Monetary Tightness Continues | Top Things to Watch this Week

Posted: Dec. 18, 2022, 3:29 p.m.

Monetary Tightness Continues

"All of humanity's problems stem from man's inability to sit quietly in a room alone." - Blaise Pascal

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 28: Chart Booklet

Check out last week's podcast episode on the Macro landscape: Macro Corner Podcast, Episode 27

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Inflation Data, Spending & Labor Trends, Financial Conditions

Fed Meeting & ECB Hawk Talk

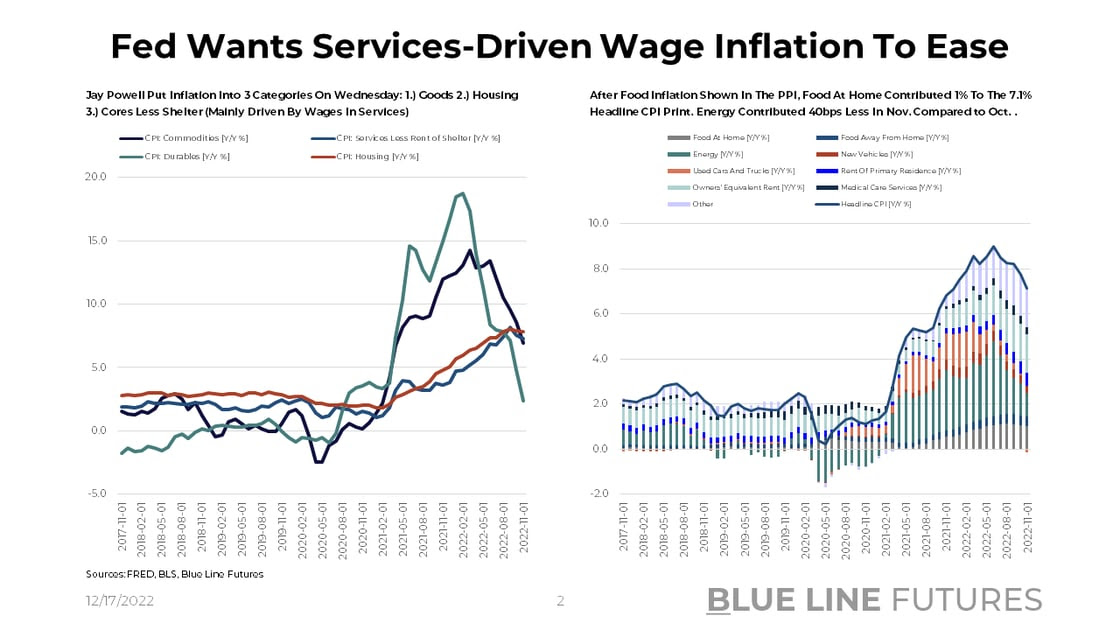

Let's start with where the macro week began, which was Tuesday's CPI report coming in lower than expected at 7.1% Y/Y headline and 6.5% on core. Breaking things down into sub-components, contributions to Y/Y headline looked as follows:

- Food at home made up 1.02% of headline (down from 1.06 a month prior, down from 1.11 in Sep., and 1.15 in Aug.)

- Food away from home stayed roughly flat at 0.44% of headline (down from 0.45% a month prior)

- Energy continues to contribute on the disinflationary side as the headline contribution went from 1.42% in October to 1.05% in November (down from 3.3% back in June.)

- New vehicles also on the disinflationary side, contributing 0.29% to headline vs. 0.34% a month prior

- Used cars and trucks, widely watched during the pandemic, were deflating at a -0.12% contribution after +0.08% in Oct.

- As expected, shelter continues to accelerate on a lag

- Rent of primary residence adding 0.58% to headline after 0.56% in Oct.

- OER adding 1.71% to headline after 1.66% in Oct.

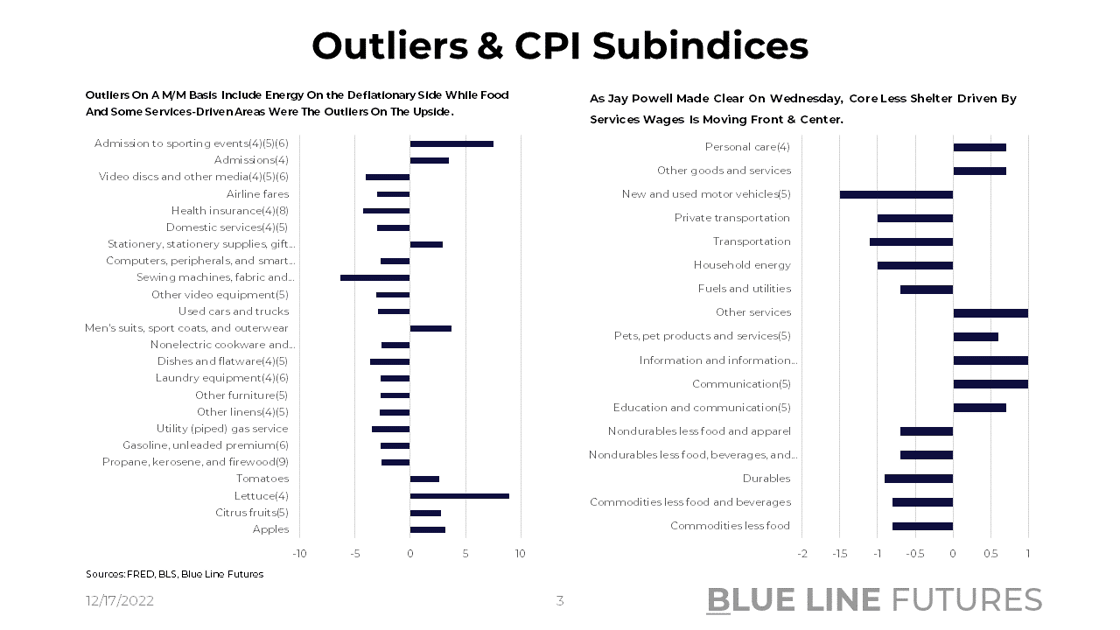

Outliers on the upside and downside were rather interesting as food as well as some service-related areas were showing a steep increase while other services slowed. Airfares, for instance, showed a -3% M/M comparison along with health insurance -4.3% on the month. On the flip side, admission to sporting events was up 7.5% from October to November.

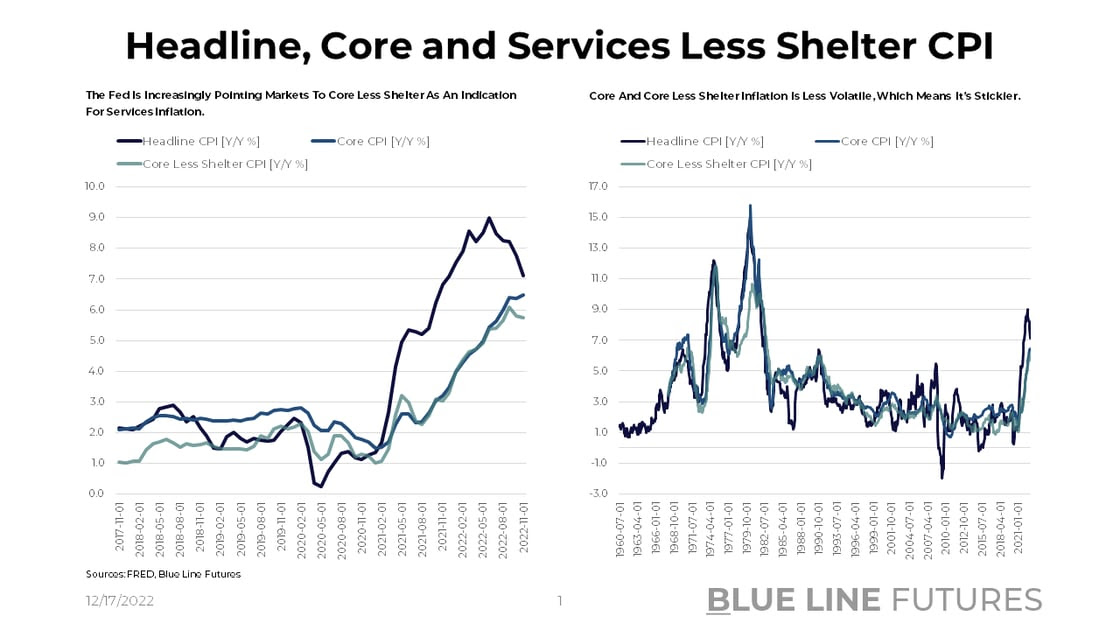

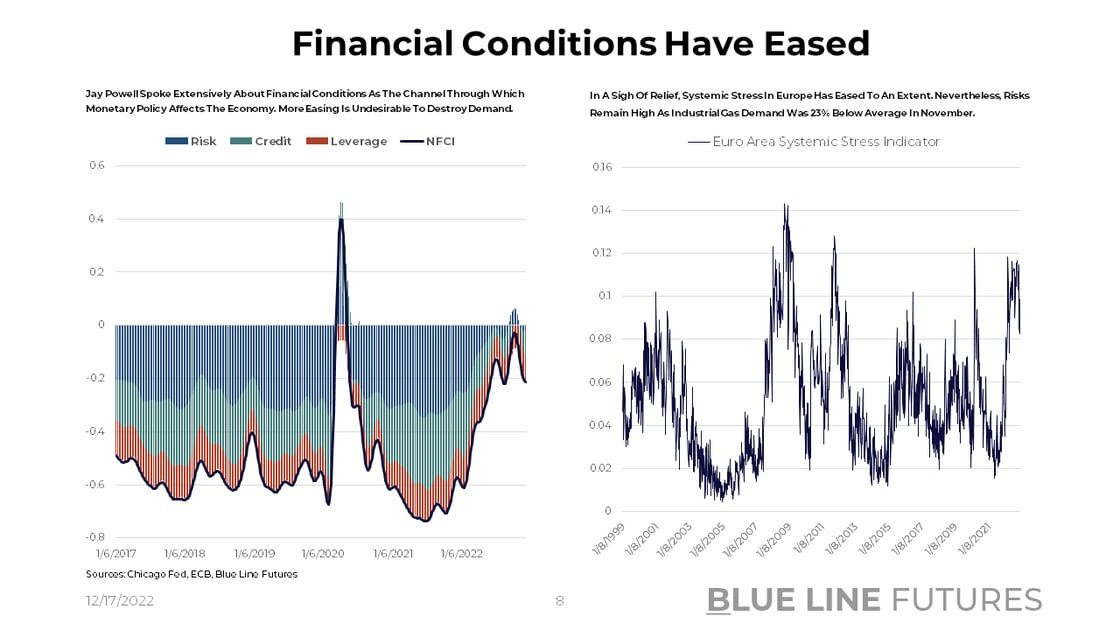

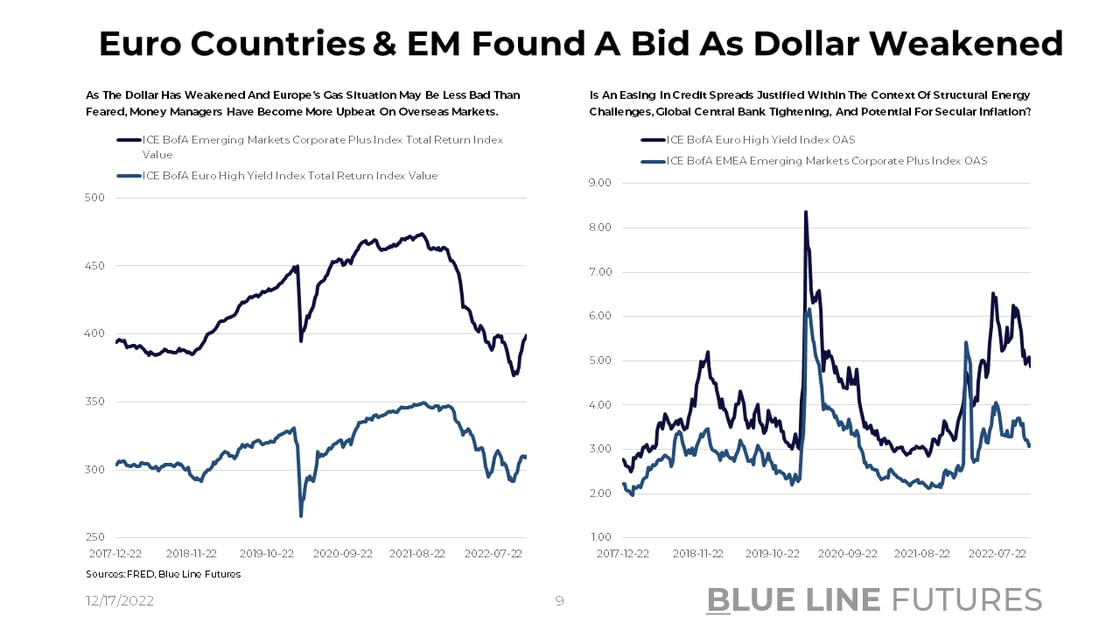

Looking at CPI-subindices more broadly, however, there continues to be clear a clear trend from good to services inflation with housing acting on a lag. Tying the CPI print into the Fed on Wednesday, the committee is steering market attention to Services Less Rent Of Shelter. While the Y/Y number has slowed from 8.2% in Sep. to 7.3% in Nov., the services less rent of shelter component is mainly driven by more sticky wage inflation in services. What does that mean? Similar to rents, wages don't reset all at once given how wage negotiations work. While some employers may have adjusted employee compensation this year, other unions may drag negotiations into next year. That dynamic may result in a degree of stickiness. Jay Powell also acknowledged that goods inflation steeply rolling over is exactly what the FOMC has anticipated with housing following the expected lag. It appears, the "only" point of concern is wages, which in turn means labor force participation and deteriorating demographics. Nevertheless, Powell's goldilocks press conference shouldn't shift the entirety of our focus to the positive side. Instead, the Fed Chair emphasized caution against loosening too quickly and therefore staying the course until the job is done. Furthermore, Jay Powell made it clear that the main channel through which the Fed can "control" inflation is financial conditions. As you can see on slide 8 of the chart booklet, financial conditions have eased recently as stocks & bonds have rallied and the Dollar has declined. To be more precise, he did point to the significant tightening since the bottom in easy conditions but made it clear that over time, it's important to see financial conditions restrictive enough to return inflation to 2% on average.

The committee revised core PCE estimates for this year up from 4.4 - 4.6 to 4.7 - 4.8; for 2023, they did revise them higher as well from 3.0 - 3.4 in Sep. to 3.2 - 3.7 on Wednesday. The committee also raised their estimates for unemployment from 4.1 - 4.5 in Sep. to 4.4 - 4.7 with real GDP revised down from 0.5 - 1.5 to 0.4 - 1.0.

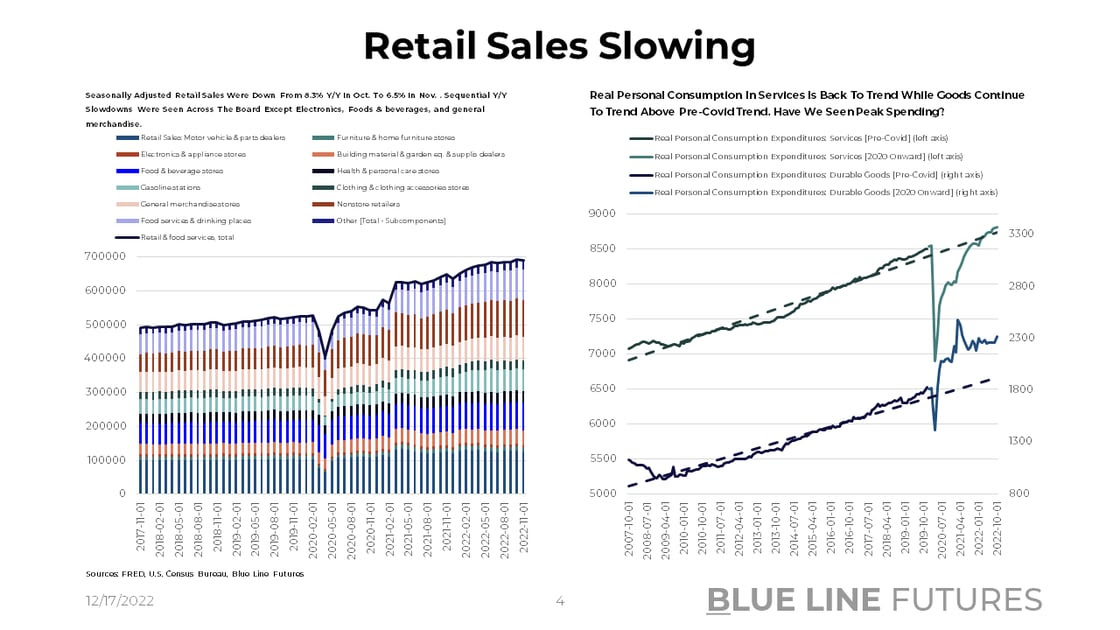

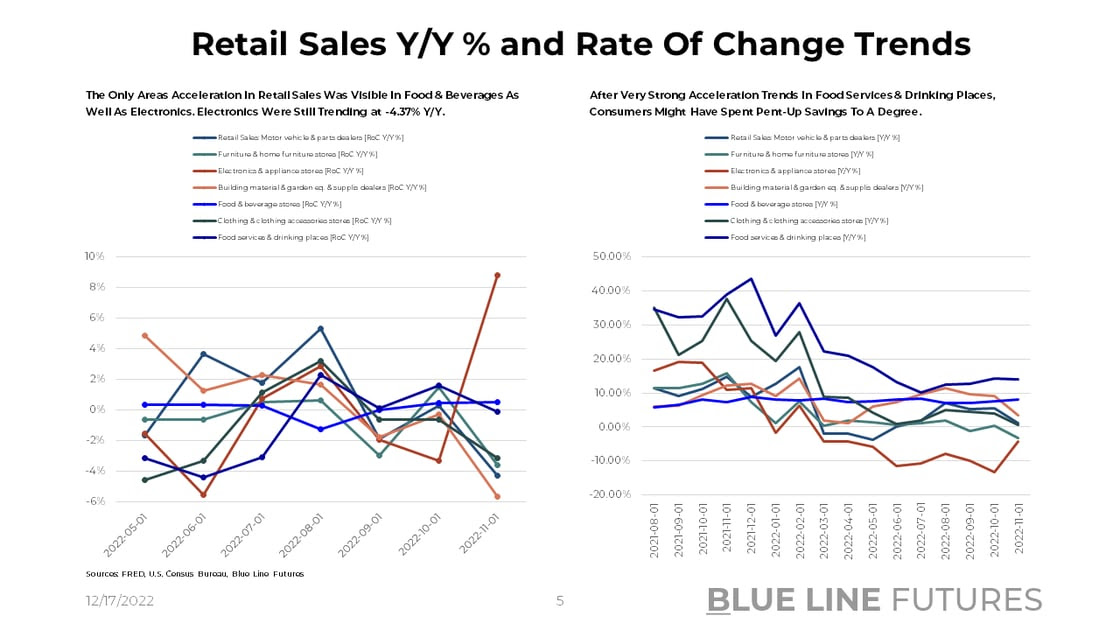

While Powell was less hawkish than feared, the cumulative impacts of tightening may have started to affect consumer spending (directly or indirectly.) Retail sales slowed -0.6% M/M on Thursday, putting the Y/Y number at 6.5% (down from 8.3% in Oct.) While these are nominal numbers, how much more can consumers spend going forward after consumption got propelled by trillions of excess savings from 2020-2022? The only two retail sales sub-components that saw a sequential acceleration were electronics (although still negative on a Y/Y basis) and food & beverage stores. Broadly speaking, however, all areas have decelerated since October of 2021 -- nominally that is still very elevated, though.

Thus, as millennials hit their peak-spending years, activity may remain relatively elevated all things considered. Moreover, those same consumers might start to see wage increases above the rate of inflation in 2023 and 2024, which further spurs absolute spending levels (hard to see accelerations, however.) That in turn explains some of the reasons behind goods consumption as measured by PCE well above 2007-2019 trend with real services expenditures back to trend. The issue with that landscape is that structural undersupply of labor in conjunction with energy scarcity and underinvestment in fixed assets can lead to corporate margin compression. Margin compression has its multiplier effects as corporate spending gets cut. Nevertheless, areas that increase productivity and enhance efficiencies (i.e. technology, automation, cloud) can continue to thrive.

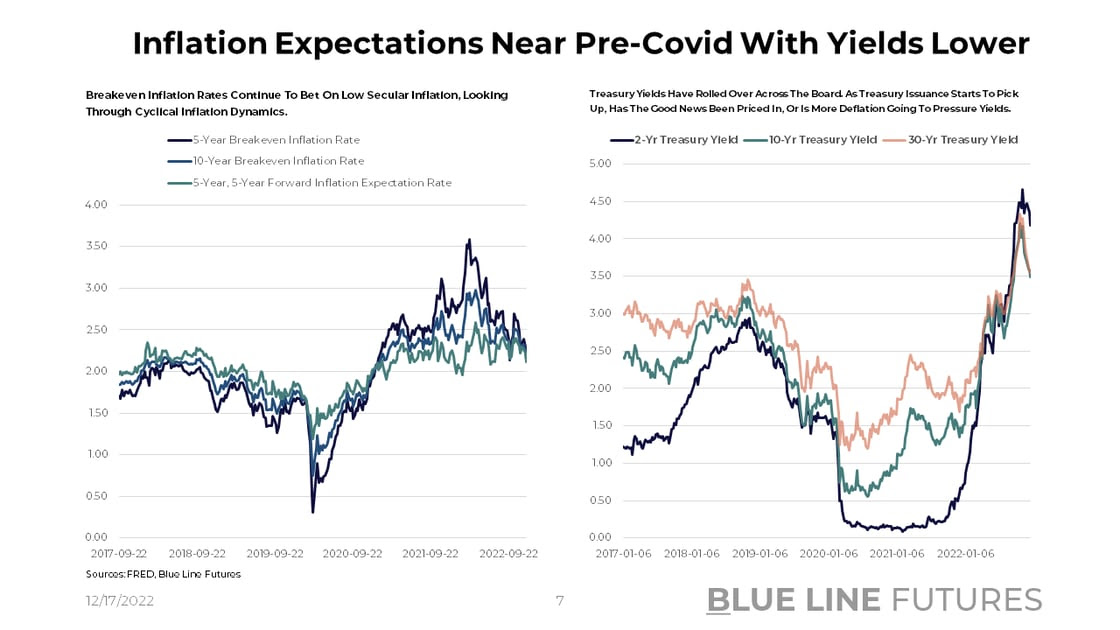

Somewhat surprisingly, as treasury yields have settled in recently, so have breakeven inflation rates. Lower breakeven rates have to be interpreted through the lens of secular inflation expectations, which the market appears to price at pre-Covid type levels. Thus, unlike some underlying dynamics in the economy suggest, inflation breakevens continue to look through cyclical inflation for the time being.

Questionable dynamics for corporations come hand-in-hand with central banks globally committed to the fight against high prices; as Christine Lagarde emphasized during Thursday's ECB meeting, the European CB is "in for a long game." She also surprised on the hawkish side when stating that it's obvious to expect more 50bps hikes going forward. More importantly, the head of the ECB was adamant that current projections for the terminal rate would not allow a return to the 2% inflation target, which implies that more needs to be done for market expectations to get priced accurately. Interestingly enough, there appears to be a divergence between what the ECB wants and what the market thinks. While the EUR/USD pair rallied during the press conference, the Dollar strengthened in the back half of the trading session. While that was accompanied by a sell-off in risk assets, we need to pay attention to markets rejecting policy; similar to the market rejecting Liz Truss' stimulus package in the UK, will policymakers face market revolts at an increased rate going forward?

With all the hawk talk, inflation may indeed face the cumulative effects of tightening soon, which then leads to an economic slowdown. Demand destruction, however, does not change the economic fabric by which I mean that central bank policy may actually work against solving supply-side issues.

Data & Commentary

Since I already introduced the ideas behind the graphs that follow, I will save you time and let the charts speak for themselves. All the graphs can be found here: Chart Booklet

Risk assets globally have rallied on hopes of less hawkish central bank rhetoric going forward. I talked about milestones to 2% average inflation last week and it will continue to be a theme going forward. While markets tend to celebrate during periods of inflation deceleration, the Fed and other central banks might stay hostile for too long. While underpinned by ample liquidity for more than a decade, markets face a liquidity headwind as we speak. Combined with relatively attractive risk-free rates, we may indeed face a regime shift during which portfolio managers re-evaluate how they manage money.

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Inflation & Growth Expectations, Terminal Fed Funds Rate, Deficit Financing - December 11, 2022

- The Prospects For Future Growth - December 4, 2022

- Is This A Titanic Economy - November 20, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

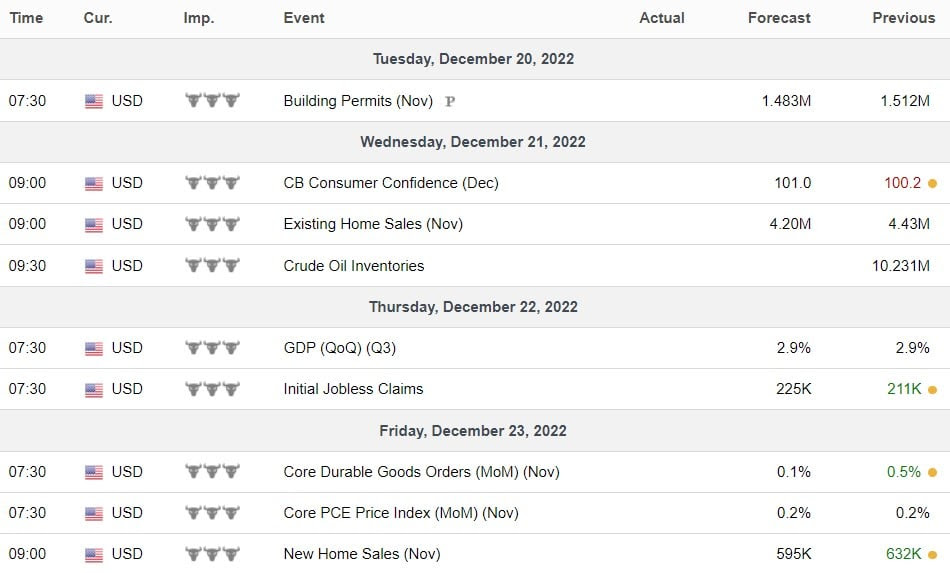

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

FedEx (FDX) reporting after the close on Tuesday:

- Consensus: EPS est. $2.77; Revenue est. $23.74bn

Commentary on the following be monitored:

- Air cargo activity as goods spending has decelerated

- Commentary on global recession fears

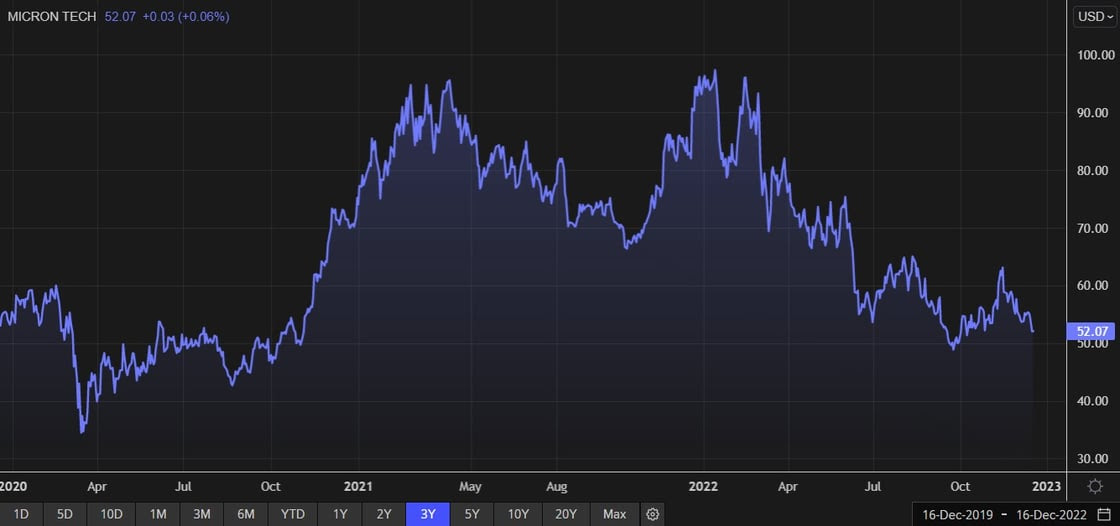

Micro Technology (MU) reporting after the close on Wednesday:

- Consensus: EPS est. ($0.01) Revenue est. $4.16bn

Commentary on the following be monitored:

- DRAM pricing and chip pricing writ large

- Chip inventory cycle and demand trends

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial