.png)

Seasonal Trade Alert: Silver

Posted: Dec. 20, 2022, 12:14 p.m.

Powered by MRCI

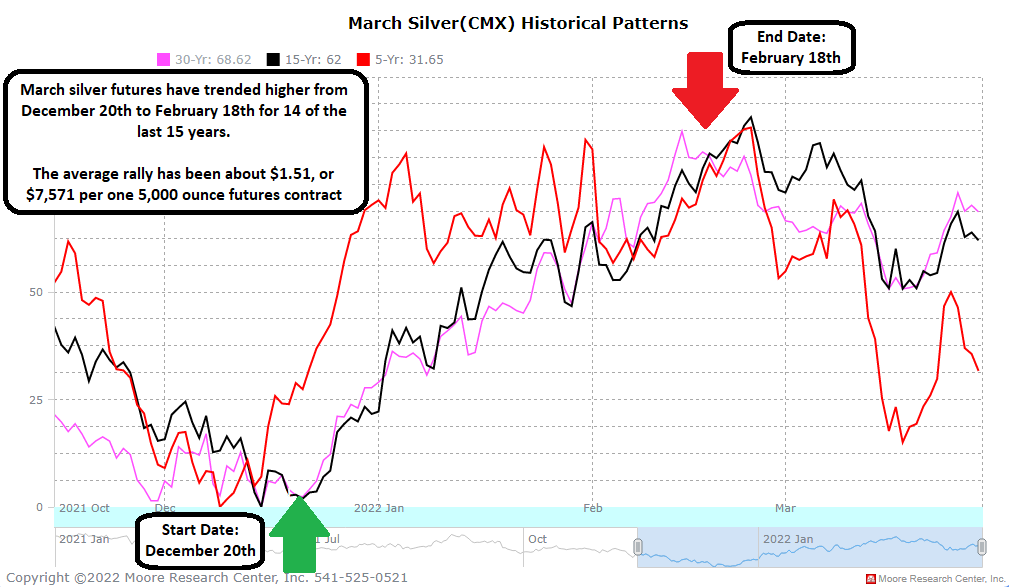

Below is a chart of the 5, 15, and 30 year average price fluctuation for Silver futures.

We've listed 3 Ways to Play at the end of this writeup.

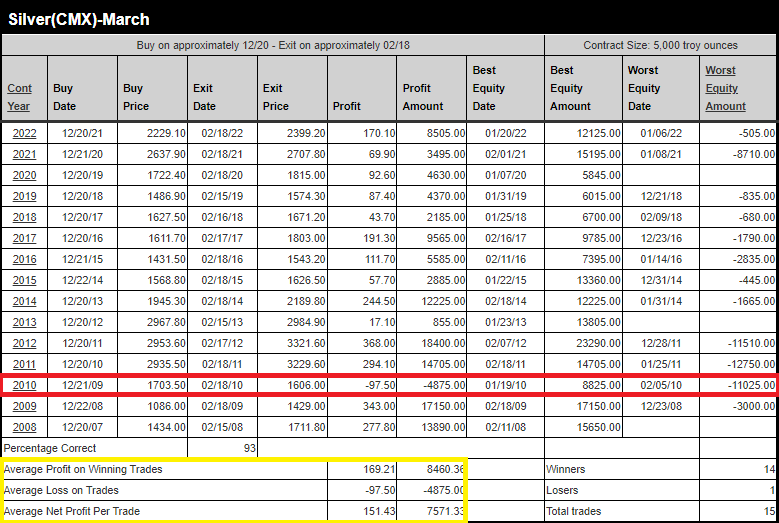

Performance Snapshot

Below is a performance snapshot of the seasonal trend for each of the last 15 years. You can find the average gain/loss, best/worst equity (based on one futures contract), and more.

We've highlighted the off-trend year in red.

The Technical Landscape

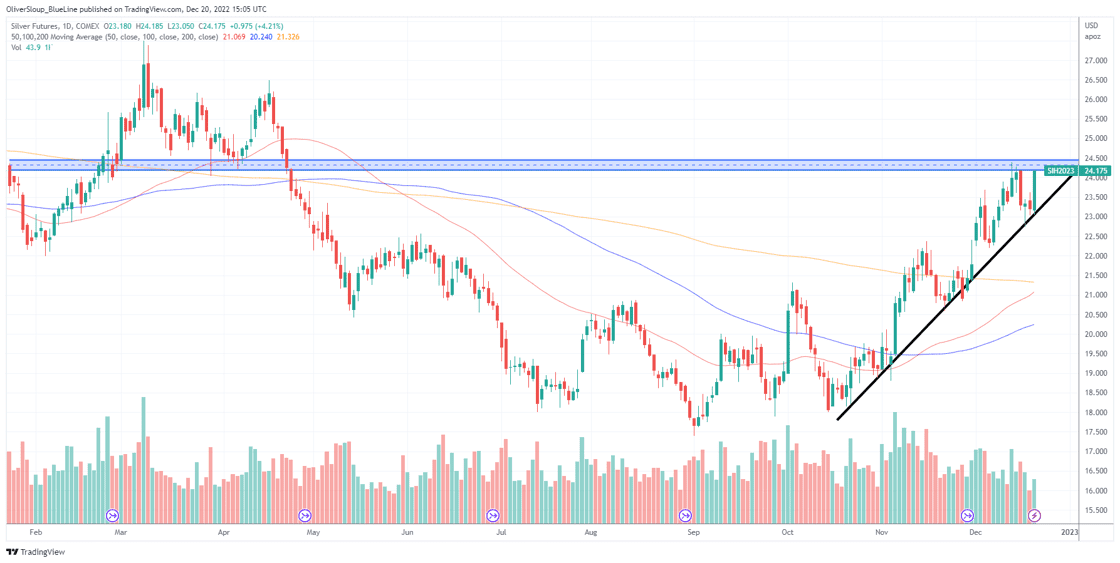

The March Silver contract has been trending higher since the bounce from the November lows, continuing to hold trendline support achieving higher lows. There is a great seasonal in play starting today, as the March Silver contract has traded higher 14/15 years from December 20th-February 18th. This does not guarantee the market will perform this year, but Silver is already up over 3.5% on today’s session, and the chart is looking great for upside potential if it can breakout above the December 13th highs. The downside risk comes if we break below the trendline support, and then look to retest the gap from November 30th.

3 Ways to Play

Here are three ways to consider playing this bullish seasonal trend

1. Buy a call spread. We are seeing an uptick in volatility which affects option pricing. Contact our trade desk if you'd like to discuss a call spread strategy that would be suitable for you: 312-278-0500.

2. Buy a future(s) with a stop loss. Deciding where to buy and where to place the stop will vary from trader to trader, as each have a different risk profile and risk tolerance.

3. Use more complex options strategies. If you're curious about other ways to get exposure via different options strategies, contact our trade desk: 312-278-0500 or email Seasonals@BlueLineFutures.com

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial