Fighting Addictions & Lonely Places | Top Things to Watch this Week

Posted: Sept. 25, 2022, 8:51 p.m.

Fighting Addictions & Lonely Places

"There's no such thing as a crowded battlefield. Battlefields are lonely places." - Alfred M. Gray

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 17 for tomorrow: Chart Booklet

Check out last week's podcast episode on the Fed's prospects of a soft landing: Macro Corner Podcast, Episode 16

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

The Reflexive Cycle Of Withdrawing Liquidity

When I think about markets, I often think about the times at which opportunities existed in retrospect; what made these investment opportunities so rewarding, what conditions were present at the time and why didn't more people see it? Investing is indeed odd. The cheaper an asset gets, the more people tend to run away. Inversely, the higher a financial asset goes in price, the more people tend to chase it, creating a reflexive cycle that can change the very conditions that compose the fundamental underpinnings of the underlying. When one has faith in someone else's faith of paying more than you did yourself, it is most likely a game of carrying the hot potato and passing it on before you burn your hands. This is not how compounding happens over the long-term.

Mostly, the best investments start in discomfort. It is for that reason that John Pierpont Morgan said: "You buy when there's blood in the streets." Yes, it is unpopular. Yes, it is discomforting. And, yes, it is a lonely place to be. Ultimately, though, you want to see people start to agree with you, just later. You don't want to see your asset remain cheap forever as by definition, it would make for an inferior return.

This is why I named today's piece Fighting Addictions & Lonely Places. After years of targeting higher prices enabled by zero or negative rates, some places are very lonely as the addicted are still on a different island. As David Tepper put it years ago on CNBC: first movers get to the good grass first.

Given humans are herd animals, they don't like to be first movers; by definition, that prevents them from exploiting returns in a world that's agreed on passive investments as the place to be. When groupthink is ample, the black swan potential is equally substantial. Building a portfolio with the necessary convexity is paramount in a world with a lot of black swan potential; perhaps, even the white swans get ignored as everyone's wearing rose-colored glasses still.

As we've learned since QE started, liquidity provision by central banks along with low inflation & stable growth can be an extremely resilient combination for asset prices. In fact, financial assets far outpaced growth of the real economy as TINA (there's no alternative) drove people into risky assets. These returns came from somewhere, however; perhaps, the future, which is now.

Data & Commentary

The theory says that as markets have gotten increasingly addicted to liquidity, the effects of withdrawing it will be that much more severe.

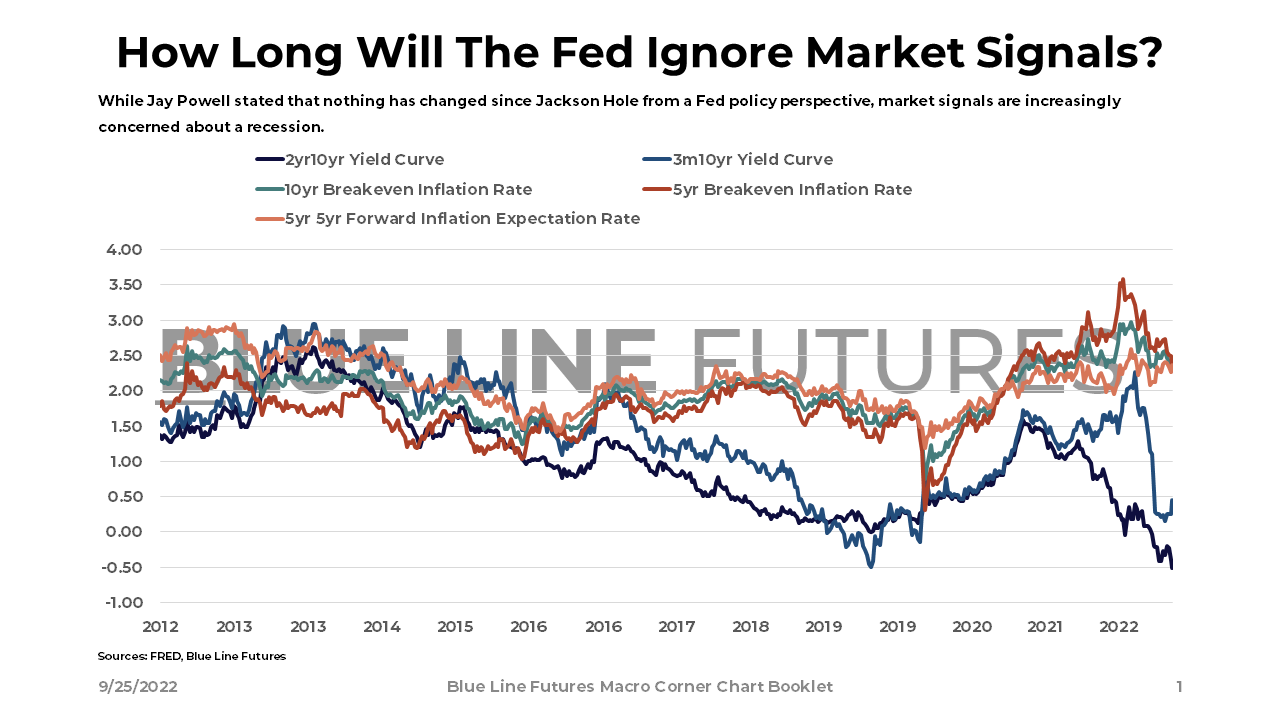

I will keep revisiting yield curve graphs along with breakeven rates as both are simply too important to ignore. The 2s10s yield curve further inverted to -50bps after the Fed raised by another 75bps on Wednesday. Along with the hike came revisions higher in unemployment and inflation while revising down economic growth. Yes, the Fed is setting expectations for a hard landing.

Increasingly tight financial conditions come at a time where breakeven rates have started to roll over and will likely continue to roll over if the Fed keeps at it. Perhaps, the lag between monetary policy and the real economy has already set our trajectory.

Product shortage indices have rolled over sharply across the G7 countries, shipping rates have collapsed, and commodity demand has sharply contracted across the key industrial commodities.

The Fed was too late to tighten as speculative bubbles kept forming and they're now tightening into a slowdown that may have happened anyways. On the way to a much weaker economy, we need to entertain the idea that an overtightening leads to a substantial deflationary shock that leads to another repricing across the yield curve (to various degrees depending on where on the curve you are.)

The Fed's tightening path is directly reflected in financial conditions, which on an absolute basis may not seem awfully tight. From a rate of change perspective, however, financial conditions are getting incrementally less favorable for risky assets and doing so after what was Zero Cost of money.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

In the process of the Fed moving to "moderately restrictive" conditions as they laid out, we will monitor the direct and lagging effects.

While financial conditions tighten, we get a real-time sensitivity analysis directly from the bond market. As primary dealer transactions as % of debt outstanding keeps trending down, we question at which point financial stability will play an increased role. In the grand scheme of things, however, and money markets as well as FX markets are not sounding the alarm.

As the Dollar keeps strengthening as a result of relatively tighter policy, emerging markets are taking the brunt of the Dollar strength. Surprisingly, EM financial conditions remain relatively low, which indicates that the Fed's "foreign affairs" are all taken care of at the moment.

The lack of market panic - reflected in market conditions in the U.S. and abroad, - is further solidified when we turn to high yield compared to investment grade credit. Both in Europe and the United States, credit spreads do not indicate a need for backstopping. The question remains: as the Fed catches up on QT and establishes a new neutral rate in accordance with a new set of economic conditions (assuming the inflation forces are a lot more structural), will credit start to be a lot more fragile?

Against expectations, Powell & Co managed to aggressively raise rates from 0% to 4% along with central banks globally tightening as well. Ironically, leveraged loan growth has continued, indicating that credit may not be as tight as one would think given high yield issuance has more or less stopped.

The same is the case for European financial markets. Despite a war, an energy security crisis, a collapse in balance-of-payments, and a move towards fiscal dominance, European credit correlations are not indicative of a stress scenario.

As the economy continues to adjust while secular forces of underinvestment and dislocations persist, a slowdown may be inevitable. That would be in line with Fed policy to reduce demand at which point it becomes a question of economic growth potential.

How will risk assets adjust to a new set of monetary conditions that are a lot less favorable in an economy that's more fragile?

Rather than turning backward, the lonely place today may be the next spot where the music gets turned up. Changes happen slowly and steadily before they occur all-at-once. Realizing that the popular trade today does not favor returns tomorrow has us turn to assets like Gold. Unlike money managers, commercial producers have increased their gold holdings. Along with that, central banks have accumulated Gold in spades. This is a timing question when the Fed realizes it's done enough - and likely gone too far, - at which point a zero yielding asset shows returns against a disinflationary backdrop.

A similar story is present in fixed income where yields not seen in a while can be had. Risk averse investors unsure where to put money can earn a 4% return buying a 2-year treasury note. They turn to other strategies - including high yield, - where returns to the tune of 10%+ can be earned.

While still deeply negative measured against a lagging CPI, real yields may soon look less bad. Markets will barely stop at "fair" price, but overshoot both ways.

The question today is: how painful is the liquidity withdrawal and for how long will the Fed remain committed to its predominant mandate of fighting inflation. Politically, unemployment is nothing but unpopular, which will likely lead to scapegoating as we've already seen from Senator Warren and the likes. Again, there's a place where you have to choose between a rock and a hard place. It will be one of the two.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- Monetary Hostile To Fiscal And Vice Versa | Labor vs. Capital - Sep. 18, 2022

- Higher For Longer & A Soft Landing - Sep. 11, 2022

- Fiscal Dominance and The Fed's Amplification Of The Business Cycle - Sep. 4, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Carmax (KMX) reporting before the open on Thursday:

- Consensus: EPS est. $1.41; Revenue est. $8.6bn

Commentary on the following will be monitored:

- Used car sales amidst rising auto-loan rates

- Auto inventories

Micron (MU) reporting after the close on Thursday:

- Consensus: EPS est. $1.41; Revenue est. $6.8bn

Commentary on the following will be monitored:

- The inventory cycle in chips

- Cyclical exposure to slowing economies globally

- The semiconductor investing cycle

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial