<p>Jerome Powell & the Federal Reserve are set to meet Wednesday, November 2, releasing the much anticipated interest rate hike (consensus is 0.75...

<p>4320 is the 200 Day Moving Average ($SPY). Is this an equities summer melt up? Is the momentum on the US Dollar slowing down? With regards to Crude...

<p>We are seeing a whipsaw day after news emerged of the White House meeting with China, topics regarding lifting tariffs.</p> <p>Germany is taking...

<p>It was a challenging week for commodities, especially the agricultural markets and industrial metals. Ags faced a correction as the hot and dry wea...

<p>The second day of Fed Chair Powell's testimony did not bring any new exciting news. With regards to the markets, the 10 yr hit 3%, Crude Oil co...

<p>Bill Baruch breaks down the action across equity indices on the back of a weak session in Asia yesterday.</p>...

<p>There is a rebound for risk assets today after Federal Reserve Chairman Jerome Powell said in a Congressional testimony that he will NOT compare hi...

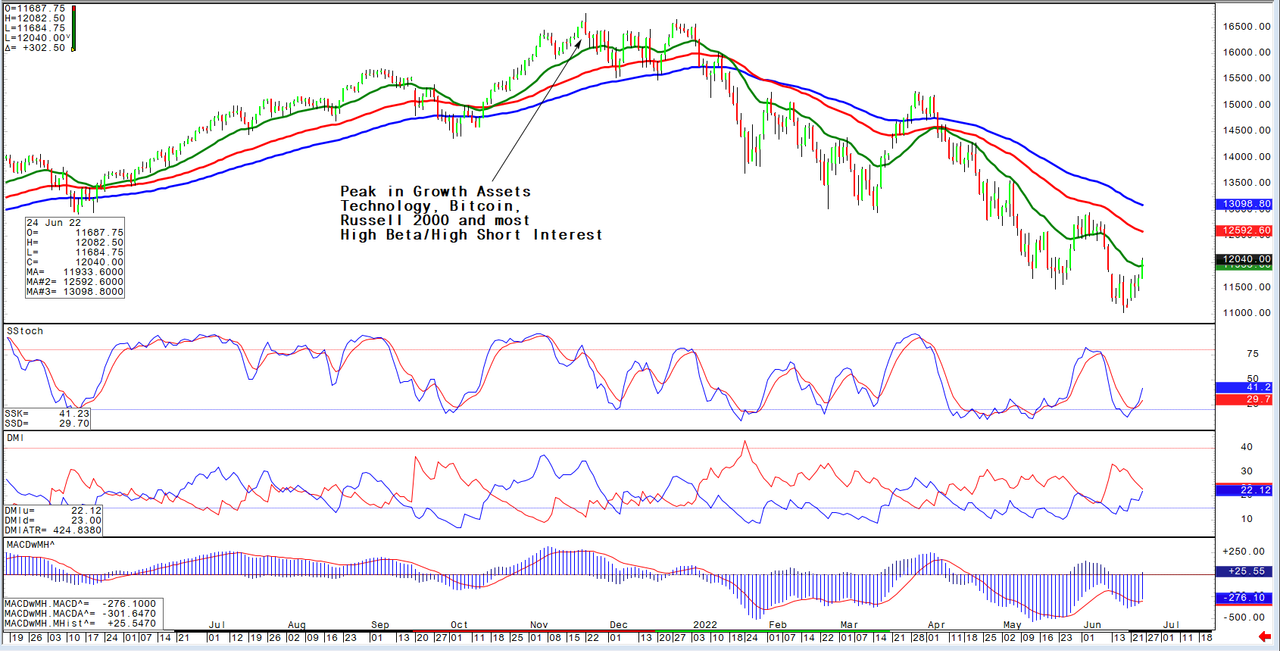

<p>Largest Fed hike in 28 Years! (75bps). This was almost certain after Friday's CPI number. Will we see easing on rates in 2024? What will CPI be...

<p>4160 was the high of the range for the S&P, hitting major 3-Star resistance, yet is still consolidating near support. $INTC is down about 5% on...

<p>Yields pull back (10yr Note back below 3%), Risk assets are on! The S&P 500 and Nasdaq are both positive, but must close above major resistance...

<p>Overnight tailwinds from China helped the S&P 500 lift off early, only to reverse as of writing. More importantly, the 10yr Bond yield breached...

<p>It was an eventful week for U.S. Equitites, with inflation data hitting 40-year highs and consumer sentiment reaching an all-time low. One bright s...

<p>Ahead of tomorrow's jobs report on the back of a weak ADP number (exp. +325k jobs created), Bill Baruch breaks down the charts and dives into t...

<p>Bill Baruch, President of Blue Line Futures joins TD Ameritrade!</p> <p><u><strong>Key Takeaways:</strong></u></p> <p>-Bill is cautiously bul...

<p>Stocks are rebounding nicely off of the lows from Friday, but at the end of the day, we NEED a close above previous highs to continue strength. The...

<p>The Selloff continues for Stocks continues this week. 4010 has given way in the S&P, joining large companies like $AAPL breaking well establish...

<p>Click Subscribe!! We Appreciate Our Followers!!</p> <p>4055-4065 is a sticky resistance level for the S&P 500 which aligns with previous low...

<p> </p> <p>Bill Baruch, President of Blue Line Futures joins Blake Morrow on Traders Summit!</p> <p><u>Key Takeaways:</u></p> <p>-The S...

<p>Jobs Friday! There was strong growth with 400k added, with contained wage growth. As of writing, the Nasdaq is 350 points higher than the low of th...

<p>Click Subscribe!! We Appreciate Our Followers!!</p> <p>The Inverse Head & Shoulder pattern is still very valid for the S&P 500, but we a...

<p>April 6, 2022 brought a dip in the recent June Nasdaq 100 Futures rally, but it stopped short at the .382 Fibonacci retracement level.</p> <p>Pa...

<p>Turnaround Tuesday! S&P and Nasdaq both closed on their highs yesterday, only to reverse sharply today. Fed Vice Chair Lael Brainard's hawk...