The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections | Top Things to Watch this Week

Posted: Aug. 21, 2022, 11:41 a.m.

The Structural Underpinnings of the U.S. Economy Compared to FOMC Projections

"Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria." - John Templeton

Blue Line Content and More

Subscribe to Bill Baruch's Morning Express, which lays out the fundamental as well as technical landscape for macro markets on a daily basis.

Chief Market Strategist Phillip Streible just launched Blue Line Tactical Insights. The report includes daily risk management levels, buy & sell triggers as well as other quantitative analysis. Be sure to subscribe here: Blue Line - Tactical Insights Sign Up

Access all of this week's charts used in today's writing and Macro Corner Episode 12 for tomorrow: Chart Booklet

Structural Underinvestment in Old Economy Sectors | FOMC Forward Projections

As I've written about in the past, markets move relative to expectations and as the anticipations of economic data, monetary policy and fiscal change, so do markets. I thought it was a helpful exercise to zoom out in today's article, look at the structural underpinnings of the U.S. economy and compare those underpinnings with the FOMC's economic projections. Are the FOMC's assumptions realistic or will rethinking and therefore market re-pricing have to occur?

1.) Old Economy Sectors Constraining The Economy

In nominal terms, the US economy has seen high economic growth rates to the tune of 6.6% in Q1, 2022 and 7.8% in Q2, 2022. If we turn to Real GDP (a function of nominal output corrected for inflation), however, the picture is turned upside down; Q1, 2022 showed a contraction of 1.6% followed by another contraction in Q2 of 0.9%. The decline is largely a function of the fact that production capacity hasn't been able to keep up with nominal spending, resulting in higher prices. The prime example of that divergence are "old economy" industries such as: energies, construction (housing, cement) and materials. While supercharged by geopolitics, Germany's producer prices rose 5.3% M/M (37.2% Y/Y) on Friday. It was arguably the suspension of disbelief that led to the current conjunction; it is a reality that will likely exist in some form (doesn't mean that disinflation can't occur and gas prices can't drop) until capital flows back into underinvested sectors of the economy, at which point long lead-time project investment picks back up, which in turn leads to sufficient supply in the distant future. That doesn't mean the economy can't grow; it does mean, however, that economic potential is constrained by real world factors.

Evidence of constraints can be observed from the IEF's oil & gas investment outlook, which provides us with an understanding about upstream's investment needs. The group's assessment states that upstream oil & gas capex will have to return to $525bn/year by 2030 in order to sufficiently meet demand -- that compares against $341bn of investment in 2021.

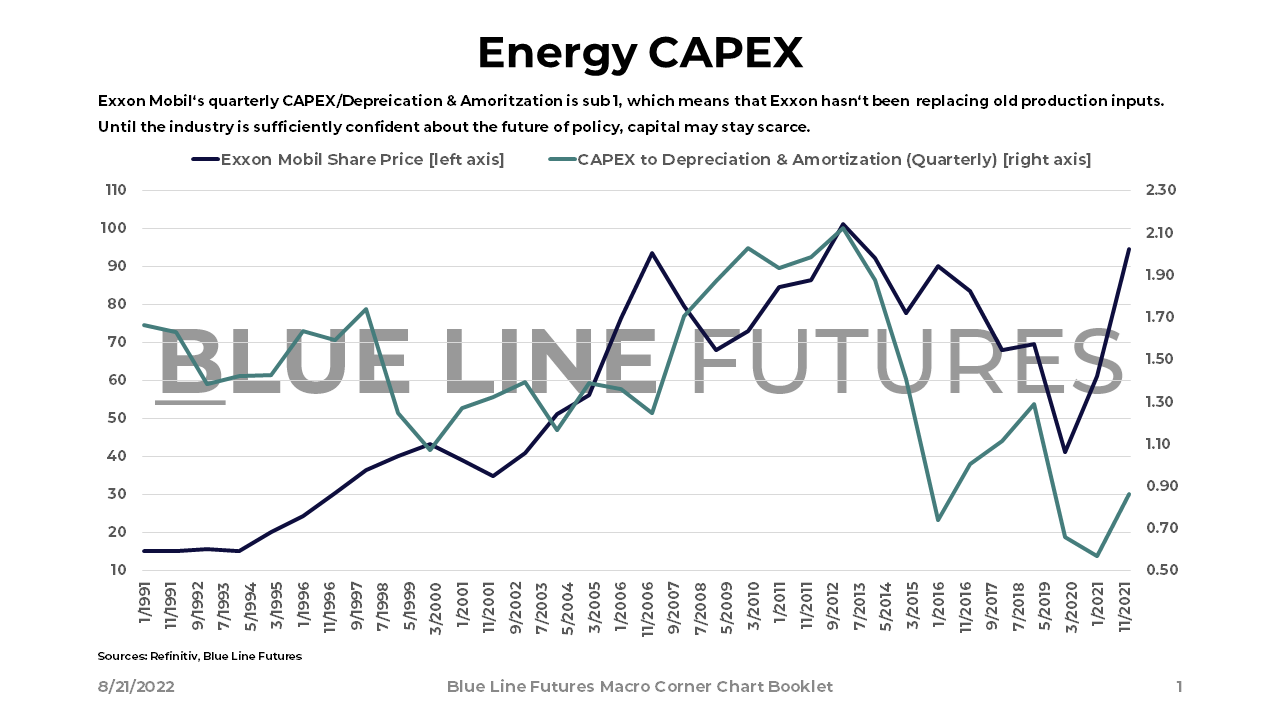

The shortfall in capital spending can be clearly illustrated when we look at energy companies investing less than they depreciate/amortize. Using Exxon Mobil as an example of the industry's overall state, we clearly observe a lack of investment driven by a lack of policy clarity and investors' demands to remain disciplined with capital allocation.

The lack of spare capacity, not only as it pertains crude production itself, but also the economy at large is spurred by the volatility that underinvestment creates. Volatility, in turn, creates a sense of unrealiability in the persistence (or lack thereof) of prices, which is the usual solution to undersupply.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

The lack of participation volatility creates is clearly illustrated by the open interest of WTI Crude Oil, Natural Gas and Copper futures.

It is, again, the constraints of production that put limits on economic growth and therefore the appreciation of financial assets over a sufficiently long enough time horizon. While Real GDP is shown to be below potential, the economy will likely have to reckon with underinvestment for quite a while: we are possibly in transition and in the areas where investment is desperately needed, we are likely in excess of potential output already.

Production constraints are ultimately a function of a lack of prior fixed capital investment. If this is a world of systematic underinvestment, a tug of war between forces seems inevitable -- a world in which active management of portfolios is critical for investment success.

2.) Contrasting Economic Underpinnings with Fed Projections & Market Pricing

Fed Real GDP Projections:

As we think about the Fed's response to economic conditions (maximum employment mandate), the FOMC's economic growth projections are as follows:

- Q4, 2022 Real GDP growth at 1.7% (median); ranging from 1% - 2%.

- Q4, 2023 Real GDP growth at 1.7% (median); ranging from 0.8% - 2.5%

- Q4, 2024 Real GDP growth at 1.9% (median); ranging from 1.0% - 2.2%

Economics 101 teaches us that inflation is a phenomenon that occurs because there's a mismatch between quantity supplied and quantity demanded. Unless the supply or the demand curve shift, the disequilibrium persists.

Taking the commentary about economic growth & economic output potential to its logical conclusion, underinvestment in areas of necessities spurs higher prices. Unless investors become more comfortable with the expected return, demand is either temporarily subdued due to interventionist policies, or demand destruction occurs as a result of unsustainably high prices.

Fed Inflation Projections:

- Q4, 2022 PCE at 5.2% (median); ranging from 4.8% - 6.4%.

- Core PCE 4.3% (median); ranging from 4.1% - 5.0%

- Q4, 2023 Real GDP growth at 2.6% (median); ranging from 2.3% - 4.0%

- Core PCE 2.7% (median); ranging from 2.5% - 3.5%

- Q4, 2024 Real GDP growth at 2.2% (median); ranging from 2.0% - 3.0%

- Core PCE 2.3% (median); ranging from 2.0% - 2.8%

Given inflation expectations have remained well-anchored for the time being, the assumption of policy makers is that the issue of high inflation is still more transitory than not. They may be right, they may be wrong, but we do know that upside surprises over the long haul will require repricing of risk assets.

We will pay attention to policy makers at Jackson Hole and Jay Powell's speech on August 26 as the Fed and global policy makers continue to set expectations.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- Markets Move with Macro Expectations and Expectations Change - Aug. 14, 2022

- Risk Asset Pricing is a Function of Flows - Aug 7, 2022

- The Reality of Negative Real Rates - July 31, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Macy's (M) reporting before the open on Tuesday:

- Consensus: EPS est. $0.85; Revenue est. $5.50bn

Commentary on the following will be monitored:

- Retail inventory levels and destocking

- Consumer spending

- The state of brick & mortar

Nvidia (NVDA) reporting after the close on Wednesday:

- Consensus: EPS est. $0.58; Revenue est. $8.10bn

Commentary on the following will be monitored:

- Chip inventory cycle

- Potential Neon gas shortages

- Customer demand

Note: Nvidia already cut earnings projections before this report

Snowflake (SNOW) reporting after the close on Wednesday:

- Consensus: EPS est. ($0.02); Revenue est. $467.05 million

Commentary on the following will be monitored:

- State of the cloud sector (implications for competitors)

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial