Markets Move with Macro Expectations and Expectations Change | Top Things to Watch this Week

Posted: Aug. 14, 2022, 4:36 p.m.

Markets Move with Macro Expectations and Expectations Change

"At the stock exchange, 2x2 is never 4, but 5 minus 1." - Andre Kostolany

Blue Line Content and More

On the back more risk-on this week, be sure to subscribe to Bill Baruch's Morning Express, which lays out the fundamental as well as technical landscape for macro on a daily basis.

Access all of this week's charts used in today's writing and Macro Corner Episode 11 for tomorrow: Chart Booklet

Inflation Deceleration, Sentiment and Short-Covering

Last week's writing concluded with some notes on money flows and stating the fact that a market is no more than a supply-demand mechanism where buyers and sellers meet. This week, we will mostly rely on the included graphs and continue drawing last week's picture.

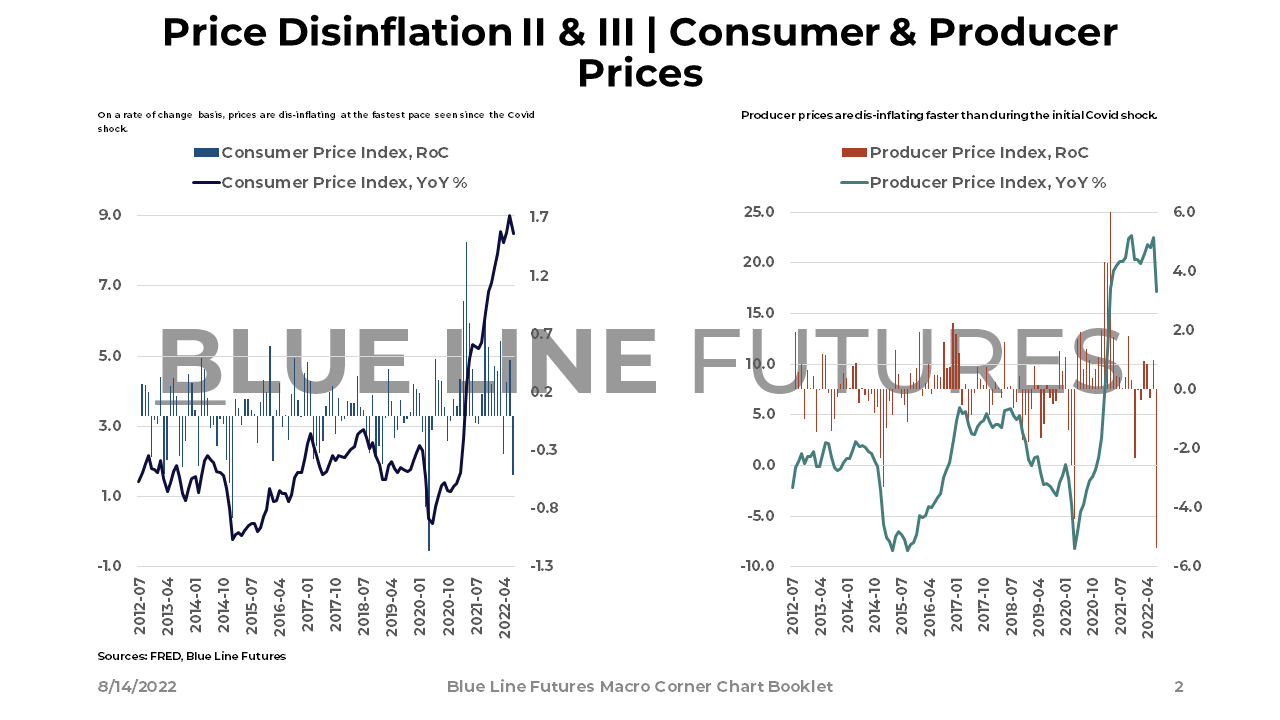

As we all try to make sense of whipsaw markets and the discounting mechanism of future macro conditions, we first need to turn to a rate of change deceleration of inflation. What began with a 60 print on ISM manufacturing prices continued with 0.0% M/M CPI, followed by -0.5% M/M of producer prices.

Jay Powell's dovish commentary during the July 27th press conference was followed by the usual hawk-speak from Fed governors. Regardless, investors take note of less bad inflation data and the assumption that the Fed will decelerate the pace of rate hikes accordingly.

Besides rate hikes, however, the pace of the Fed balance sheet run-off is set to double in September and the harbinger of financial asset growth therefore in question. Absent productivity gains driving economic growth going forward, financial backstopping "ending" will more likely than not leave its marks on risk assets (see chart titled: Backstopping Risk Assets.)

The withdrawal of liquidity coming at a time where treasury market liquidity is already thin doesn't only affect financial stability, but also the rate at which future inflation surprises will reflect in treasury bonds (removal of demand allows yields to rally faster.) That in turn affects the rate at which markets expect the Fed to respond.

More likely than not, the Fed will be able to set up a separate treasury note facility (similar to the standing repo facility) that can support treasuries.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Similar to inflation itself, inflation surprise indices are decelerating, implying that markets have priced in higher inflation (at least the initial wave.)

Inflation combined with economic growth as the two main drivers of investor sentiment are key to positioning. As implied by the NAAIM Exposure Index, active investors had as low as 20% of equity exposure in their portfolios. Individual investors were max bearish at 60%, exceeding bearishness during the initial Covid shock.

As markets move relative to expectations, investors were quick to reposition and are now driving prices north. Led by short covering, expectations for this initial inflation wave are calibrating somewhere less bad than feared and somewhere quite a bit worse than goldilocks (we've also discussed the realities of negative real rates in the past.)

As we've possibly seen peak hawkishness and peak inflation on an absolute basis, low quality stocks were the ones rallying the most after the recent drought (as tends to be the case during sharp turns.) The data below is not yet reflecting the rally in low quality stocks (data as of June.)

While the initial inflation wave may be adequately reflected, longer-term expectations are anchoring on the Fed's 2% average inflation target (rates adjusted accordingly.) A second wave of inflation to which the Fed has limited ability to respond to is not yet priced in; it is all about timing these waves.

While markets may be in the clear from a hawkish surprise perspective heading into Jackson Hole as well as September's policy meeting, a second inflation wave leading to another economic downturn would make things a lot more challenging. Persistent inflation to which the Fed has to figure a different response comparatively to past economic downturns may make things enormously different. Sometimes, the revolver of bullets with easy solutions is not available.

Money Flows

As part of the inflation phenomenon over the last 1.5 years, hedge fund exposure to inflation beneficiaries has reached multi-year highs in recent past. Reflation exposure (modest inflation + economic growth) has continued to drop off as HFs have become increasingly concerned about the health of the US economy. Amidst a decrease in growth exposure, hedge funds increased ownership of defensives such as staples and health care. Net exposure to North America growth has decreased from 20%+ to sub 10% (below 5% earlier this year.)

Over the last month, systematic buyers are expected to have been net buyers to tune of ~$92bn in global equities. As the focus shifts towards month end and the options expiration that comes with it, systematic buyers are expected to be net buyers of $102bn in an up market and net sellers of ~$92bn in a down market.

Note: Data by MS and GS

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- Risk Asset Pricing is a Function of Flows - Aug 7, 2022

- The Reality of Negative Real Rates - July 31, 2022

- The Withdrawal of Liquidity - July 24, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Walmart (WMT) reporting before the open on Tuesday:

- Consensus: EPS est. $1.60; Revenue est. $150.51bn

Commentary on the following will be monitored:

- Inventory story

- Wages

- Consumer demand for durable goods

- Inflation on groceries and daily goods

Home Depot reporting before the open on Tuesday:

- Consensus: EPS est. $4.95; Revenue est. $43.38bn

Commentary on the following will be monitored:

- State of the housing market

- Commentary on do-it-yourself and building costs

Synopsys reporting before after the close on Wednesday:

- Consensus: EPS est. $1.99; Revenue est. $1.23bn

Commentary on the following will be monitored:

- Semiconductor inventory cycle and possible ripple effects into Synopsys' revenue line

- Digitization and automation trends (IoT etc.)

|

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial