Higher For Longer & A Soft Landing | Top Things to Watch this Week

Posted: Sept. 11, 2022, 8:14 p.m.

Higher For Longer & A Soft Landing

"When you see someone doing something that doesn't make sense to you, ask yourself what the world would have to look like to you for those actions to make sense." - Shane Parrish

Chart Booklet & Podcast

Access all of this week's charts used in today's writing and Macro Corner Episode 15 for tomorrow: Chart Booklet

Check out last week's podcast episode on Fiscal Dominance and what it means for asset prices going forward: Macro Corner Podcast, Episode 14

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Is Higher For The Longer The New Lower For Longer?

First and foremost, today we remember the victims of 9/11 and their families who were left behind. Blue Line's thoughts and prayers are with those affected by that day's terror!

Market participants of all shapes tend to talk about the extreme of outcomes, while those very outcomes are often at the tail end of the probability distribution. In other words, the likelihood that extremes play out are rather small in the grand scheme of things. It's got to be a crash or another epic rally, doesn't it? Partially, we've been hard wired that way; partially, our own mortality makes us think that anything and everything has got to be "unprecedented"; by definition, unprecedented describes an extreme conditions.

As a matter of fact, however, markets are as old as the hills and macro gods have seen stranger things before. Hence, it is important to find a balance between entertaining tail-end outcomes while realizing that the shape of the distribution is one that favors the median outcome over the extreme.

The Fed has successfully raised rates from the zero-bound - something that was described as very challenging by Ben Bernanke, - to a target rate of 2.25-2.50. Additionally, the market is pricing another 75bps hike in September and is calling for a 3.75-4.00% target by December. In conjunction with a balance sheet runoff to the tune of $95bn/month, they are making solid strides towards tighter financial conditions restraining heightened demand. I would argue that very few people would have seen the S&P 500 at 4,000 and bond markets relatively calm despite low liquidity. In other words, the Fed hasn't hit a brick wall despite an unfavorable backdrop of high debt levels, high inflation and deteriorating economic conditions on the back of post-pandemic spending dynamics.

One way of looking at this conjunction is to call the Fed's current policy a success and expect smooth sailing going forward. Another way of looking at it is that we are going to hit the inevitable brick wall as they define the health of the economy at large as fully conditional on price stability. As the Fed's Vice Chair Clarida put it on CNBC this week: "Until inflation comes down a lot, the Fed is really a single mandate central bank."

If the Fed is indeed a single mandate central bank, it will be challenging to not see the effects of tighter financial conditions flow through into the real economy, profit margins etc. For now, however, markets are sensing relief as signaled by breakeven rates, supply chain bottleneck indicators and raw material prices.

Data & Commentary

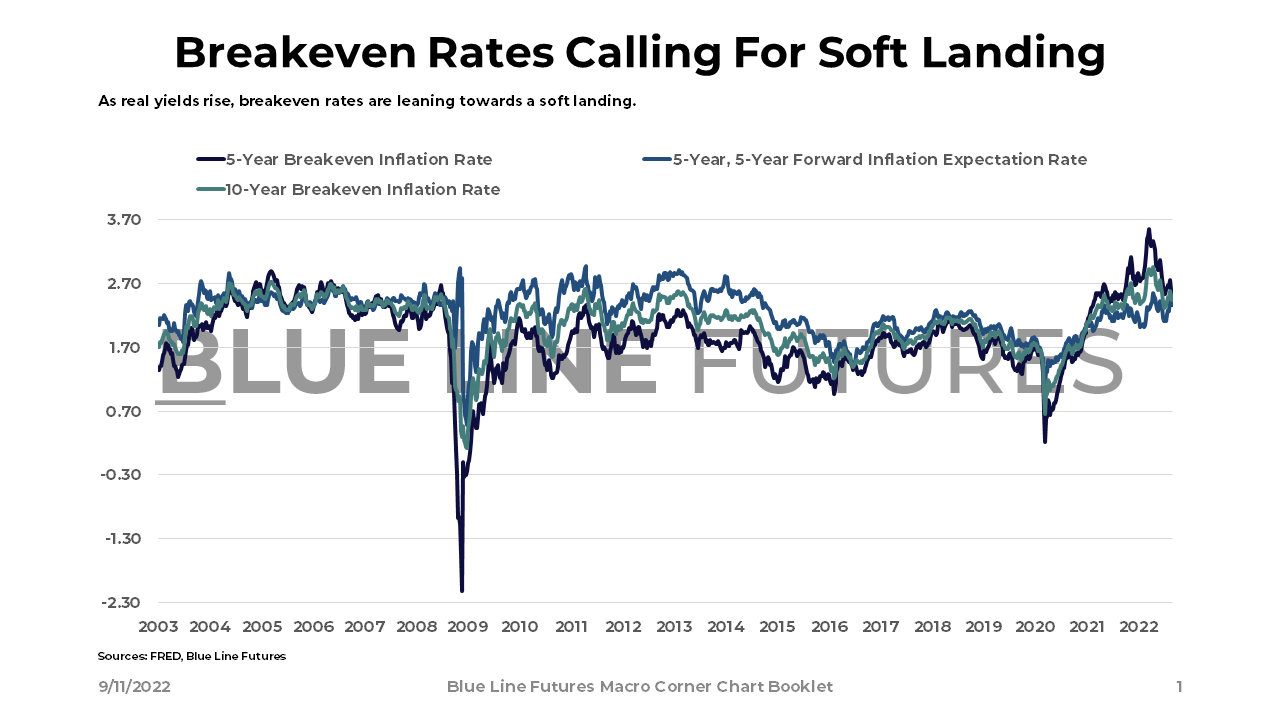

Breakeven rates (the difference between nominal and real yields) are settling in despite elevated inflation. Yes, these rates are forward rather than backward looking, which indicates the markets' vote of confidence in the central banks' ability to control inflation over the long haul. The same dynamic is playing out on the short-end where 1-year and 2-year breakeven rates are falling of a cliff, quite literally. Just in February of this year, the 1-year breakeven was above 6% and is down to 1.7% as we speak.

This means that the market is more likely than not discounting something closer to a soft- rather than a hard landing.

The echoes of a soft landing are also reflected in raw material prices deflating substantially.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Despite deflation in raw materials, it is paramount to remember that indices can obscure individual components. While relatively less critical parts may return to normal, some essential components may stay elevated.

Coming off of elevated durable goods spending, markets are starting to pay increased attention to services inflation. Nevertheless, spending on goods remains crucial as the profit margins of companies selling goods had rapidly expanded.

There are few things more mean-reverting than profit margins, leaving us with question marks behind margins.

Unlike deflation reflected in breakeven rates, shipping rates, raw materials etc. , fossils and materials remain scarce. While there are some signs that capital is slowly but surely starting to return - fracking in the UK and permits for the North Sea, - issues created over the course of decades won't disappear over a span of months.

Perception might be obscured by rhetoric, reality is path dependent on the laws of physics.

As markets find comfort in the trends that may imply a soft landing, one has to imagine alternate realities and examine the probabilities of such scenarios. As found in the "Food For Thought" section, monetary policy has a lagging effect on profit margins. As indices continue to be geared towards growth names, a reshuffling of where value is going to be had does also have implications for markets.

While some indicators may suggest a quick return to 2% average inflation at which point the Fed will loosen policy, a paper by Domash and Summers indicates that wages are predicted to keep rising -- wages driving prices are crucial in the determination of the economy's path forward.

If the Fed can successfully engineer the balance sheet run-off while continuing to deal with inflation from energy, materials, housing and labor, higher for longer may be a new reality. For now, markets appear to lean on the recent past rather than the fullness of history when extrapolating the path of earnings & multiples.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- Fiscal Dominance and The Fed's Amplification Of The Business Cycle - Sep. 4, 2022

- The 2nd Fed Error - Aug. 28, 2022

- The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections - Aug. 21, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Oracle (ORCL) reporting after the close on Monday:

- Consensus: EPS est. $1.08; Revenue est. $11.46bn

Commentary on the following will be monitored:

- Follow through momentum on what the company called a "new hyper-growth phase" in the last earnings report

- Cerner and Oracle healthcare service provision

Adobe (ADBE) reporting after the close on Thursday:

- Consensus: EPS est. $3.35; Revenue est. $4.43bn

Commentary on the following will be monitored:

- Creative Cloud adoption

- Document cloud

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial