The Prospects For Future Growth | Top Things to Watch this Week

Posted: Dec. 4, 2022, 5:17 p.m.

The Prospects For Future Growth

"I directed our focus less to the prize of victory than to the process of improving - obsessing, perhaps, about the quality of our execution and the content of our thinking." - Bill Walsh

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 26: Chart Booklet

Check out last week's podcast episode on the Macro landscape: Macro Corner Podcast, Episode 25

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

The Fed Wants A Pre-Covid Economy

Jay Powell On The Lagged Effects Of Tightening

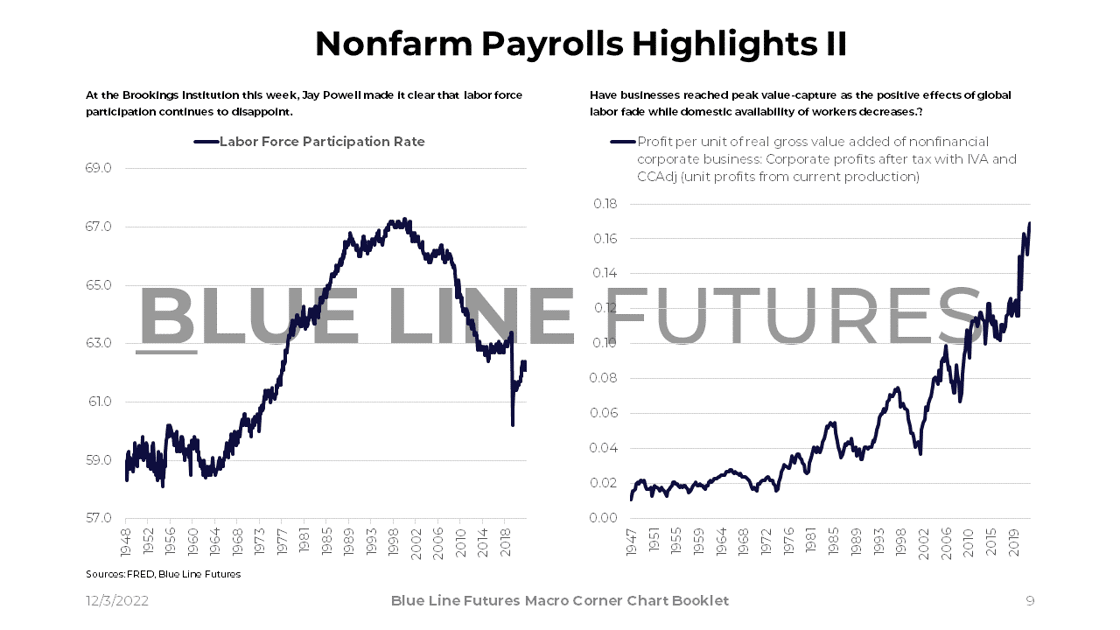

Rather than thinking tactically, Jay Powell took a degree of optimism to the stage at the Brookings Institution on Wednesday. Not only did the Fed Chair mention the Fed's preference for real-time housing indicators over the lagging shelter numbers, but he also course-corrected on what side the Fed is erring on. Rather than continuing to stress the importance of risking "overdoing it", the Fed appears hesitant to cause an economic downturn that later requires the FOMC to cut rates. Cutting rates would perhaps be the Fed's worst nightmare amidst an ongoing battle against inflation, which has the committee put emphasis on "uncertain lags". The Fed's belief that monetary policy is acting on a lag comes clear when we turn to a paper from the San Francisco Federal Reserve Bank that estimates the proxy Fed Funds rate to be ~2% higher than the effective Fed Funds rate; in other words, the cumulative effects of QT combined with rate hikes make the regional Fed believe that we are at a Fed Funds proxy rate of ~6%. Interestingly enough, the SFF's paper also references a paper that quantifies the lags with which central bank policy acts on the economy: "...most inflation-targeting central banks have adopted a value between twelve and twenty-four months as their policy horizon."

During his conversation with David Wessel, Jay Powell was very much in line with that message as he expressed his view that tightening has been very aggressive and slowing down the pace of hikes is the thing to do.

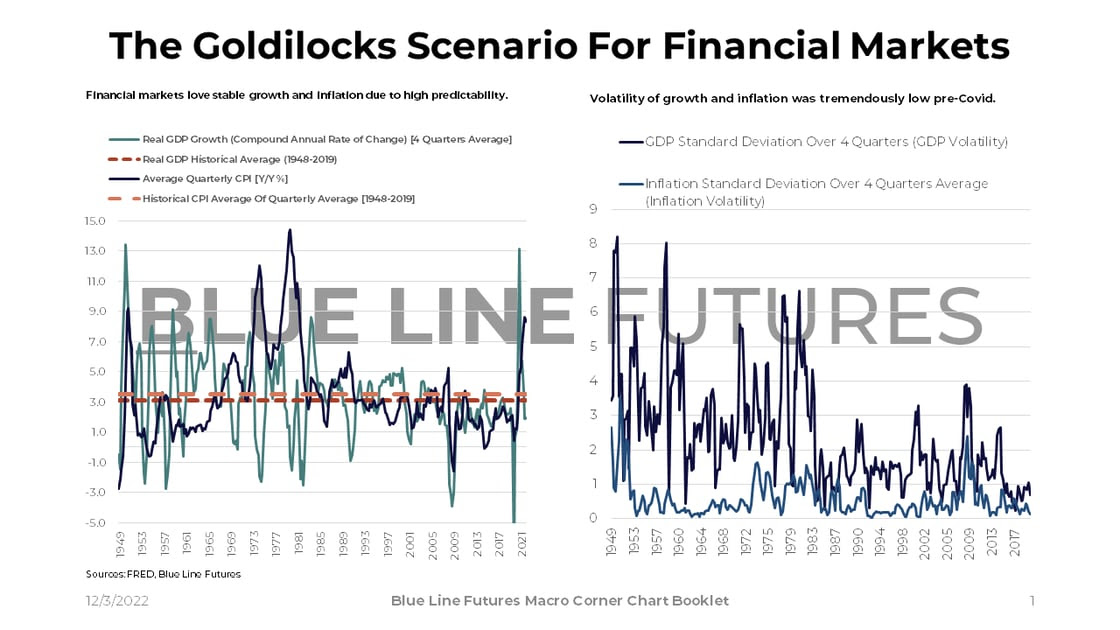

More significantly, however, Jay Powell stressed the economic benefits of long expansions that raise the tide for all of society. Long expansions don't come about by accident, however. Tremendously low volatility of economic data is rare when we look back in history. Nevertheless, we need to answer whether the conditions for another pre-Covid expansion are currently present, or if the road ahead is going to look different.

Conditions Of Economic Expansions

Firstly, we need to identify the sources of economic growth. Most economists agree that the 2 main drivers of economic growth are: the accumulation of physical capital and human capital. The more factories there are, the more goods we can produce. The more people we can use as programmers, manufacturing workers, and bartenders, the more services & goods we can produce and provide for consumption. The third factor that affects both, capital and labor, is the overall state of technology contributing to productivity gains. Productivity writ large is defined as work per time (we proxy it by GDP per worked hour); multi-factor productivity as an alternative measure is defined as the value of output/value of the input. The value that's added in the process of producing goods or services is a function of the technology that's available and therefore can aid capital & labor. Just imagine how much more value car engineers were able to add with the advent of manufacturing robots; the prime example in cars would be Henry Ford's assembly line process. 1.) The world started to use cars as a means of transportation, and 2.) Henry Ford maximized the output of cars per available input by using a technologically advanced manufacturing process. Another example would be the advent of the airplane. Not only could tourists start to consume from a myriad of countries & continents, but business people could suddenly make deals across borders and take advantage of cheap labor elsewhere. As a result, countries specialized in a few sectors that they thought would be most beneficial on the world stage. Nations most open for trade were the ones reaping the benefits.

It should become clear that labor, capital, and technology work hand-in-hand. Technological progress in the U.S. leads to more productivity of capital & labor domestically but also internationally. Key to understanding in that context, the degree of liberalization of trade zones & countries is important when it comes to taking advantage of economic potential. Absent structural reforms, nations may be isolated from trade, which in turn affects more open players unable to specialize in the highest value-add areas. This complex web of global trade, structural reform, and availability of capital & labor is not simple to reconstruct, but fairly intuitive to understand.

In today's data collection, I won't try to make predictions, but rather provide historical context around the aforementioned dynamics. The world's complex and never static, so inevitably things will change and expectations will have to readjust accordingly.

Data & Commentary

It's no secret that markets hate uncertainty and love predictability. That's precisely why the pre-Covid period coined by easy money was a tremendously good time for financial asset returns. As we know, markets extrapolate current conditions and price-in assumptions way out into the future. Historically speaking, however, these conditions are rather unusual. Just imagine this: we had global labor arbitrage in full swing, few-to-no wars disrupting trade and slow but steady progress of technology. One could argue that technology was rather disappointing in the grand scheme of things, but at least we didn't walk backward. Financial markets loved it.

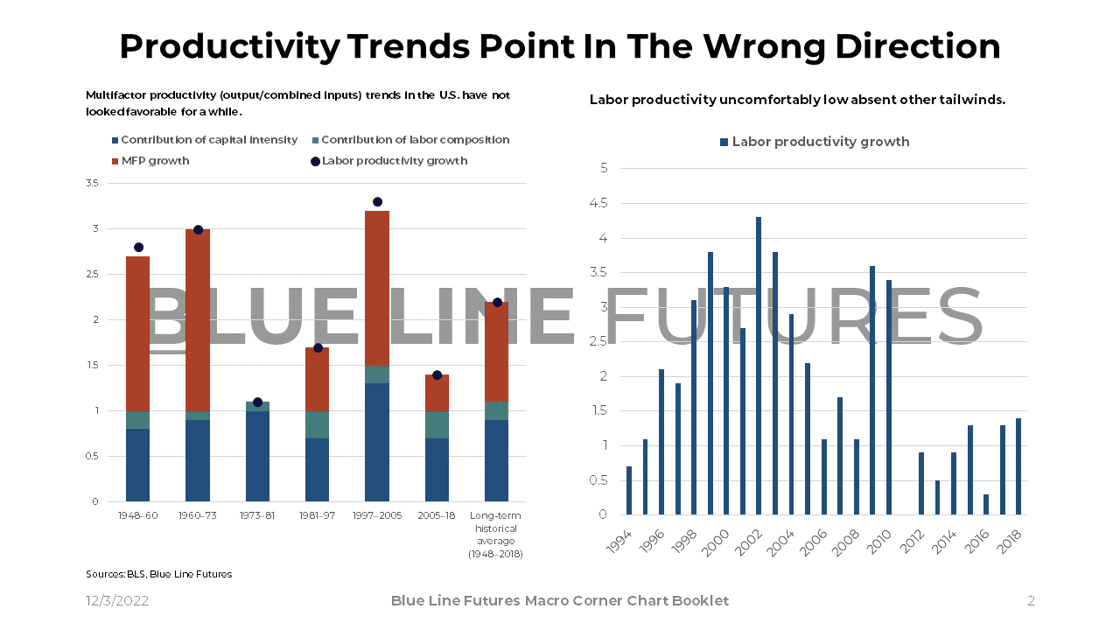

It was extremely low volatility in growth conditions that awarded us with the rewards of high financial asset returns despite productivity trends pointing in the wrong direction. The first possibility would be that productivity measures don't capture the advancements in technology during that time because it is simply hard to quantify the benefits of Instagram, WhatsApp, and Google. The second possibility is that these advancements are simply not as favorable toward value creation as we may think. Scrolling on Instagram all day and watching ads may bring pleasure, but not much growth. Sending funny memes on WhatsApp may also be quite amusing, but doesn't enhance how we can utilize labor and capital either. It is for you to judge what applies here.

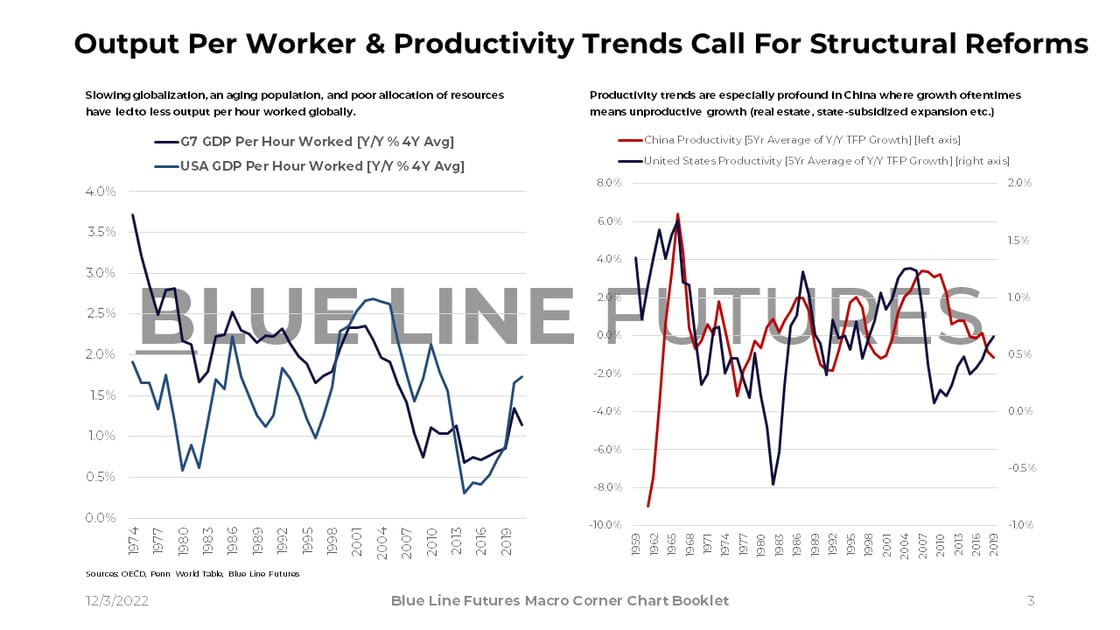

The lack of technological advancements is reflected in overall productivity measures. GDP per worked hour in the United States and the G7 have trended unfavorably for a while. Productivity trends in China are even worse than they are in the developed world; no surprise given the amount of unproductive growth in China (i.e. real estate).

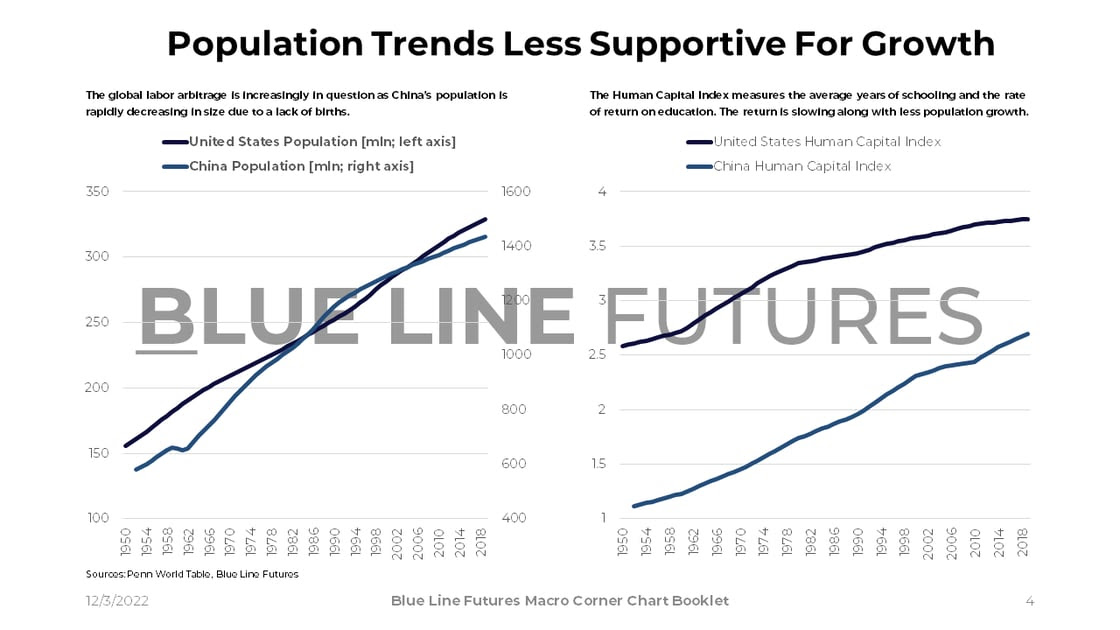

Given that labor is a key input into our output equation, population trends in consumption & production hubs are crucial. According to the World Economic Forum, China's birth rate has declined from 2.6 in the 1980s to just 1.15 in 2021. In the United States, the birth rate stands at 1.6.

As a result, the Shanghai Academy of Social Sciences estimates an annual decline of China's working-age population of 1.73% and China's increasingly old total population to peak at 1.44bn in 2029 with the fertility rate further slipping from 1.15 to 1.1. Some estimate that China's population has already peaked.

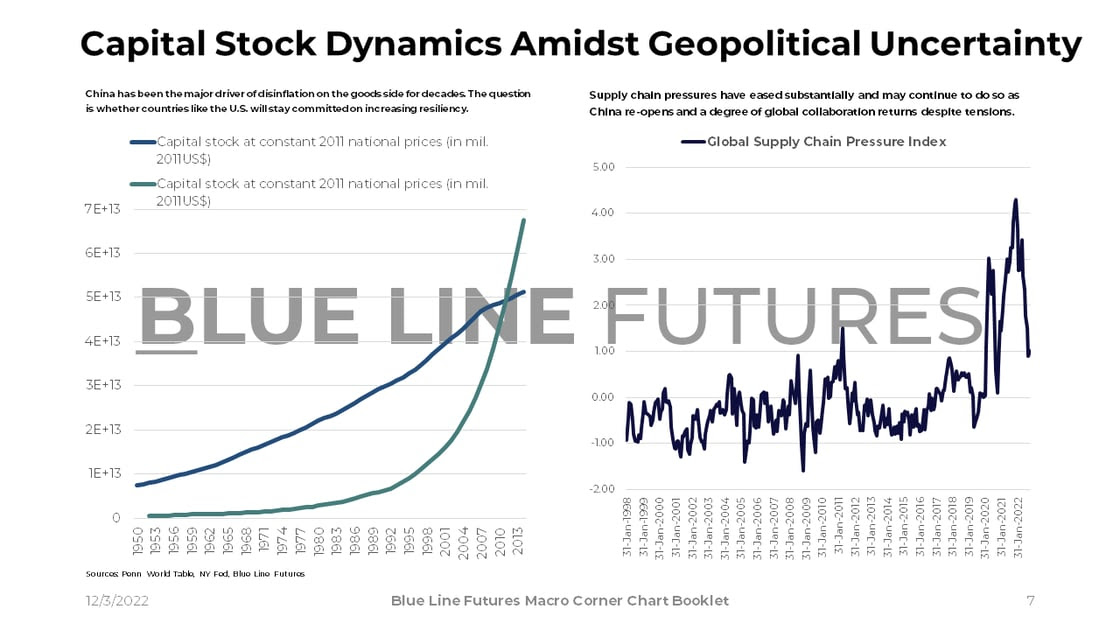

It becomes a question of whether another nation can substitute China's production function for the world and to what degree. Skills in increasingly high-tech areas aren't easy to transfer, especially at the size & scale we're dealing with.

|

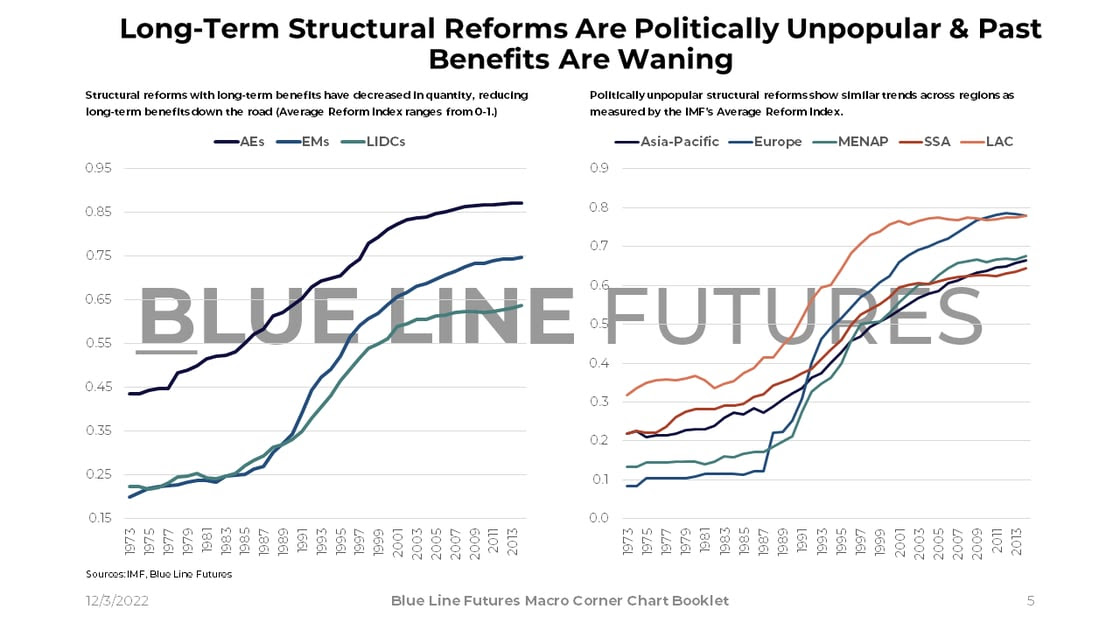

Lackluster gains in productivity can partially be attributed to the slowdown in structural reforms across trade regions. The IMF defines the Average Reform Index as an aggregate measure of reforms in trade (tariffs), finance (domestic & external; regulation, supervision, capital account openness), labor market regulation (job protection legislation), and product market regulation (electricity, communication, etc.). The effects of structural reforms can be long & lagging, which makes those reforms politically unpopular in today's day & age. Thus, as the benefits of past reforms wane, the world needs a revitalization of such efforts to see those same productivity gains in the distant future. Absent sufficient reform, the world needs to rely on domestic growth of labor and capital. Surely, technological progress could come from vast progress in AI and how computers can aid labor in high-value add jobs, which in turn makes capital more productive. From a policy perspective, however, economic growth as a function of structural reform remains on the wish list for now. |

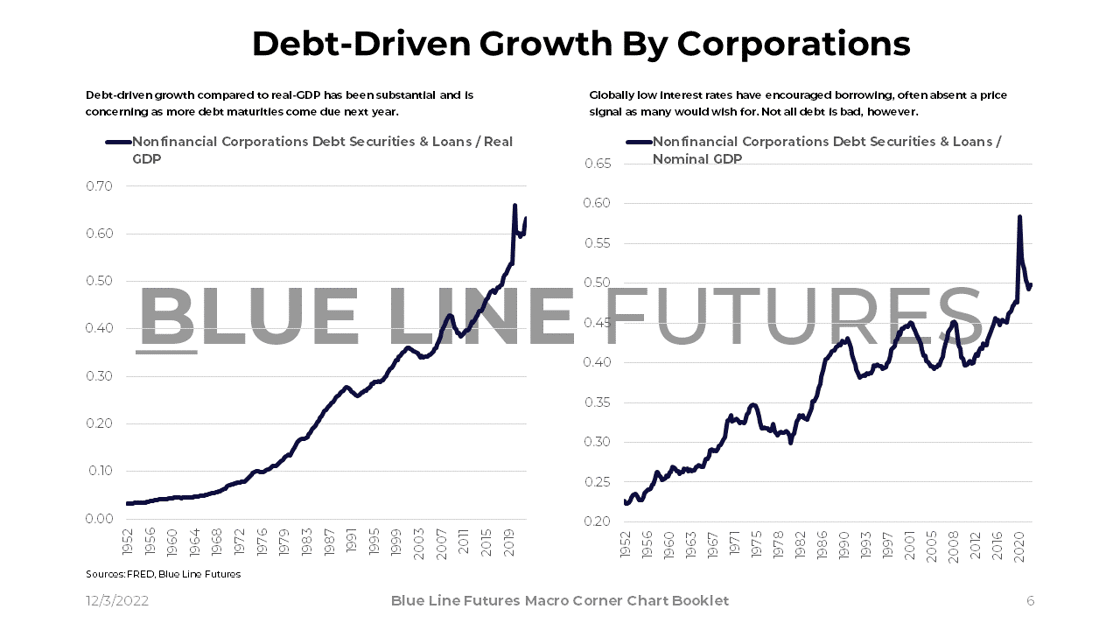

A distinct but important factor in today's world is the degree of debt-driven growth that was possible in a low-interest rate regime.

If my assessment of economic growth and productivity is somewhat accurate, a different inflation & growth regime is possible. A different inflation regime would imply an interest rate regime that's less favorable towards corporations with debt. While real interest rates may remain in negative territory, making debt less costly in real terms, there still needs to be value creation in excess of business costs. Absent that basic tenant holding true, companies need to get restructured and perhaps shut down.

In a world that's increasingly focused on resiliency, a reorientation in the priorities of nations is not ruled out. Different from tech-fueled growth in financial markets, countries focusing on less-dependencies will have to increase their capital stock. Therein is implied that fiscal will play a greater role in how capital gets allocated, and as we all know, fiscal policymakers are not exactly the most efficient when it comes to that.

Essentially, these are the very structural reforms the IMF is talking about. By definition, though, more countries specializing in more areas is a productivity trend in reverse.

Monetary policymakers love to talk about 'long and variable lags' when it comes to the effects of rate hikes & balance sheet dynamics. Yet, the lags of global productivity gains and changes in labor & capital are much longer than that. In the face of globalization slowing, population aging, and lackluster technological progress, a reacceleration of structural reforms is desperately needed.

While the frequency of those reforms has slowed, it is not unthinkable to see fiscal dominance revitalize economies globally. This would not only follow the tendencies of politicians to take control as public demands in the fight against inflation grow, but it would also be consistent with the build-up in resiliencies.

The goal of today's writing was not to explain and predict every aspect of the economic machine, but rather to understand the factors that drive economic growth. Long expansions with ultra-low volatility of economic data are unusual in the grand scheme of things, but possible. It is perhaps the lack of reforms and technological progress that leads to such conditions, which would make it a possible scenario yet again if we look beyond the current inflation regime.

We will continue to listen to the market and let those signals dictate expectations for the future.

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Is This A Titanic Economy - November 20, 2022

- The U.S. Economic Cycle - November 13, 2022

- Regime Shift On Wall Street - November 6, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

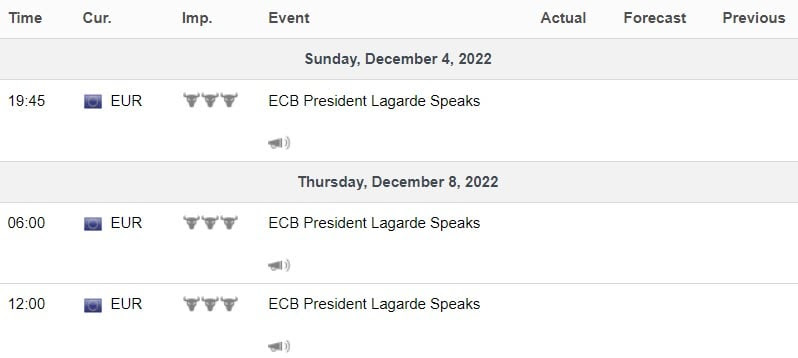

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Autozone (AZO) reporting before the open on Tuesday:

- Consensus: EPS est. $25.59; Revenue est. $3.86bn

Commentary on the following be monitored:

- Auto inventory dynamics (low new auto inventories forces people to replace parts on old cars.)

- Recession outlook

Costco (COST) reporting after the close on Thursday:

- Consensus: EPS est. $3.14; Revenue est. $54.81bn

Commentary on the following be monitored:

- Consumer spending trends

- Inventory and supply chain dynamics

|

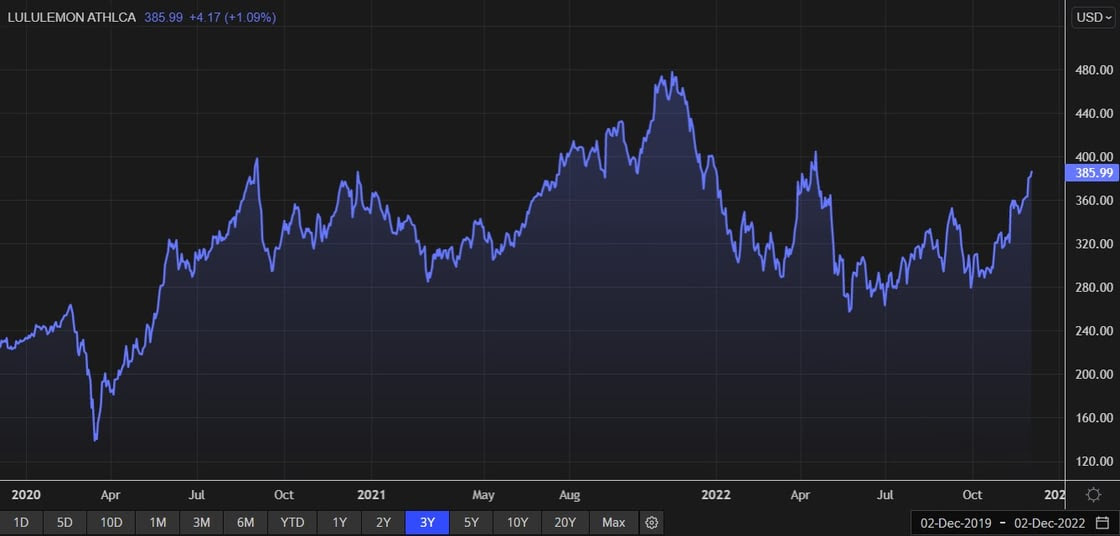

Lululemon (LULU) reporting after the close on Thursday:

Commentary on the following be monitored:

|

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial