Grain Express 10/26/22

Posted: Oct. 26, 2022, 9:15 a.m.

South America

With harvest approaching an endpoint in the United States, attention is shifting to South America. Soybean planting in Brazil's southern state of Parana is at an 8-year low for this time of year, the delay comes on the back of wet weather. Planting in Mato Grosso is 67% complete, in line with last year's pace.

Ukraine Wheat

Ukraine is keeping its forecast of the winter wheat sowing area for the 2023 harvest unchanged at 3.8 million hectares despite a delay caused by unfavorable weather, deputy agriculture minister Taras Vysotskiy told Reuters on Tuesday. -Reuters

A Look at the Outside Markets

Equity markets are giving back some of yesterday's gains in the early morning trade. Crude oil is up 1.30% to $86.50. The USD is in retreat and on the verge of a bigger technical breakdown if trendline support gives way, near 109.60. If the dollar continues to retreat, it could offer a kneejerk reaction higher for some commodities.

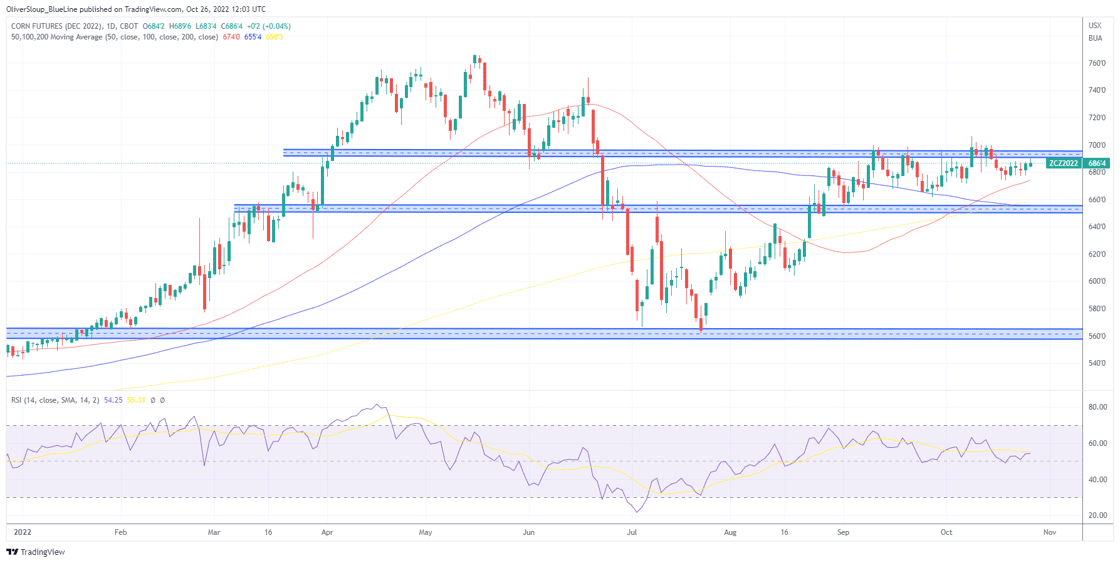

Corn

December corn futures continue to consolidate, presenting some great opportunities for short term traders, while driving the perma-bull/bear nuts. The sideways trade keeps our technical support and resistance levels intact. Rather than add fluff, we will leave it at that.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

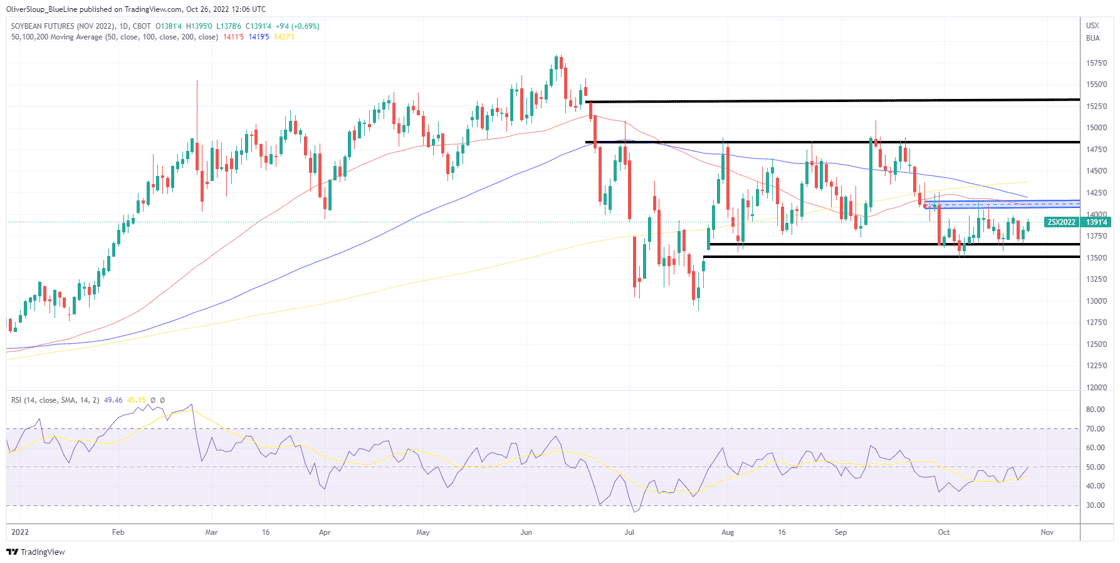

Soybeans

Much like corn, soybeans remain mostly rangebound, which is great for the nimble traders, but a headache for those looking for a breakout or a breakdown. It should be noted that the gap in January soybeans is more pronounced than that of November. That gap comes in from 1357-1362 1/4. If that pocket gives way, we could see the selling accelerate with little support until the $13.00, which is technically and psychologically significant.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

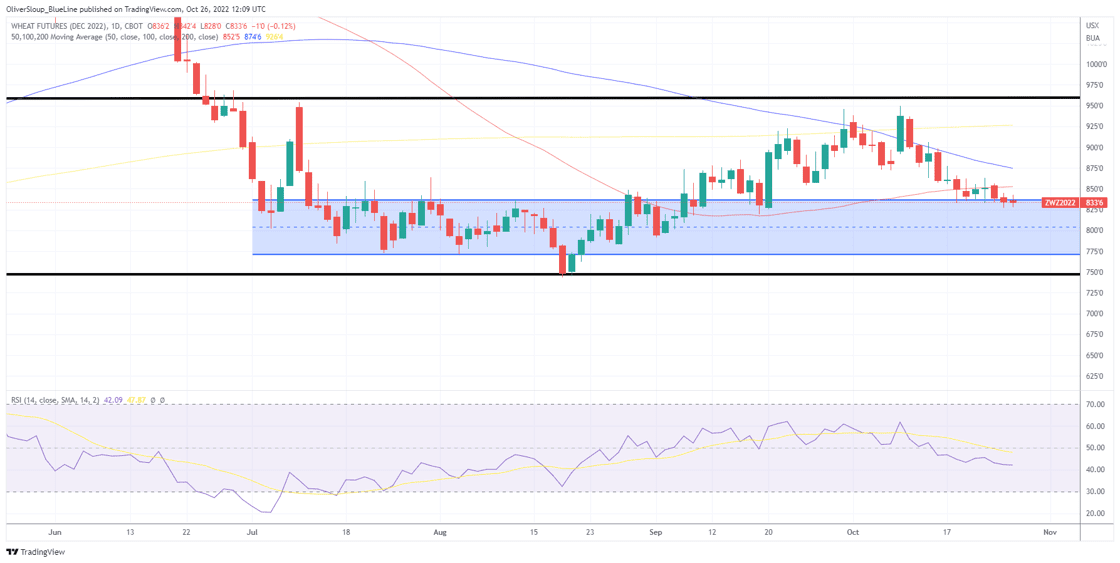

Wheat

Wheat futures are treading along support still, which we have outlined as 833-839. A failure to defend this pocket could trigger a bigger break, potentially taking prices back below $8.00. As mentioned in previous reports, we could make the case for a 40 cent move in either direction, for that reason we are keeping our bias at Neutral.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial