Poking Holes In The Inflation Balloon | Top Things to Watch this Week

Posted: Oct. 3, 2022, 6:02 a.m.

Poking Holes In The Inflation Balloon

"The art of simplicity is a puzzle of complexity." - Douglas Horton

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 18 for tomorrow: Chart Booklet

Check out last week's podcast episode on the Fed's prospects of a soft landing: Macro Corner Podcast, Episode 17

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Inflation & Fed Policy | Sequence of Events

Last week, I wrote about addictions and how coming off of an ultra-easy monetary & fiscal regime is connected with pain; be it financial depreciation, economic, or societal in nature. We are only now starting to understand how poor capital allocation decisions were under that past regime and why it has implications for today's monetary and fiscal actions.

Just to sprinkle some oreo cookies over your ice cream, the Bank of England announced a special GILT buying program, which was apparently necessary to act as a lender of last resort for the UK pension system. Yes, an entire country's pension system has been unable to withstand an increase of interest rates to 2.25% (the current bank rate set by the BoE.)

As guests on various networks put it this week: if I just told you economic statistics from the UK (inflation, GDP, currency) and didn't tell you the country, the chances are that you would probably not end up with your finger pointing to the UK, but rather an emerging market type economy. The fact that Europe is dealing with EM type problems is not only surprising from the perspective of the continent's energy crisis; it is even more surprising to see how quick markets appear to "break" in the face of less accommodative and slightly restrictive monetary policy. In other words, we are in the process of revealing poor capital allocation decisions made over the course of the last 15+ years and the ways in which they affect portfolios when throwing darts at the board is not enough to achieve sufficient returns.

Models break, correlations go to 1, and it was just "the macro" that ran over the portfolio. Yes, heard that story before.

Using the NFCI (national financial conditions index) as a gauge for tightness in markets can be misleading in the sense that the place we're coming from created and enhanced "zombie companies", encouraged excessive multiples across asset classes. When Stanley Druckenmiller talks about him not being sure whether the banks are as safe as everyone thinks, he might be talking about things just like the UK-pension system. Those factors may not be reflected in readily available investor presentations, but float around somewhere in the universe. Again, unintended consequences of a system that tried to engineer itself around deteriorating demographics, leading to unfunded liabilities, leading to quant-based models that work in theory but break in practice.

One way to think about this is the following: everything looks terrible, central banks have no choice but to continue their tightening cycle, and financial assets will immediately start to reflect these realities.

Another way: before a regime shift in multiples gets more entrenched, markets will look for signs of central banks taking their foot off the gas, at which point risk assets try to sniff out a market bottom and rally from there.

Yet another way: the Fed signals easier policy, inflation expectations continue to roll over, the Fed hangs out at 4% Fed Funds, and eventually we get to a place where the future looks very much like the recent past. While higher than previously, inflation settles in, the economy grows below trend, but it grows; market stress is yet again met with a Fed Put

Regardless of what you think of as the reality we're most likely going to see, I wanted to share what I thought was enormous wisdom from a mentor of mine. To paraphrase: When there are many moving pieces, we default to process.

Meaning that there has to be a larger framework beyond the speculative endeavor of what the future may or may not look like. Yes, speculation is necessary, but it has to happen with a probabilistic and risk-management cognizant framework. Whatever your rules-based system looks like, you have to know you follow some rules.

Today, I want to indeed entertain the idea that the Fed is much more concerned about financial stability than most might think. Ultra-hawk Jay Powell at Jackson Hole puts on his dovish jacket again and tries to sell us a narrative that makes it comfortable enough for us to believe we're on a path to 2% inflation. The job is done or closer to done than you suspect today.

Interestingly enough, I started to paint this picture in my head Friday morning when I saw Nick Timiraos' Tweet on PCE that goes as follows:

FWIW, the core PCE inflation numbers to be released this morning are likely to show a sizable increase in August from July. This would've been known to the Fed at last week's meeting based on the CPI and PPI. Powell referred to the 12-month rate of change as 4.8% at the presser.

If Nick is the communication channel through which the Fed sends us the incremental signal, then this sounds incrementally dovish to me. Interestingly enough, he followed with an article citing the Fed's Vice Chair Brainard growing more concerned about financial stability after the UK's pension system shock. Again, incrementally dovish language.

In the U.S. it may be a run on passive funds from investors, illiquid asset investors unwilling to put money into marks that don't reflect the realities of public markets, or perhaps something entirely different. As I wrote last week: Even the white swans get ignored as everyone's wearing rose-colored glasses still.

Anyways, if inflation expectations have rolled-over sharply, goods-related inflation is close to getting fully restored to prior trends, and services are seeing the marginal tightening impact, then what the Fed expects is vastly different from the recent past. While they are data dependent, they get to choose what data it is they depend on. One of the most important indicators is financial conditions, of course. But financial conditions do represent a static make-up of underlying trends, which means it becomes hard to capture all the most important factors all of the time; by definition, static models are bad at capturing the unique one factor that has a limited impact on the whole. Looking at alternate indicators such as rate-of-change, the relative strength of the Dollar compared to recent history, the level of rates relative to the recent past, and equities on a relative basis, we've seen substantial tightening.

That doesn't mean the Fed will return to prior easy conditions, but it may mean they'll reduce their hawkish posture in an effort to stabilize markets and take a wait & see attitude. Recall, monetary policy acts on a lag and the Fed itself doesn't know what the precise impacts will be; they're not fighting the last war and they're certainly not fighting the war that everyone's already declared as "obvious". A treasury facility is maybe warranted at this point as liquidity provision by primary dealers deteriorates while foreign holders continue to shed U.S. treasuries. This would mark the start to another set of interventionist policies.

Remember, I am engaging in a probabilistic assessment of future outcomes, envisioning alternate scenarios that could result in substantial convexity either way.

Central bank policies may not be sufficient to drive secular forces, but they can engineer temporary market outcomes. We are talking about the sequence with which events are unfolding while secular drivers persist. Secular is great over the intermediate to long-term, but not good enough to understand some of the dynamics that happen on the margin. In short, the wage-price cycle is still in place, commodity underinvestment is not going anywhere, and the need for fixed capital spending remains present. However, there are shorter term cycles around those longer term forces.

Data & Commentary

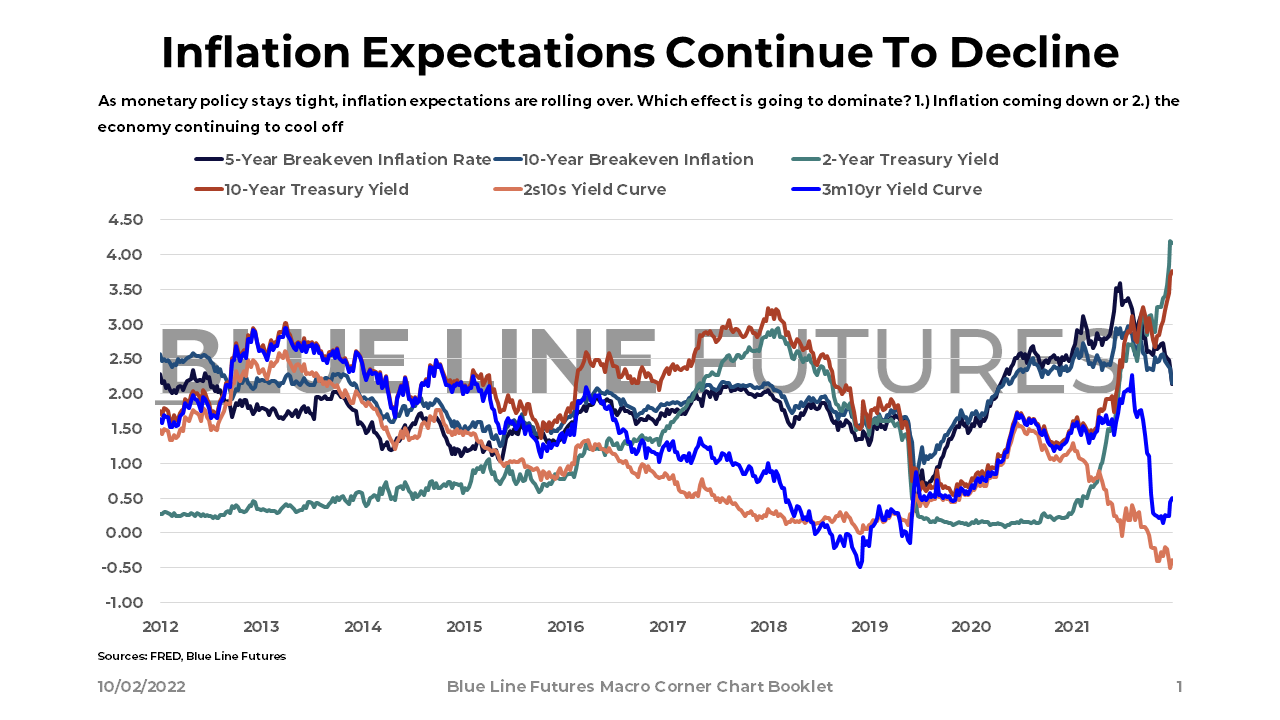

Now that I've set the stage for where we are, let's return right back to where we started last week. The potential for inflation & inflation expectations to roll over here is noticeable. Against the odds, that would mean a less hawkish Fed that pays increasingly more attention to financial stability.

Lower inflation is not only reflected in breakevens, but also in consumer surveys.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

In a survey for the month of August, 1-year inflation expectations have decreased while 3-year inflation expectations have ticked down even more rapidly.

The rapid deceleration in inflation expectations is also echoed by the cost of shipping goods. After a long time of bottlenecks and production constraints driving up shipping costs, we appear to be on the other side.

Combine inflation with economic activity not as bad as feared, and we are back in a cocktail of "less bad".

We have to monitor the lagging effects of monetary policy, however, as they could be substantial.

While economic activity expectations show some hope, the longer-term structural underpinnings remain a significant driver.

Fiscal dominance seems to be going nowhere as $1trn/year in budget deficits needs to get financed somehow. The increase in outlays necessitates more debt issuance, which leads to more inefficiencies due to government interventionism etc.

Shorter term, inflation expectations look less bad than they used to. Economic activity shows some signs of hope, and the Fed appears incrementally more inclined to pay attention to financial stability.

As we've learned, a UK government bond maturing in 2061 decreased in value from 140+ in 2020 to below 25 this week. It is hard to quantify the exact spillover effects, but coming off of record liquidity and zero-rates is inevitably a painful process. The Fed and CBs globally will have to deal with the consequences, which may infer that some sort of pivot-esque conjunction could be in the makings.

This shorter term dynamic stands against the backdrop of secular forces that remain challenging. Service sector inflation is making up for the slowdown on the goods side while productivity remains challenged as a result of debt-cycle dynamics (withdrawal of credit.) Perhaps, we've talked ourselves into a notion that didn't exist in the first place. Companies require profits to work (real profits, not EBITDA), the economy requires real output to make ends meet on the interest outlay side, and central banks require a more contained debt backdrop to enable more hawkish policy.

Yet again, we find ourselves in the fog of war, trying to piece together the macro puzzle.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- Fighting Addictions & Lonely Places - Sep. 25, 2022

- Monetary Hostile To Fiscal And Vice Versa | Labor vs. Capital - Sep. 18, 2022

- Higher For Longer & A Soft Landing - Sep. 11, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

|

Food for Thought

Earnings

Constellation Brands (STZ) reporting ahead of the open on Thursday:

- Consensus: EPS est. $2.83; Revenue est. $2.49bn

Commentary on the following will be monitored:

- Input costs

- Consumer spending appetite

Conagra Brands (CAG) reporting before the open on Thursday:

- Consensus: EPS est. $0.52; Revenue est. $2.83bn

Commentary on the following will be monitored:

- Food inflation

- Wage inflation

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial