Climbing The Macro Mountain | Top Things to Watch this Week

Posted: Oct. 30, 2022, 7:01 p.m.

"Every age has its own collective neurosis, and every age needs its own psychotherapy to cope with it." - Viktor Frankl, Man's Search For Meaning

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 22: Chart Booklet

Check out last week's podcast episode on the Dollar, Bond Yields, and Credit Risk: Macro Corner Podcast, Episode 21

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Perspective From The Macro Mountain

Sometimes, we have to take a step back from the screens and remove ourselves from the noise that is the daily news flow. Today's day and age is largely not about access, but rather about variant perception. But how do you perceive things different from everyone else? How do you get to have an opinion before incrementally more market participants start to agree with your viewpoint? In my mind, it is about the perspective one gets from breaking it down to the most fundamental truths with the the ultimate fundamental being price. Depending on the gap between your perception and current price, an opportunity exists or doesn't exist.

In today's article, I will take a slightly different approach and draw from our new research report series Weekly Tactical Insights. We currently cover Crude Oil, Natural Gas, Copper, Treasuries, and a special Commitment of Traders summary. Each report is meant to be as data-rich as possible. The rawness of data can afford an opportunity to reach a conclusion that differs from consensus.

Data & Commentary

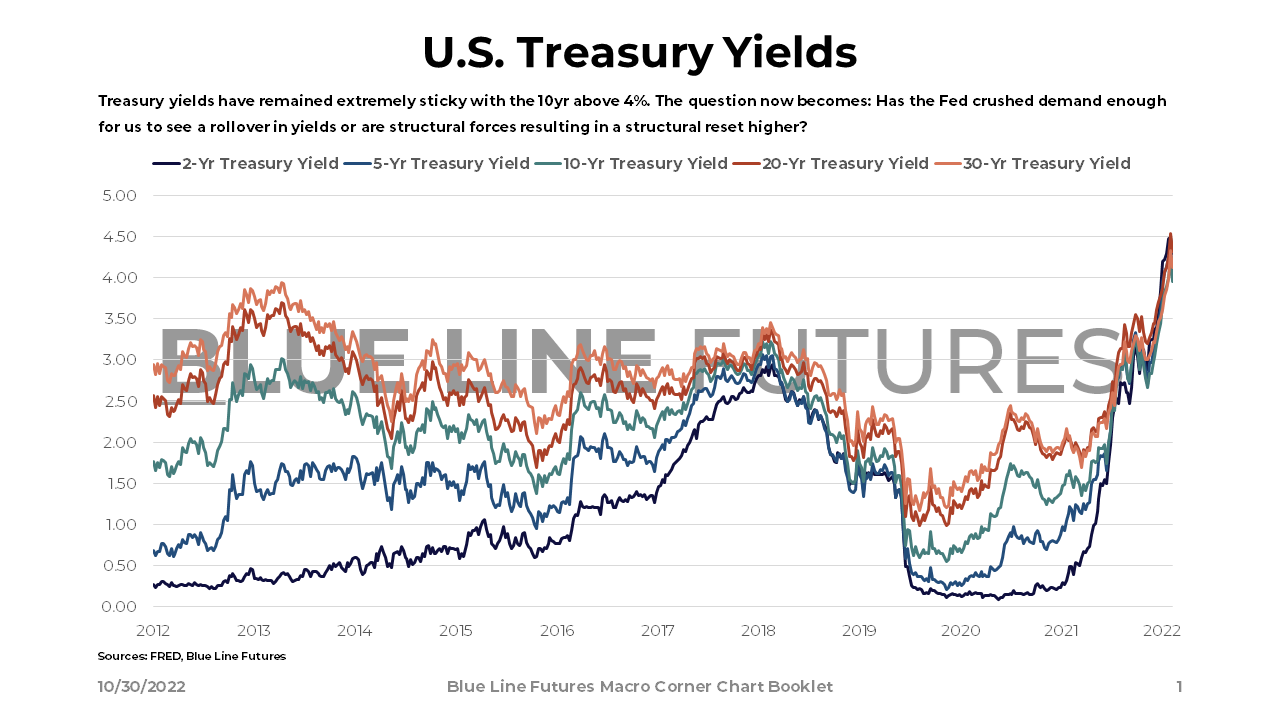

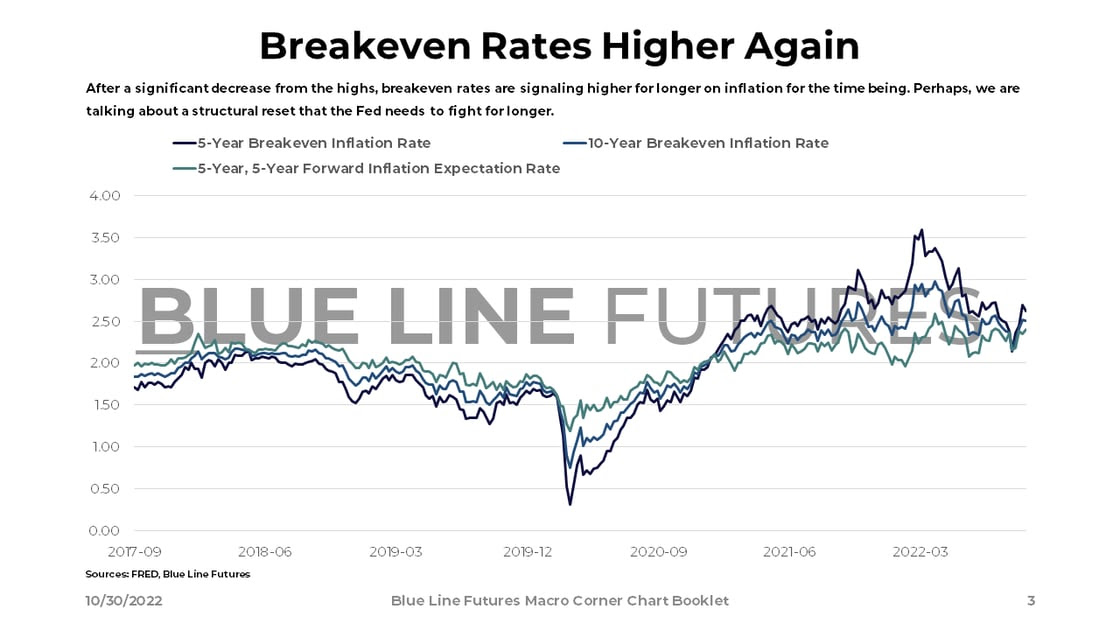

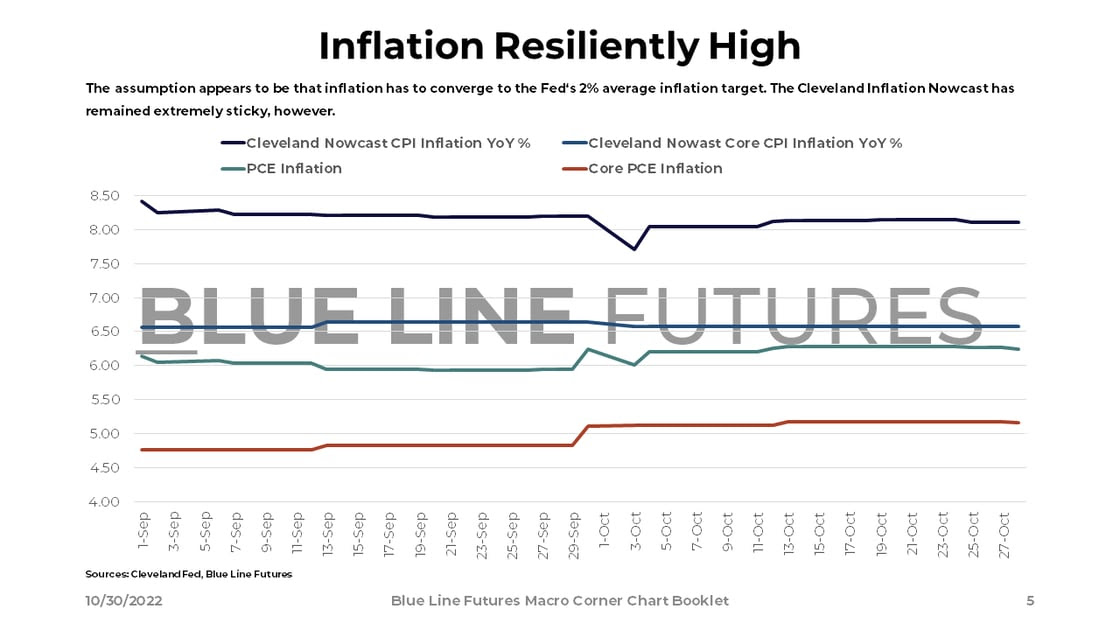

U.S. treasury yields across the curve have remained sticky as inflation data continues to come in hot. While recession talk is front & center, yields are yet to reflect deflationary dynamics that stem from a recessionary shock. Higher yields occur at a time when nominal spending is still very elevated, especially in services. The longer inflation sticks around, which then leads to upward pressure on wages, the longer the Fed will maintain tight financial conditions. As Nick Timiraos from the WSJ shared in a series of Tweets: "The big question heading into the Fed meeting is about what, if anything, Powell will say about December...the bigger challenge is this: 'How do you slow down demand for labor?'"

Slowing down labor happens via a slowdown in spending, which implies that wealth needs to get destroyed before the Fed has a chance to pause or pivot. Right now, we are in the midst of markets trying to anticipate that very pause.

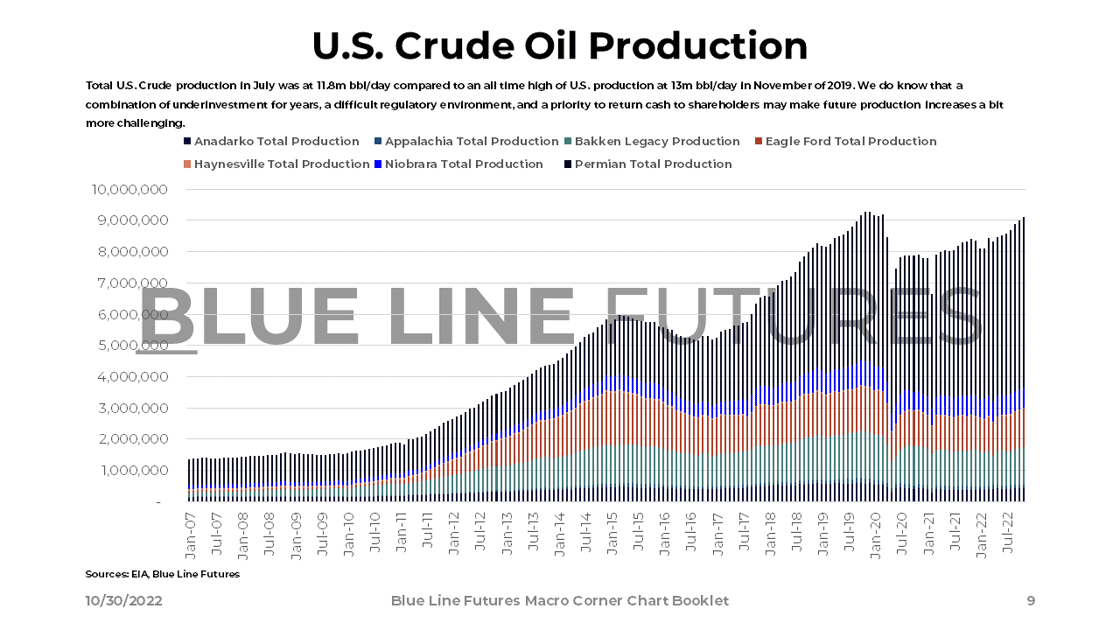

We need to balance the idea of wealth destruction with the notion that terminal rates may be higher for longer as a result of structural underpinnings (underinvestment in energy, housing shortage, labor availability.) We wrote a piece titled The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections back in August.

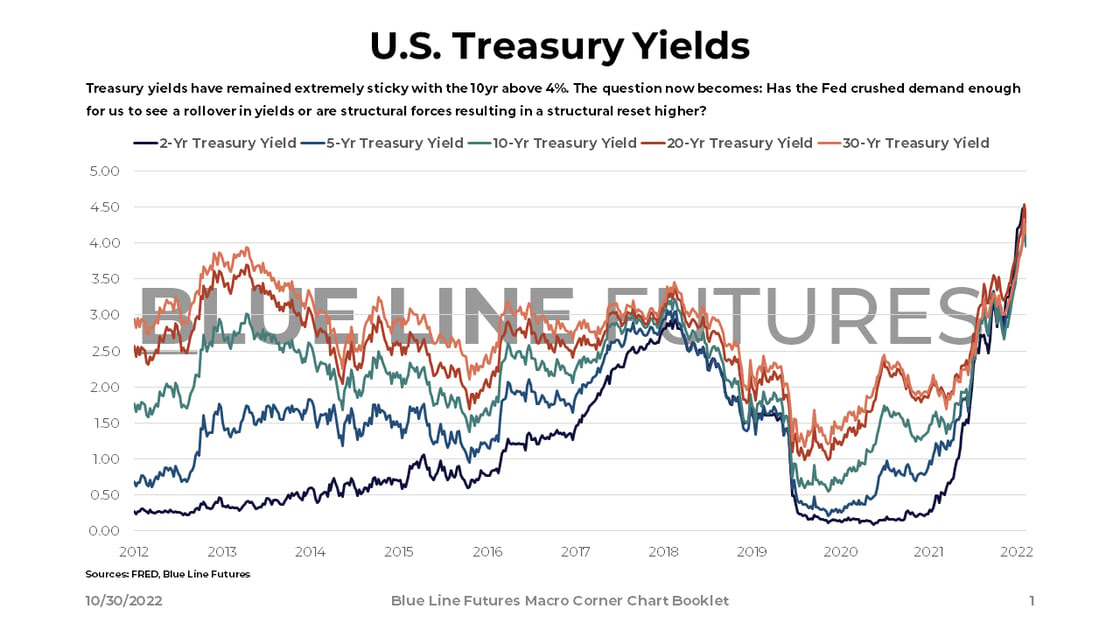

Unlike nominal treasury yields steering clear of the recession trade, yield curves are flashing red. Not only does the 2s10s curve continue to be inverted, but we also witness a 3m10yr curve that is right around inversion.

The Fed will welcome pain for the economy as pain is required to bring down inflation. The assumption is that financial stability is assured.

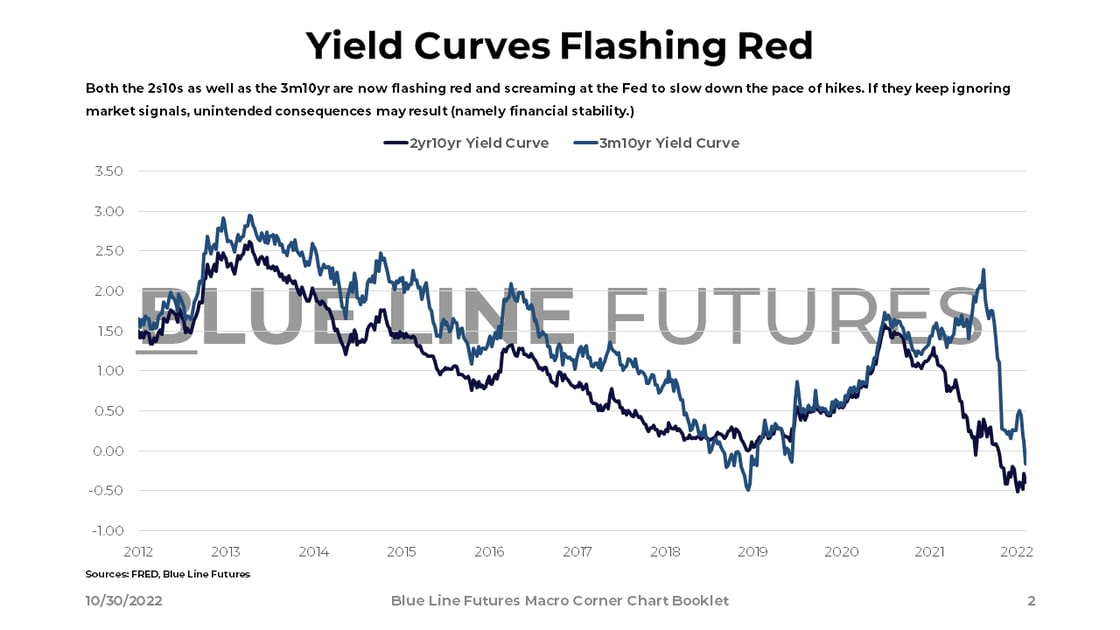

Frustratingly for the Fed, breakeven rates are not corroborating.

Again, this is about future inflation expectations and how entrenched a higher nominal yield curve becomes. The Fed is likely to accept higher nominal yields if that is indeed the state of the economy. If that nominal number is too high to achieve price stability, though, below trend growth may be required.

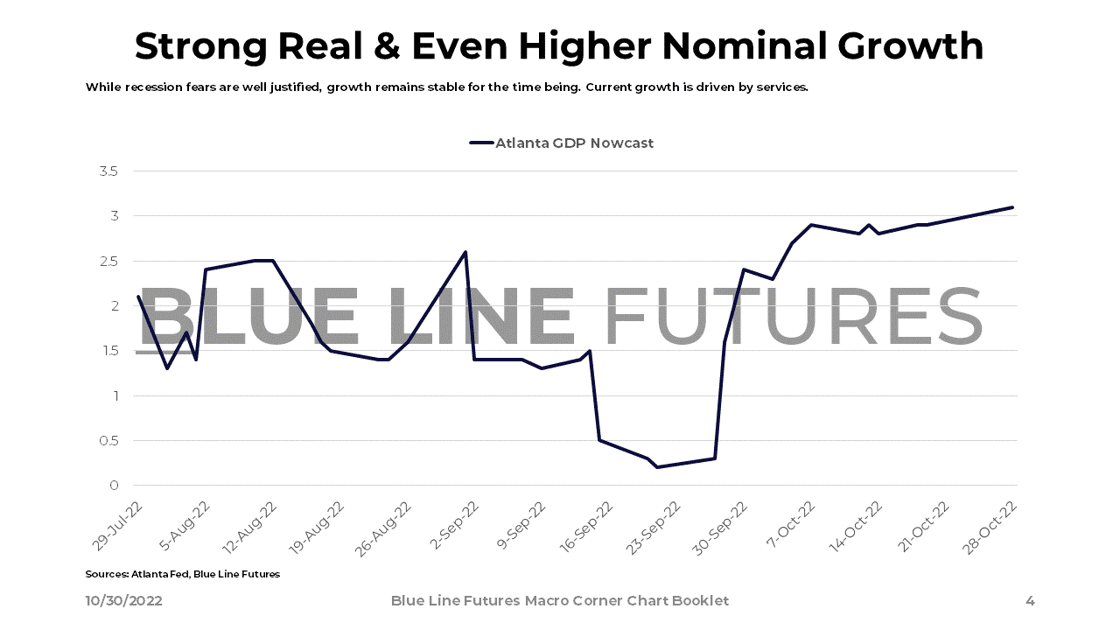

Despite 400+bps in rate hikes along with Quantitative Tightening, nominal as well as real economic growth remains strong. As the economy shifts to services, it is unlikely the current binge in the experience economy will continue to the same extent, which would again be desirable to slow wage inflation.

As spending shifts around at unusually high levels - one sector of the economy at a time,- inflation has stayed resiliently high. The Fed needs to destroy enough wealth to reduce spending.

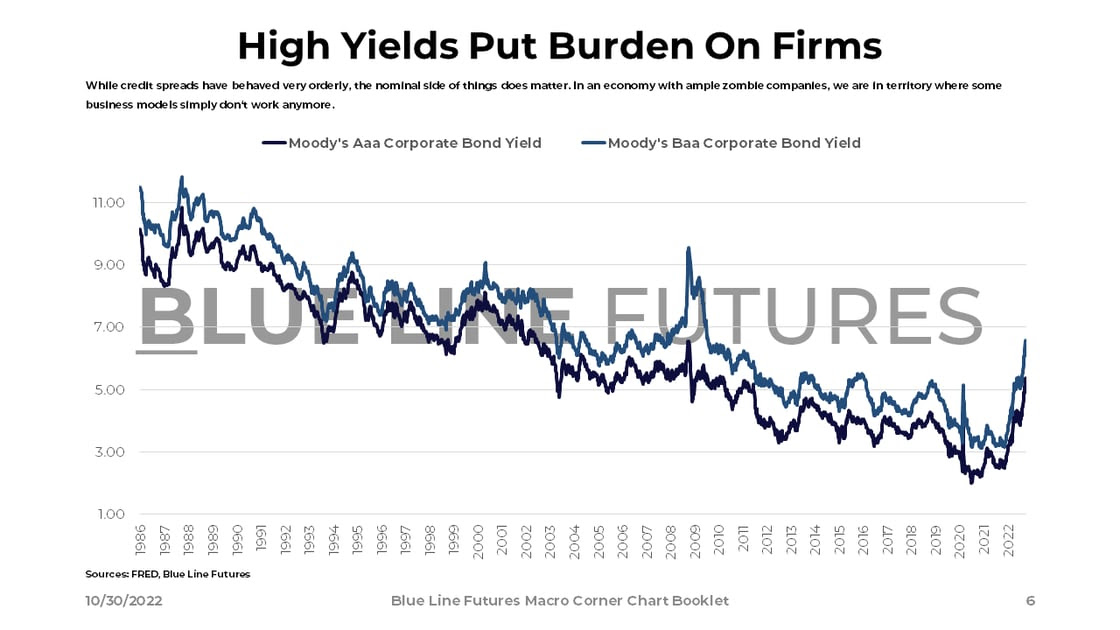

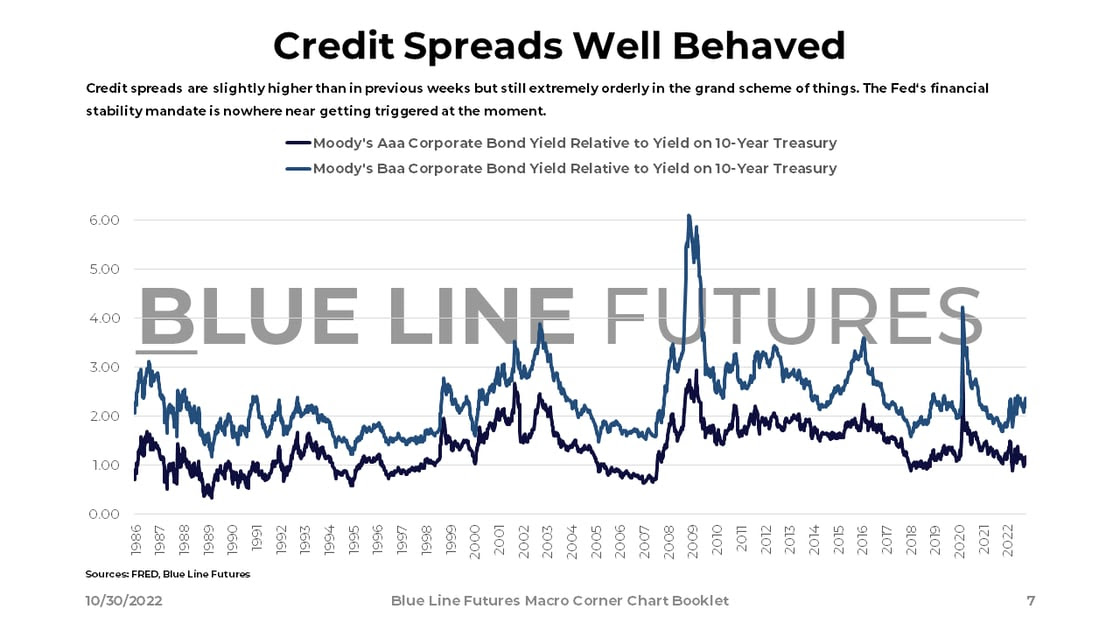

While credit spreads in isolation have been extremely well behaved, nominal yields are putting a burden on highly levered firms. The reality is that some business models simply don't work with higher cost of capital.

Without circulation of credit, the wheels of the economy stop spinning. We have not seen that despite an increase in the nominal cost to borrow. Devoid of credit spreads worsening substantially, we may see a slow but steady deleveraging cycle.

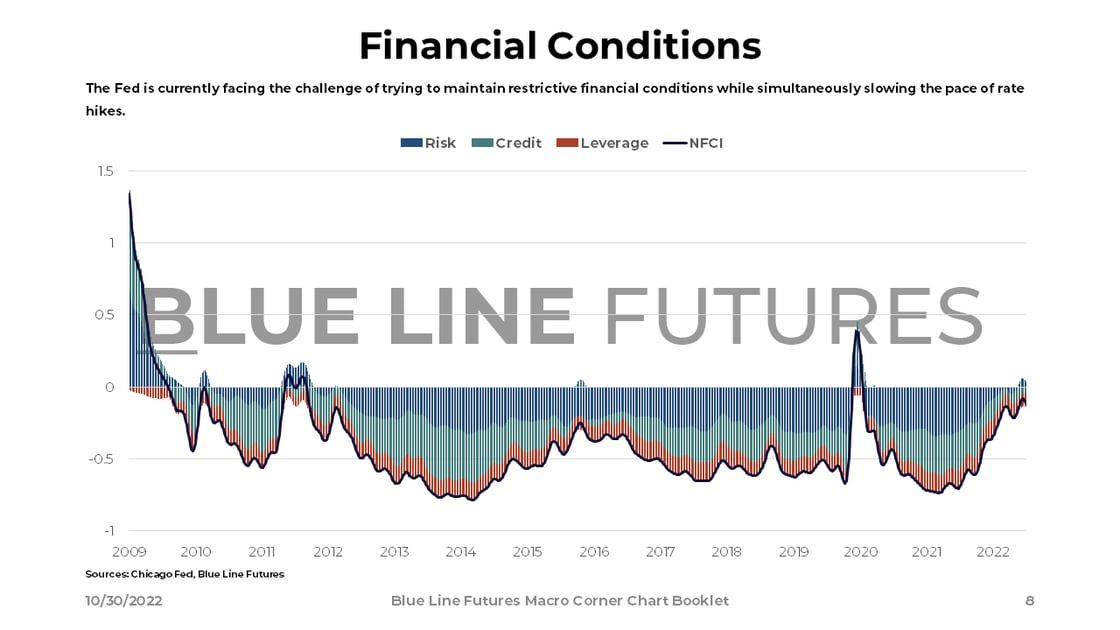

The Fed has made it very clear that it wants financial conditions to stay tight in order to break the inflation cycle. Whether they have the tools to do so is a question yet to be answered. Regardless, we do know that it was a loosening in financial conditions that had triggered Powell's hawkish Jackson Hole speech. Now that they are loosening again as the stock market rallies and credit spreads remain well behaved, markets will watch the Fed's reaction.

In order to declare victory, the Fed needs to be aggressive enough to reduce demand without destroying long-term growth potential. However, the latter is of lesser concern as central banks globally are dealing with a single mandate assuming financial stability is in place. Until the job is done - a clear path to 2% average inflation, - Fed hostility will remain the primary risk to the economy, earnings, and the financial system writ large.

At some point, we will get to a place where we either need to accept higher nominal rates as a result of structural forces, or return to conditions that resemble the pre-Covid economy. While the latter is less likely, we will listen to market signals and continuously update our views based on the ultimate fundamental and variant perception thereof: price.

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- The Dollar Wrecking Ball & Sovereign Bond Yields - October 23, 2022

- Finding An (Un)Happy Equilibrium While Running From Oil Vigilantes - October 9, 2022

- Poking Holes In The Inflation Balloon - October 2, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

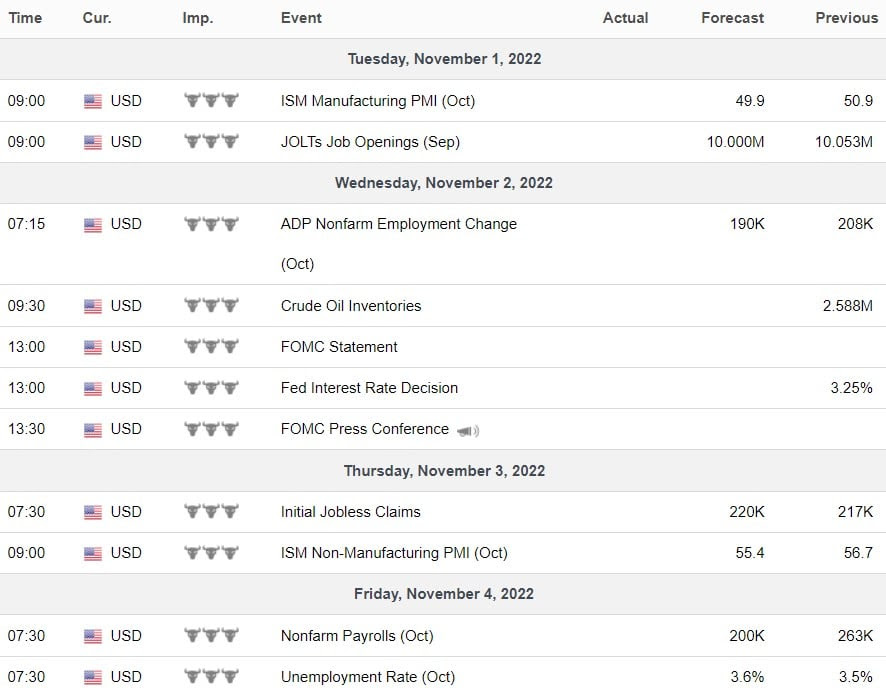

Economic Calendar

U.S.

Data Release Times (C.T.)

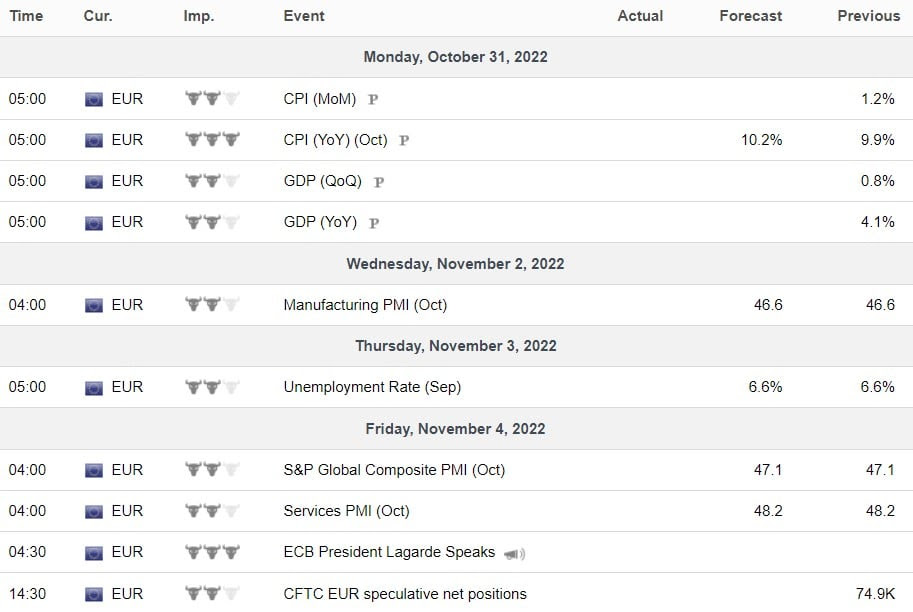

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Marathon Petroleum (MPC) reporting before the open on Tuesday:

- Consensus: EPS est. $6.80; Revenue est. $35.67bn

Commentary on the following be monitored:

- Refining capacity

- Crack spread outlook

- Investment spending outlook

- Crude product demand

Advanced Micro Devices (AMD) reporting after the close on Tuesday:

- Consensus: EPS est. $0.55; Revenue est. $5.58bn

Commentary on the following be monitored:

- The semiconductor inventory cycle

- Will the absolute inventory level be higher than before?

- Capital spending cycle

Cheniere Energy (LNG) reporting before the open on Thursday:

- Consensus: EPS est. $5.45; Revenue est. $7.83bn

Commentary on the following be monitored:

- Long term LNG contracts

- Freeport LNG export facility updates

- Export capacity and U.S. production

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial