Grain Express 10/14/22

Posted: Oct. 14, 2022, 9:10 a.m.

Export Sales

Corn: Net sales of 200,200 MT for 2022/2023

Soybeans: Net sales of 724,400 MT for 2022/2023

Wheat: Net sales of 211,800 metric tons (MT) for 2022/2023

Logistics

Logistics continue to be a big concern, both river and rail. The low water levels of the Mississippi and Ohio river are creating delays and making it hard to ship grain to export terminals. The risk of a railway strike is also hanging over head as negotiations continue. The next vote will take place mid-November.

Inflation Data

Yesterday's CPI (Consumer Price Data) rose 8.2% from a year earlier, analysts were expecting to see a rise of 8.1%. The initial reaction from the outside markets was sharply lower, but everything reversed mid-morning and markets continued to rally into the afternoon

A Look at the Outside Markets

Equity markets have been choppy in the overnight trade, following yesterday's WILD day. The US Dollar is recovering some of yesterday's losses, trading back to 113.00. Crude oil is down roughly $2.

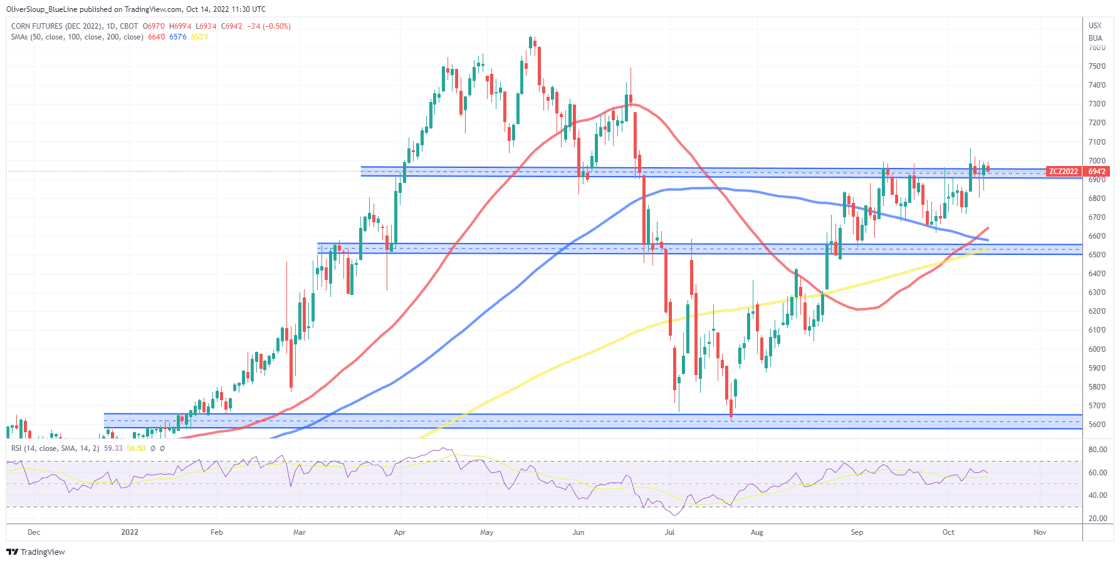

Corn

December corn futures had an inside day (trading within the previous day's range). The consolidation is continuing in the early morning trade, which is starting to form what could be a Bull-Flag. If the bulls can chew through 706 1/4-708, we could see an extension towards the June 1st gap, that comes in from 725 3/4-728 1/4. A break and close below 680-684 would neutralize our bias.

Seasonal Trend in Play: December corn has been higher from October 10th-October 20th for 13 of the last 15 years.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Soybeans

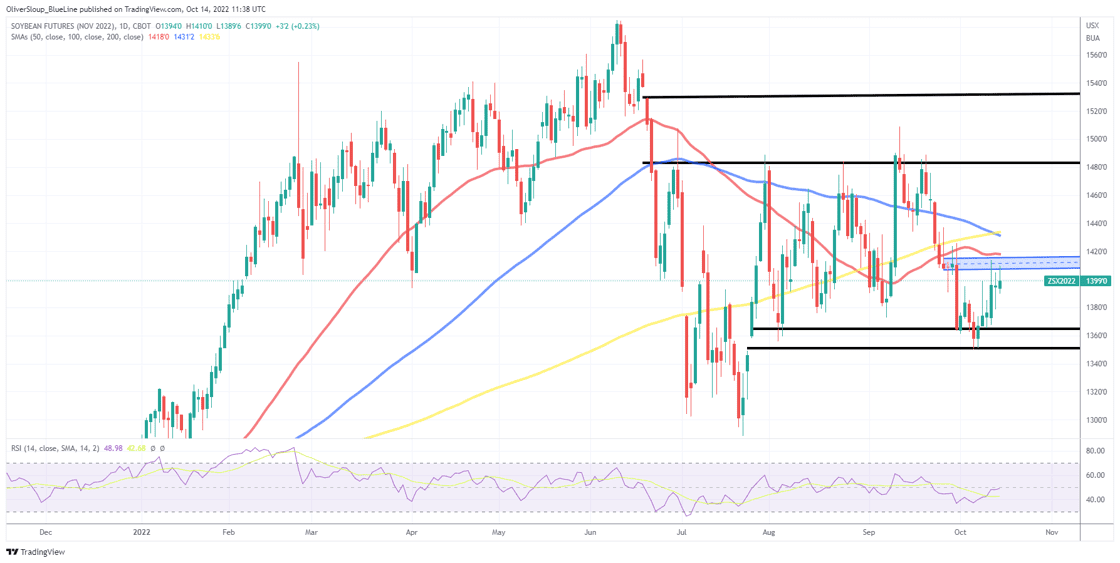

Soybeans have tested our resistance pocket again in the overnight session, 1407 1/2-1415 3/4, but have so far failed. Our bias remains Neutral/Bullish, aka cautiously optimistic. If the Bulls can chew through that resistance pocket, it could spark a bigger move, back towards the top end of the multi-month range, in the neighborhood of 1460/1470.

Seasonal Trend in Play: November soybeans have been higher from October 4th-October 27th for 13 of the last 15 years.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Wheat

Wheat futures were all over the place yesterday, which is about par for the course. The market did take out support, but managed to close back above it, keeping it intact. With that said, it was enough to neutralize the short-term technical landscape. As mentioned previously; if you don't need to trade wheat, you may be better off preserving your mental capital for another market.

Technicals Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

Levels Premium

🔒 You need to be a Premium User to unlock this content. Click here to unlock.

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Sign up for a Free Trial

Start Trading with Blue Line Futures

Don't have an account with Blue Line Futures?

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial