Fed Whispering, Xi's Supreme Power, and Big Week of Earnings | Morning Express 10/24/2022

Posted: Oct. 24, 2022, 9:02 a.m.

Fed Communication

- The Federal Reserve went into its blackout period with a bang Friday. The bank’s November 2nd policy decision is basically a forgone conclusion with a 75bps hike at a 93.7% probability, according to the CME’s FedWatch Tool. However, it is the communication regarding their December 14th policy decision in which they can use advantageously.

- As of Thursday, expectations for another 75bps hike in December were mounting with a 75.4% probability.

- Markets began exuding stresses Thursday night as the U.S. 10-year hit a new cycle high of 4.335%, and the Japanese Yen was falling precipitously to a fresh 32-year low.

- The Bank of Japan was forced to intervene once again, with September 22nd being the other. The bank purchased about $36.5 billion worth of Yen. However, given the lack of staying power the prior intervention had, the first since 1998, the BoJ needed a more coordinated effort.

- In comes the Fed Whisperer, the Wall Street Journal’s Nick Timiraos, whose 7:30 am CT article signaled a debate for the Fed’s December meeting, where they could step down to a 50bps hike.

- The news was aided by comments from San Francisco Fed President Daly, who said, “the Fed should avoid putting the economy in an unforced downturn … it's time to consider slowing the pace of rate hikes”.

- It is also speculated the maneuver is politically motivated ahead of the midterms.

- The U.S. 10-year slipped as much as 20bps and the 2-year as much as 22bps. The yield of the 30-year remained sticky, and the curve was able to steepen.

- The S&P gained 2.4% on the session and more than 3% from its overnight low.

Xi’s Supreme Power

- China concluded its weeklong National Communist Party Congress on Saturday, and President Xi tightened his grip with an unprecedented third term.

- Video surfaced on Xi’s goons removing those who could create friction or stand between him and absolute power, including his predecessor Hu Jintao.

- Given Xi’s new supreme power and prior pressures on big tech, markets did not take kindly to what is ultimately more uncertainties. KWEB, the Chinese internet ETF, is lower by 12% ahead of the bell, a new record low.

- The Hang Seng is -6.36% in its worst day since 2008 and -11.88% on the month.

- Commodities are under pressure as the Chinese Yuan loses another 1.39% against the USD today, marking -2.60% on the month.

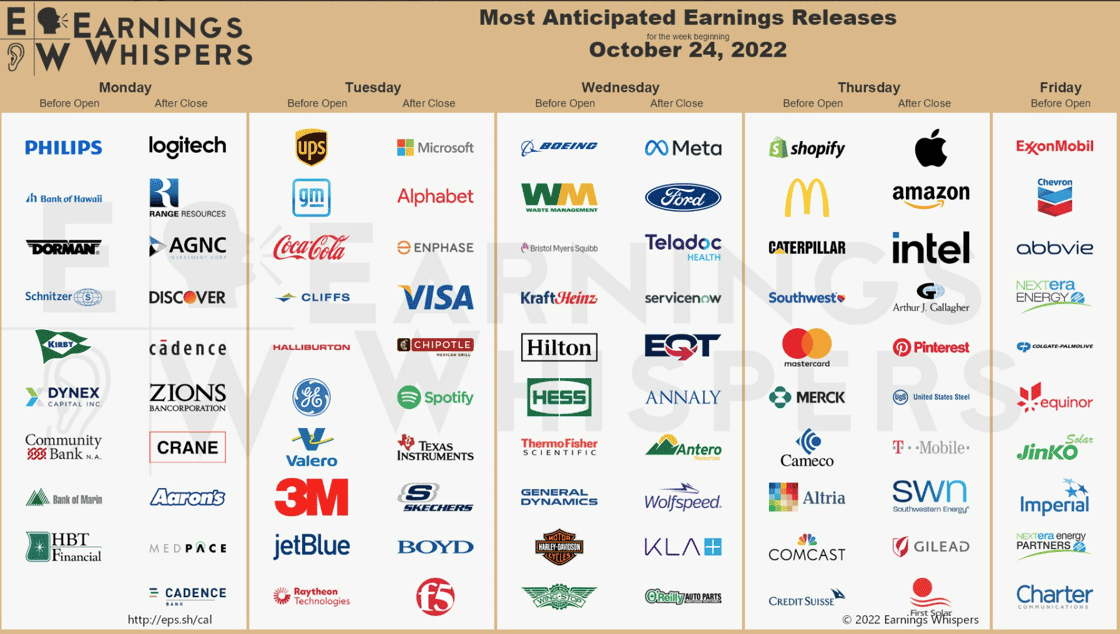

Big Week of Earnings

E-mini S&P (December) / NQ (December)

S&P, yesterday’s close: Settled at 3764.00, up 88.75 on Friday and 166.50 on the week

NQ, yesterday’s close: Settled at 11,358.50, up 267.75 on Friday and 614.50 on the week

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

NQ (December)

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Crude Oil (November)

Yesterday’s close: Settled at 85.05, up 0.54 on Friday and 0.40 on the week

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Gold (December) / Silver (December)

Gold, yesterday’s close: Settled at 1656.3, up 19.5 on Friday and 7.4 on the week

Silver, yesterday’s close: Settled at 19.066, up 0.377 on Friday and 0.995 on the week

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Silver (December)

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial