Monetary Hostile To Fiscal And Vice Versa | Labor vs. Capital | Top Things to Watch

Posted: Sept. 18, 2022, 7:12 p.m.

"Investment success doesn't come from buying good things, but rather from buying things well." - Howard Marks

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 16 for tomorrow: Chart Booklet

Check out last week's podcast episode on the Fed's prospects of a soft landing: Macro Corner Podcast, Episode 15

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

The Limits Of Monetary Policy | Financial Stability

In a paper titled "Inflation as a Fiscal Limit", Francesco Bianchi and Leonardo Messi shine light on the implications of fiscal policy for price stability. Is low inflation achievable if fiscal dominance is on the rise? The paper concludes that both fiscal as well as monetary policy need to be consistent in order to avoid fiscal stagflation resulting from fiscal stimulus; with one of the two setting out on its own, the economy may well be devoid of stable prices. It becomes clear that the state of stable prices and stable economic growth may be a fragile one.

The paper speaks to the idea that we've increasingly talked about in this writing as well as the Macro Corner podcast: fiscal spending flowing to the lower income deciles of the population is inevitably inflationary, leading to a hostile Fed for a prolonged period of time (or until something breaks.) That "something" is tied to financial stability.

Turning to treasury market liquidity trends, the treasury market itself has literally ballooned in size and is projected to keep increasing as debt as % of GDP is projected upward. Primary dealers, however, have not kept pace with liquidity provision, reducing primary dealer transactions as % of debt to ~2.5% from over 14% pre-GFC. Treasury market depth is near Covid-shock and GFC lows, indicating the need for a separate treasury buyback facility that the treasury has started to hint at implementing -- that in turn allows for tightening without "breaking" that part of the equation.

What else needs to get fixed along the way before financial markets, including CDS, demand a pivot? By definition, market surprises stem from the idea that a non-consensus risk needs to become common knowledge. At that point, the Fed may give financial stability a heavier weight.

Data & Commentary

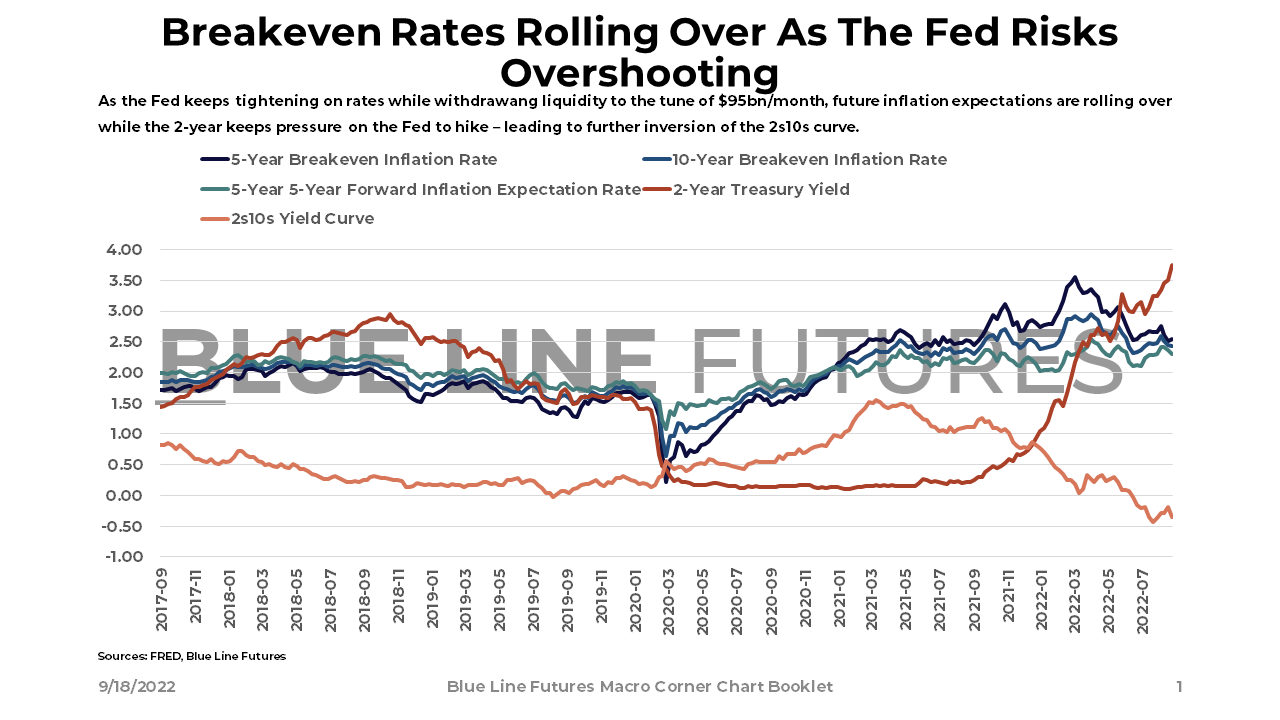

As the Fed keeps hiking rates in conjunction with QT, breakeven inflation expectations are turning down, reflecting the slowdown expected as a result of tight monetary policy. The degree to which a more aggressive fiscal path combined with a redistribution from capital to labor is priced in at this point is unclear.

Focusing solely on monetary, however, the 2-year yield keeps dictating a rise in rates, further inverting the 2s10s curve. Given that monetary policy affects the economy on a lag in the midst of a data dependent Fed, monetary transmission may be much more visible in the coming months.

As the long-end of the curve is unable to keep pace with the rise in yields on the short-end, one has to make a probabilistic assessment of the implied slowdown from tight policy. If indeed this is about accomplishing a loser labor market, less demand, and deflated asset prices, a deflationary shock further down the line may not be out of questions (potential Fed error in the making.)

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

After Powell's hawkish Jackson Hole speech and this week's CPI - OER as one of the main drivers, - credit markets are incrementally more concerned. While Investment grade CDS is trading closer to 90bps again, high yield closed at +525bps on Friday (up from sub 400 in August.)

As we discussed last week, fiscal spending is more targeted towards consumption of real goods instead of financial assets. Together with demand spurred by fiscal stimulus, higher wages in blue-collar areas may further contribute to secular inflation dynamics.

Despite a rollover in the labor market, broader dislocations persist. If reining in inflation means a much loser labor market, policy makers may be in the process of creating a new set of issues.

Combined with labor remaining scarce, capital owners adjusting for higher wages may have to rethink their own assumptions going forward.

If the capture of profits is decreased amidst a higher discount rate, the present value of capital has to go down.

Considering that capital has been able to capture a great deal of the value-add over the last few decades, investor assumptions/sentiment could be in for a long-run readjustment.

I led with a research paper that suggested fiscal and monetary policy need to be closely aligned for inflation goals to get realized. Absent coordination, central banks are fighting an uphill battle for which asset prices have to adjust if conditions persist.

Tactically, financial assets will follow flows; secularly, broad economic dynamics as the ones described require long periods of recalibration.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- Higher For Longer & A Soft Landing - Sep. 11, 2022

- Fiscal Dominance and The Fed's Amplification Of The Business Cycle - Sep. 4, 2022

- The 2nd Fed Error - Aug. 28, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

KB Homes (KBH) reporting after the close on Wednesday:

- Consensus: EPS est. $2.67; Revenue est. $1.87bn

Commentary on the following will be monitored:

- The Fed's aggressive tightening cycle leading to deteriorating conditions in housing

- State of the great migration going to continue (from the Northeast & California to TX, FL, CO etc.)

Costco (COST) reporting after the close on Thursday:

- Consensus: EPS est. $4.11; Revenue est. $72.04bn

Commentary on the following will be monitored:

- Consumer spending

- Supply chain pressures and prices

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial