The Reality of Negative Real Rates | Top Things to Watch

Posted: Aug. 1, 2022, 6:38 a.m.

The Reality of Negative Real Rates

"Kites rise highest against the wind - not with it." - Winston Churchill

Blue Line Content and More

Macro markets stay busy on the back of this week's Fed. Be sure to subscribe to Bill Baruch's Morning Express, which lays out the fundamental as well as technical landscape for macro on a daily basis.

If you haven't gotten a chance to listen to Macro Corner Episode 8, you can do so here: Liquidity Withdrawal | Recession Risks & Global Slowdown

Access all of this week's charts used in today's writing and Macro Corner Episode 9 tomorrow: Chart Booklet

Paul Wankmueller and Phillip Streible also recorded a special metals episode of Macro Corner you can access here: Macro Corner Special Metals Episode

Dovish Fed, Debt and Negative Real Rates

This week was filled with a plethora of new and interesting policy statements from the Fed, which started with: recent indicators of spending and production have softened. What kicked off with a dovish-leaning Federal Reserve on Wednesday, continued with touting ~2.5% as the neutral rate before abandoning forward guidance and switching to data dependence. During Jay Powell's press conference, he didn't only point to the idea that jobs and the economy are likely to be in a much weaker place than economic data suggests, but also indicated that the FOMC isn't solely focused on absolute rates of inflation; instead, marginal directional improvements are already positive.

So, what does talking about talking about a Pivot meant? As David Einhorn already noted during his Sohn presentation, when Powell was asked whether the Fed was prepared to take a 'whatever it takes' approach as it pertains to the fight against inflation, he replied: I hope that history will record that the answer to your question is yes.

Yes, that means that the Fed doesn't want to raise rates above the inflation rate, but they will use what is otherwise a commonly spoken term in geopolitics: strategic ambiguity. That's precisely what data dependence means.

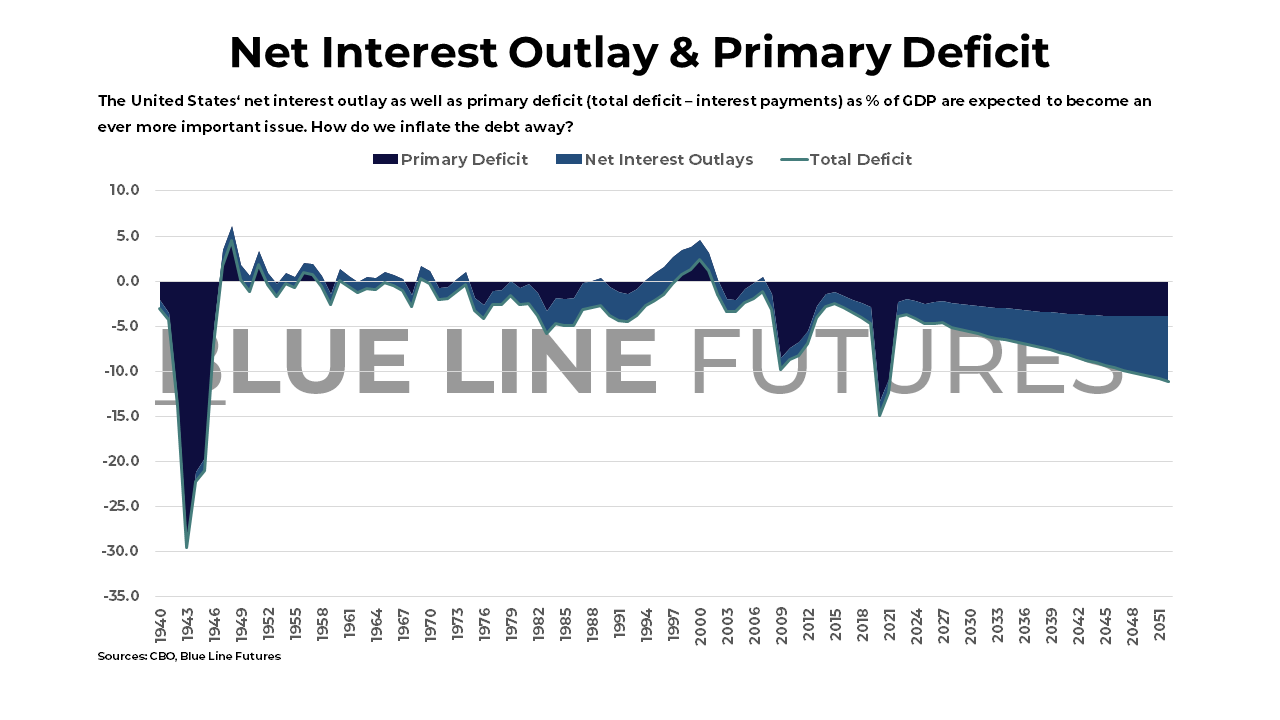

The unwillingness to raise rates to a level above CPI leaves us with negative real rates and a neutral rate that's likely much higher than officially acknowledged. If some of the more secular forces of inflation persist, it may be the only way out for the central bank. After all, negative real rates inflate the GDP number and deflate the value of outstanding debt. Debt that is so large that it is projected to be ~185% of GDP in 2050. Demographics are not helping and neither are ballooning social costs as well as fiscal spending (fiscal dominance.)

This means a regime change in what investors value. Short term cash flows become more valuable and long term lottery tickets less attractive.

The below graph illustrates the degree to which positive real rates would not only tighten financial conditions at large, but also question the treasury's soundness over the long haul. While the Fed is an independent body, it is not a secret that the institution has had to withstand political attacks and will likely be in the spotlight as it drains liquidity.

As much as the Fed aims to operate in a vacuum, the forces exuded by fiscal as well as the population at large constrain the degree to which credit is allowed to get cut off.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Shorter term, however, the Fed balance sheet increased by $4.8 trillion from the start of the Covid shock and the Fed is more likely than not going to test the limits of QT. The effects of which won't be entirely clear until things break.

Financial conditions suggest that we are not yet in restrictive territory, which echoes Jay Powell's commentary that the Fed aims to move to moderately restrictive conditions.

The next crisis will likely be dissimilar to the last one; 08 was a result of ballooning mortgages that turned into a more systemic financial crisis. If the current environment, however, turns out to be a tug of war between inflation, the state of the economy and financial conditions, then this won't be a straight line move.

More likely than not, there will be surprises along the way to which monetary policy makers will try to react with tools whose impacts nobody fully understands. Yes, knowing that there are many unknowns ahead is beneficial.

After all, broader forces will also have to get balanced with shorter term effects such as money flows. Just in a recent note by Goldman Sachs, the bank noted FOMU (the fear of materially underperforming.)

Speaking of broader macro forces, higher wages leading to indexation of wage contracts may be an underlying force driving higher prices. As supply chains become more decentralized, long-term inflation expectations as indicated by Fed Swaps may understate the persistence of things. Yes, a lot of market participants continue to reside in the transitory camp over a time frame of 1+ years.

Sentiment plays a crucial role in where the incremental Dollar is going to flow. The starting point of things does matter and we will continue to frame things within the larger context. Unlike during the last decade where flows didn't discriminate and favored whatever was weighted most in indices, the next decade may benefit active management and careful consideration of a multivariate equation.

Until next time, good luck & good trading.

Be sure to check out prior writings of Top Things to Watch:

- The Withdrawal of Liquidity - July 24, 2022

- Central Economic Planning and Economic Conditions - July 17, 2022

- The China Divergence - July 11, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Pioneer Natural Resources (PXD) reporting after the close on Tuesday:

- Consensus: EPS est. $8.81; Revenue est. $3.86bn

Commentary on the following will be monitored:

- Hydrocarbon production profile

- Inventory cycle and capital spending

- Industry supply & demand dynamics

Energy Transfer (ET) reporting after the close on Wednesday:

- Consensus: EPS est. $0.34; Revenue est. $20.19bn

Commentary on the following will be monitored:

- Pipeline capacity and activity levels

- New pipeline projects, FERC and EPA commentary

- Capital investment in the industry

- U.S. export capacity for crude oil & natural gas

Twilio (TWLO) reporting after the close on Thursday:

- Consensus: EPS est. ($0.21); Revenue est. $920.08 million

Commentary on the following will be monitored:

- Technology cycle and whether easier base comparison can help

- Tech spending by enterprises

- Can the tech trend of 'better than feared' continue?

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial