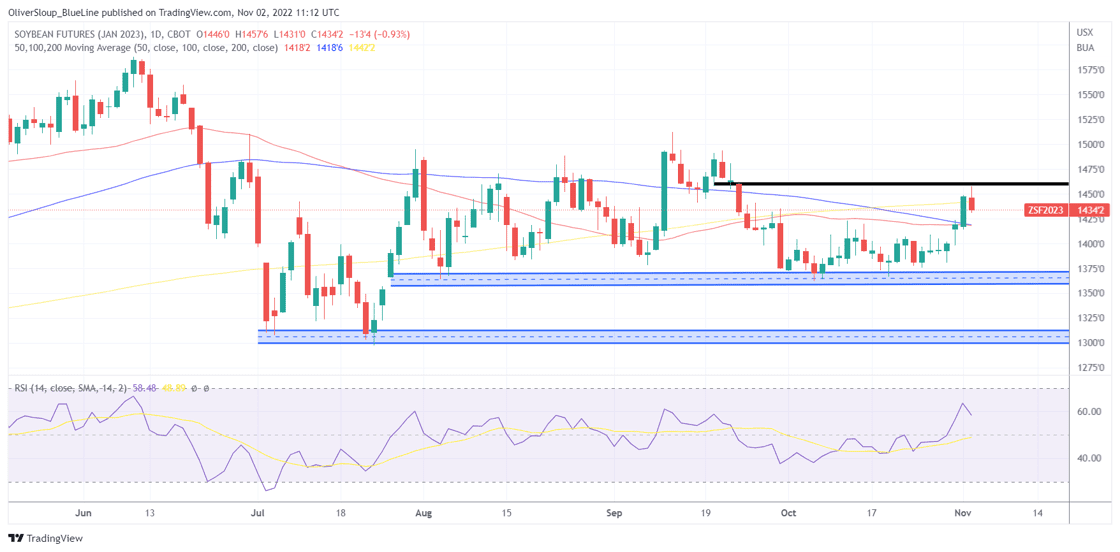

Soybeans

January soybeans rallied to three-star resistance overnight, we've had that defined as 1454 1/4-1462 1/4. The test and failure against resistance moves our bias back to outright Neutral, as we could see the market backfill some of the recent breakout points. If the Bulls do test that pocket again in the near term, that may be enough to spark another move higher, with little technical resistance until you get near the $15 marker.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

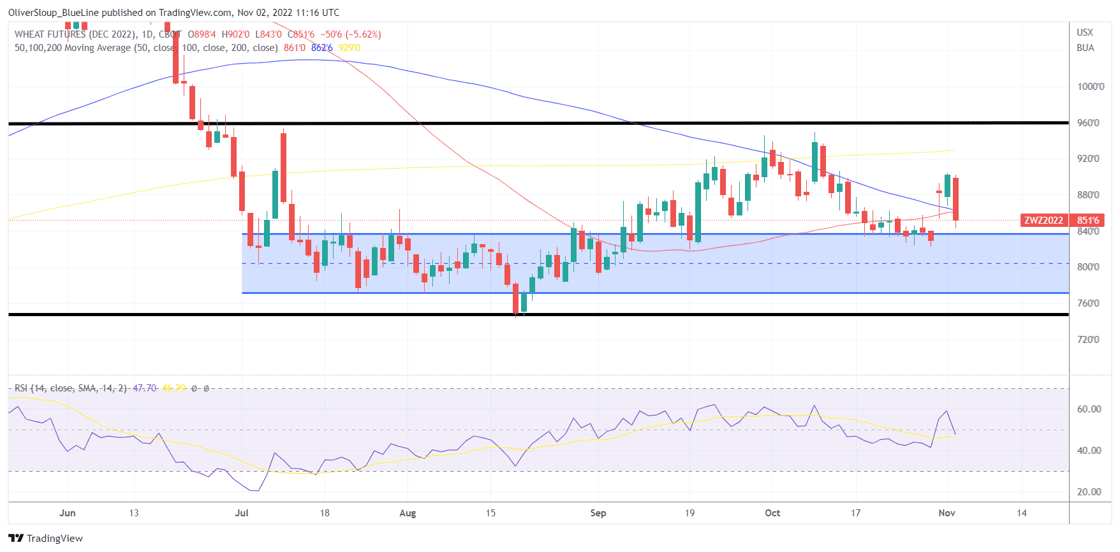

Wheat

In yesterday's morning report we wrote: "We expect the volatility to continue as mixed headlines will likely continue to be a common theme.". Which is why we've kept our bias at Neutral and noted in previous reports that if you don't need to trade wheat, then you really don't need to. That may come across as boring and that's ok, but we prefer to use the term prudent.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial