The Dollar Wrecking Ball & Sovereign Bond Yields | Top Things to Watch this Week

Posted: Oct. 23, 2022, 7:53 p.m.

"I've done a lot of thinking about fear. For me the crucial question is not how to climb without fear - that's impossible - but how to deal with it when it creeps into your nerve endings." - Alex Honnold

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 21: Chart Booklet

Check out last week's podcast episode on Crude Oil, Natural Gas, Copper, and Treasuries: Macro Corner Podcast, Episode 20

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

The Central Bank Balancing Act

It’s hard to ignore central bank actions during a time where central banks are precisely the ones driving market outcomes. One of the utmost important dynamics within the landscape of central bank policies today is the fact that CB policies are diverging. While the Fed keeps hiking rates and the debate is over whether to slow down to 50 or 25bps post-November, the ECB is debating whether to hike to 1.50% while German PPI runs at 46% Y/Y. Most likely, the PPI number overstates the real-time data of inflation, but it is indeed a tricky equilibrium. First, central banks are acting on a lag to actual data while their own policies act on a lag as well. Secondly, the fact they think they act on a lag makes them much more hesitant, which has its own implications for the degree to which inflation expectations can potentially get entrenched. Central banks are doing so in a heavily indebted world where the interest paid on debt is largely subject to short-term maturities sensitive to changes in short-term rates as outstanding debt needs to get rolled. In 2020, the IMF estimated that total debt as a percentage of global GDP reached 256%. One way to get out of this debt spiral is to inflate nominal growth and lower the value of the interest paid on debt; that is precisely what happened on the back of WWII.

So, at what point does the central bank balancing act move from single mandate inflation fighting to financial stability, or perhaps assuring that nominal growth remains high enough in the name of keeping up employment conditions?

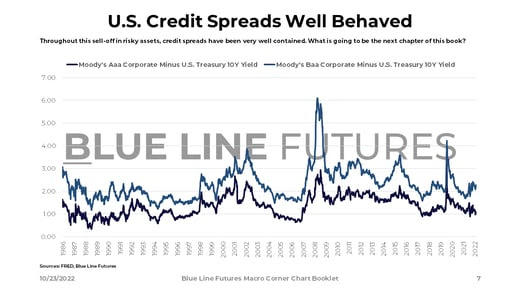

Perhaps, when a lack of hedging in financial instruments leads to higher velocity moves in risky assets than we’ve seen thus far. In fact, the sell-off we’ve had has been rather orderly as earnings have remained relatively elevated, delinquencies by consumers low, and inflation expectations relatively contained.

Additionally, credit spreads as evidenced by Moody’s Baa and Aaa spreads are very well behaved with little indicating that credit markets are taking it on the chin just yet. However, as Jay Powell has repeatedly pointed out: there’s a clock ticking and the clock is counting down to a point where inflation expectations move structurally north. A world in which nominal spending remains relatively strong, where fiscal retrenchment is nowhere to be seen, and capital allocation remains poor for longer leading to lesser marginal returns on risky assets. Doing so might inflate the debt away over the long-term, but doing so before declaring a victory over inflation is unlikely. But when can victory be declared? Not until either the economy miraculously normalizes to a pre-Covid state or demand slows so suddenly that inflation runs back to 2% on average as a result of a drastic demand shock.

The reason why the Fed inflated financial assets by hundreds of percent in order to achieve a 2% average inflation goal is because the effects of asset prices on inflation are rather loose; in fact, Nick Timarious from the WSJ quoted Nathan Sheets on October 9: “They have absolutely zero confidence in their ability to forecast inflation.” On October 21 Jeanna Smialek wrote as part of a Tweet: “But slowing down could be a tough needle to thread w/o triggering a market rally.”

See the dilemma?

The Fed is stuck between a rock and hard a place, but perhaps the hard place is not so bad when you consider that high debt needs structurally high inflation to go away. But again, victory cannot be declared today as developed countries deal with emerging market type problems; just turning to Europe, years of “Wandel durch Handel” has turned into complete dependence on foreign suppliers of energy and foreign consumers from China. The world is not as stable as Merkel’s mantra assumed when the world was in an anomaly of stable and flourishing economic relationships.

You combine war, higher structural inflation forces, and a 60/40 portfolio drawdown at its worst on record for this year, one has to wonder what the next absurdity will look like. Is it going to be a pink flamingo everyone sees but nobody dares to point to? Or is it a black swan event that will trigger the next macro outcome? I very much echo Stanley Druckenmiller during Delivering Alpha (paraphrasing): We got so many problems even without any black swans.

The point is to identify current world issues and deal with them; one cannot create the world around us fully, but impact things on the margin by managing risk and being a good steward of capital.

So, the next move in this game of 4D chess has multiple possibilities. Most importantly, however, we will have U.S. midterm elections on November 8th and the next Fed meeting on November 2nd. While another 75bps are set in stone for the most part, it is all about signaling a potential pause and getting to a “neutral rate”. The Fed has made it quite clear that they want to keep Fed Funds at a high level for quite some time before pivoting; the question becomes how steadfast will they be if unemployment ticks up substantially, profit margins start to shrink, and cracks in the financial system become more apparent. Ultimately, congress sets the Fed’s mandate, not the Fed itself.

Data & Commentary

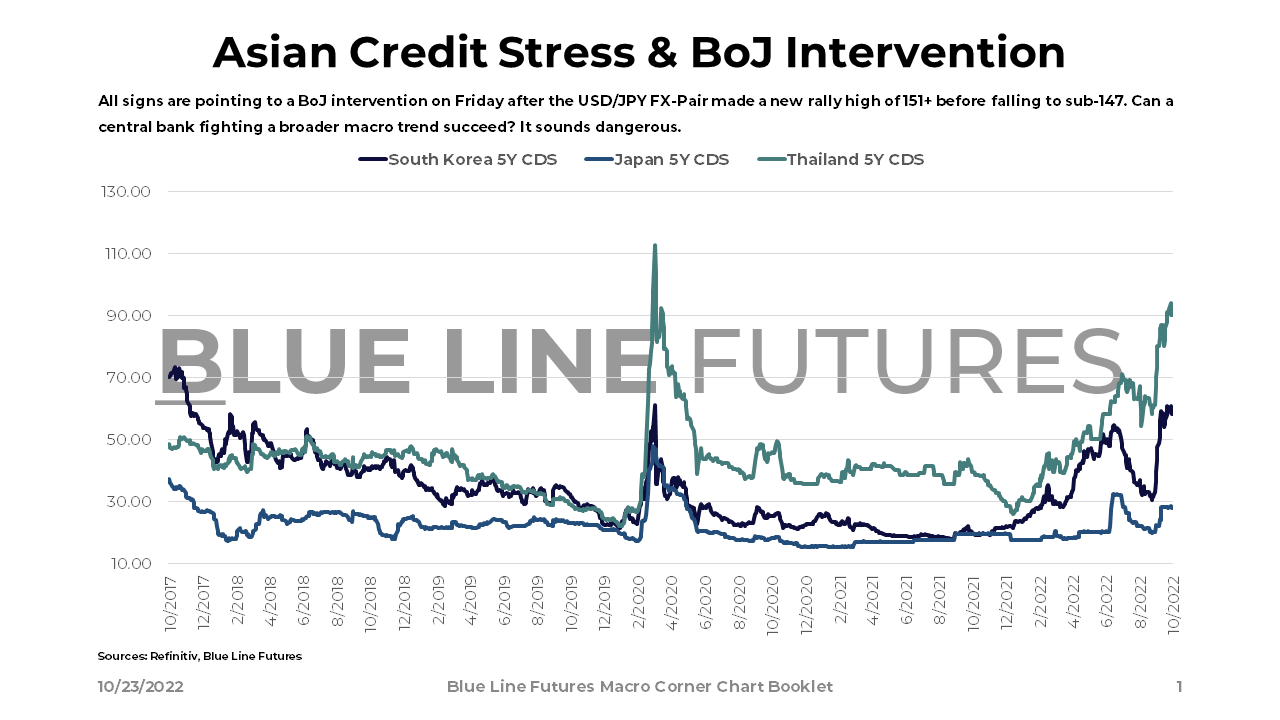

The BoJ intervention is just one instance of Asian countries trying to hold their currency together; a similar theme is playing out in China where state banks are increasingly managing the Yuan. A similar story is playing out in South Korea where the central bank is using the national pension fund as a tool to defend the Won. “The dollar is our currency, but it’s your problem.” - John Connally

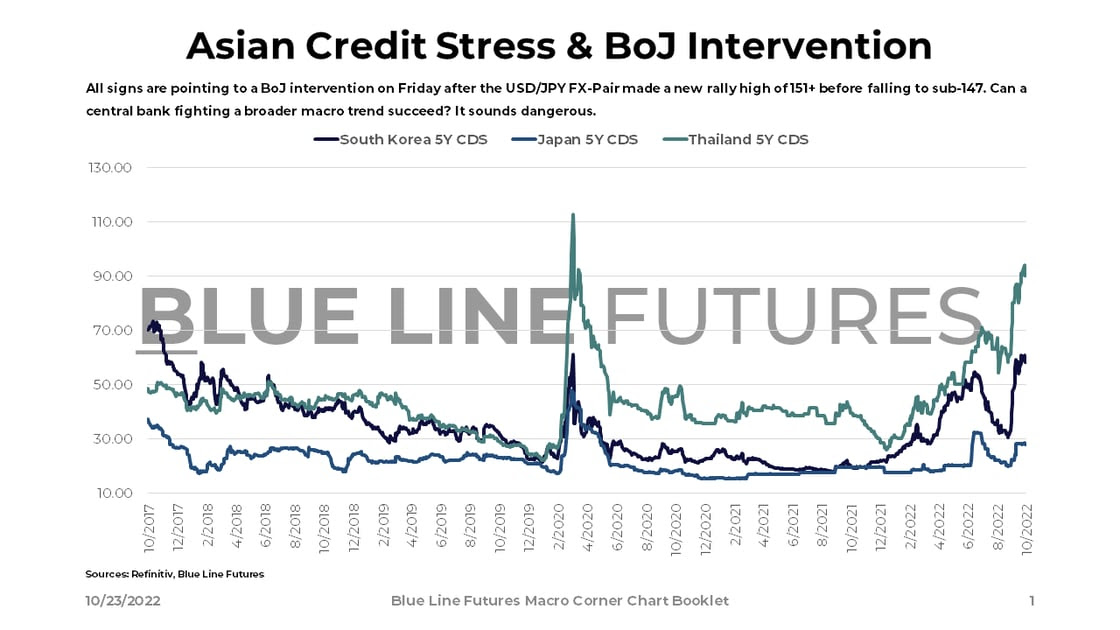

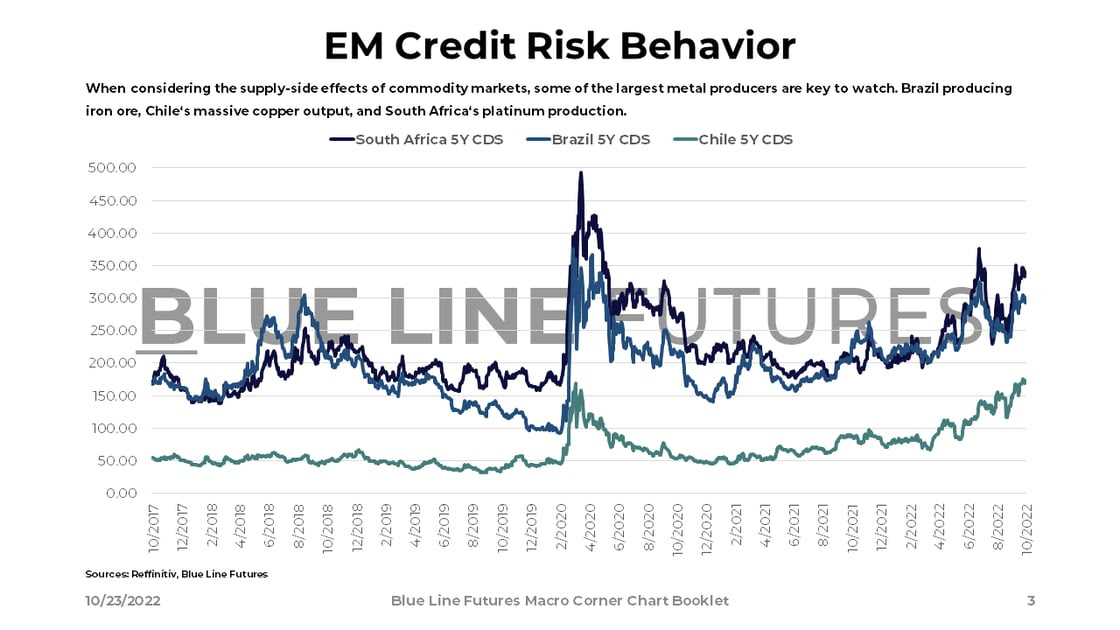

Increasingly so, Europe is dealing with emerging market type problems. While an experiment from the beginning, it becomes clear that devoid of the German manufacturing hub maintaining a trade surplus, the Eurozone becomes rather fragile. It all boils down to energy, whether it will be a mild winter or not, and how much leverage Putin can get while Europe tries to attract more LNG deliveries from the U.S. Thus far, Europe has been reluctant to sign long-term LNG contracts as Asian nations re-rout gas at a massive spread (they keep getting tied to spot.)

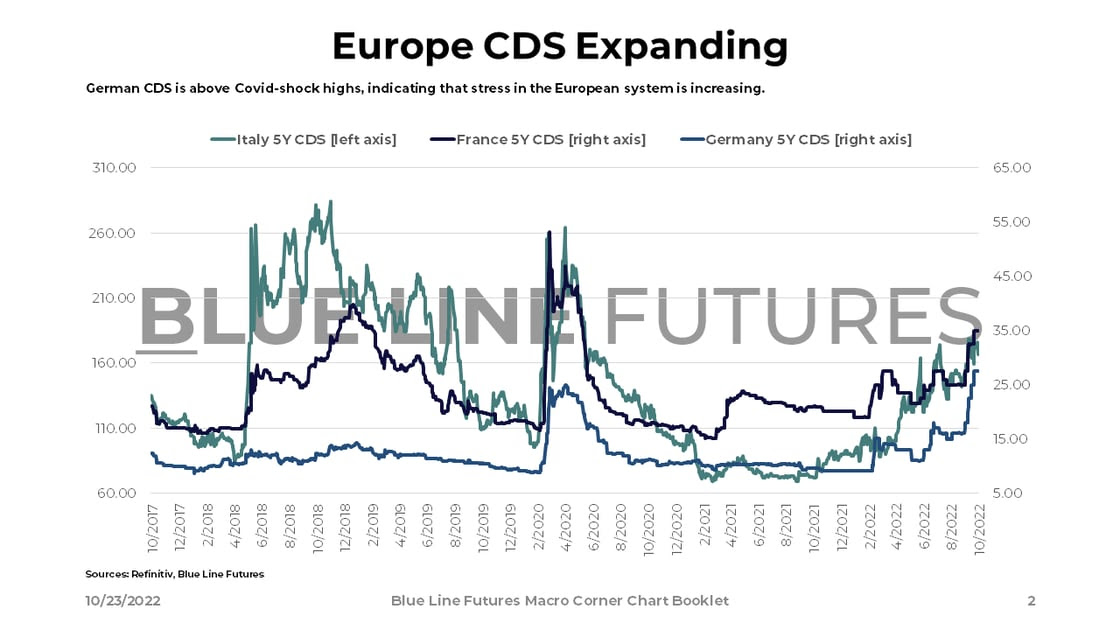

Perhaps most importantly for the supply side in metals, EM CDSs remain elevated. Brazil as a producer of iron ore, Chile as the world’s largest copper producer, and South Africa as the predominant platinum miner. While emerging markets have remained rather stable thus far, it remains to be seen whether the lagging effects of Fed policy combined with a lack of EM growth will spur the impacts of the Dollar wrecking ball.

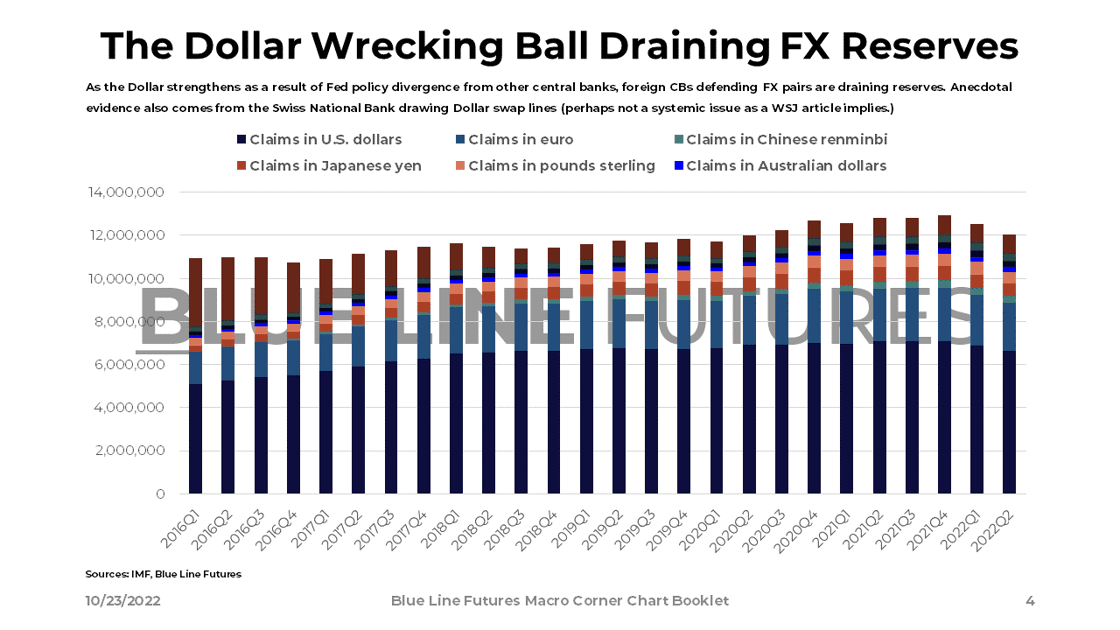

Talking about the Dollar wrecking ball, central banks are increasingly draining FX reserves in an effort to defend their own currencies. Bloomberg reported that YTD, central banks drained reserves by $1 trillion (from a pool roughly $12 trillion.)

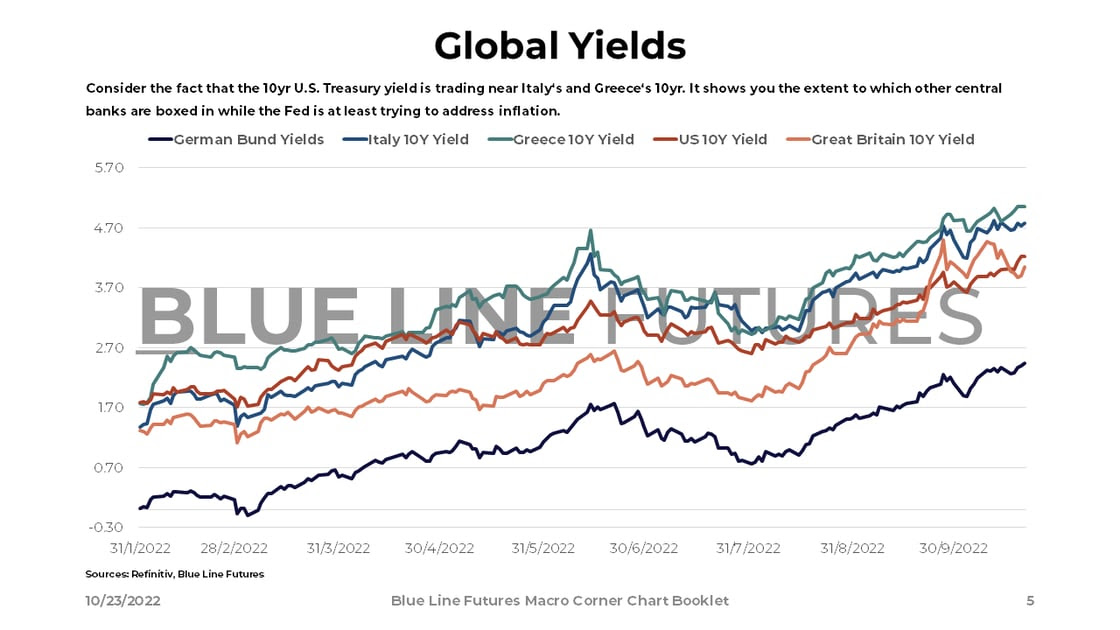

Yields are a function of short-term interest rates plus a risk premium on top to compensate investors. The fact that the 10yr U.S. treasury bond is trading near the 10-year of Greece and Italy is a major display of the rate differential between the U.S. and Europe. How systemic are Europe’s problems will determine outcomes.

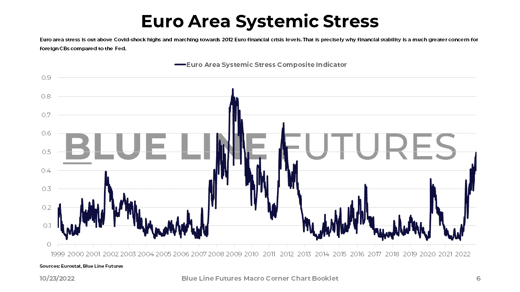

While U.S. credit spreads have behaved extremely orderly across investment grade and high yield, the Euro Area’s Systemic Stress Index is flashing red. Not only is it above Covid shock highs, it is also nearing 2012 European financial crisis levels. This all relates back to the financial stability mandate of the Fed and other central banks; the longer things are not breaking, the higher rates are allowed to go/stay.

The world remains in a place where we need to find a balance between how long CBs will keep financial conditions tight vs. how fast things break. A pivot in a highly indebted world most likely means nominal asset inflation to a degree that makes being short very scary and difficult. In the same respect, there’ve been very few instances in the past where the Fed literally told you that they want to see financial asset prices lower. It is all about the sequence of events and combining future probabilities with points in time.

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Finding An (Un)Happy Equilibrium While Running From Oil Vigilantes - October 9, 2022

- Poking Holes In The Inflation Balloon - October 2, 2022

- Fighting Addictions & Lonely Places - September 25, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

|

Data Release Times (C.T.) |

Food for Thought

Earnings

UPS (UPS) reporting before the open on Tuesday:

- Consensus: EPS est. $2.84; Revenue est. $24.42bn

Commentary on the following be monitored:

- Goods spending

- Economic slowdown

- Labor costs

- Holiday shopping season

|

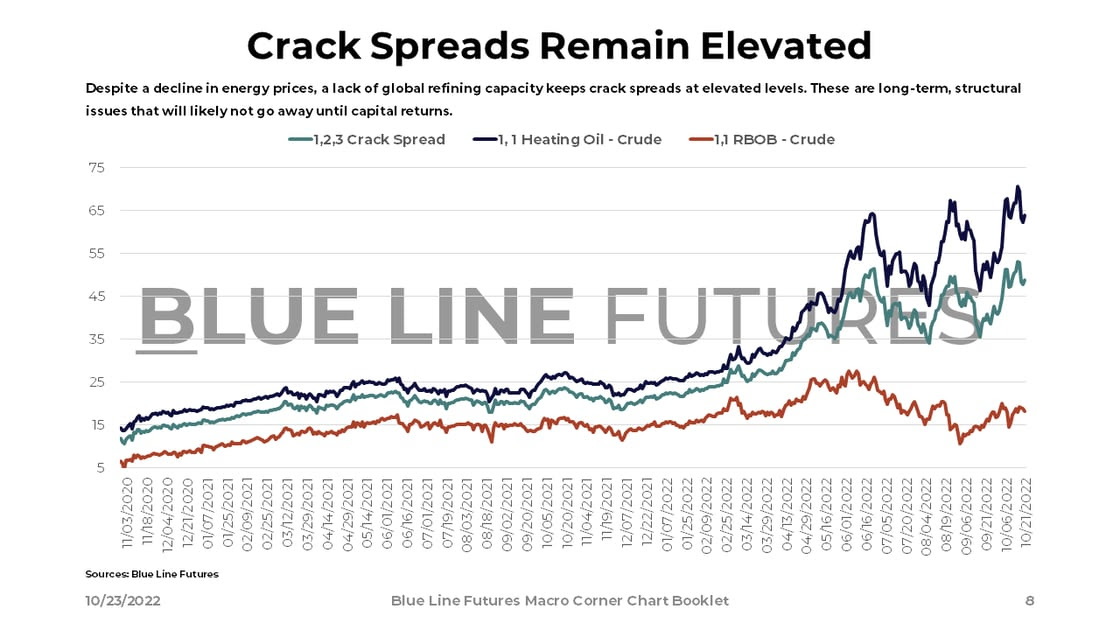

Valero (VLO) reporting before the open on Tuesday:

Commentary on the following be monitored:

|

|

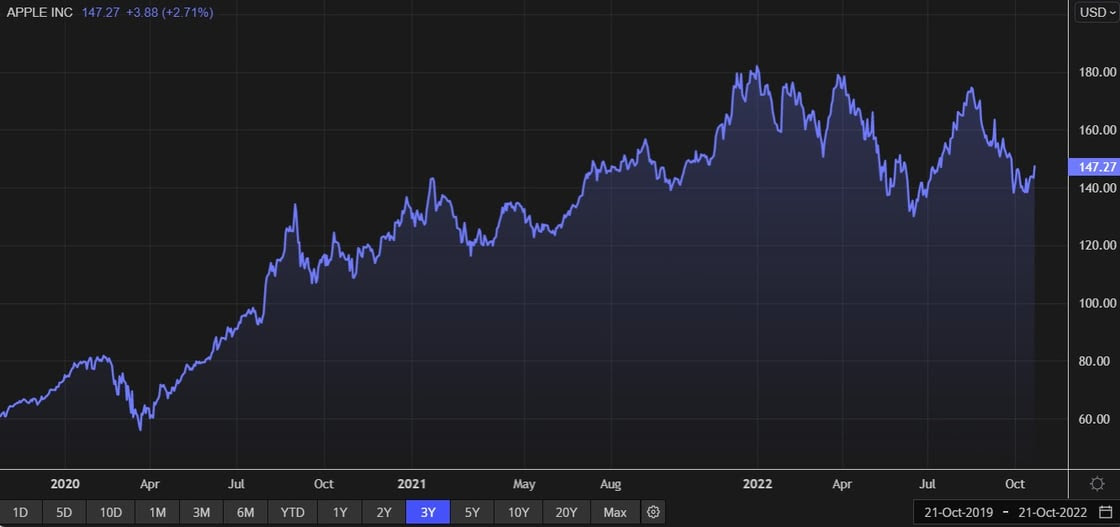

Apple (AAPL) reporting after the close on Thursday:

Commentary on the following be monitored:

|

Amazon (AMZN) reporting after the close on Thursday:

- Consensus: EPS est. $0.23; Revenue est. $126.42bn

Commentary on the following be monitored:

- Consumer spending

- Shipping costs

- Labor costs

- Holiday shopping season

- AWS

- Amazon Enterprise Products

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial