Regime Shift On Wall Street? | Top Things to Watch this Week

Posted: Nov. 6, 2022, 8:24 p.m.

Regime Shift On Wall Street?

"My approach always was that I'd rather risk embarrassment now than be embarrassed later, when I've won zero titles." - Kobe Bryant

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 23: Chart Booklet

Check out last week's podcast episode on the Macro landscape: Macro Corner Podcast, Episode 22

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Do Portfolio Managers Need To Shift Allocations?

There are no certainties, but only probability distributions. As you go out on the distribution curve, payoff ratios move up while the associated probabilities decrease; way out-of-the money options are cheap for a reason.

Nevertheless, it is worth looking at the current state of markets and perhaps gain variant perception. What may be different in a year from now and how will it affect capital flows in and out of various sectors, asset classes, and countries?

For too long, we have gotten used to low cost of capital assumptions. Debt and equity issued in a different macro regime got absorbed by investors, some of whom are still holding those assets in the hope of a turnaround (a Fed pivot, a miracle on the business side, or some other event.) More likely than not, those investors who reallocated their capital didn't shift to a completely different area of the market. Instead, large-cap growth became the new attraction. As a result, multiples of those stocks stayed elevated while the incremental risk-taker supported by central bank stimulus disappeared into the shadows. Absent sufficient cash flows supporting business prospects, it becomes a greater fools game.

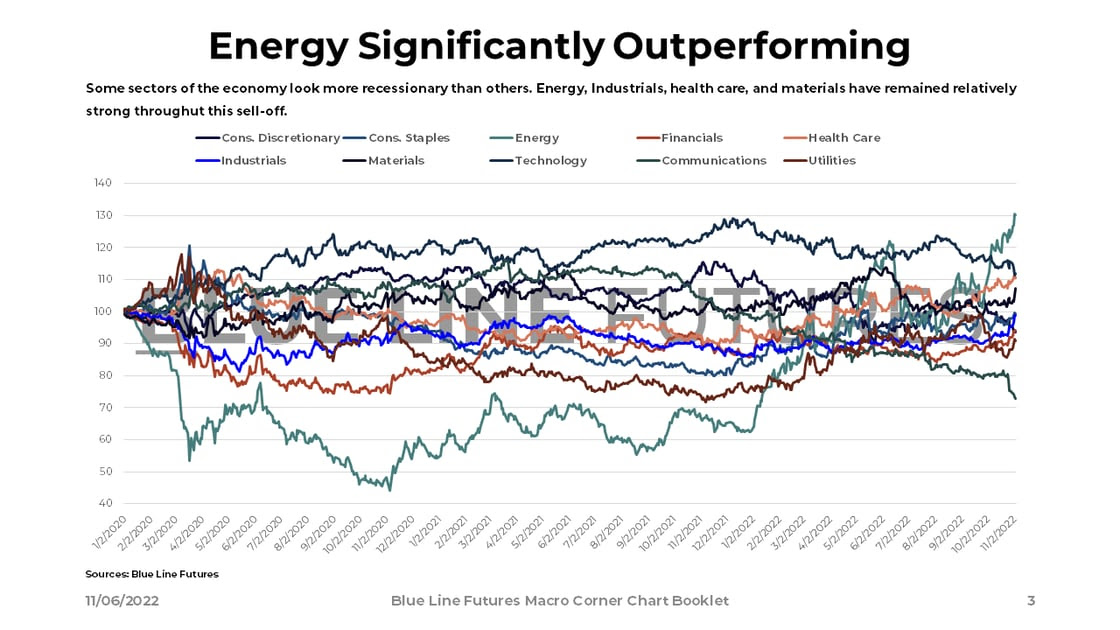

At the point at which the asset that was thought of as relatively safe turns out to be a lot more cyclical, PMs re-evaluate portfolio construction on a much more fundamental level. Does it make sense to have a 2-4% allocation to energy when the sector trades at 1/2 the P/E of technology?

Perhaps, the recession occurs in sectors that need re-rating, but not in areas that have remained structurally undersupplied with capital. That in turn makes those companies owners of assets whose output can remain scarce for a long time. Scarce output in an industry with inelastic demand leads to pricing power, which translates into relatively higher profit margins despite rising wages.

It is a fundamental reconstruction of portfolios that can set large flows of capital in motion, which then becomes a self-fulfilling prophecy as PMs managing against a benchmark are forced to pivot.

Data & Commentary

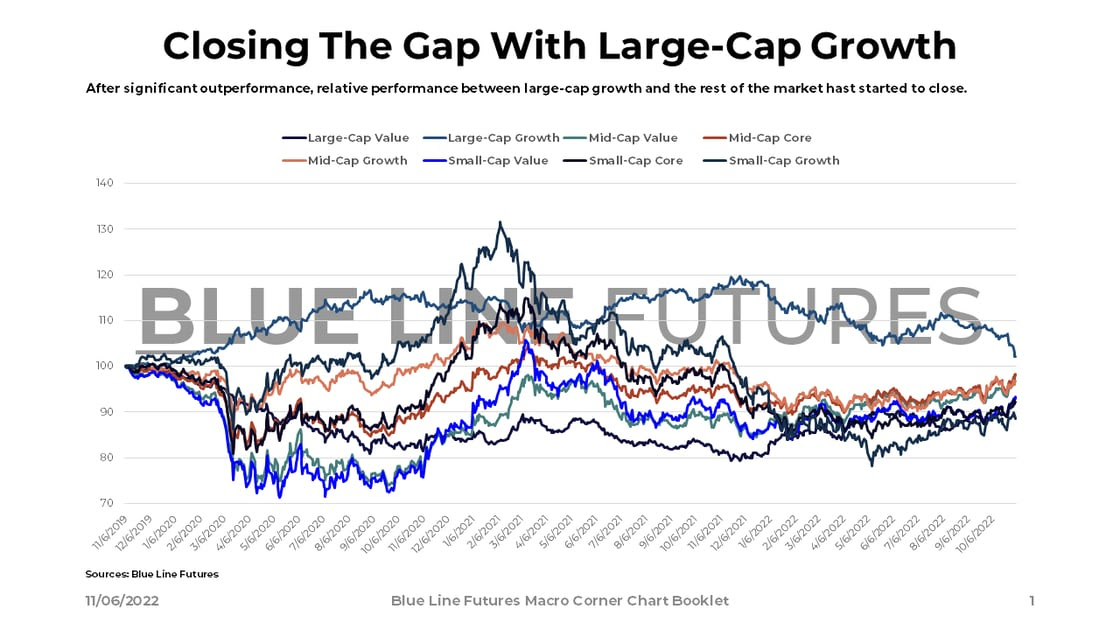

Having established that the world is a flow chart of capital (credit to Paul Tudor Jones), we look beneath the surface of U.S. equity markets. While large-cap growth has been the contributor to portfolio returns ever since QE began, rotations can work in reverse. At the point at which multiples matter, portfolio managers need to adjust. Today, we deal with the issue of the Fed staying higher for longer with a chance that we are undergoing a much more fundamental regime shift pertaining to cost of capital assumptions. In that world, which is rather different from the last decade+, we are in the early innings of what has been a superb run in some areas.

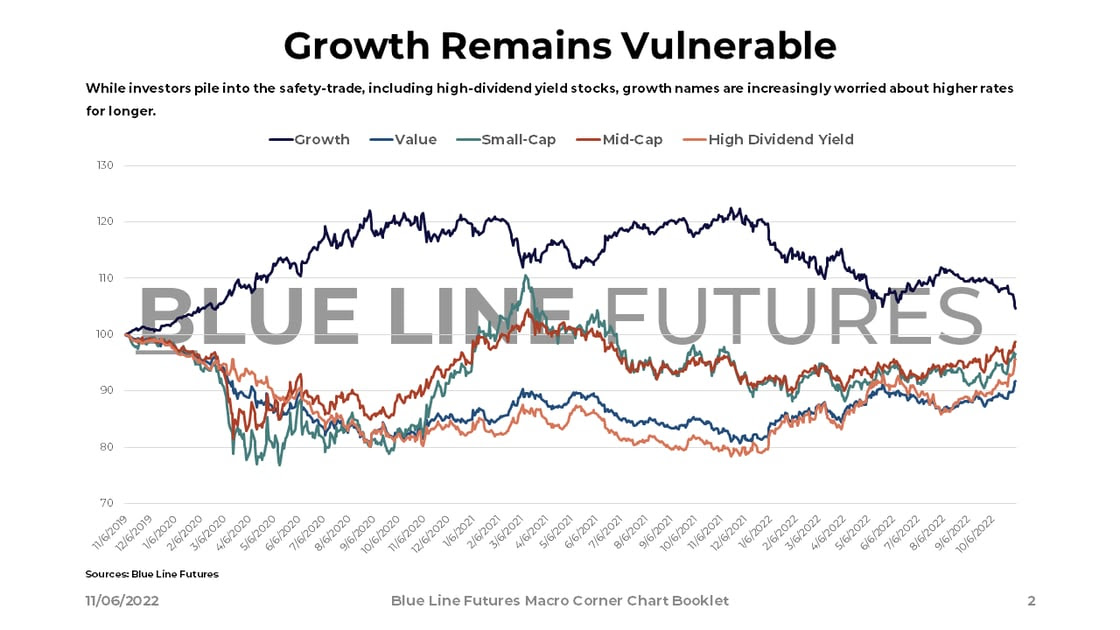

Below we show the same dynamic in a more simplified manner. As investors seek cash flows and real returns, growth has started to underperform on a relative basis while high-dividend yield stocks are playing catch-up.

People moving in on the risk curve is also getting reflected on a sector-by-sector basis. Rather than lottery tickets, investors are starting to chase cash-flow rich firms.

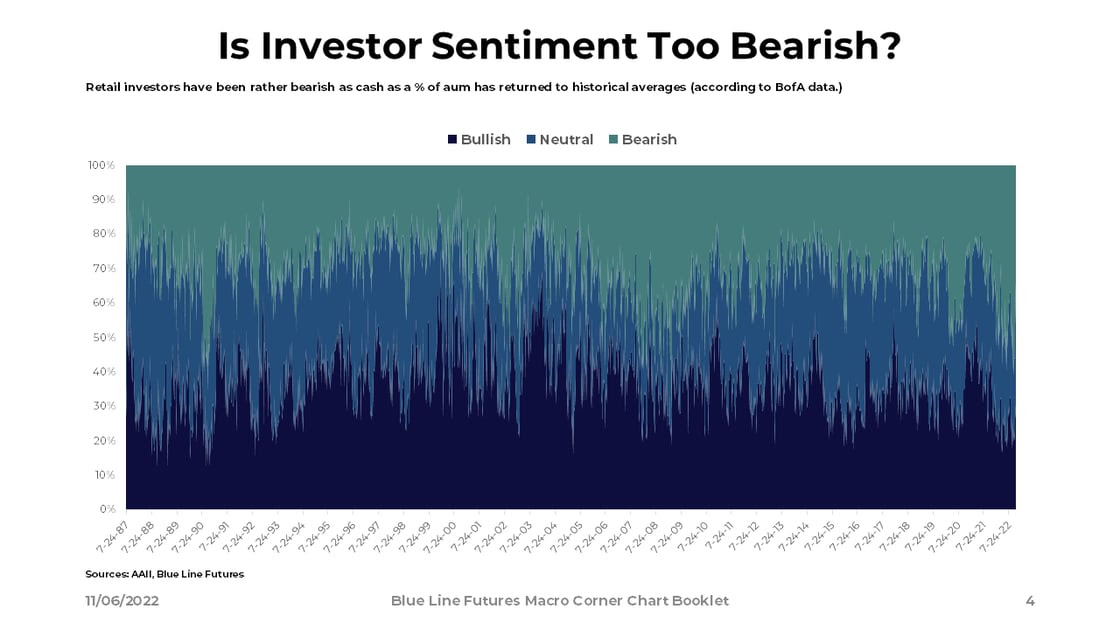

As investors navigate a difficult market regime, retail is showing rather bearish sentiment, thus lending itself to rallies despite a Fed overhang.

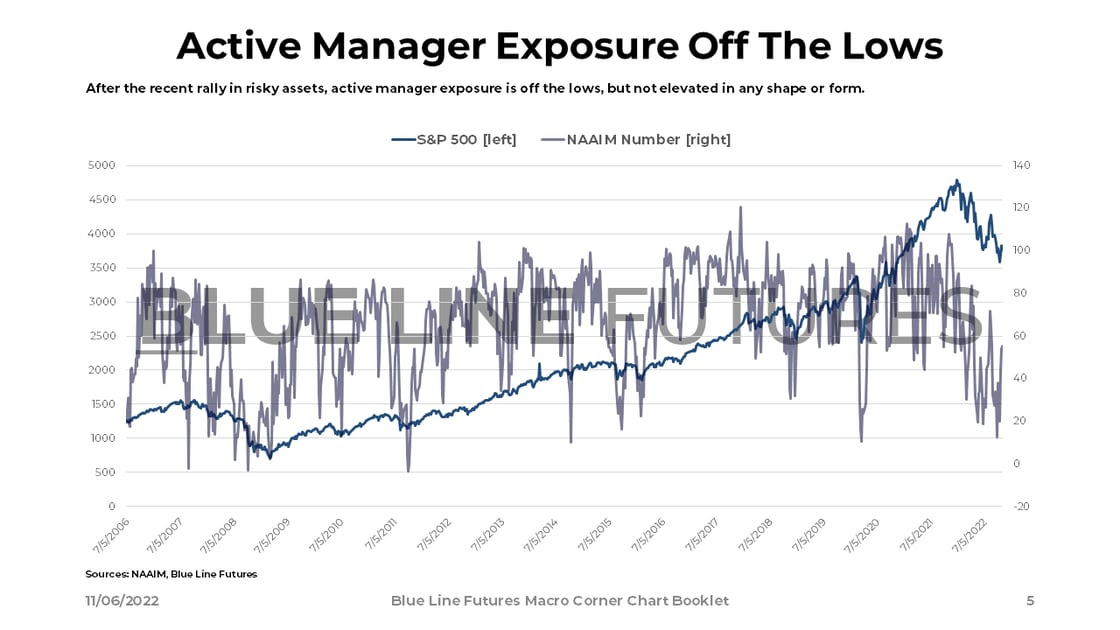

A similar dynamic is reflected among active managers, who have been positioned very lightly. However, conversely, there's a FOMU risk that requires managers to chase into rallies (fear of materially underperforming as coined by Goldman Sachs.)

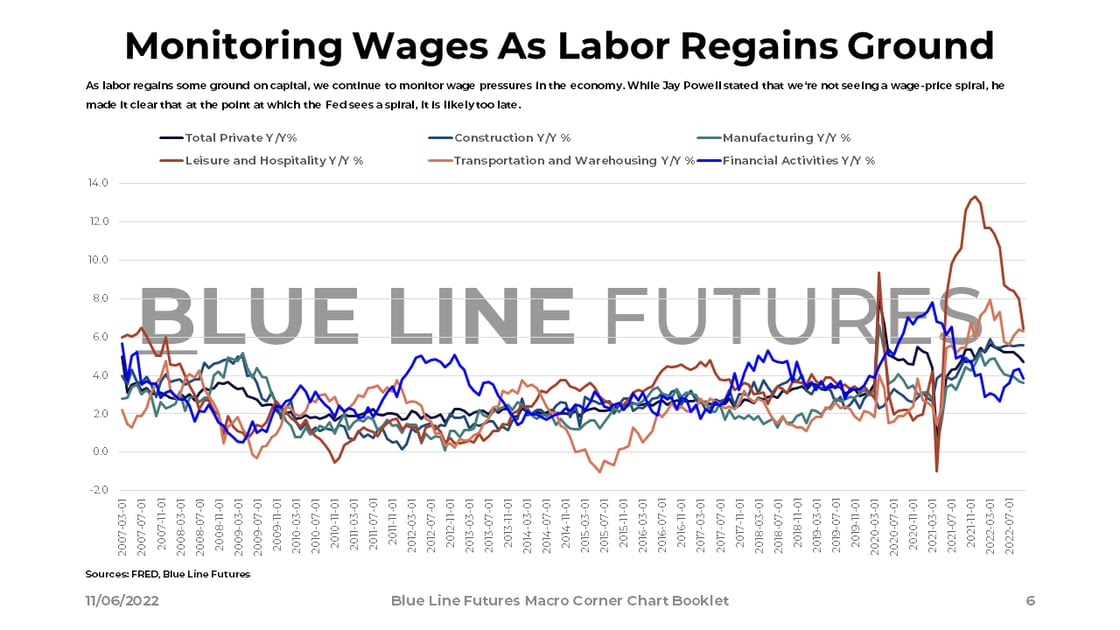

Turning away from positioning and a regime shift in allocations, we focus on the risks of a wage-price spiral becoming more entrenched. While wages have come off from the initial spike, the real concern would be a resurgence in wages, which would render the Fed's tools unsuitable. As Jay Powell said very clearly: "I also don't think we see a wage-price spiral but again it's something once you see it you're in trouble."

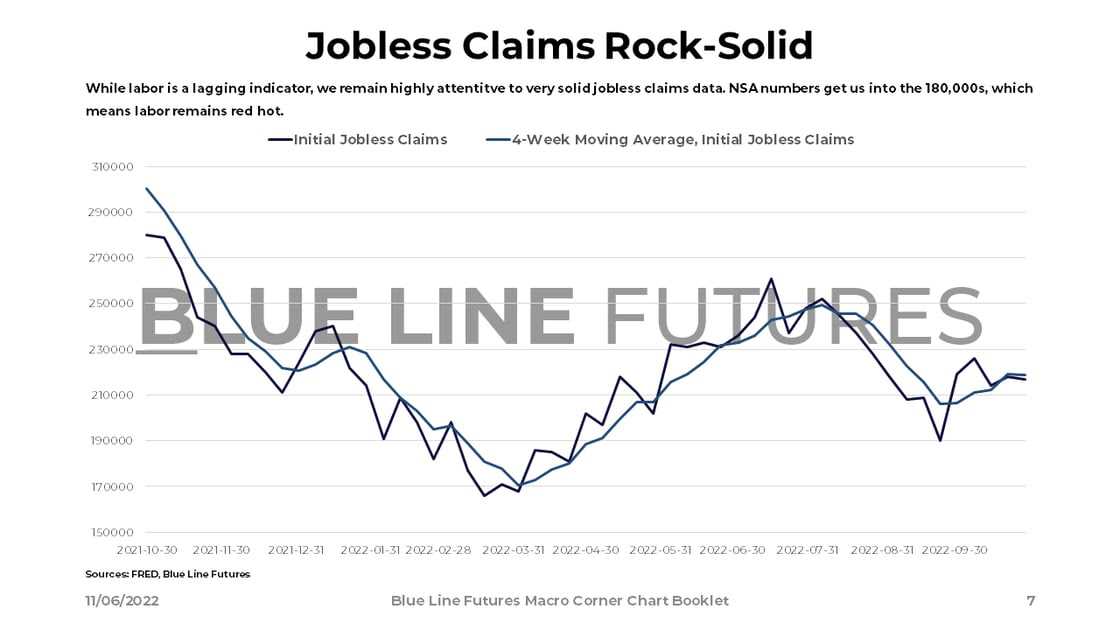

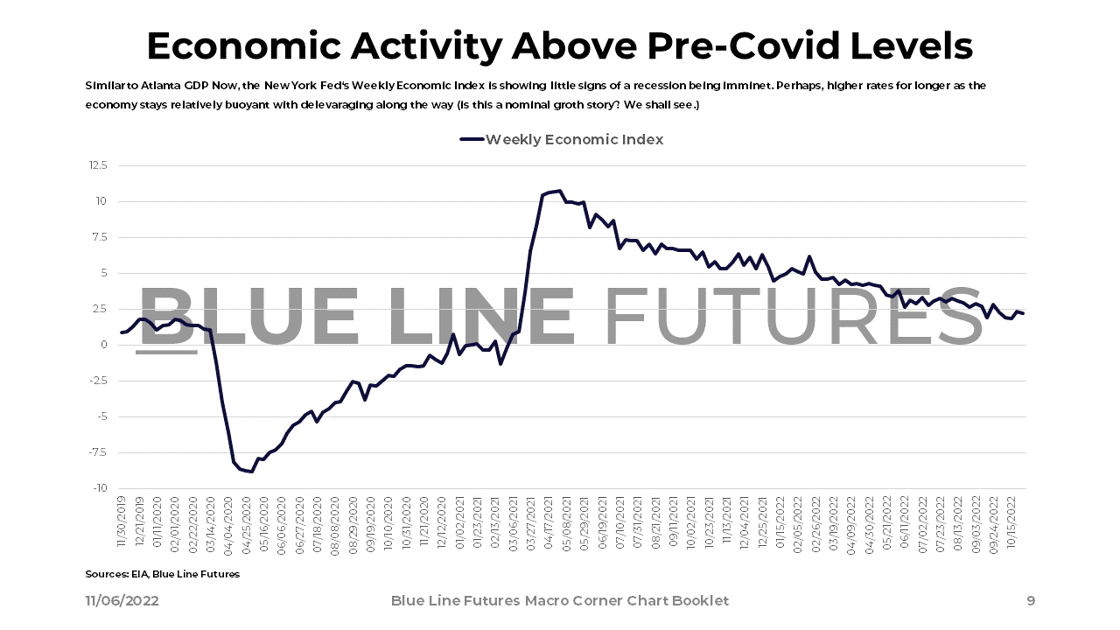

The risks of a wage-price spiral increase as the lagging effects of tight monetary policy are yet to show up in real economic data. Again, jobs are a lagging indicator and the slight increase in unemployment does flow into our assumptions. Nevertheless, the lack of deterioration in the labor market has to be of concern to the Fed.

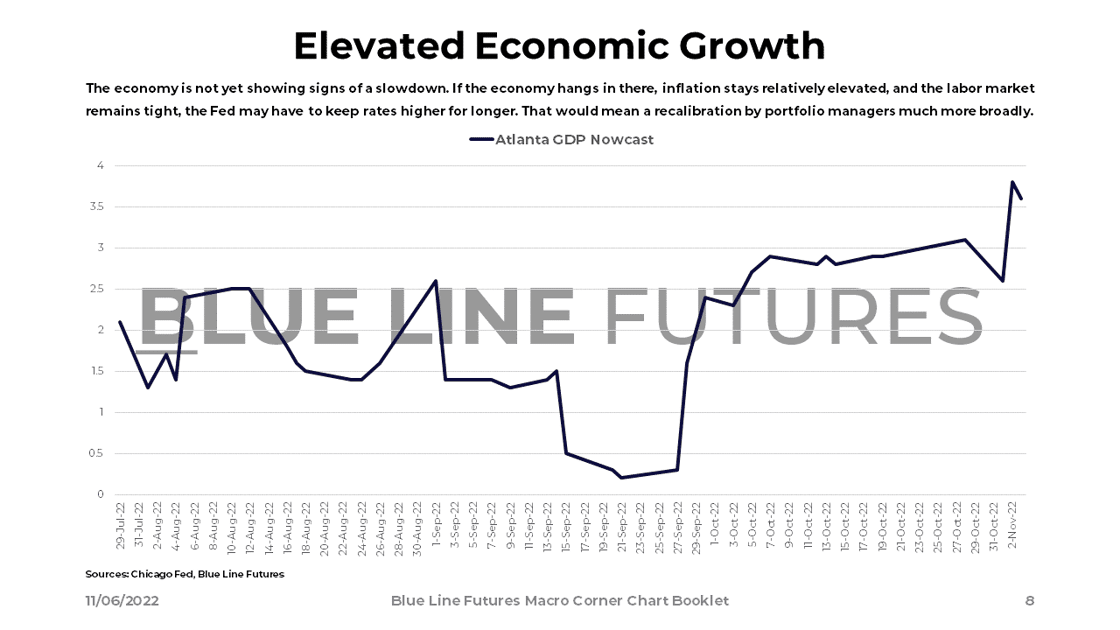

A tight labor market does make intuitive sense given how elevated economic growth has been -- especially on a nominal basis driving hiring activity.

The Fed is engaged in a credibility game. Unless they can control inflation, the market place will question the effectiveness of their tools, which could lead to a further tick-up in prices. However, we must not underestimate the steady & slow nature of the traditional business cycle. Michael Kantro from Piper Sandler calls it the HOPE cycle (housing, orders, profits, employment.) Therefore, the Fed's lack of sympathy towards pause or pivot hopes could lead to a further slowdown in 5-6 months from now while the undercurrent has already changed.

It is the prematureness of pivot hopes that could lead to a fundamental regime shift in how Wall Street allocates capital. In other words, low rates + low & stable growth is a different environment than either high rates + low/negative growth, or high rates + high nominal growth.

Entertain possibilities and probabilities because rarely do we deal with certainties.

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Climbing The Macro Mountain - October 30, 2022

- The Dollar Wrecking Ball & Sovereign Bond Yields - October 23, 2022

- Finding An (Un)Happy Equilibrium While Running From Oil Vigilantes - October 9, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

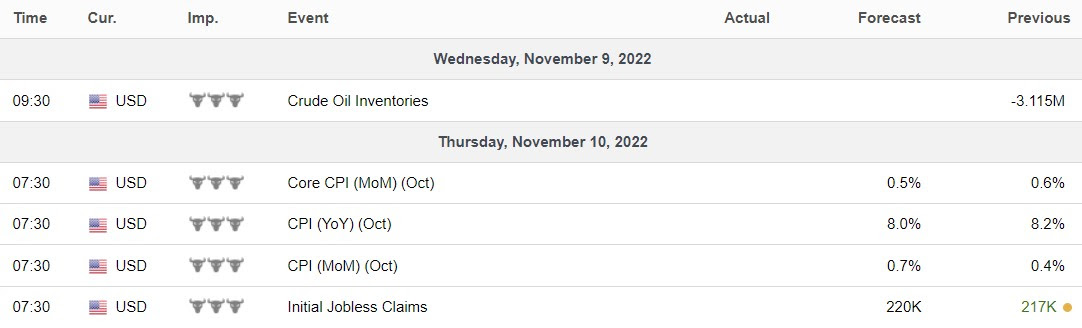

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Occidental Petroleum (OXY) reporting after the close on Tuesday:

- Consensus: EPS est. $2.48; Revenue est. $9.35bn

Commentary on the following be monitored:

- Capital investment vs. returning capital to shareholders

- Drilling activity

- Supply availability for oil drillers (oil services, offshore drilling etc.)

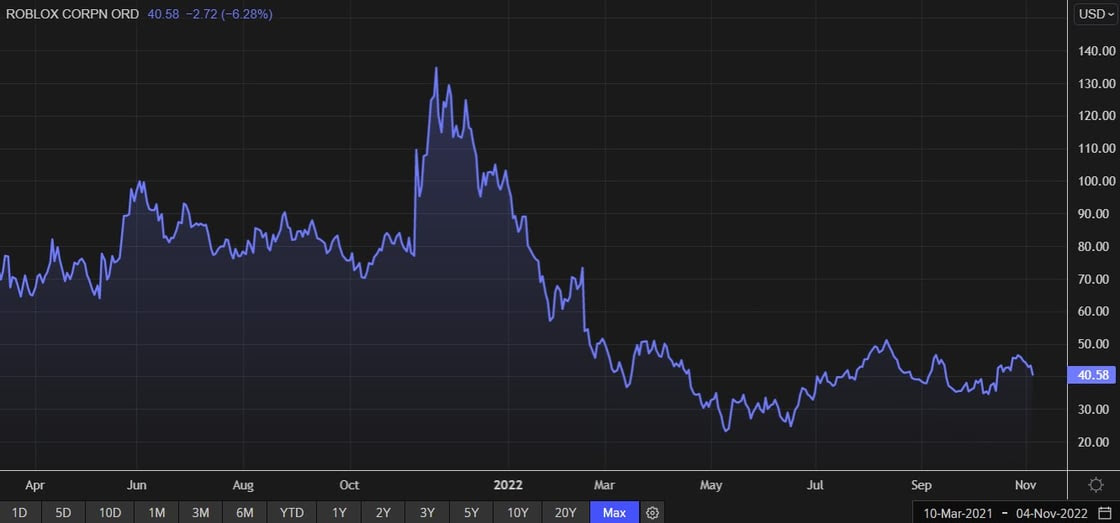

Roblox (RBLX) reporting before the open on Wednesday:

- Consensus: EPS est. ($0.37); Revenue est. $694.88mln

Commentary on the following be monitored:

- Mostly watching the market's reaction to high growth names reporting

Daseke (DSKE) reporting before the open on Wednesday:

- Consensus: EPS est. $0.30; Revenue est. $466.50mln

Commentary on the following be monitored:

- State of the transportation sector

- Transportation rates

- Labor tightness and wage pressures

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial