Finding An (Un)Happy Equilibrium While Running From Oil Vigilantes | Top Things to Watch this Week

Posted: Oct. 9, 2022, 12:48 p.m.

Finding An (Un)Happy Equilibrium While Running From Oil Vigilantes

"The best weapon against an enemy is another enemy." - Friedrich Nietzsche

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 19: Chart Booklet

Check out last week's podcast episode on the Fed's prospects of a soft landing: Macro Corner Podcast, Episode 18

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Getting Rid Of Zombies

This week was another remarkable one as most weeks are in macro these days. Not only did the week get started on strong footing after inflation expectations came off, but we also observed a renewed course correction in the Fed's posture. It reminds me of Ben Bernanke's quote I used a while ago: "Monetary policy is 98% talk and 2% action, and communication is a big part." While the Fed tries to find an (un)happy equilibrium in order to reign in inflation while also avoiding cracks in the financial system, the odds are that things are not as straightforward. Perhaps, we're at a point where talking is insufficient.

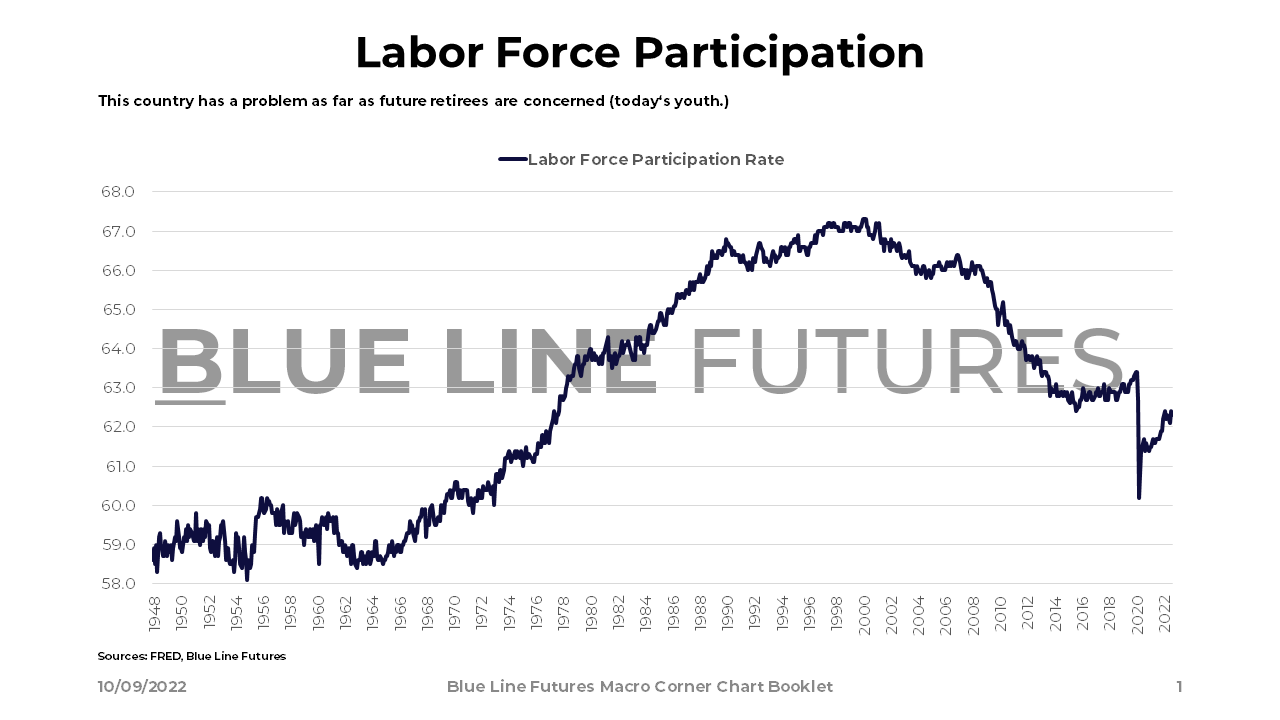

During a panel with the Aspen Institute, Fed Governor Neel Kashkari was very adamant that the Fed's credibility rests on their ability to return inflation to 2% on average. They're doing so despite seeing PCE inflation trend above 2% until 2024 and possibly 2025. Yes, that's a long time from now and the chances are that the predictive power we have over that time horizon is fairly low. The Fed knows it, I know it, you know it. So, one has to ask: at what point does congress, the general public, and the Fed accept a reality that we could be in a new regime? One where labor force participation is structurally lower and trending down, immigration is stale, and demographics keep deteriorating. In the midst of that deterioration in labor markets, Washington and governments globally fear social unrest and therefore corner monetary policy makers with fiscal dominance. If the Fed and central banks see a soft landing as possible, I see this outlined reality as just as likely.

But perhaps, a new average inflation target is a stretch at this point in time and it probably doesn't matter for quite a while. So what does matter?

Once inflation becomes entrenched, the cycle is one that reinforces at every turn. You show me another price increase, I show you my higher wage contract. The wheel keeps spinning until business becomes so bad that I get laid off due to Fed policy, or we keep going until the business' share of profit declines to a point where it refuses to renegotiate for a renewed time. The bottom line: some sort of reset is needed. On the way to that reset from which we can lever up the economy again, we need to get rid of debt, run leaner organizations, become more productive, and reduce the number of zombie companies. Today is not the time for complacency, and it probably never was. But zombies were created, stayed at the Fed's house, and overstayed their welcome. Kicking them out of the house isn't an easy process; they first refuse, then we feel bad for making them leave, and later we finally decide to get rid of them fully. They won't go without a fight and we'll have to pay a price.

The price will largely get determined by the willingness we show to adapt. The longer we accept, do nothing, and suspend disbelief, the longer we will have to deal with issues such as energy shortages. Fossil fuels are still the bedrock on which economies run and without it, the loss of economic output is substantial. The abundance of energy determines living standards and the luxuries people can afford. As more people from the Asia Pacific region to Africa will want to enjoy similar living standards as the developed world, their energy consumption will increase. Their leaders will need to develop oil fields, close contracts with allies, or get replaced by a popular revolt.

I will keep today's writing fairly short, please look at this piece and every other piece I am glad to send each Sunday with a critical eye. While my words come from a place of scrutiny, they are never absolute. Half of it is most likely wrong; in fact so wrong, it will be laughable in a year from now. Therefore, think critically, think for yourself, and never be driven by the noise of your surroundings.

With that, let's get into some data.

Data & Commentary

As one of the indicators for wages, we turn to labor participation, which as of Friday's jobs report ticked down from 62.4% to 62.3%. All in all, that is discouraging as unemployment also ticked down from 3.7% to 3.5% . In other words, the Fed needs to destroy job demand or wage pressures will persist.

Labor force participation isn't the only datapoint that shows a tight jobs market. While JOLTs Job Openings came off by more than 1 million jobs early in the week, lending itself to a risk-on rally, we are far from pre-pandemic levels.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

The Conference Board Consumer Confidence survey with cut-off on September 20 showed renewed tightening of the labor market. Jobs plentiful ticked up from 47.6% to 49.4% of survey respondents; jobs hard to find ticked down from 11.6% to 11.4%.

In an effort to break the inflation cycle, central banks keep withdrawing liquidity as shown by the substantial slowdown in Y/Y M2 money growth. In the meantime, treasury holdings on the Fed balance sheet decreased by $37.9bn over the last week, bringing the cumulative 8-week runoff to a total of $86.6bn.

Oil Vigilantes

China might the biggest question market out there as crude imports for 2022 have trended on the lower end of the range dating back to 2017. The same holds true for refinery throughput this year. However, the country announced unexpectedly high export quotas for crude products, implying that they want to reopen at some point. That in turn should support crude prices. China has been a question mark and will likely remain one in the near future; however, we will look for signals coming out of the People's Party Congress that takes place on October 16; does Xi want to revitalize the economy after further entrenching his power?

China and the Middle East have been the predominant regions where refinery capacity has increased as of recent years. Refining capacity in the OECD Americas (US, Canada, Chile, Mexico) peaked in 2018 and it peaked pre 1980 in Europe. It is for that reason that crack spreads remain elevated with RIN prices (Renewable Identification Numbers) continuing to climb. Combined with the existing environmental standards, new refineries are unlikely to get built; in fact, it is even difficult for pipelines to get completed due to FERC hurdles there.

Just this week, Munich RE, one of the largest reinsurance companies, stated that it will no longer invest or insure oil projects starting April 1. It is also starting to steer clear of midstream oil projects and new oil-fired power plants. In addition, the company requires new net-zero compliance by companies starting in 2025.

In the process, strategic petroleum reserves continue to get drained at a weekly rate of 6m bbl on an 8-week average. It is the release of oil that has put a lid on prices, which is now in direct opposition to OPEC+ policy, which aims to address the issue of underinvestment. The organization knows that spare capacity is extraordinarily tight, more oil will be floating on water as Russia needs to re-rout oil, and new investment continues to steer clear.

Managed money continues to express a rather bearish view as shown by Commitment of Traders data. Caught in the volatility trap of the recent past, funds reduced position size, leading to a cleansing of prices. In stark contrast to that, oil producers have become increasingly upbeat on prices.

The Fed can withdraw liquidity and they can hike rates until things break while fixing leakages along the way. They can not print molecules, they are limited in the ways in which they can impact fiscal policy, and they cannot determine geopolitical outcomes. Oil vigilantes are one aspect to that equation as nominal economic growth stays elevated while supplies remain sparse. The central bank of oil (OPEC+) is taking on the central bank of fiat (Fed).

While the world is being affected by these factors, the Fed is only a responsive tool. Like or hate their forecasts, their response function remains pretty clear for the time being. They tighten if prices stay unacceptably elevated. We are not yet at the point where a higher inflation target would be feasible, which means the central bank stays on a mission of demand and job destruction. They will likely take political heat for it, getting scapegoated as a recession creator.

As a mentor of mine put it this week: we remain maximally humble in the process.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- Poking Holes In The Inflation Balloon - Oct. 3, 2022

- Fighting Addictions & Lonely Places - Sep. 25, 2022

- Monetary Hostile To Fiscal And Vice Versa | Labor vs. Capital - Sep. 18, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Taiwan Semiconductors (TSM) reporting before the open on Thursday:

- Consensus: EPS est. $1.69; Revenue est. $19.91bn

Commentary on the following will be monitored:

- Semiconductor demand trends

- CAPEX

- Inventory cycle

JP Morgan (JPM) reporting on Friday before the open:

- Consensus: EPS est. $3.03; Revenue est. $32.05bn

Commentary on the following will be monitored:

- Lending trends and bad debt

- State of the U.S. and global economies

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial