<p>Phil Streible with Blue Line Futures discusses Gold, Silver, Copper, Platinum, and other commodity topics.</p>...

<p>Chinese Deflationary Data While Gold and Silver Wait for tomorrow! The Metals Minute w/ Phil Streible</p>...

<p>Chinese Trade Balance data SLAMS the Copper Market! The Metals Minute w/ Phil Streible</p>...

<p>Precious Metals under pressure from a More Hawkish Fed!</p>...

<p>Nonfarm Payroll was expected at 200,000! Here's what I am watching - Metals Minute w/ Phil Streible</p>...

<p>Gold sells off on a U.S. Credit Downgrade? August Seasonal Pattern - Metals Minute w/ Phil Streible</p>...

<p>U.S. Credit DOWNGRADE! What this means for Precious Metals. The Metals Minute w/ Phil Streible</p>...

<p>Phil Streible with Blue Line Futures discusses Gold, Silver, Copper, Platinum, and other commodity topics.</p>...

<p>Phil Streible with Blue Line Futures discusses Gold, Silver, Copper, Platinum, and other commodity topics.</p>...

<p>Phil Streible with Blue Line Futures discusses Gold, Silver, Copper, Platinum, and other commodity topics.</p>...

<p>ECB Meeting Today! The Metals info you need to know to start your day w/ Phil Streible.</p>...

<p>Chinese Stimulus talks BLAST Copper higher! Here's what to watch-The Metals Minute w/ Phil Streible</p>...

<p>German PMI disaster sets up the Fed! Here's what I am watching.</p>...

<p>Gold and Silver volatility is set to SKYROCKET next week!</p>...

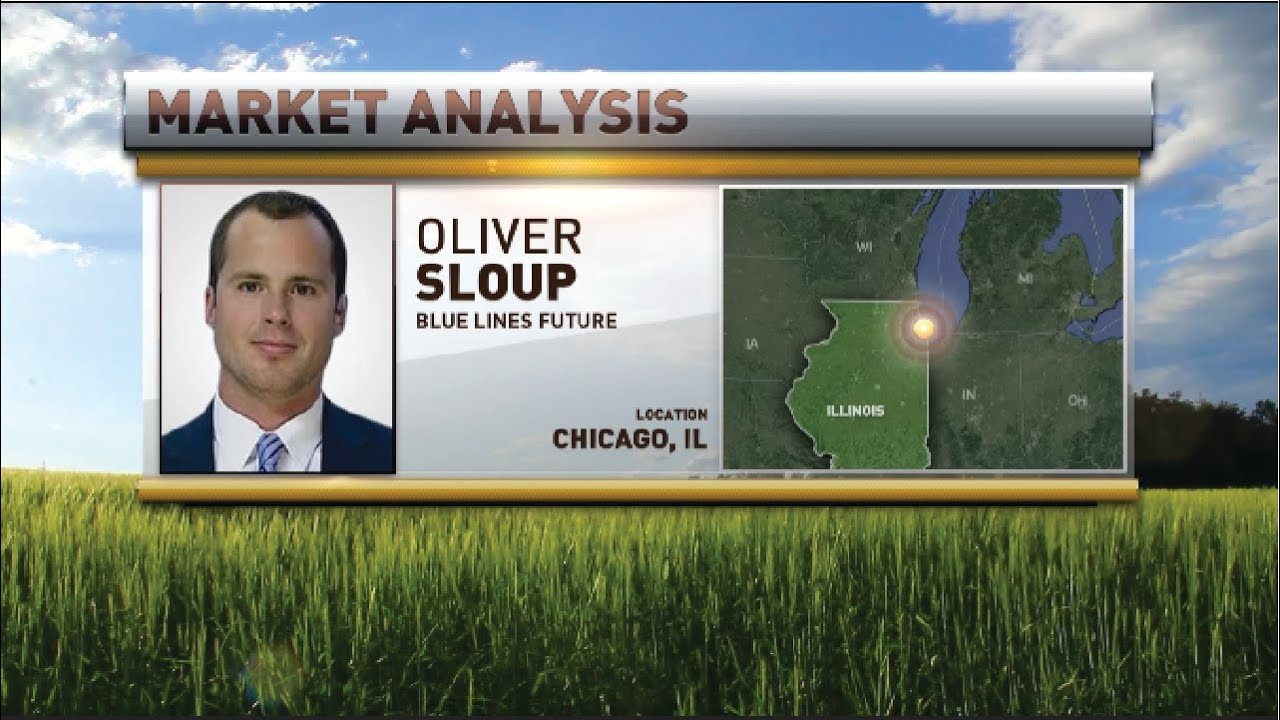

<p>Oliver Sloup discusses how export data and South American weather forecasts are impacting soybean futures.</p>...

<p>Oliver Sloup joined Scott the Cow guy on RFD-TV! Volatility is near 2020 lows in the grain markets, which presents cheaper protection for producers...

<p>Oliver Sloup joined RFD-TV to talk about the possible continuation of last week's strength in the Soybean market. Which price do the corn bulls...

<p>Oliver Sloup joined RFD-TV to talk about the recent constructive price action in the Soybean market. In addition, how will the inflation data comin...

<p> </p> <p>Oliver Sloup joined RFD-TV to talk about the price action in the Soybean market. In addition, what are the funds' positions te...

<p>Oliver Sloup joined RFD-TV to talk about the impact of Opec (and subsequently oil) on the price of corn. Thanksgiving can be volatile, as OPEC has ...

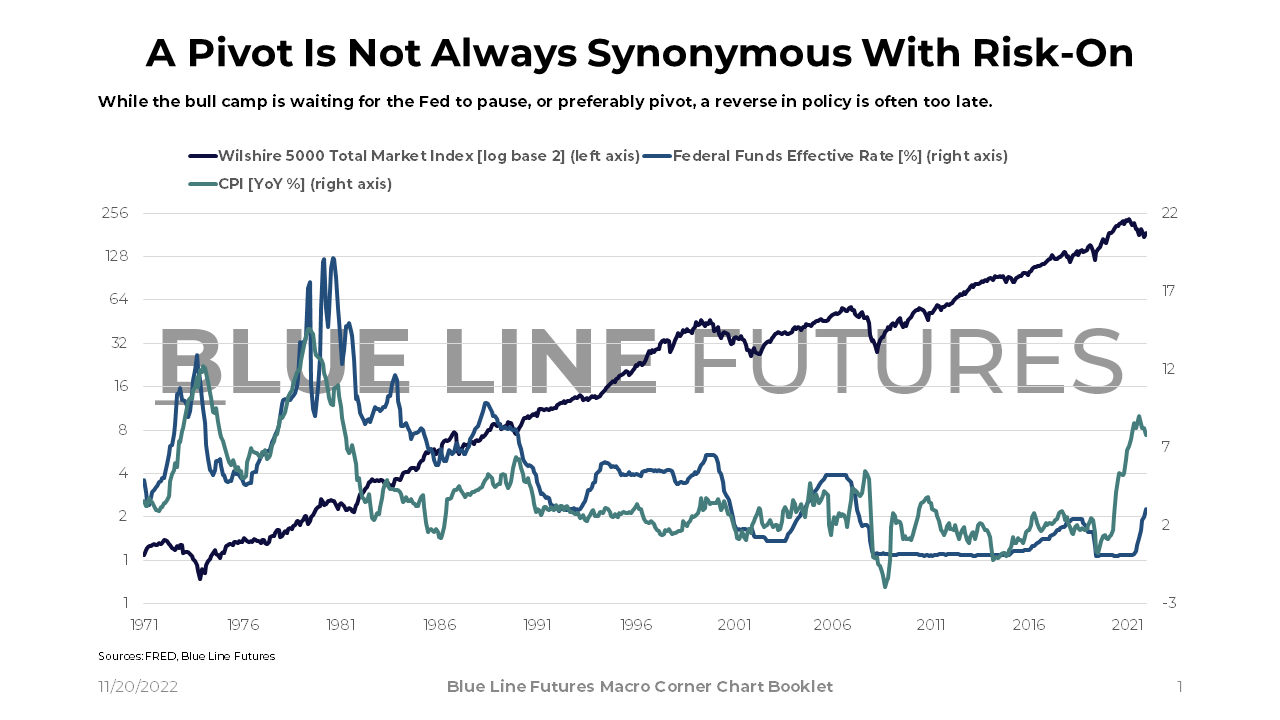

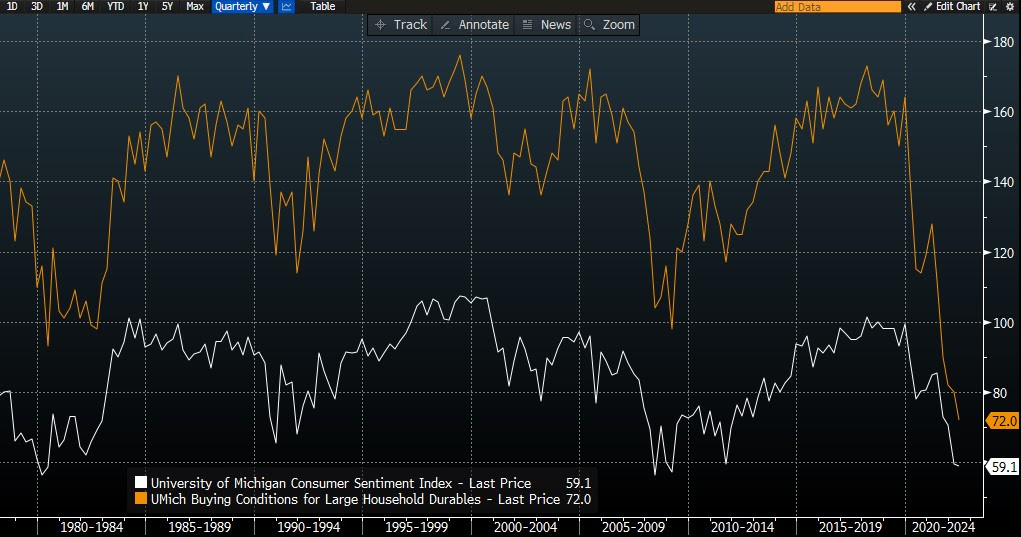

<h2><strong>Is This A Titanic Economy?</strong></h2> <p>"<em>I cannot imagine any condition which would cause a ship to founder. I cannot conc...

<p>Click Subscribe!! We Appreciate Our Followers!! Corn continues to be quiet, but will it last? Will the South American weather be the catalyst, or w...

<p>Attention is being turned to South America, as harvest season is past the 50% mark. Will the weather support or suppress grain prices going forward...

<p>Corn, Soybeans & Wheat are drifting lower, yet Soybeans are on their way to filling a gap going back to July 26. Will Beans carve out a harvest...

<p>Will the acreage number have a large impact on price, or has the market already digested a potential lower yield? How will the outside markets infl...

<p>Click Subscribe!! We Appreciate Our Followers!!</p> <p>The US Dollar has broken out to the highest levels since last month. Wheat is typically t...

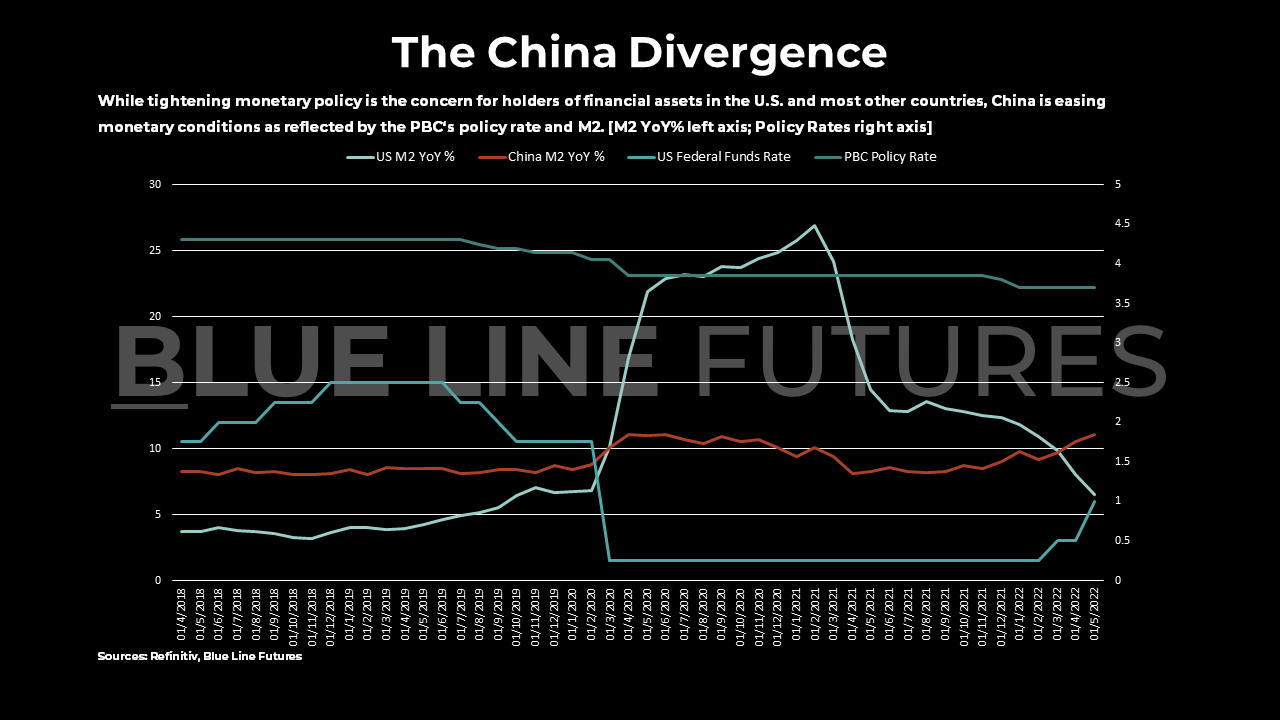

<h2><strong>The China Divergence and Commodities</strong></h2> <p>"Climbers that have been fortunate enough to reach the top and successfully ...

Oliver Sloup joined RFD-TV (Scott the Cow Guy) to talk about the market action and his outlook for the grains! Long Liquidation is seen in Corn, as...

<p>Whether has been the catalyst of extreme choppiness in the Grain markets as of late. Soybeans and Corn are going in opposite directions, as the 143...

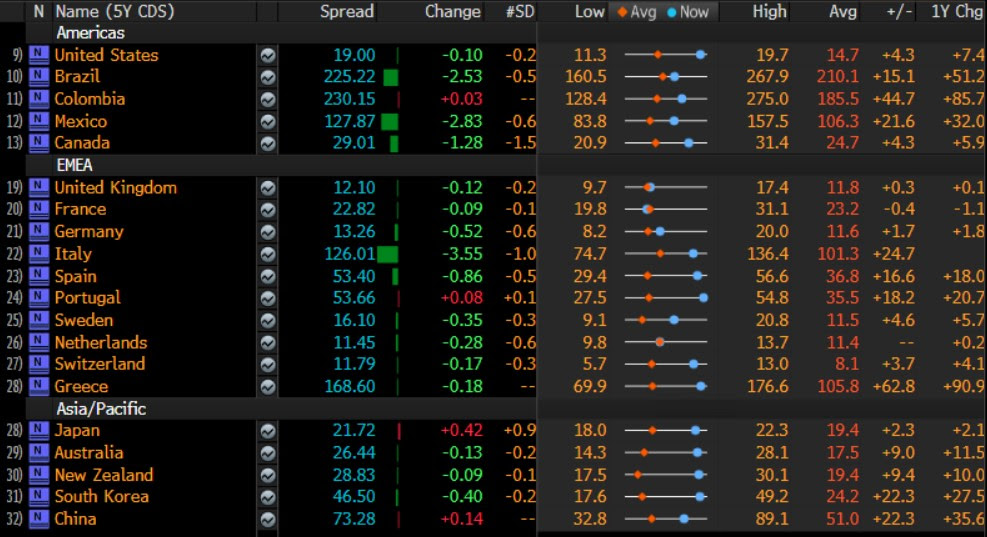

<p>What are the implications of this commodities sell-off within the context of structural undersupply, is the Fed handcuffed by debt and what is happ...

<h2><strong>Commodities and Fed Dilemma</strong></h2> <p>"Courage isn't having the strength to go on - it is going on when you don't h...

<p>Bill Baruch joined CNBC to discuss the commodities outlook on the back of the most recent washout across hard assets. With tighter financial condit...

<p> </p> <p>In today's episode, recorded on June 6, 2022, Paul Wankmueller and Jannis Meindl talk about energy markets, inflation, the wea...

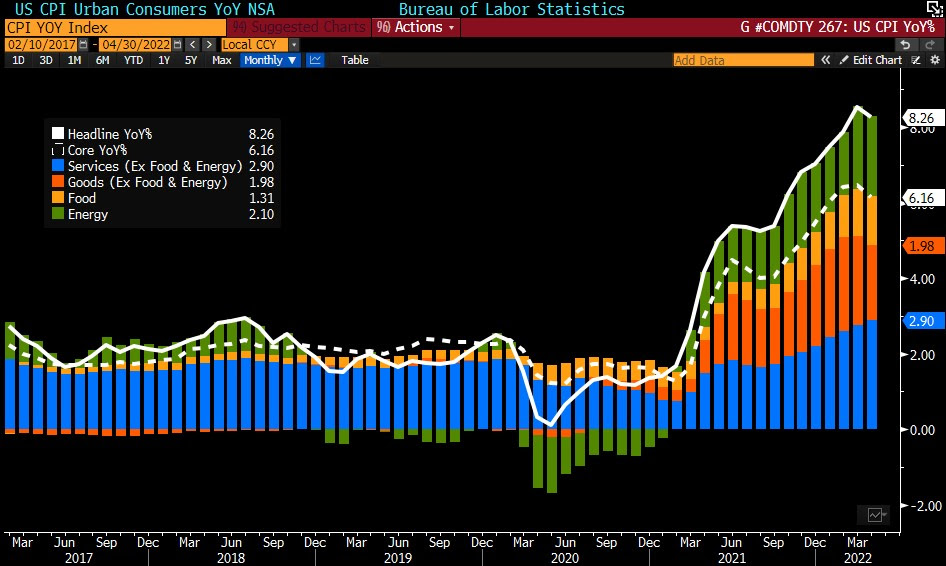

<h2><strong>Commodities, Inflation and Labor Market </strong></h2> <p>"The man who acquires the ability to take full possession of his ow...

<h2><strong>Commodities and A Redistribution of Wealth Fueling Secular Inflation</strong></h2> <p>"Don't be a hero. Don't have an ego....

<p>Phillip Streible joined the TD Ameritrade Network to talk commodities, interest rates and currency markets ahead of Memorial Day Weekend.</p>...

<p>With 70% of the world's corn reserves in China's hands, Beijing has the ability and willingness to use lockdowns as a strategic tool agains...

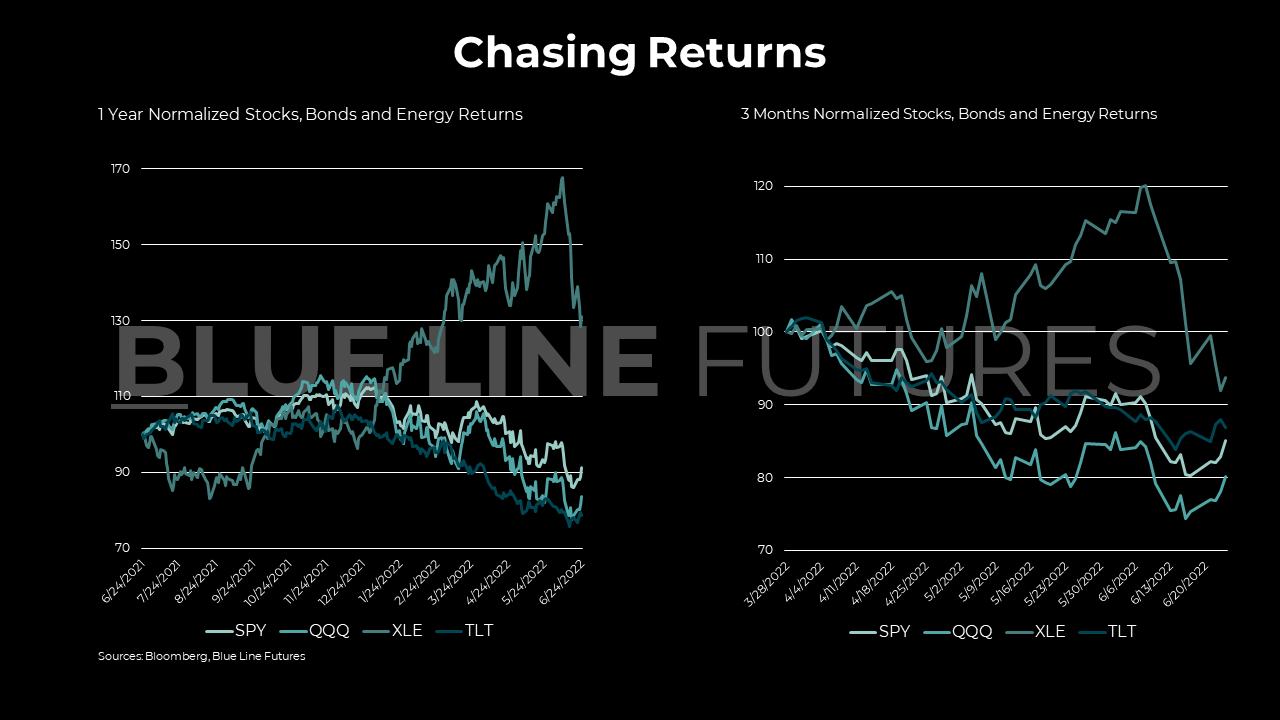

<h2><strong>The Capital Allocation Question</strong></h2> <p>"The market's very emotional but over time, doing something logical and syste...

<p>Wheat is leading the Grains after the much anticipated USDA Report. After breaking through the top end of the range (1150'0), there is not much...

<p>As outside markets continue to sell-off (Crude Oil, Equities, Metals), the pressure of Risk-Off momentum has bled into the grain markets. The mid-w...

<p>There was a lot of action in the outside markets today. Crude Oil had a $5 range and Equity Indices were off 5%. In spite of this, Corn & Soybe...

<p>Corn, Soybeans, Wheat & Crude Oil are all trading lower today due to lower demand outlooks as China expanded their Covid lockdown for the 4th s...

<h2><strong>Market Expectations</strong></h2> <p>"The whole world is simply nothing more than a flow chart for capital." - Paul Tudor Jon...

<p>Oliver Sloup, Vice President at Blue Line Futures, joins Scott the Cow Guy on RFD TV to discuss the Grains Futures Markets.</p> <p>Corn is the l...

<p>Oliver Sloup, Vice President at Blue Line Futures, joins Scott the Cow Guy on RFD TV to discuss the Livestock Futures Markets.</p> <p>June Live ...

<h2><strong>Market Expectations</strong></h2> <p>"When the facts change, I change my mind." - Winston Churchill</p> <p><strong><u>Fed ...

<p>When a technician talks about a price support level, what is going on behind the scenes? Paul Wankmueller CMT, Director of content and education at...

<p>Click Subscribe!! We Appreciate Our Followers!!</p> <p>The S&P continues to be drawn to the 50DMA after breaking the 200DMA. Fed tightening ...

<p>With 1 million barrels per day planned to be released from the Strategic Petroleum Reserve, how will the price of Crude Oil react? Bill Baruch, Pre...