Risk Asset Pricing is a Function of Flows | Top Things to Watch this Week

Posted: Aug. 7, 2022, 5:56 p.m.

Risk Asset Pricing is a Function of Flows

"Investment success doesn't come from buying good things but rather from buying things well." - Howard Marks

Blue Line Content and More

On the back of this week's risk on move, be sure to subscribe to Bill Baruch's Morning Express, which lays out the fundamental as well as technical landscape for macro on a daily basis.

Making sense of precious & base metals on a daily basis, Chief Market Strategist Phillip Streible will be launching Blue Line Tactical Insights with actionable trading & risk management levels! In Friday's Metals Edge video he talks about the report pre-launch and shares his thoughts across metals here.

Access all of this week's charts used in today's writing and Macro Corner Episode 10 for tomorrow: Chart Booklet

Stagflation Factors vs. Forced Buying

If we go all the way back to March of 2020, we remember a world in which there were many unknowns: the virus, the economy and the central bank response on a more targeted basis than ever before. It was the uncertainty of it all that increased the wariness of market participants and their unwillingness to step in front of a supposed train running over financial assets. With the help of monetary and fiscal policy makers, however, prices were quick to recover and the real economy began a phase transition. As Jim Bianco likes to say: we are still debating whether that transition ever happened, rather than acknowledging the need for solutions.

Perhaps, it does mean regime change. An economic state where inflation is more persistent, a wage-price spiral that's starting to work its way through the system, and manufacturing that will require automation for it to remain efficient. In addition, the global monetary system is in question; Bretton Woods III may be the answer and commodities therefore much more relevant in global trade.

You contrast the markets' expectation of these stagflation forces vs. the anticipated impact, you end up with a delta. The greater the delta, the greater the return that can be extracted. It is not what is common knowledge that drives prices, however, it is the "secrecy" of a catalyst that makes prices move. Friday's jobs report with more than 2x as many jobs added and increasingly hot wage numbers does nothing but confirm the picture we painted above. Financial markets may well be in for regime change where more of the income flows towards labor and less to the benefit of shareholders. It is stagnation or stagflation, a combination of stagnant growth and elevated inflation where traditional portfolios have a hard time earning a sufficient return -- unlike the last few decades where financial assets have significantly outperformed the real economy.

Despite the reality of these broader forces, however, a market consists of buyers and sellers who need to find an agreed upon price. Price is a function of the urgency and magnitude both sides of the market have as it pertains to executing orders. There are a multitude of factors that drive both urgency and magnitude, but one of them is certainly the risk of underperforming the benchmark. If 'forced' buyers or sellers are present, price tends to drift until a new incremental buyer/seller has to be found at which point the market may reverse. We already introduced GS's FOMU concept in the past: the fear of materially underperforming. This week, we will continue to look at that theme and what it may mean for the path forward in markets.

The former and the latter dynamics as presented above are not necessarily contradictory; instead, they are two possibilities that can be equally present; it is the sequence with which they play out that determines where markets are headed.

The Economy & Wages

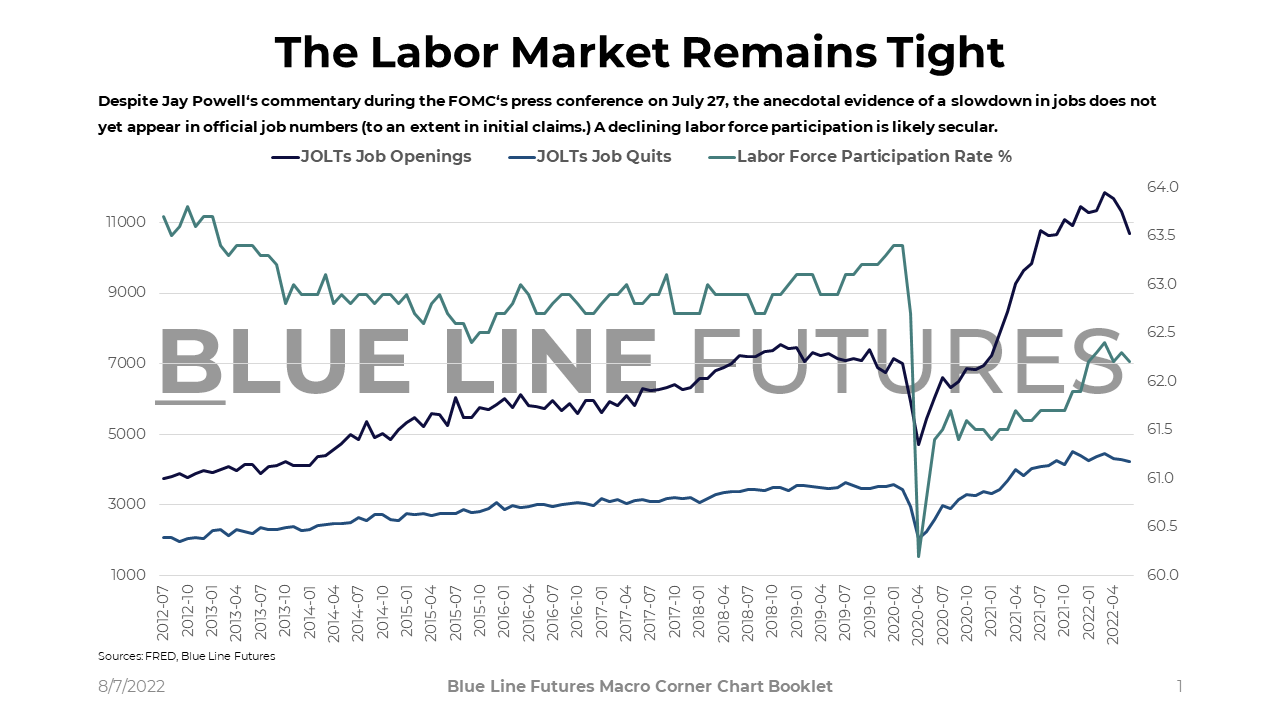

While initial jobless claims have started to tick up, the labor market at large remains tight. Along with +528k jobs created in July and the unemployment rate ticking down to 3.5%, both May and June were revised up (resulting in +28k more jobs created than previously expected.) With more than 10 million job openings, elevated but stable quits rate and labor force participation going down, it suggests that there are structural forces at play. Unlike Jay Powell's commentary during the FOMC's press conference on July 27th, the anecdotal evidence of a labor market slowdown isn't showing up just yet. Yes, there is a lag between real economic conditions and headline numbers; however, we need to assess whether the lead-lag relationship is sufficient for a less restrictive monetary policy path forward.

A tight job market translates into more leverage on the side of labor, which is a structurally supported dynamic. A research piece by Bridgwater suggests that there is a 2ish year lag between a slowdown in jobs and a slowdown in wages, which would require substantial policy tightening (all be it, the variance of that lag is high the piece notes.)

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Higher income then translates into spending, which under inflationary circumstances tends to be more frontloaded and spent at point of reception -- if you expect your money to be worth less in the future, you make use of the money you have today.

Stickier wages translate into stickier core inflation, which is one of the more important risks to financial assets going forward. If the narrative shifts from temporarily higher prices to inflation that's more entrenched, financial markets will inevitably respond to stagnation/stagflation pressures.

If the above assumptions are true, one would imagine liquidity conditions to tighten significantly and therefore put substantial supply into markets.

This fear is clearly reflected in both the 2s10s yield curve as well as the Fed's preferred recession indicator: the 3m10yr curve.

Since financial markets have been in substantial wariness over a tightening of financial conditions into an economic slowdown (usually these two variables are directionally opposite), sentiment and positioning reached low levels. A change in inflation, economic activity and central bank liquidity assumptions will ultimately impact the direction of financial assets.

Money Flows

If we turn from economic indicators to flows data, GS suggests that systematic buyers will be forced to buy $100bn of equities in an up-tape within the next month. Macro hedge funds and CTAs have shown very little correlation to U.S. equities, which also suggests they're under-positioned in case equities rally. It is at that point where FOMU kicks in.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- The Reality of Negative Real Rates - July 31, 2022

- The Withdrawal of Liquidity - July 24, 2022

- Central Economic Planning and Economic Conditions - July 17, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Tyson Foods (TSN) reporting before the open on Monday:

- Consensus: EPS est. $1.91; Revenue est. $13.27bn

Commentary on the following will be monitored:

- Food costs

- Labor costs

- Effects of energy on production

- Are famine fears justified?

Coinbase (COIN) reporting after the close on Tuesday:

- Consensus: EPS est. ($3.04); Revenue est. $1.23bn

Commentary on the following will be monitored:

- Rather than commentary, price actions in punished names will be of essence post-print

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial