Is This A Titanic Economy? | Top Things to Watch this Week

Posted: Nov. 20, 2022, 5:40 p.m.

Is This A Titanic Economy?

"I cannot imagine any condition which would cause a ship to founder. I cannot conceive of any vital disaster happening to this vessel." - Edward Smith, Captain of the Titanic

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 25: Chart Booklet

Check out last week's podcast episode on the Macro landscape: Macro Corner Podcast, Episode 24

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Steering The Economic Ship Into An Iceberg

The Fed is in a tough place, partially by their own doing, partially because the circumstances today are different from the past. But when is the future not different from the past and at what point did we start to forget about weighing risks vs. rewards? Decision making under uncertainty is difficult by definition, which requires the necessary guardrails to be in place to begin with. Reckless behaviors can lead to enormously fortunate outcomes, but equally result in catastrophic economic and social consequences. The Fed and central banks more broadly missed the train when inflation started brewing beneath the surface, and they're just as likely to stay hostile for too long. Again, there are no certainties, only distributions of probabilities when it comes to market outcomes. It is for that reason that I'm not a fan of overly catchy headlines, yet I titled today's article much more aggressively than I otherwise would.

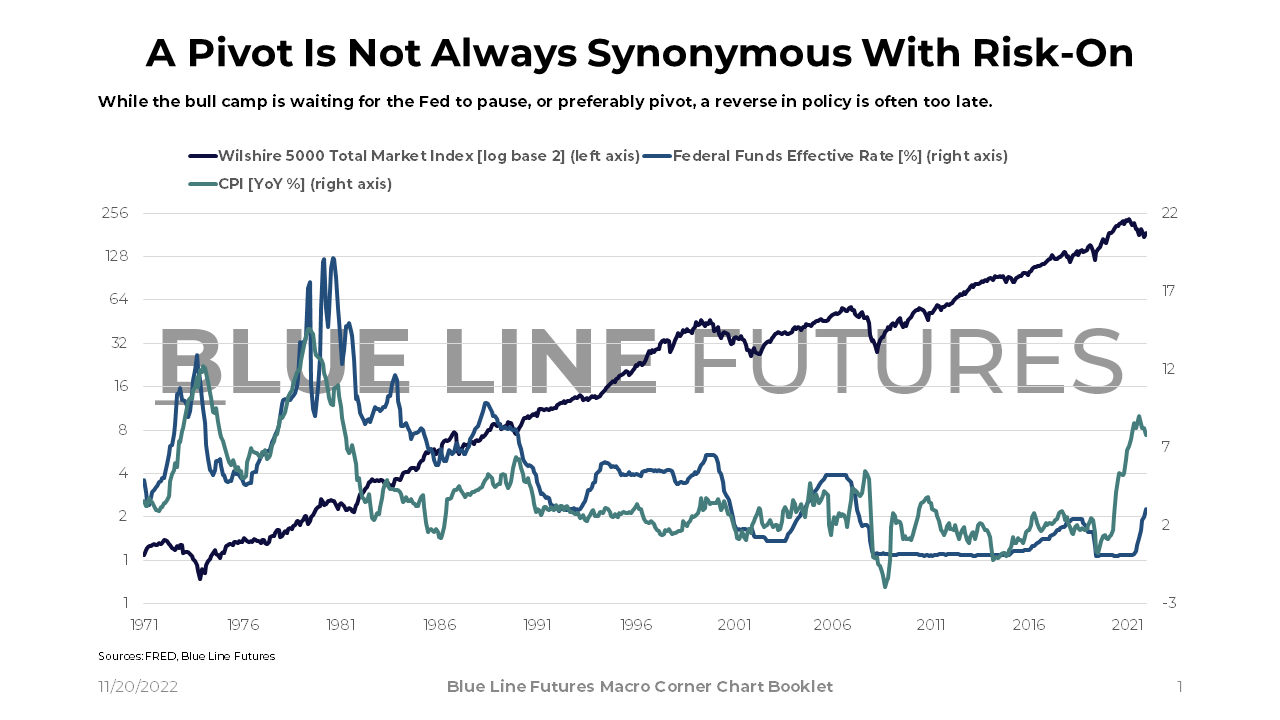

As evidenced by the Fed's press conference at the beginning of this month, Jay Powell made it once again clear that they're not even thinking about thinking about pivoting; they're correcting for the loss of credibility accumulated over years of extremely accommodative policy.

Janet Yellen was on record saying 'I Don't See a Financial Crisis 'In Our Lifetimes'. Now, this wouldn't be unusual to hear from a political figure, but surely from the head of a central bank.

To a man with a hammer, everything looks like a nail. The Fed's toolkit with QT on autopilot and interest rates higher for longer, the committee's reaction function is always the same irrespective of the economic fabric. Whether the economy saw massive underinvestment in critical sectors or not, the Fed is not reacting to the fabric of the economy. Instead, it's reacting to data derived from underlying conditions. It is the doctor who treats the symptoms rather than the root causes, who will keep the patient sick without ever helping him get back on his feet.

Eventually, the Fed might have to move from a place where the committee thinks it can steer the economy to a place where it needs to accommodate fiscal policy. At the point at which unemployment and social dissatisfaction are higher and economic growth much weaker, fiscal dominance may become a real issue.

Data & Commentary

As I wrote about last week, covenant lite leveraged loans are up to 88% of total outstanding, Moody's expects high-yield defaults to increase from 2.3% in September of this year to 7.9% next year. As more maturities come due for refinancing, investors will grow increasingly concerned about the economy's indebtedness and fiscal's response to dire economic conditions. If we look at Ray Dalio's framework, each downturn is followed by a more aggressive response. This time, it could be fiscal dominance starting to be a concern.

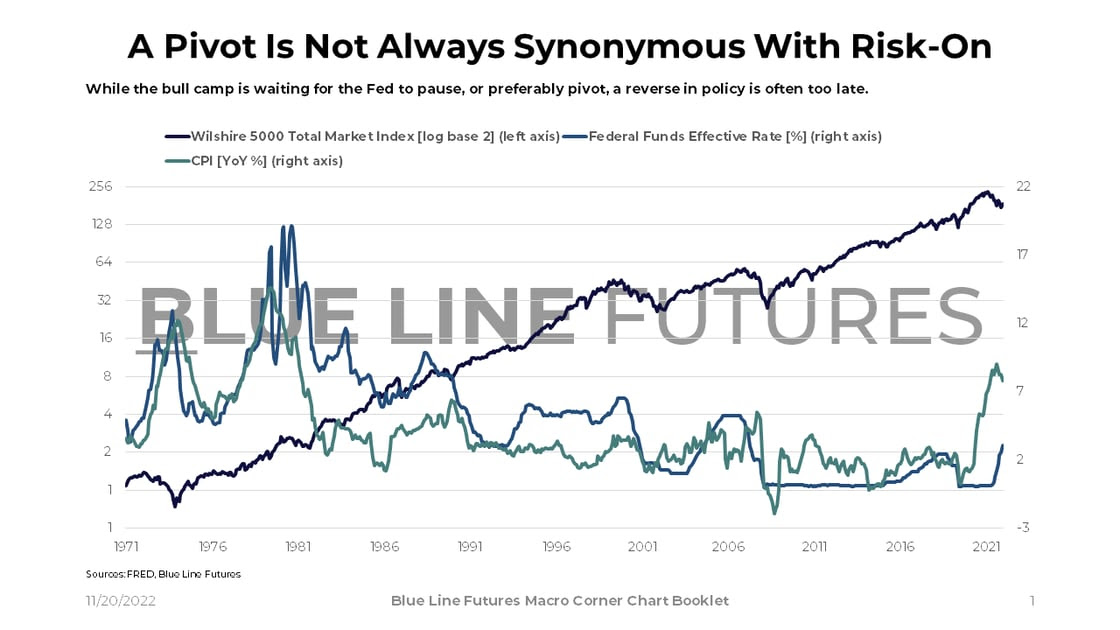

As the economy becomes more uncertain, so do inflation expectations. The lack of certainty is the behavioral aspect of higher prices that makes things so difficult to forecast. The long-term fix to this issue is not monetary policy, but a change in the economic fabric. When Barry Sternlicht was talking about "self-inflicted suicide" by the Fed on CNBC, one needs to know that it's exactly what the Fed is committed to.

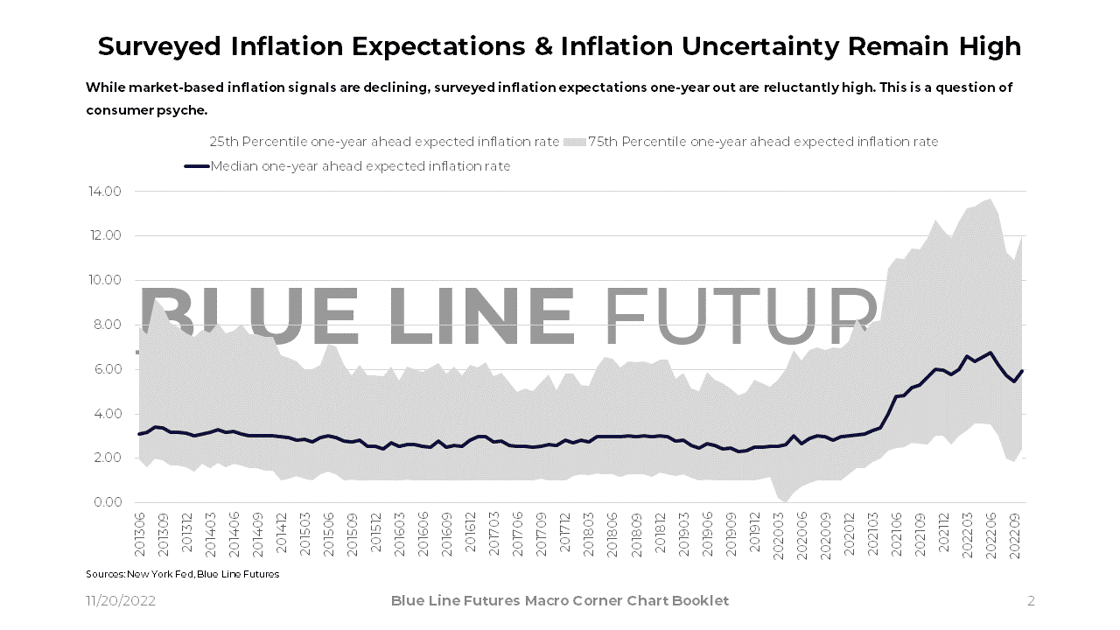

The behavioral aspect is perfectly illustrated by the similarity of price changes as inflation increases. When Jay Powell referred to a "clock ticking", he meant that higher prices are very much a psychological phenomenon. While the developed world didn't experience that dynamic for a long time, we may be well-advised to consider and risk-manage against that possibility.

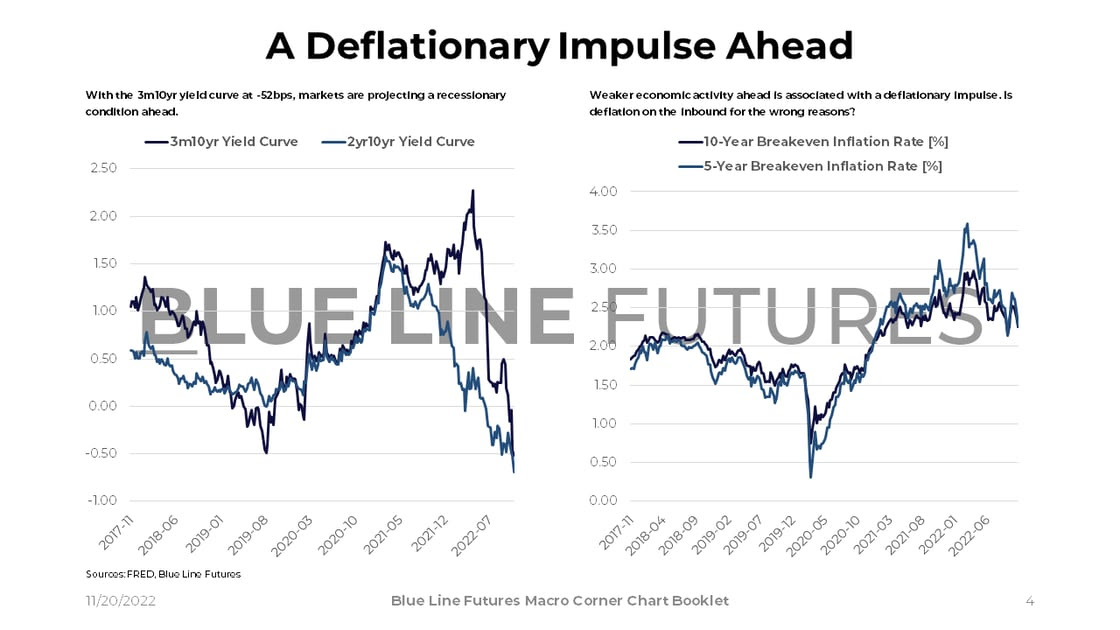

The Fed's hostility towards asset prices continues despite deflationary impulses showing up across yield curves as well as breakevens. It's simply not good enough to tell union workers that long-term inflation expectations are barely above 2%; the real economy has to deal with real jobs and real people; those people need to make ends meet.

As we saw in response to the last CPI print, deflationary signs are positive for risk assets on the margin. Nevertheless, will the direction of travel be enough to satisfy a central bank that's highly afraid of an emerging market type inflation scenario?

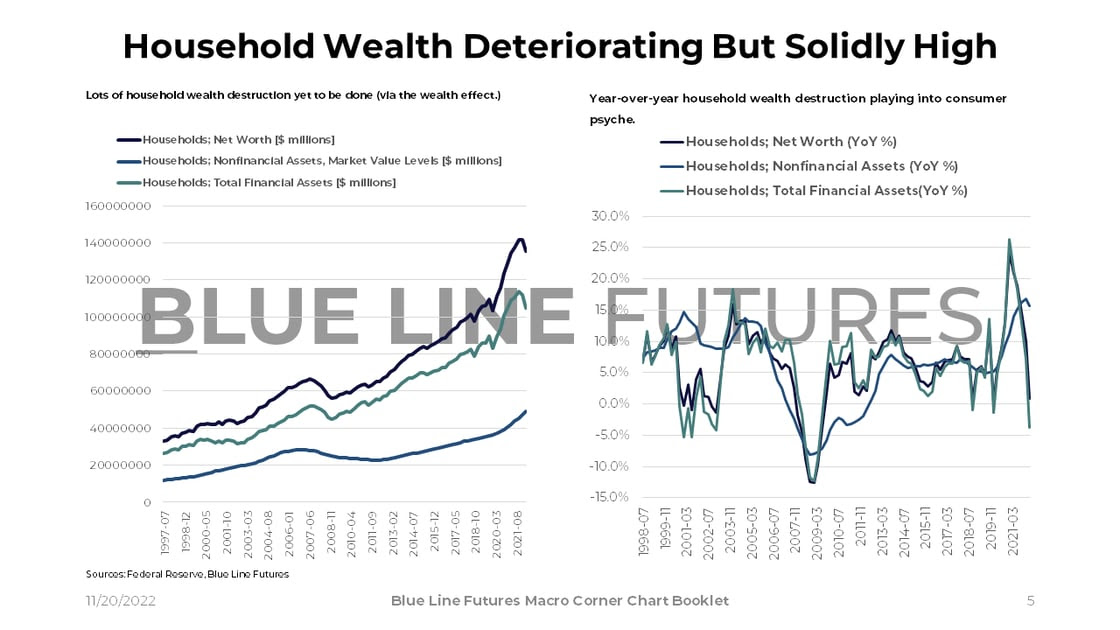

The Fed's primary tool to change sentiment is asset prices. The higher household wealth, the more consumers spend. Conversely, the less wealthy one feels, the less people are going to spend. This is known as the wealth effect.

While relatively worse off on a YoY comparison, household wealth remains substantially above pre-Covid levels.

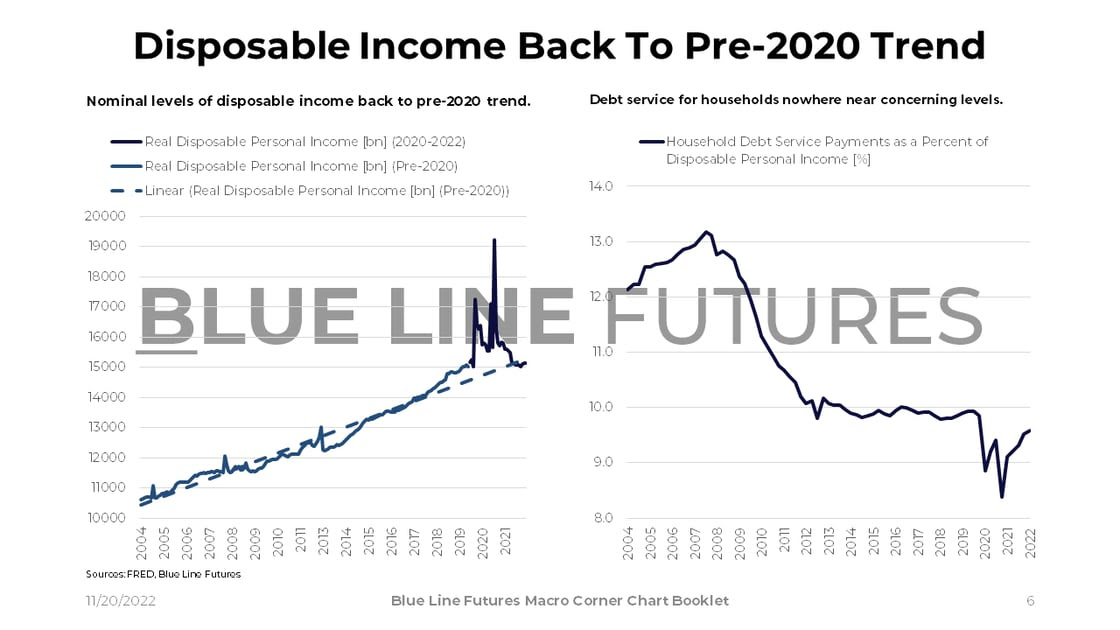

While household wealth is driven by nominal asset inflation, real disposable income is back to pre-Covid trend. At what point will households pull back on spending to the extent that it shows up in economic numbers? Household debt service remains relatively low despite higher cost of capital, which is very much similar to what we've seen from corporations.

We will have to put emphasis on the long-term trends in credit -- long up- and downcycles driving economic activity, unemployment, and financial markets.

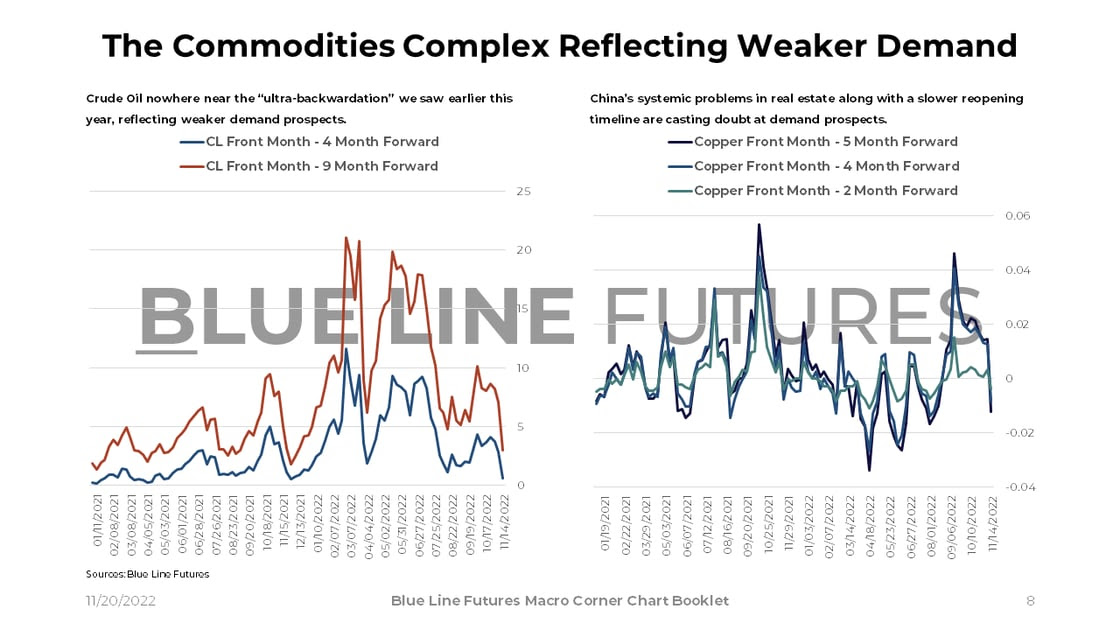

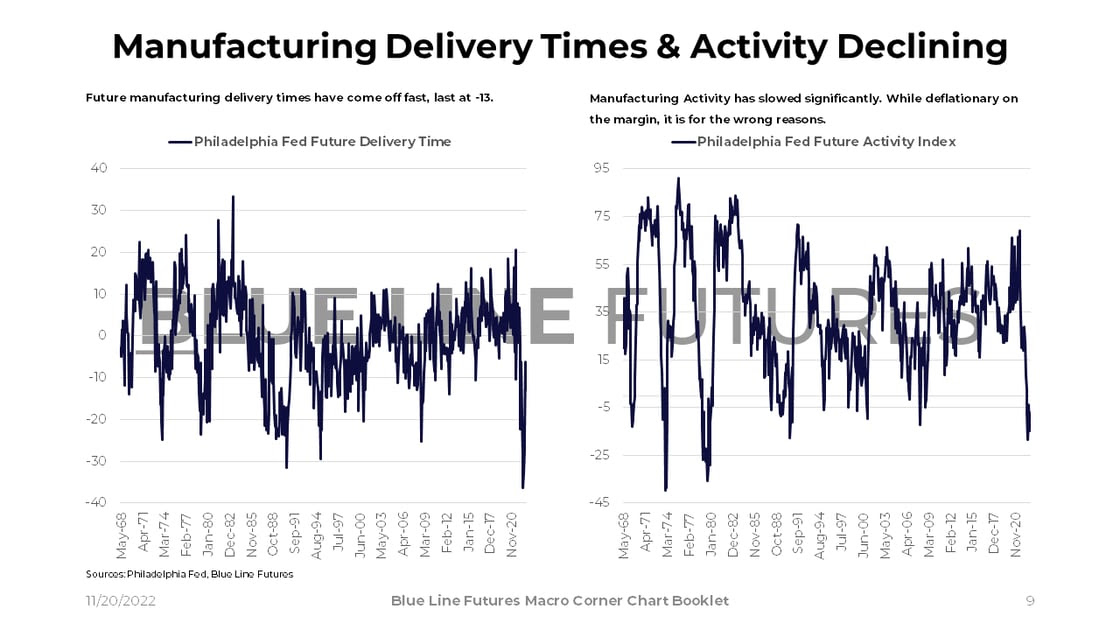

While weaker economic activity may not be showing up in consumer spending numbers, commodity markets are looking out on the curve and implying markets that are less tight as a result of weaker demand.

The supply side in commodity markets remains very much unchanged as underinvestment takes time to resolve.

A couple of months back, we started writing about the Fed's opportunity set shrinking with the passage of time. We're now at a point without many good choices. While the Fed anticipates the lagging effects of their actions, they are equally constrained by the psyche of the market if they were to allow financial conditions to ease.

There are only tradeoffs, distributions, and choices none of which look too attractive. While I question may own assessment all of the time, starting with a clean sheet of paper every week, the opportunity set does indeed look grim.

Right now, we're in the midst of opposing forces as to how fast inflation can cool off, how quick the economic fabric can change, and how monetary as well as fiscal policy are going to respond. Cycles take time and while cooler inflation data can become much cooler from here, we are dealing with a Fed course-correcting for past actions.

Can we avoid the iceberg ahead?

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- The U.S. Economic Cycle - November 13, 2022

- Regime Shift On Wall Street - November 6, 2022

- Climbing The Macro Mountain - October 30, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

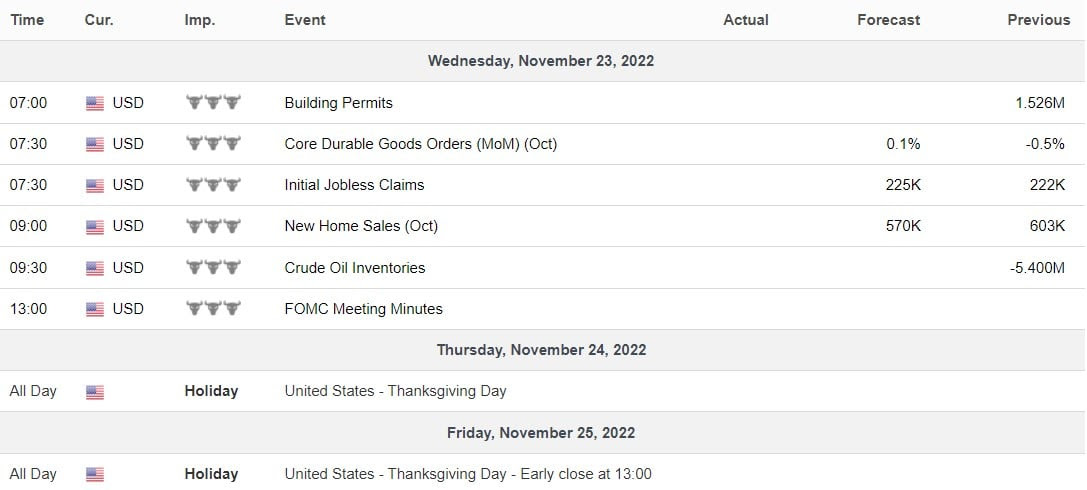

Economic Calendar

U.S.

Data Release Times (C.T.)

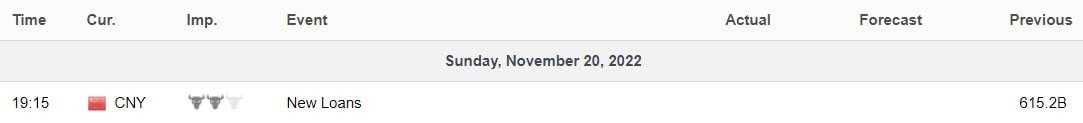

China

Data Release Times (C.T.)

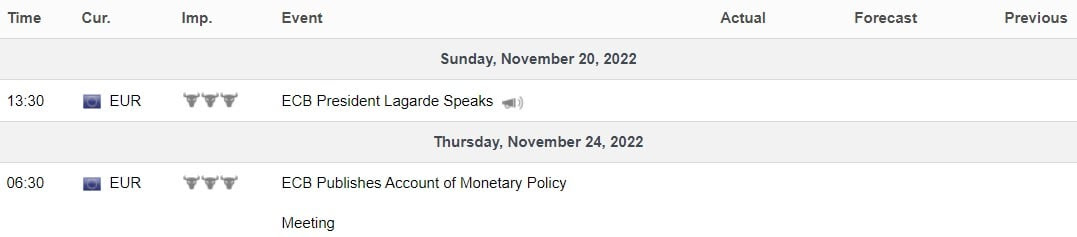

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

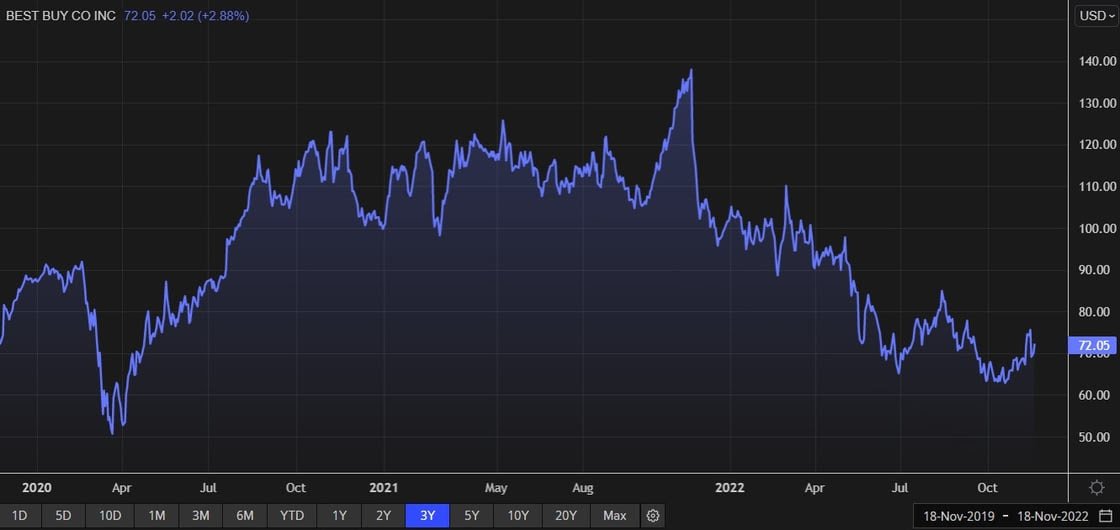

Best Buy (BBY) reporting before the open on Tuesday:

- Consensus: EPS est. $1.03; Revenue est. $10.31bn

Commentary on the following be monitored:

- Goods spending trends

- Consumer spending appetite writ large

- Inventory levels

Dollar Tree (DLTR) reporting before the open on Tuesday:

- Consensus: EPS est. $1.17; Revenue est. $6.84bn

Commentary on the following be monitored:

- Inflationary pressures

- Consumers trading down

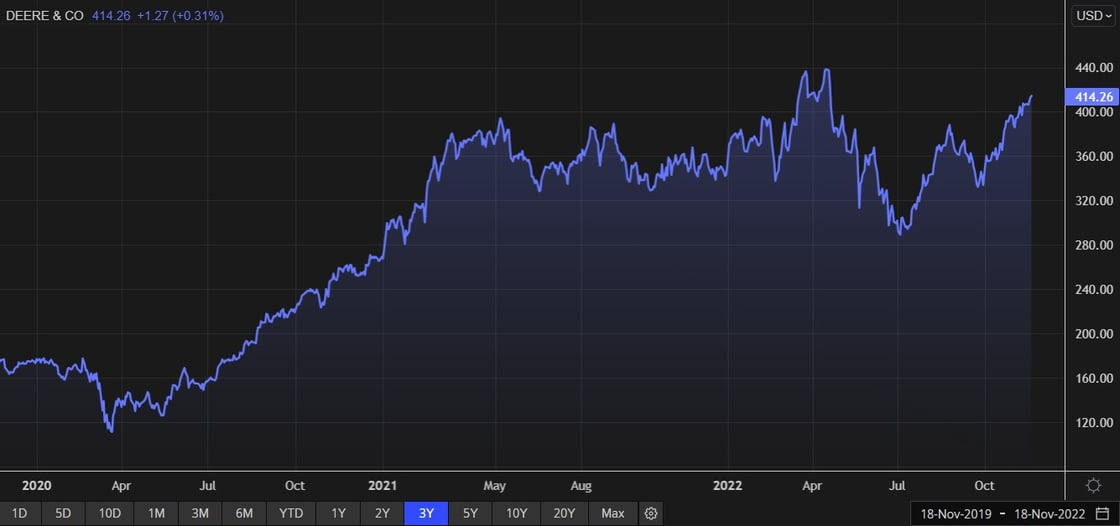

John Deere (DE) reporting before the open on Wednesday:

- Consensus: EPS est. $7.09; Revenue est. $13.39bn

Commentary on the following be monitored:

- Heavy equipment inventory

- Services revenue

- State of the agriculture industry amidst global food shortage concerns

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial