Central Economic Planning and Economic Conditions | Top Things to Watch this Week

Posted: July 17, 2022, 1:31 p.m.

Central Economic Planning and Economic Conditions

"Sometimes, you get a groupthink around a base assumption and everybody agrees to the same thing and acts reflectively, and doesn't really challenge what's going on." - David Einhorn

How Low Do We Need To Go?

I hope you had a great weekend after a busy and inflation-data driven week in markets. In the lead-up to the upcoming Fed policy decision on July 27, we will continue to provide you with content, so be sure not to miss out on it. You can access last week's Macro Corner Episode #6, The China Divergence and check out this week's chart booklet with all the graphs and data here: Blue Line Futures Macro Corner Episode 7 Chart Booklet

During a conversation with a long-time friend this weekend, we theorized about the state of European politics and society. Why has the continent been so ignorant about its energy security and what is the coming famine in parts of the world going to mean for the EU member states' social construct? While many questions stayed unanswered in our conversation, one 'answer' was closely related to a quote by Blaise Pascal: All of humanity's problems stem from man's inability to sit quietly in a room alone.

I wrote about this some months ago and shared my thoughts about the idea of increased interventionism as a result of high inflation, polarization and food/energy shortages. Indeed, political history suggests that times of stress are often used to excuse higher taxes, more government intervention and less problem-solving in the hands of market participants. However, it is again the lack of inaction, the lack of market forces resulting in maximal surpluses that lead to inefficient and unequal outcomes. Rather than realizing that compounding happens as a result of creating the conditions of good returns (exceptional, far above-average research, etc.) and then sitting still for a long-time, central planning agencies created unsustainable fiscal and monetary conditions. MMT is one such idea.

MMT, also known as modern monetary theory, has certainly contributed to a speculative mindset over the course of the last 2 years. In the case of Japan, MMT has left the BoJ with few options when it comes to the impact of inflation; in fact, the country is buying an unlimited number of bonds to keep 10yr JGBs inside 0.25%, despite import inflation and a cyclical slowdown of global economies pushing the Yen south.

Now, to be clear: unsustainable conditions can be quite sustainable and the market can remain irrational longer than you can stay solvent. Thus, risk management within the context of your convictions is of awfully critical importance!

Central Bank Planning In The Present Day:

Central bankers globally are wrestling with high inflation prints. Just this week, CPI came in at 9.1% as energy accelerated from 3.9% MoM in May to 7.5% in June. Broadly speaking, the energy component acts on a lag and is expected to cool with gasoline, crude oil and heating oil having deflated over the recent past. While energy will decelerate, shelter accelerated from 5.4% to 5.6% YoY (1/3 of headline CPI). Noticeable, OER (the bulk of shelter) tends to act on a lag to housing prices and there's catch-up to be had when we compare OER vs. the Case-Shiller Housing Price Index. In addition, deflationary forces from used cars over the last few months are set to become less and decelerating freight rates will only get reflected on a massive lag; thus, preventing the Fed from declaring 'victory' any time soon.

Markets move on the margin, however, and markets are quick to price marginally dovish news. In fact, Fed governors commenting on the rate at which inflation may cool gave a lift to markets at the end of the week and brought down the likelihood of a 100bps hike at the next Fed meeting to 'just' 29%. As Ben Bernanke put it: setting monetary policy is 98% talk, 2% action.

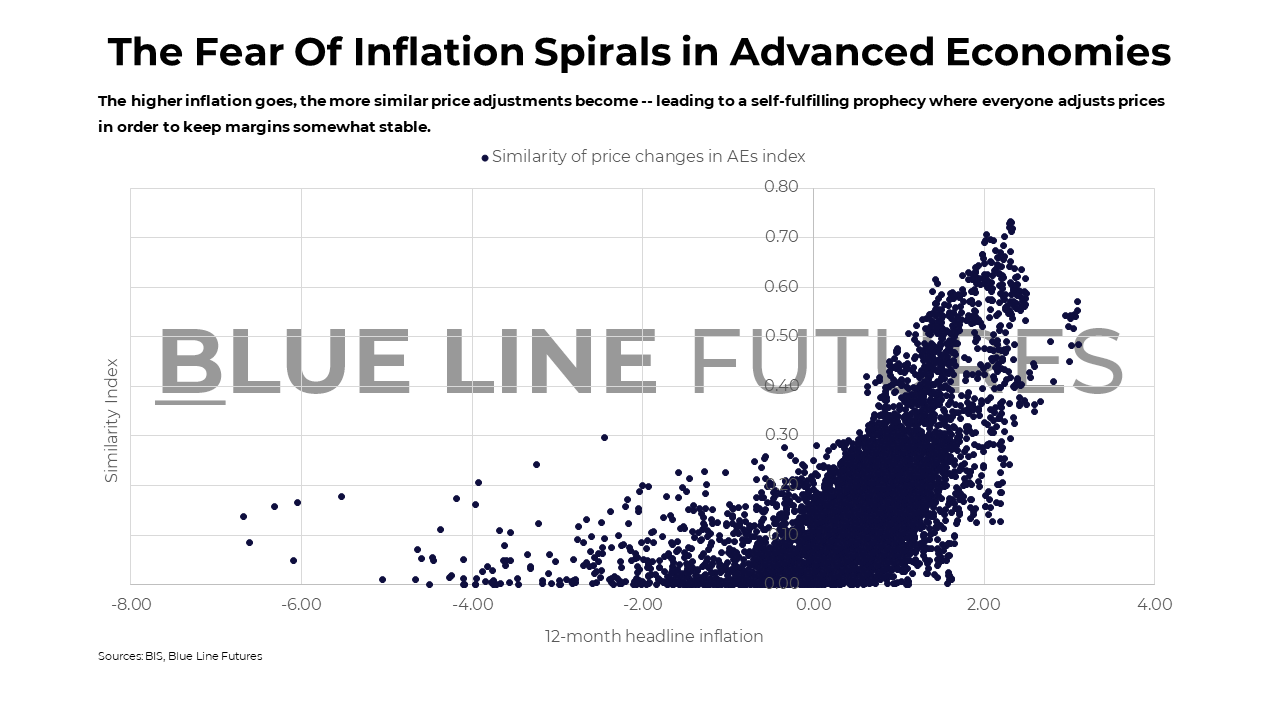

Returning to what's being planned, we remember early 2021 before inflation took off and few saw coming what later unfolded. To be more precise, one of the main things the Fed was aiming at avoiding: a wage-price spiral. As prices increase, price changes in the economy become more and more similar. That is partially a result of the self-fulfilling prophecy called inflation where price sentiment permeates through the economy. One component of those price changes is wages. As inflation remains elevated, the indexation of wages to inflation increases (also known as the wage-price spiral.)

The velocity with which the risk of highly similar prices can be fought depends on how much excess there is in the economy.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Besides excesses, we have also talked about credit spreads and the fact that the lower-end of the consumer is hurting substantially. But overall, albeit the need to find a lower equilibrium point, data is getting worse; potentially, though, not enough to turn an acknowledgement of 'weaker demand' in the Fed's Beige Book into something more significant.

This is arguably to the contrary of the 'Fed Pivot' being introduced soon enough for it to become tradeable -- a theory we've discussed in past writings. However, big picture, things are worsening but not yet in a horrific place.

With that being said, the Fed's goal is to worsen the economic environment (the Fed refers to this as financial conditions.) Worsening conditions amidst a divergence amongst low-to-high income consumers is particularly tricky in a world where high interest rate credit is expanding rapidly (the burden is not shared equally.)

While high interest credit is largely a reflection of low income consumers trying to keep pace with price appreciation, a substantial portion of assets are held by people outside the bottom 50%. That part of the demand equation is mostly addressed via wealth destruction (the price of assets coming down.)

So, again, while financial conditions have gotten significantly worse, structural forces of inflation are persistent and call for action. Credit spreads are relatively higher, but not yet recessionary. With that being said, the market is screaming for recession given where the 2s-10s curve is trading.

Where interest rate policy is ultimately going to settle will most likely depend on financial plumbing indicators rather than absolute inflation (temporary victory being declared at that point.)

At the end of this writing, I would like to address what I started of with: central planning and interventionism. While the underpinnings of those two variables may be highly questionable, there are people trying to 'get the job done' regardless. It is not a role many would aspire to be in given the circumstances and the potential for a lose-lose scenario. There is a balance to be struck between respect for what is trying to be accomplished and a healthy dose of caution when it comes to the underpinnings of the aforementioned actions.

Be sure to check out prior writings of Top Things to Watch:

- The China Divergence - July 11, 2022

- Emerging Markets and Financial Conditions - July 3, 2022

- Commodities and Fed Dilemma - June 27, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Earnings

Bank of America (BAC) reporting ahead of the open on Monday:

- Consensus: EPS est. $0.77; Revenue est. $22.82bn

Commentary on the following will be monitored:

- Costumer credit

- M&A Activity

- Economic conditions

Netflix (NFLX) reporting after the close on Tuesday:

- Consensus: EPS est. $2.90; Revenue est. $8.06bn

Commentary on the following will be monitored:

- New equilibrium for post-Covid streaming behavior

- Content spending

- Customer churn

- Password sharing

- Potential partnerships and M&A

Tesla (TSLA) reporting after the close on Wednesday:

- Consensus: EPS est. $1.73; Revenue est. $18.26bn

Commentary on the following will be monitored:

- Car sales expectations

- Labor situation and lay-offs

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial