The State Of Corporate America | Top Things to Watch this Week

Posted: Dec. 27, 2022, 5:46 a.m.

The State Of Corporate America

"We want to get more earnings for the price we're paying." - Joel Greenblatt

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 29: Chart Booklet

Check out last week's podcast episode on the Macro landscape: Macro Corner Podcast, Episode 28

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

A Look Underneath The Corporate Hood

Themes In Corporate Earnings

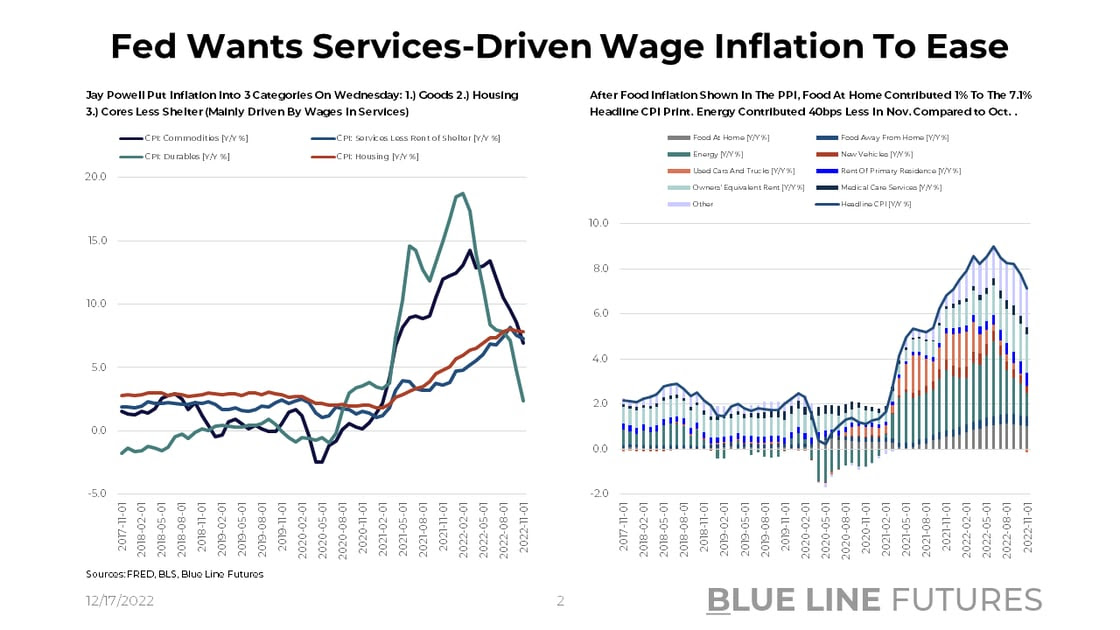

We will handle things a bit differently today, shifting the conversation from macro-level data to micro-level corporate highlights. From a macro perspective, we've mainly been dealing with the shift from goods to services spending, a market that refuses to see secular inflation, and utterly concerning yield curve dynamics. It is undeniable that those same trends affect the way companies invest, hire or fire people, and ultimately determine their capital allocation framework. Capital allocation includes M&A, dividends, and buybacks, all of which drive stock price performance over the long haul. The reflexive nature of the macro and the micro makes the intersection such an intriguing area to investigate.

More often than not, we've been told that 2023 will be a year of earnings recession, margin compression, and spending decline. To assess the extent to which those themes will or are already playing out, each company's graphs are split into 2 categories: 1.) Earnings Highlights and 2.) Revenue, Free Cash Flow, And Margin Trends

To get a sense of the corporate landscape, I chose companies in different areas of the economy, driven by Covid-related themes to varying degrees. The companies are Micron Technology, CarMax, Nike, Macy's, Spirit Airlines, Royal Caribbean, and Carnival Cruises.

Given the mix of businesses, I believe we will cover a broad gambit of corporate themes intertwined with macro-data points such as services & goods spending, corporate distress, as well as global activity trends.

Particularly this time, I encourage you to check out today's Chart Booklet as it contains a tremendous wealth of information, which likely takes time to digest.

Company-Level Data & Highlights

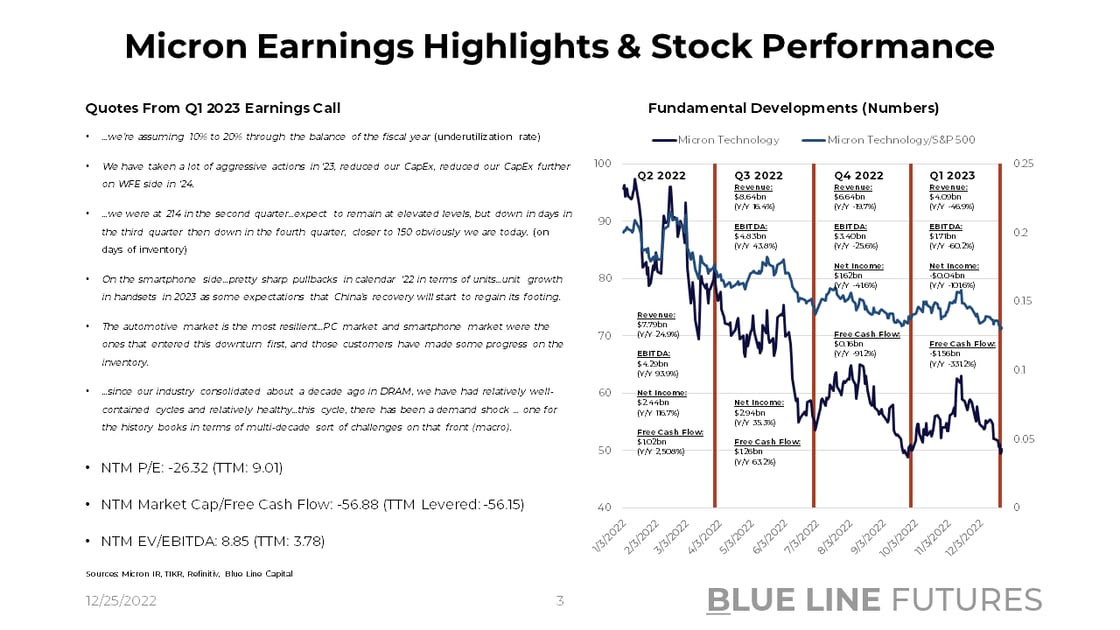

Micron Technology

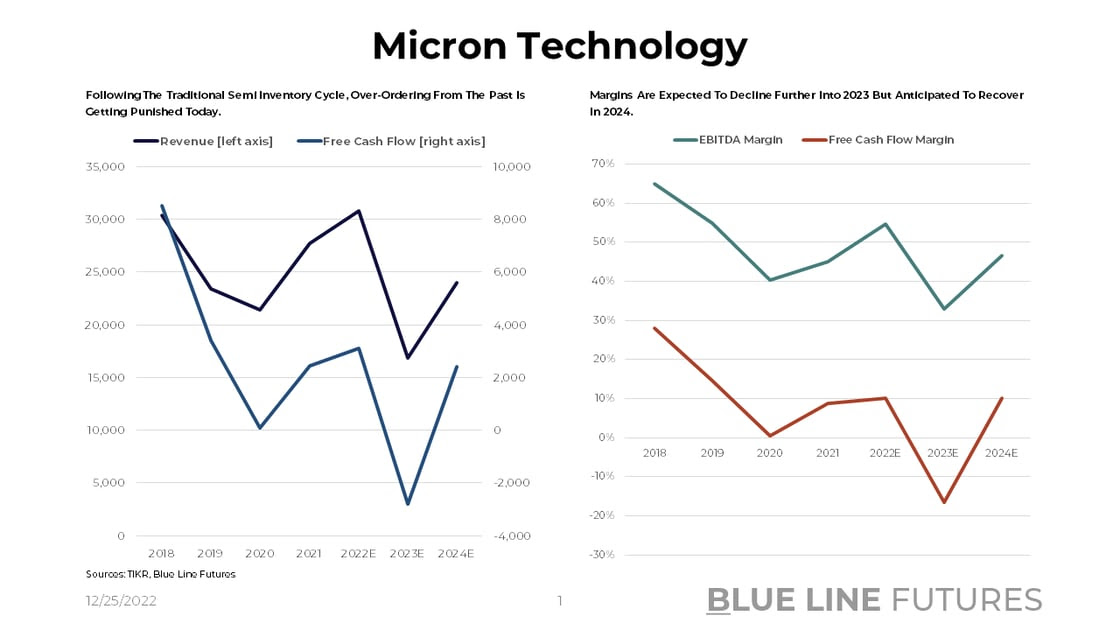

Going back to December 2020, global lockdowns dominated our lives and work-from-home became the primary way of participating in an organization. By then, most of us either had already invested in a new remote workstation or some might still have been waiting for a new laptop, webcam, or headset. Either way, consumer spending trends were heavily skewed towards goods as we reorganized our daily behaviors around new circumstances. As a result, chip stocks were high flyers amidst high spending combined with ultra-accommodative monetary policy. Unlike hockey-stick theories suggested at the time, the inventory cycle in semis played out the way it always plays out: as consumer demand spiked, the days of inventory at PC, smartphone, and server companies went down, leading to more orders, which in turn led to a further decrease in availability. That went on until consumer spending slowed on a relative basis, which started the same dynamic in reverse. Now that people returned to the office, needed less work-from-home equipment, and shifted spending to services, days of inventory increased rapidly, leading to fewer orders by Micron's customers.

Here we are as DRAM and NAND prices have collapsed as the world deals with a broad set of macro challenges. In a consolidated industry, memory chip makers are certainly in a better position than they once were. As Micron highlighted during its Q1 2023 earnings call, management has taken aggressive CapEx reduction measures with hopes for the rest of the industry to do the same. On a relative basis, the stock has done relatively poorly against the S&P 500 given its levered exposure to economic activity. While running at a 9 P/E on a trailing basis, a hit to profitability next year and in 2024 cautions investors against prematurely allocating to another upswing in semis. Whether you agree or disagree with those investors, the question is not whether their thesis is right; rather, have negative expectations gotten priced in or not?

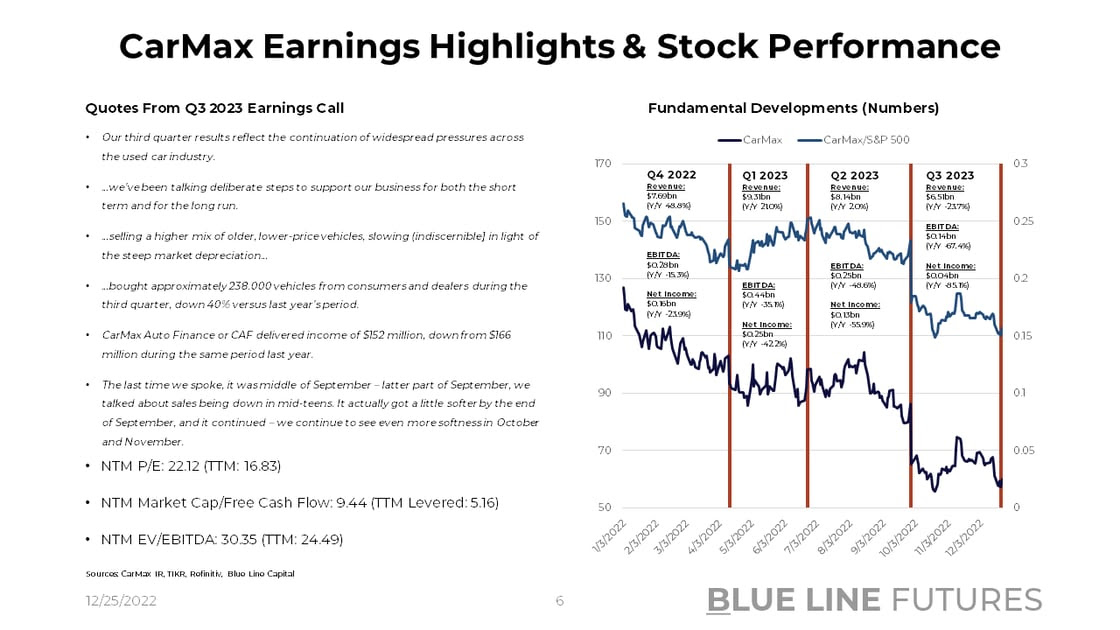

CarMax

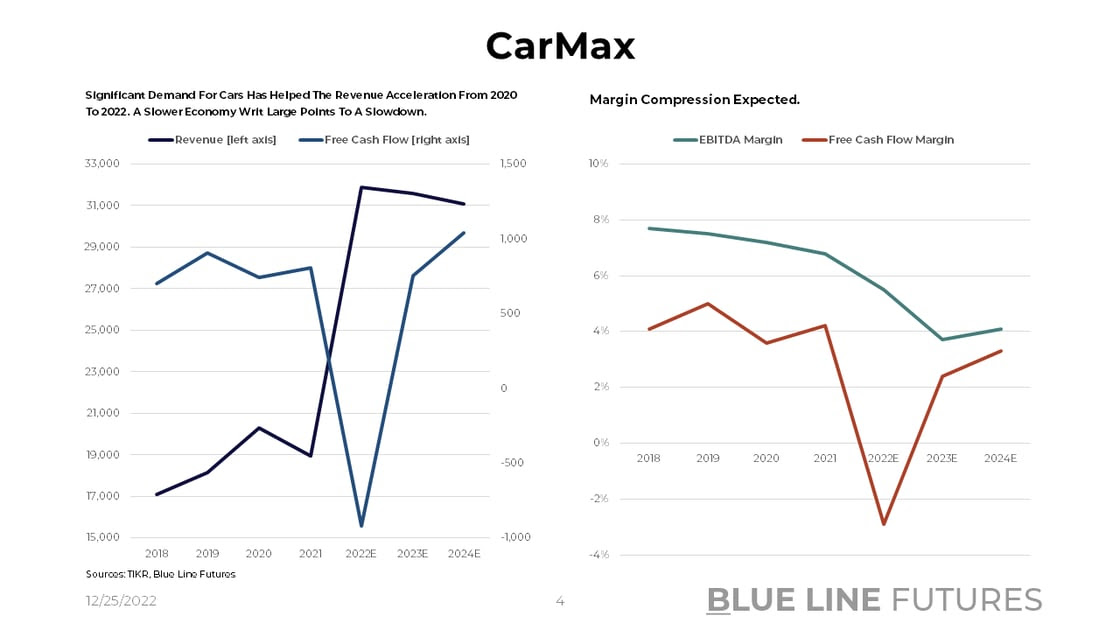

CarMax is the largest used car retailer in the United States, retailing more than 900k vehicles in fiscal 2022. Used cars, of course, have been one of the predominant beneficiaries of rampant Covid-spending as decentralized supply chains got clogged, reducing the availability of new cars. To get a sense of the magnitude of the price increase in the space, you can look at the Manheim Used Card Index which measures used car prices. You can also pull up the used car component of CPI and it will become clear that we were dealing with abnormal developments.

While domestic vehicle inventories remain low, a slowdown in consumer spending may be first seen in the higher-priced categories of the economy. Moreover, if new vehicle availability increases, who will want to buy another used car as their next car? Surely, it could be forced on people as the cost of living, including car loans, is on the rise. Nevertheless, CarMax's underperformance in isolation and also relative to the S&P 500 is certainly telling. Expectations are that earnings will be about 1/2 in 2023 & 24 of what they were in 2022. More significantly, it puts us below 2018 levels.

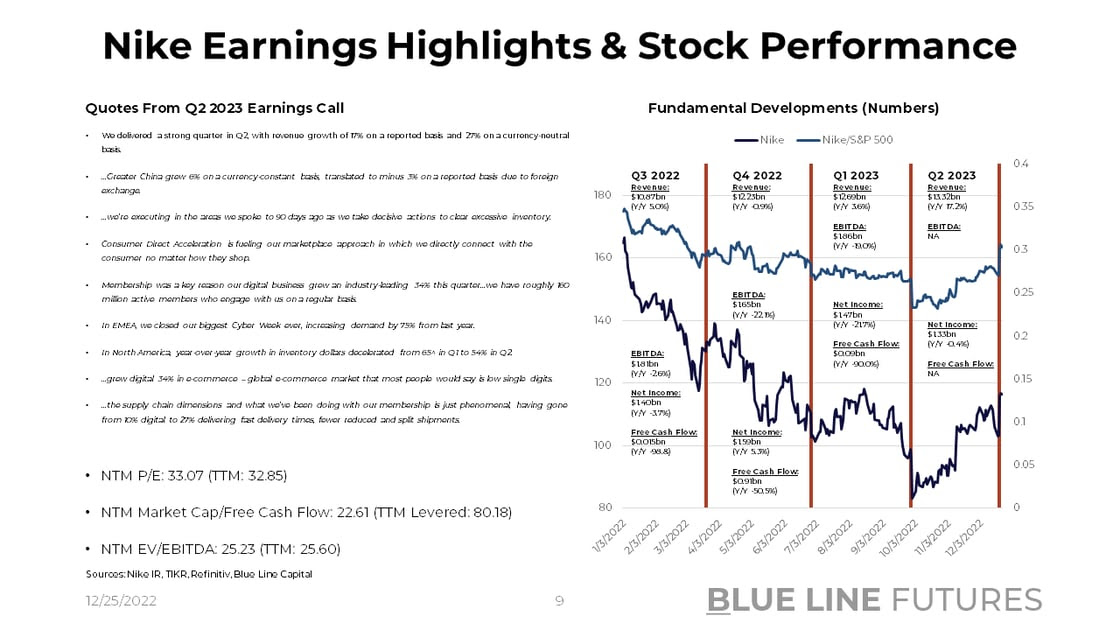

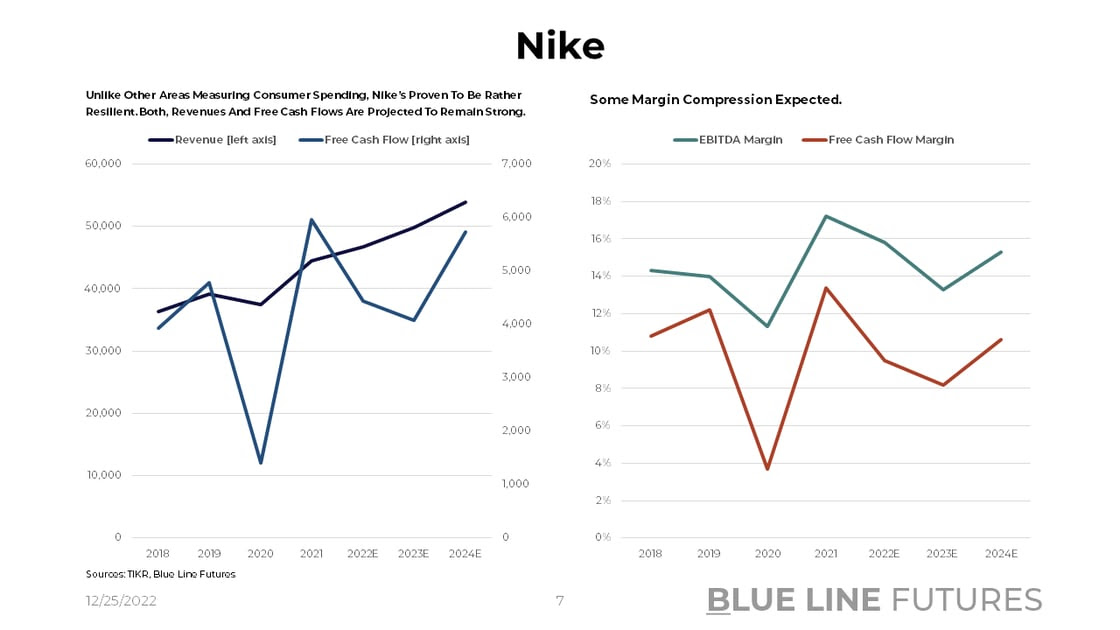

Nike

Unlike its peers, Nike has proven tremendous brand resiliency despite a slowdown in goods spending. Nevertheless, the stock is forward-looking and discounts future cash flows. More recently, the stock has outperformed the S&P as a positive earnings surprise in fiscal Q2 of 2023 turned investors' attention to positive e-commerce and membership trends. The company's direct-to-consumer channel via its membership platform has certainly contributed to maintaining margins while clearing excess inventory in the process. Despite recent positivity, it is all about the sequential change in retail; as pointed to in today's Food For Thought section, retail spending has remained tremendously resilient, but the rate of change dynamics are pointing south.

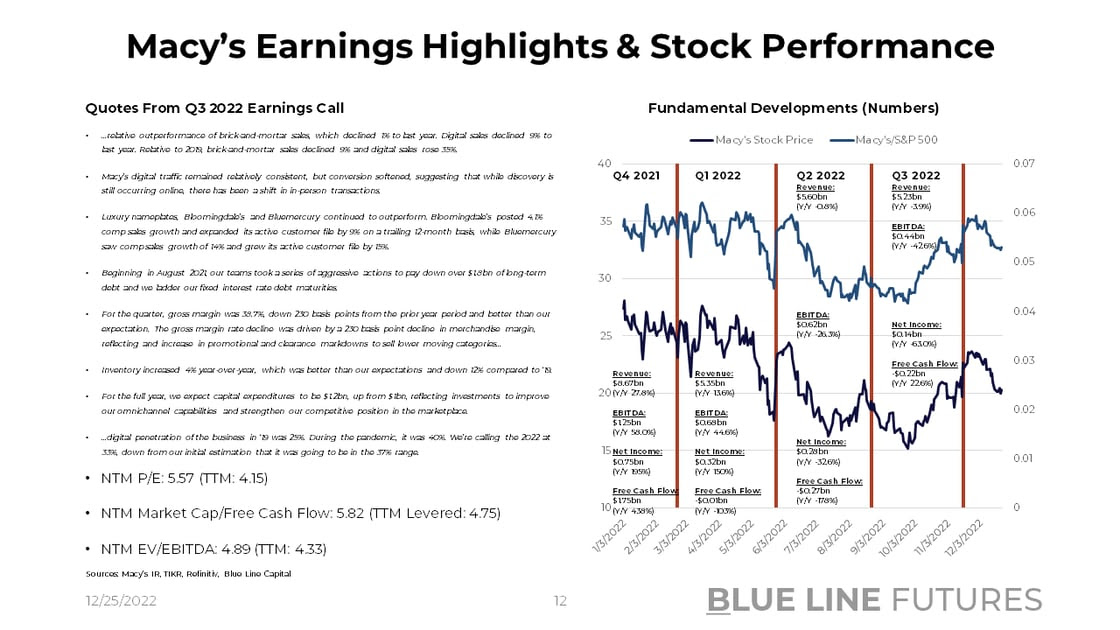

Macy's

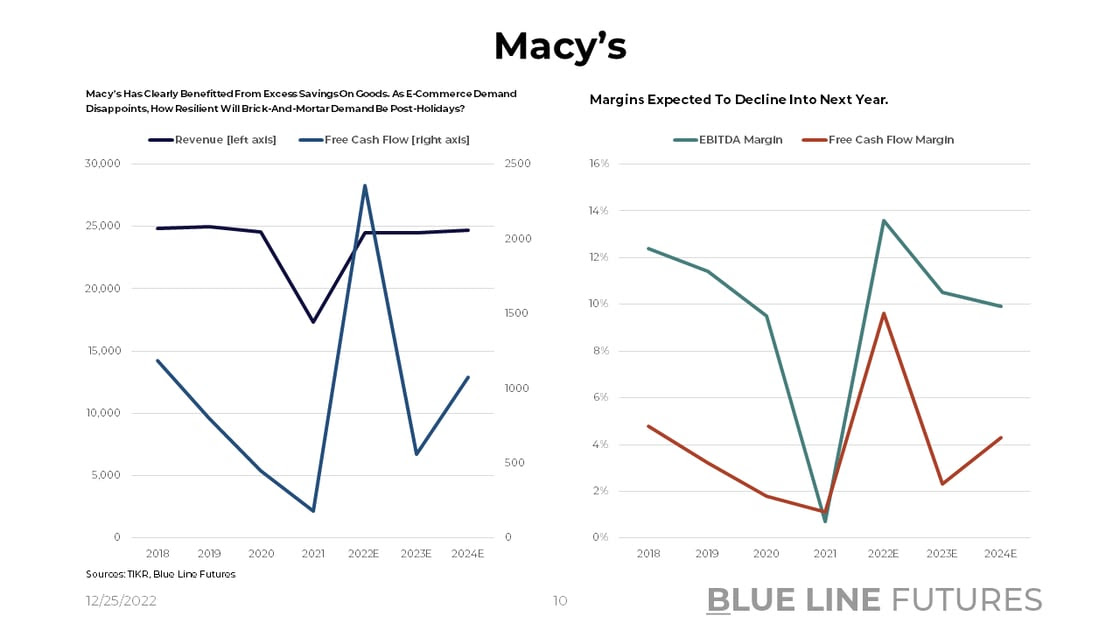

While vastly distinct from Nike, Macy's relative performance against the benchmark is eerily similar to Nike's. Unlike others, Macy's didn't benefit from rampant e-commerce spending during lockdowns to the same degree. That in turn led to favorable comparisons as the U.S. economy reopened and brick-and-mortar stores regained traction. As the company highlighted in its Q3 2022 earnings call, e-commerce sales as a % of total are disappointing while in-person shopping is outperforming. Maybe, habits have not changed that much after all.

Nevertheless, Macy's low NTM P/E multiple of 5.57 tells us that the market continues to look at the company as a secular decliner, meaning the business is in the later stages of its lifecycle. While its omnichannel approach is encouraging, the company has guided up CapEx by $200m, reflecting the intensity of a transition. Reflected in negative free cash flow trends, one has to be aware of the challenges that come with the transition from a traditional to a modern-day business. Luckily, no major bond maturities are due in the coming years.

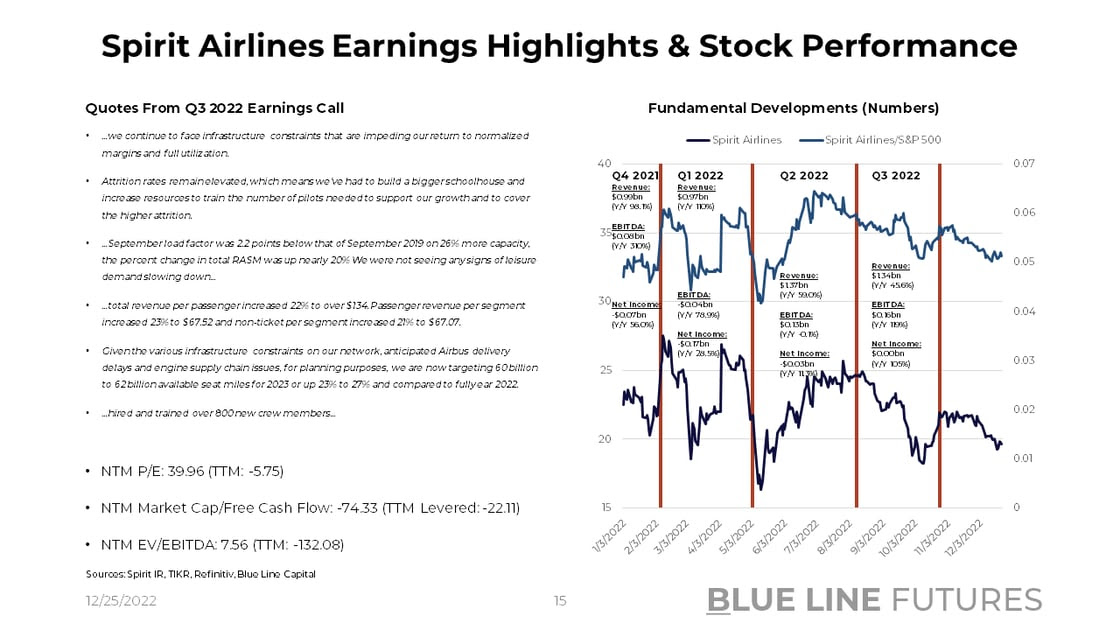

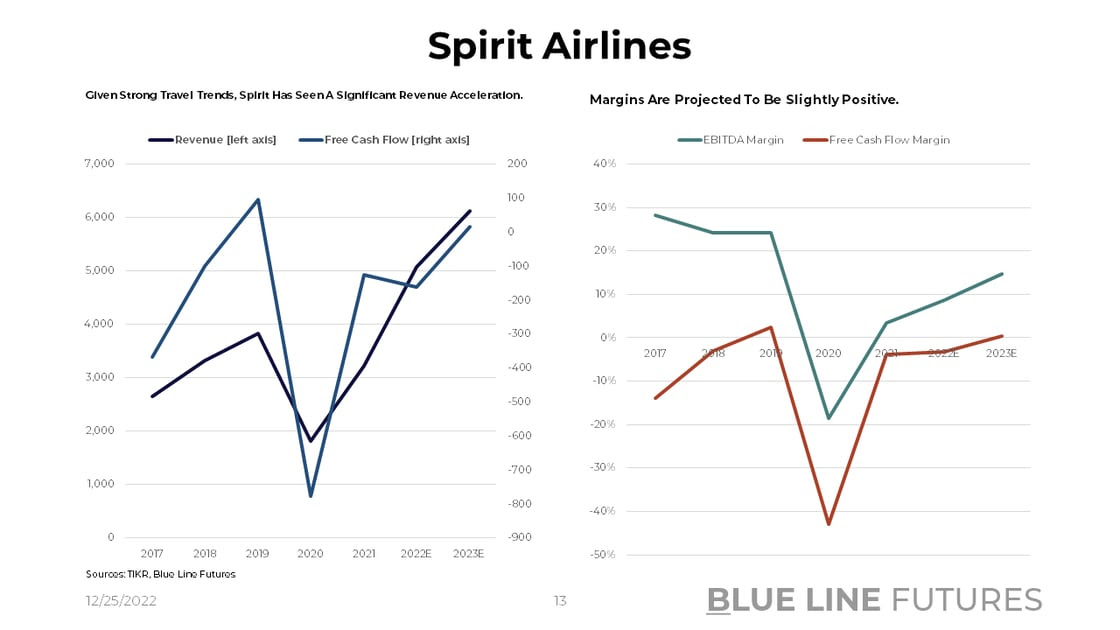

Spirit Airlines

As a low-cost carrier, Spirit Airlines has not only been eyed by M&A arbitrageurs given activity around JetBlue's bid for the company but has also been seen as a leisure pure play. It is no secret that activity at airports has been rampant as evidenced by TSA checkpoint numbers over 2019; yet, airline stocks have underperformed the index. The reality is that airlines are dealing with much more variables than just transporting passengers. Firstly, you need to buy airplanes, pay for slots at airports, and hire the staff that will operate those planes on and off the ground. Secondly, you are operating in a highly competitive market with a product that's little differentiated from peers. Thirdly, airlines have been one of the main pandemic victims, carrying gigantic debt loads that will require restructuring or a business miracle to get rid of. Given the complexity and competitiveness of the industry, low profitability may hold investors from rewarding these stocks.

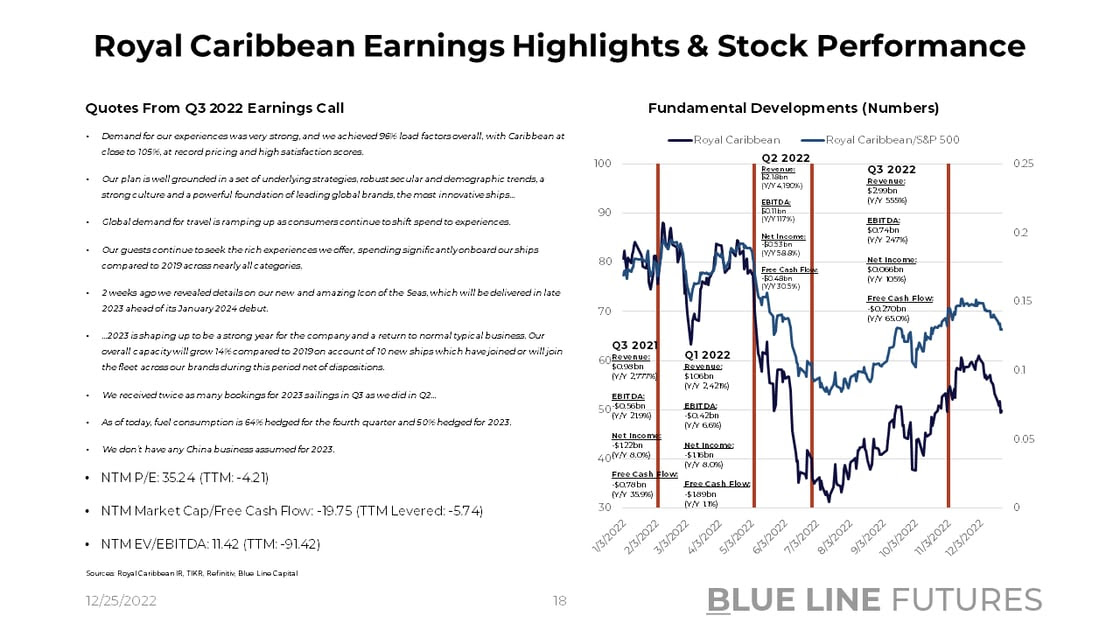

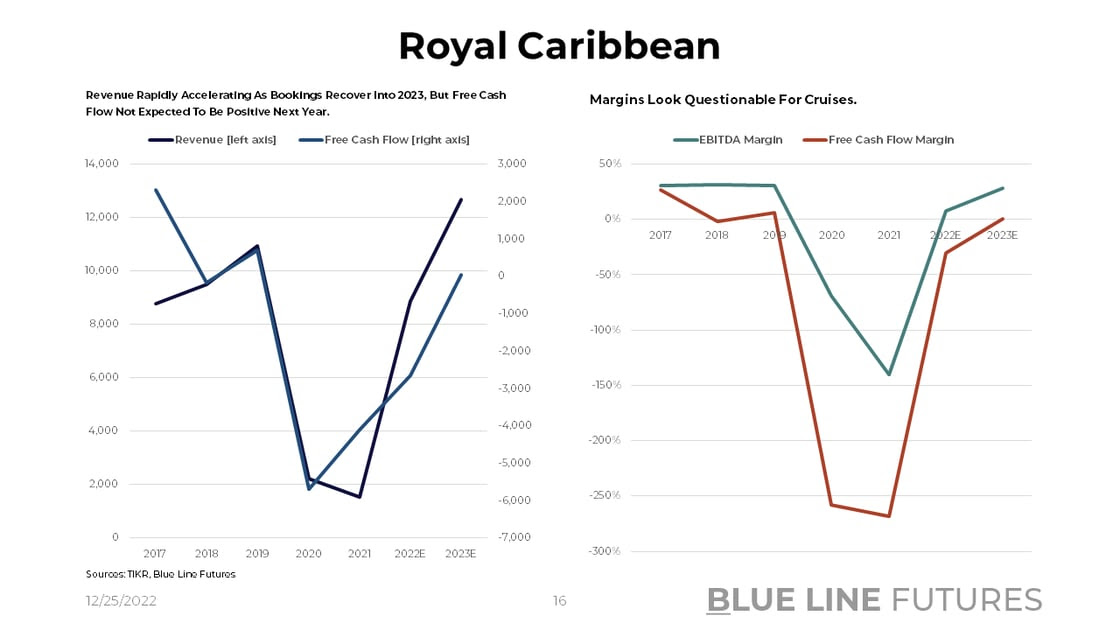

Royal Caribbean

If airlines are what you think about when you think of debt-loaded companies, I will show you something else. Cruise lines are the pinnacle of what it looks like when you have your business destroyed by an external shock. Today, Royal Caribbean is back at 2019 capacity levels with more ship deliveries expected. Relative to the S&P, we did see relative outperformance as the market started to discount the shift to services spending. Nevertheless, there are secular challenges, including ugly balance sheet dynamics. For what it's worth, Royal Caribbean's co-founder has dumped ~1.4m shares on the open market since December 1st.

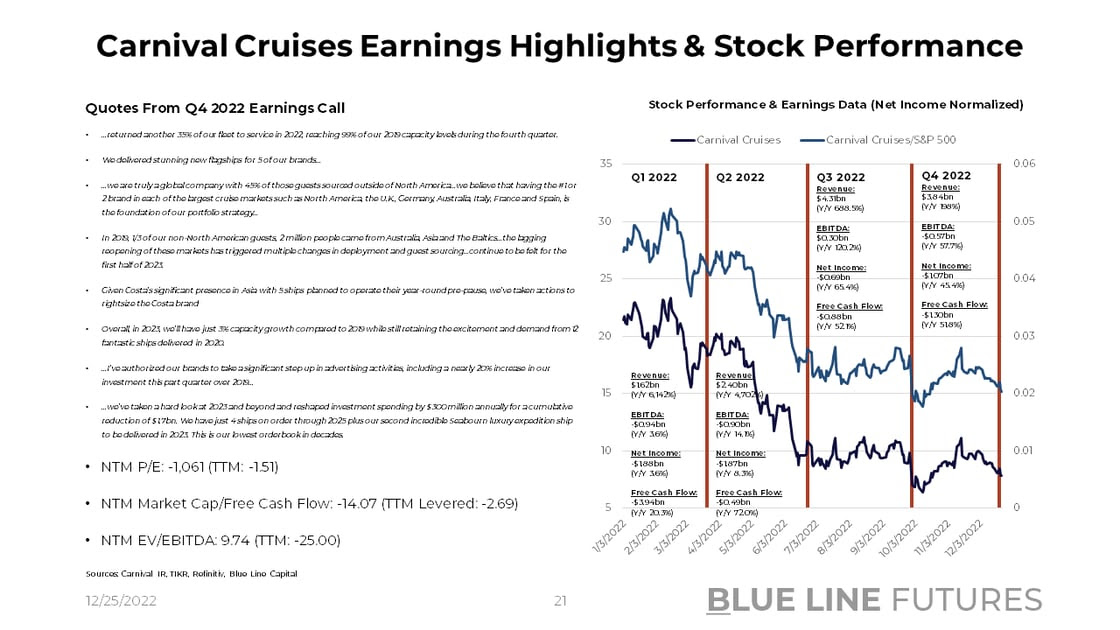

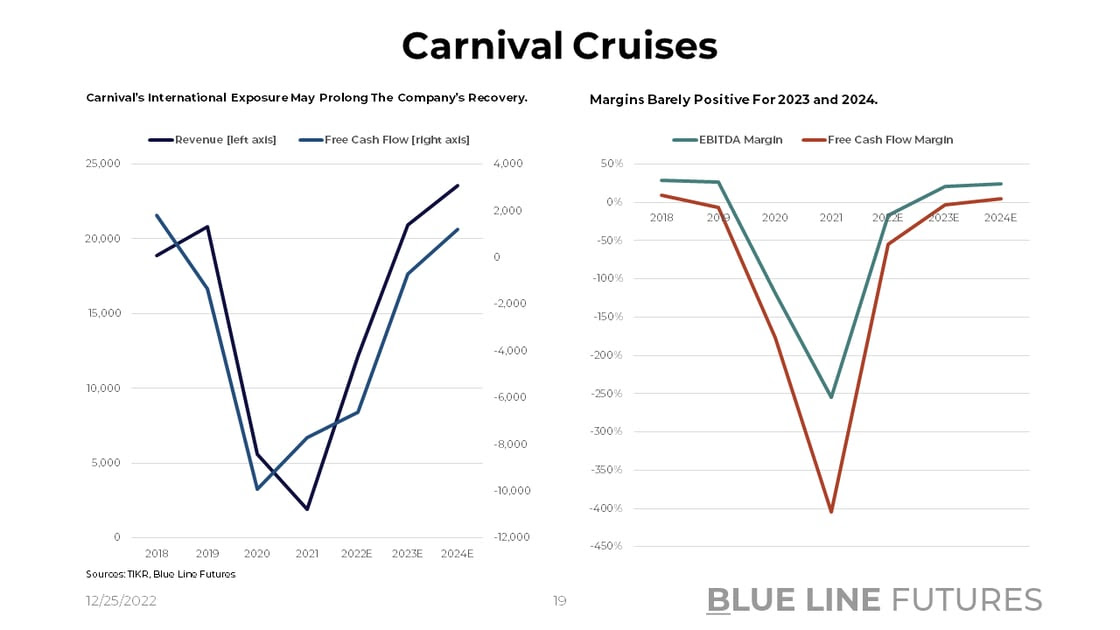

Carnival Cruises

Putting a sweetener on the Royal Caribbean story, Carnival Cruises is dealing with the fact that large swaths of its fleet are operational outside North America. As a result, the company didn't only have to deal with a domestic reopening but is now challenged by foreign nations' post-Covid policies. As we've learned, countries can diverge on their choice of policy for quite a while, which makes fleet allocation challenges. Currently, the market is expecting a tad of positive free cash flow generation in 2024.

You will find that the chart booklet of today's article is extremely content-rich. I hope that today's piece helped in bringing some understanding to the corporate landscape, what drives stock returns & multiples, and why macro and micro are much less distinct than we may have thought. In addressing macro headwinds, companies will have to look towards efficiencies and utilize companies that can provide a toolkit with which to do that. In an era where labor might be scarce, global security is in question, and inflationary concerns are still front & center, there will be winners & losers. Businesses that failed to retain some sort of discipline will pay the price; corporations that are taking the necessary steps will succeed. Businesses are a levered bet on the economy, but it is important which part of the economy you're levered to and whether there are micro-forces that may lead to diverging outcomes.

Enjoy the rest of your holidays and all the best as we get ready for 2023!

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Monetary Tightness Continues - December 18, 2022

- Inflation & Growth Expectations, Terminal Fed Funds Rate, Deficit Financing - December 11, 2022

- The Prospects For Future Growth - December 4, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

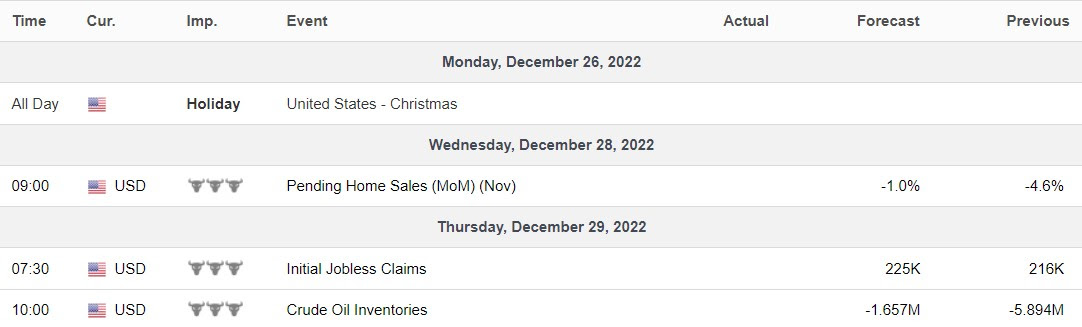

Economic Calendar

U.S.

Data Release Times (C.T.)

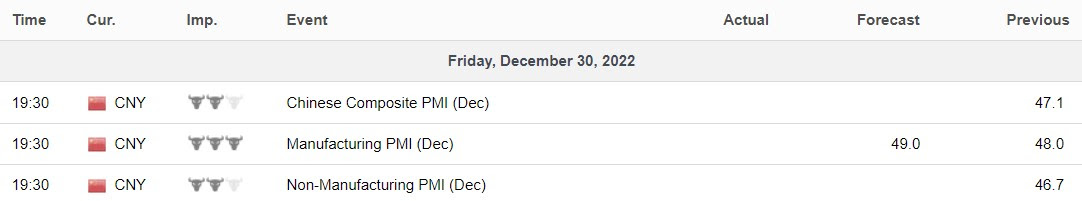

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

The following charts are picked from last week's Macro Corner Chart Booklet. You can access the entire pack here.

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial