Fiscal Dominance And The Fed's Amplification Of The Business Cycle | Top Things to Watch this Week

Posted: Sept. 4, 2022, 4:08 p.m.

Fiscal Dominance And The Fed's Amplification Of The Business Cycle

"If I have seen further it is by standing on the shoulders of Giants." - Isaac Newton

Chart Booklet & Podcast Contact

Access all of this week's charts used in today's writing and Macro Corner Episode 14 for tomorrow: Chart Booklet

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

The Median Voter Prefers Fiscal Dominance While The Fed Amplifies The Business Cycle

If politicians like one thing, they love to get elected and retain electoral power for as long as possible. They do that by making promises that appeal to the voting population; the greater the appeal, the more votes a politician is likely to receive. Promises made are mainly a function of two variables:

- The politicians' belief system

- More importantly: what is popular with voters, especially the median voter of a population

In a democracy, the most important individual(s) is the person whose preferences can skew a vote one way or another. That person is called: median voter. Whatever that person's preferences are, they are enormously relevant for each party's political candidate as shifts determine on which topics an election gets decided. For that reason, some issues become bipartisan while others are just tied to a single party. Political matters on which there is broad consensus are most likely ones that are relevant to the median voter as they are the people from whom political opponents aim to get the incremental vote.

Examples would include: energy independence (increasingly so), reshoring of semiconductor manufacturing, rethinking of industrial policy, legislation favoring labor over owners of capital etc.

Anticipating what issue becomes marginally more important to the median voter next should provide us with a framework around the "target areas" of the fiscal impulse.

As I've written about in the past, capital owners have received the majority of profits over the last few decades, which leads me to believe that labor will demand more returns going forward. That framework consists of multiple variables, including:

- More government interventionism in an effort to redistribute returns from capital to labor

- Inefficient capital allocation by the public sector leads to upward inflation pressures

- Higher wages beget higher wages with a potential to introduce a more entrenched wage-price spiral (entrenched can mean gradual but steady); quite contrary to the ease with which the world has been taking advantage of labor arbitrage

- Whereas accommodative monetary policy tends to flow towards financial assets, fiscal spending has a direct link to real economic demand

- ....The list goes on

Decreased returns on capital will most likely lead to greater demand for automation as a substitute for expensive labor. Temporarily, the terminal rate needs to be higher for longer for two reasons: 1.) bargaining power from labor can entrench a secular wage-price spiral 2.) capital spending in areas that are structurally undersupplied requires rebuilding.

Please refer to The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections for more on capital investment.

If public officials cater to voters, who demand higher wages in the face of a geopolitical trend that requires an industrial build-up while central banks try to reign in inflation, we are moving somewhat closer to fiscal dominance.

Fiscal dominance implies that government officials try to support the needs of voters, suggesting that public sector spending will increase. Recent examples include:

- U.S. CHIPS Act

- Germany's ruling coalition has agreed to spend 65bn Euros on new inflation relief package

- Sweden and Finland provide a combined €33 billion in loans and credit guarantees to bail-out local utilities facing margins calls in power and gas markets

- ...The list goes on

Demands by the population to support labor come at a time where the Fed has committed to what I referred to as the 2nd Fed Error last week. Acting in line with the business cycle rather than counter to it, therefore amplifying the extremes.

Data & Commentary

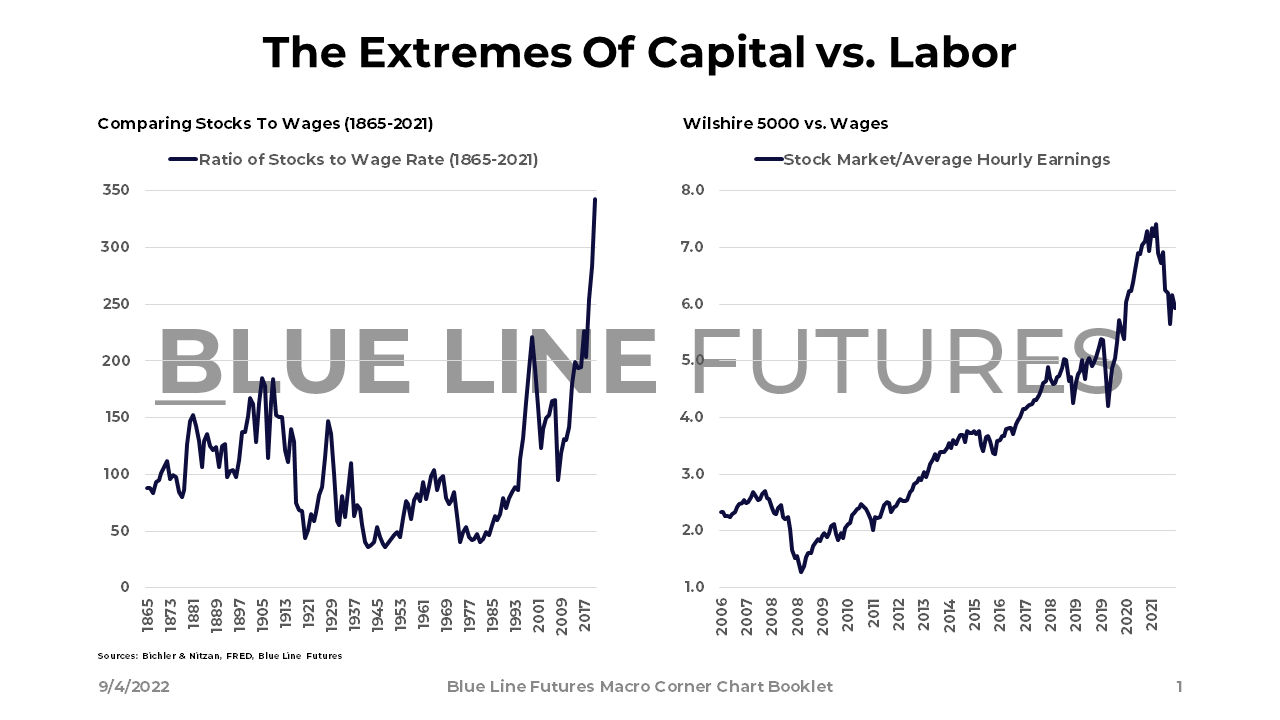

One way to show the outsized returns of capital vs. labor over the decades that followed the opening of China is a display of stock market returns vs. wages.

Comparing stocks to wages is one element feeding into the fiscal dominance thesis.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Another datapoint calling for fiscal support is Michigan consumer sentiment, gauging how consumers feel from a spending perspective. While flights & restaurants remain full, low consumer sentiment encourages interventionist governments redistributing returns.

Contrary to consumer sentiment, the job market has not fallen off a cliff. In fact, it has likely been one of the best labor markets for households on record.

However, as investors we need to act on possibilities that lie ahead rather than looking in the rearview mirror. As the economy cools, it is hard to see natural conditions to stay as accommodative for labor, which again calls for fiscal support in some shape.

An increase of accommodation on the fiscal side comes at a time where the Fed is in the process of committing its 2nd error in what has been a very short but fast business cycle. We may be moving closer to too tight for too long (higher for longer on rates.)

Shifts that are this fundamental to the economy do not happen within weeks or months; markets might over- or underreact at any point, but the economy at large is a machine that consists of thousands of parts with a need to readjust a good portion of these parts.

As the Fed acts in line with the business cycle while fiscal stays on a spending spree, the macro landscape will remain extremely fascinating.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- The 2nd Fed Error - Aug. 28, 2022

- The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections - Aug. 21, 2022

- Markets Move with Macro Expectations and Expectations Change - Aug. 14, 2022

|

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

RH (RH) reporting after the close on Wednesday:

- Consensus: EPS est. $6.82; Revenue est. $968.42 million

Commentary on the following will be monitored:

- Consumer spending demand (RH has been very outspoken in past conference calls.)

Kroger (KR) reporting before the open on Friday:

- Consensus: EPS est. $0.80; Revenue est. $34.23bn

Commentary on the following will be monitored:

- Food inflation

- Food shortage situation domestically and globally

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial