The Withdrawal of Liquidity | Top Things to Watch this Week

Posted: July 24, 2022, 4:52 p.m.

The Withdrawal of Liquidity

"Knowing yourself is the beginning of all wisdom." - Aristotle

Blue Line Content and More

It is indeed Fed week again with a 75bps hike expected from the FOMC. Be sure to subscribe to Bill Baruch's Morning Express, which lays out the fundamental as well as technical landscape for macro on a daily basis.

If you haven't gotten a chance to listen to Macro Corner Episode 7, you can do so here: Why MMT Fails | China's Tectonic Demographic Shift | The Inflation Mindset

Paul Wankmueller and Phillip Streible also recorded a special metals episode of Macro Corner this week: Macro Corner Special Metals Episode

Liquidity, Inflation and Recession

When we think of portfolio construction and exposure to different risk assets, it is always a question of whether the risk allocation happens for temporal or structural reasons. That decision is then weighed against tactical factors such as market sentiment and whether the error of omission is greater or less than the error of commission in any given situation (type 1 vs. type 2 errors.) We then turn to risk-weighted probabilities of any given outcome, which we use to determine capital at risk.

When it comes to the performance of various assets, it is often a dichotomy; meaning, we may see one outcome as just as probable as a different outcome. Yet, decisions have to be made and hard-earned capital put to work.

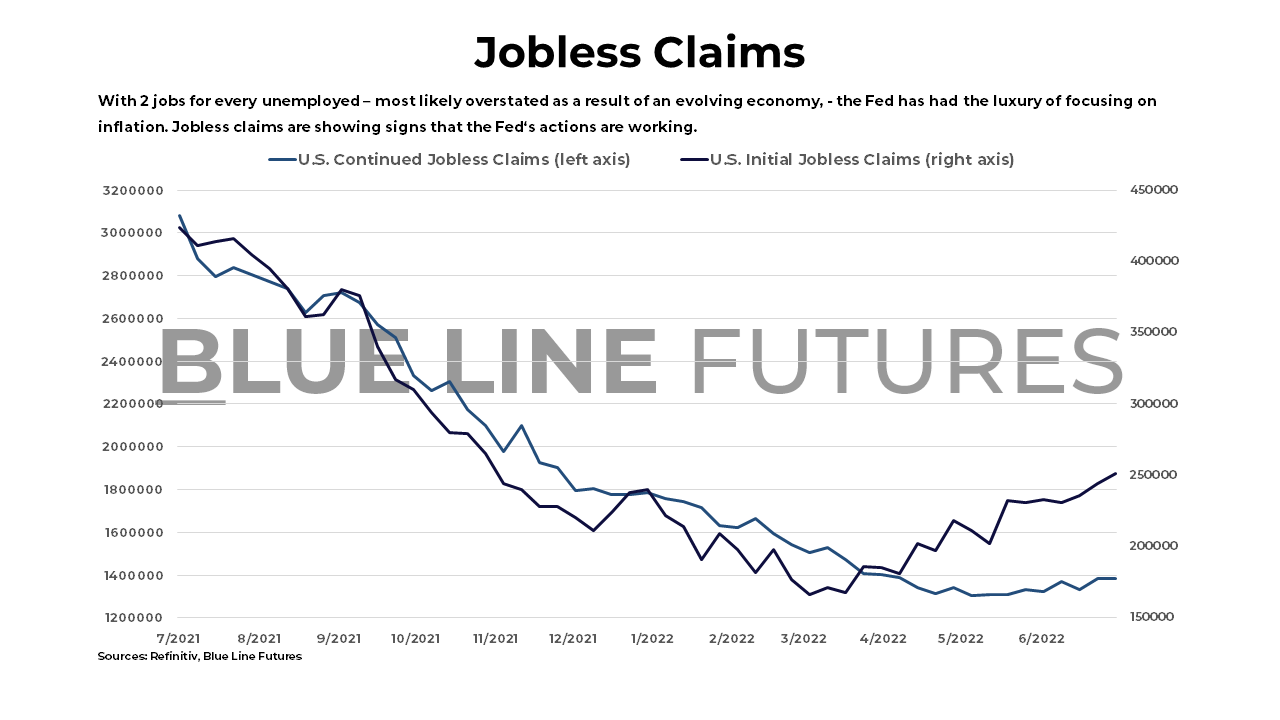

Under the title of 'The Withdrawal of Liquidity', I want to point to some of the most relevant factors and parameters in financial markets. The Fed, at least on the surface, is highly committed to fight inflation and people like Janet Yellen are talking down the risk of recession. Jay Powell puts himself in the same camp as the treasury secretary and has talked down the risks of "overdoing it". High Yield credit spreads back below 500bps and jobs staying stable - on a lag and with an uptick in jobless claims, - more likely than not embolden the Fed. The very tools that propelled the price of risk higher in the last decade are now working in the opposite direction.

The Fed has had the luxury of a stable and tight job market, which allows for tight financial conditions in a fight against inflation. How tight the job market is in reality, after taking post-Covid adjustments into account, is open to debate; however, we do know of tremendously high salaries in Silicon Valley, which are getting unwound as we speak.

Jobless claims have ticked up, but are still at very low levels. As a lagging indicator for real economic conditions, unemployment will likely stay relatively low and give the Fed more room to tighten. Remember, lower wages is part of the Fed's job as the FOMC tries to understand a post pandemic world in which we will likely see a mismatch between supply and demand. Adding to secularly higher wages, which the Fed is trying to combat, are reshoring efforts and favorable, but tightening, demographics in the U.S -- on the one hand, an upward demographic slope makes it compelling for firms to re-locate; relocation, by definition, leads to blue collar workers being able to demand higher wages, however.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

A tight labor market directly translates into the Fed's willingness to further tighten financial conditions. 1.) We have have an expectation for a 75bps hike this week. 2.) Quantitative tightening is set to double on September 1 and put a "drag-function" on the price of risk assets.

The job market is a lagging indicator, however, and most likely of relatively low predictive power when it comes to the Fed's future actions (i.e., Pivot). More likely than not, financial plumbing (the functioning of the financial system) will be much more relevant.

One indicator we can turn to is the MOVE Index; a volatility index for U.S. treasury bonds.

While elevated, the MOVE has moved from 156 to 123.70 as of Friday's close. This is elevated, but below levels that would imply panic. This is more likely than not leading to incrementally more hawkish policy as the market signals "green lights".

A similar dynamic has played out in the High Yield credit space. From ~600bps a few weeks ago, High Yield CDS has settled in below 500bps as of Friday. Again, an incrementally more hawkish tone by the Fed is "permitted".

Net stress levels of financial indicators aren't the only factor to consider when it comes to the price of assets, however. Besides liquidity parameters, the 2s10s curve is signaling a red-hot recession warning. Higher yields in the forward months implying inflation risks while lower yields further out signal slow economic growth. The shift from inflation to recession risk may be yet another risk, which the Fed doesn't appear to be highly concerned about (therefore allowing things to deteriorate.)

Another way of looking at economic conditions are currencies. Cyclically and export-driven currencies such as the Korean Won, Japanese Yen and Singapore Dollar are all driven by trade flows and demand for goods for the respective trade areas. All of the three have weakened against the U.S. Dollar, reflecting a global slowdown.

You can find the currency graphs in the writing's "Food for Thought" section.

Bottom Line:

On the margin, liquidity conditions continue to get worse. While relatively high, liquidity and volatility indicators aren't yet at levels that would force the Fed to pivot. At the same time, the fight against inflation is turning into a fight against business activity and therefore heightened recession risks.

The fight against inflation is arguably harder than it's ever been. Just this week, the ECB came out with what appeared to be a hawkish 50bps hike; wait, hawkish until Christine Lagarde started introducing a fragmentation tool, which will allow the central bank to buy bonds from countries whose yields are viewed to be too high.

If we indeed live in times where negative real yields are the name of the game, capital preservation via cash flows will be extremely important.

Be sure to check out prior writings of Top Things to Watch:

- Central Economic Planning and Economic Conditions - July 17, 2022

- The China Divergence - July 11, 2022

- Emerging Markets and Financial Conditions - July 3, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Microsoft (MSFT) reporting after the close on Tuesday:

- Consensus: EPS est. $2.28; Revenue est. $52.87bn

Commentary on the following will be monitored:

- Enterprise sales

- Cloud business

Apple (AAPL) reporting after the close on Thursday:

- Consensus: EPS est. $1.13; Revenue est. $82.42bn

Commentary on the following will be monitored:

- Consumer spending

- China

Chevron (CVX) reporting before the open on Friday:

- Consensus: EPS est. $5.01; Revenue est. $55.13bn

Commentary on the following will be monitored:

- Physical energy market

- Crack spreads

- Energy policy

- Capital investment

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial