The 2nd Fed Error | Top Things to Watch this Week

Posted: Aug. 28, 2022, 2:16 p.m.

The 2nd Fed Error

"Don't be a hero. Don't have an ego. Always question yourself and your ability." - Paul Tudor Jones

Blue Line Content and More

Access all of this week's charts used in today's writing and Macro Corner Episode 13 for tomorrow: Chart Booklet

Email podcast@bluelinefutures.com with any questions as it pertains to today's article or any Macro Corner podcast episode -- we are more than happy to discuss!

Economic Health Conditional On Price Stability (Does Nothing Else Matter?)

Fed Chair Powell came out hawkish at Jackson Hole. He directly stated: economic health - hence the Fed's maximum employment mandate, - is fully conditional on restoring price stability. Devoid of a return to 2% average inflation, all other economic conditions are put under massive strain and may get impaired permanently, or at least for much longer than the Fed would like see. Powell's hawkish rhetoric was underpinned by using words such as "pain", quoting Paul Volcker, and referring to "costs of reducing inflation". Yes, he is telling you that the Fed is willing to accept economic pain in exchange for impairing demand and thereby reducing inflation. In essence, the 2nd Fed error after they kept financial conditions too easy for too long coming out of the initial Covid shock.

Powell was also explicit when he said that the longer term neutral rate stated in the last policy statement is not to be mistaken with the interest level needed to restore price stability. In other words, we are going higher on rates and tighter on liquidity because not all neutral rates are created equal, largely depending on the inflation regime we're in. It is for that reason that the speech began with: Today, my remarks will be shorter, my focus narrower, and my message more direct. The Fed knows that their credibility has gotten impaired ever since QE started and they need to regain that very credibility if they are indeed committed in the fight against inflation.

This time period may diverge from the recent past insofar as the Fed may reduce the traditional ebb and flow of Fed speak. Now, hawkish policy talk is just flowing, not ebbing. We are in a data dependence regime, meaning that the Fed will try to repair broken pipes along the way while tightening as long as inflation data suggests (until financial stability moves front & center.)

Starting on September 1st, the Fed is also going increase QT when the balance sheet run-off starts in earnest to the tune of $60bn/month of treasuries and $35/month of MBS. Is the harbinger of financial asset appreciation under fire?

As the traditional ebb and flow of Fed speak is perhaps on hold, one needs to wonder for how long. On hold until credit spreads move higher, risk assets get impaired and the economy returns to a state where demand is sufficiently reduced to see an "acceptable" level of inflation. Inflation pressures won't be removed at that point because price pressures upward will persist until capital flows back into old economy sectors -- see last week's writing: The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections. Ironically, tighter financial conditions may have a negative effect on returning supply in capacity-constrained sectors as the cost of capital increases. This is not a forecast, these are assumptions to be critically looked towards.

Market Indicators & Brief Commentary

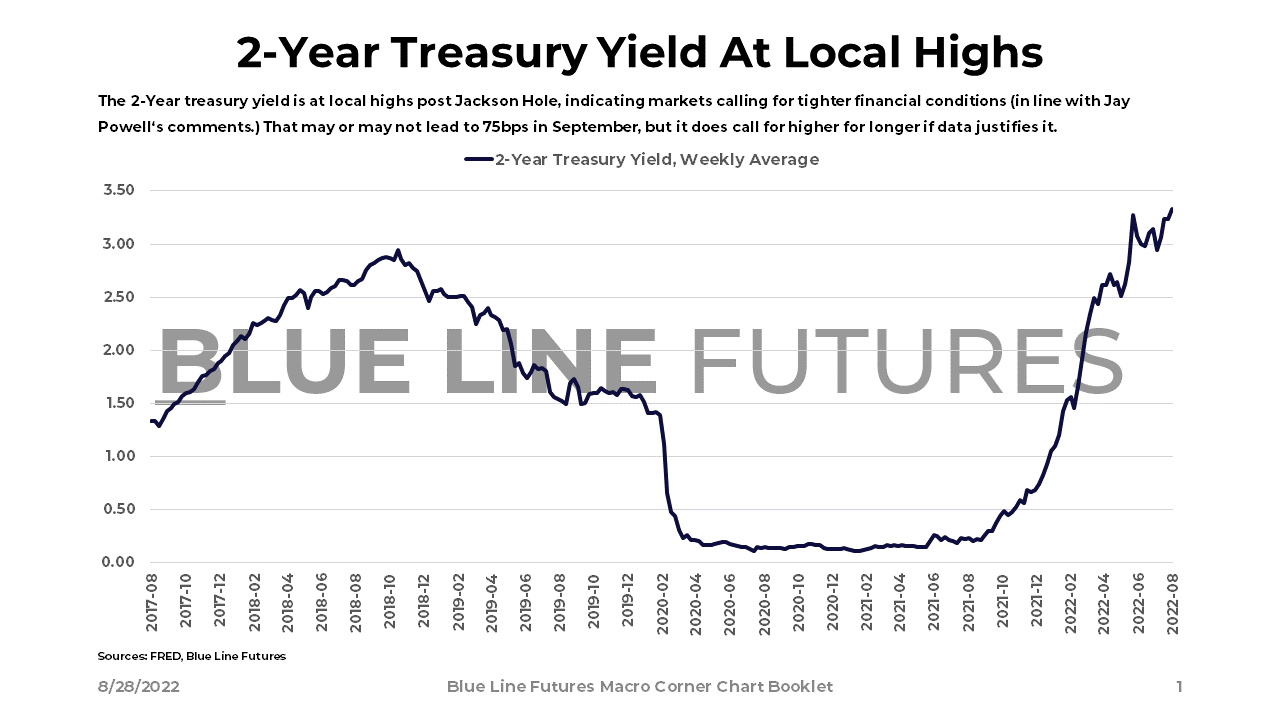

Turning from Friday's Jackson Hole speech shaking markets to market-based indicators, the 2-year yield is currently at local highs (the 2-year tends to set Fed policy.)

An increase in short-run rates reflecting the need for higher Fed Funds in order to subdue inflation is directly affecting pricing relative to long-term rates as a proxy for growth expectations.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

As the 2s10s curve remains inverted while the 3m10yr curve has increasingly caught up (the Fed's preferred recession indicator), the market signals suppressed economic growth prospects. The Fed is well aware of that dynamic (the acceptance of short to intermediate term economic pain in exchange for long-term price stability.)

Along with a hawkish Fed, there are spillover effects into currency markets reflecting relative policy stances by central banks. As Jay Powell made clear on a past central bankers panel: despite the Dollar's effects on other countries, the level of the currency is not a Fed mandate.

As markets price in a Fed that is hesitant to stop tightening preemptively, relative pricing has skewed towards value as of late. As you can see in the chart below, growth has led the equities rally from the June low, but is now faced with longer-term economic expectations (that may include a re-rating process for high-multiple stocks.)

Assuming the economy is capacity constrained, leading to a persistency of higher prices, coordination of labor will play an increasingly relevant role in macro. As corporate profits are forced to get distributed to employees, capital owners might see diminished returns (calling for active management.)

As I've talked about in past writings, today might very much be different from the globalization era in which deflation was the name of the game. As the world moves away from just-in-time inventory, needs to increase spare capacity, and rebuild & retrain, active management will remain a crucial aspect of risk & portfolio management.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections - Aug. 21, 2022

- Markets Move with Macro Expectations and Expectations Change - Aug. 14, 2022

- Risk Asset Pricing is a Function of Flows - Aug 7, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Best Buy (BBY) reporting ahead of the open on Tuesday:

- Consensus: EPS est. $1.29; Revenue est. $10.27bn

Commentary on the following will be monitored:

- Consumer spending on durable goods

- Staff cuts as was already reported

- State of brick & mortar store presence

Crowdstrike (CRWD) reporting after the close on Tuesday:

- Consensus: EPS est. $0.27; Revenue est. $515.47mln

Commentary on the following will be monitored:

- Cybersecurity momentum as the world becomes more multipolar

- Similar trends as observed in Palo Alto Networks' earnings report

- Cloud-based cybersecurity trends

Lululemon (LULU) reporting after the close on Thursday:

- Consensus: EPS est. $1.86; Revenue est. $1.77bn

Commentary on the following will be monitored:

- State of middle-income to high-end consumer spending

- Pricing power, state of labor market, in-store presence

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial