The China Divergence and Commodities | Top Things to Watch this Week

Posted: July 11, 2022, 2:39 a.m.

The China Divergence and Commodities

"Climbers that have been fortunate enough to reach the top and successfully return, call 26,000 feet the "death zone"." - Bill Gross

The China Divergence

I hope everyone had a great weekend on the back of a busy week in markets. Ahead of Wednesday's CPI report, we come to you with another Top Things to Watch writing, which will be followed by Macro Corner Episode 6 (be sure to check out #5 if you haven't already.) For Episode #6, we have another chart booklet that you can access here: Macro Corner Chart Booklet, Episode 6

Continuing on what I wrote about last week, contagion in EM is spreading. We saw the presidential palace stormed in Sri Lanka, protests in Albania, Georgia, Macedonia and Bulgaria, and political turbulences in Ghana. The preconditions have existed for a while as the world has underinvested in the necessary supplies of what the everyday household needs most: energy and food (the two are linked and things have accelerated as a result of external shocks.) Combined with questionable, and potentially fatal policies, debtor nations will rely on the IMF, the World Bank and other countries coming to the rescue -- the terms set in these negotiations will affect the economic and social construct for years, potentially decades.

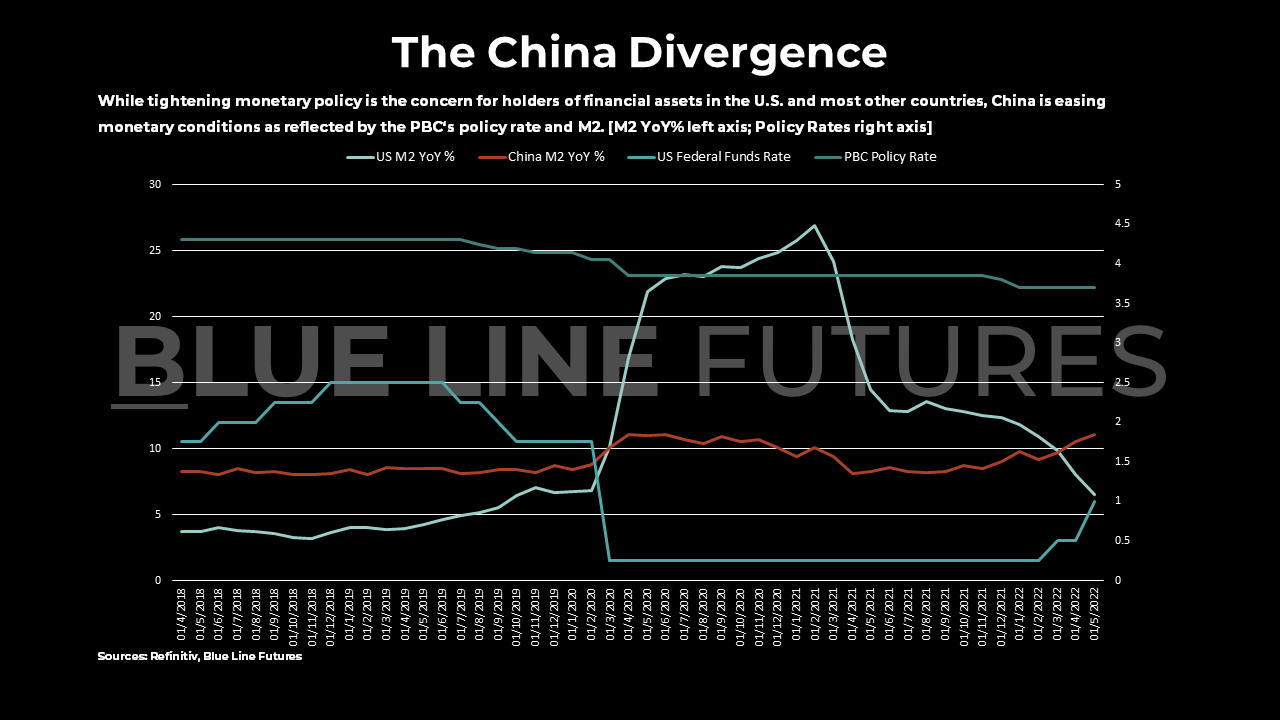

Turning from EM to what we can refer to as 'The China Divergence', we are at yet another interesting macro conjunction. While the U.S. and western nations have seen increasingly hawkish rhetoric from central bankers in the fight against inflation, the PBoC's one year LPR (loan prime rate) is at the lowest level it has seen (3.7%). In addition to easy interest rate policy, China's M2 Supply has accelerated from a low of 8% in April to 11.1% YoY as of the last reading in May.

One needs to ask 2 questions:

- What allows China to ease while other central banks are tightening?

- What are the implications for risk assets?

The world is barely linear and we need to proceed with caution when dealing with the intersection of known knowns and unknown knowns. We do know that China has been one of the largest buyers in the grain markets for a while and has accumulated critical resources in the process. According to the USDA, China holds 69% of the world's corn reserves, 60% of rice and 51% of wheat reserves. We also know that the Chinese are critically aware of "solving" hunger on a sustainable basis as revolutions in the past were either triggered or fueled by famine. In addition to hoarding strategic reserves, China's geostrategic partnership with Russia and the BRICS alliance at large gives the country a degree of security in times of uncertainty. If we view the world as a flow chart of capital and currencies as calories, then economic strength - at least to a degree - depends on a country's ability to secure critical supplies of food and energy; thus, allowing the central bank to ease into what is widely viewed as an inflationary cycle.

As said, things are barely linear, however, as the deflationary cycle induced by an implosion of China's real estate sector has allowed the country to ease policy. Moreover, as the rest of the world slows, the demand pull on the manufacturing side is likely to be subdued in the forseeable future (along with a transition from durable goods to services spending.) So, both access to food & energy alongside a slowing demand pull from the rest of the world allows the PBoC to ease while the rest of the world tightens.

The implications:

China consumes 52% of the world's copper, is increasingly exporting less crude products, and is hungry for commodities as the country is headed for Xi's reappointment in the fall. Whether economic activity or Zero Covid will prevail, we are likely going to find a commodity demand equilibrium that is higher than what we've seen recently.

Looking beyond monetary policy, we turn to economic indicators that look as if they've found a bottom in May of this year.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

China Business Conditions have rivaled the lows of the initial Covid shock, but appear to be recovering now.

Constrained by a lack of export capacity as a result of port shutdowns as well as waning construction, industrial profits in China have come off considerably.

From negative territory on a YoY basis, more favorable base effects are set to kick in.

While onshoring is certainly a theme we have been talking about, the coming years will continue to be under the name of China reliance -- as long as the rest of the world relies on China manufacturing, China's industry will produce.

China's lack of industrial activity in the recent past clearly shows in steel stocks from key enterprise.

Real estate has been a key growth driver for China's relevancy in commodities. While most likely more challenged as Xi made it clear that "houses are for living, not investment", it is critical to remember that it is still about location. As China's urbanization continues, real estate in the right places will be flowing to the demand function.

China plays a key role in what is often referred to as a 'multipolar world'. The country's vision for a new 'international order' has vast implications for geostrategic partnerships and how nations with commodities will play into that equation. While facing massive challenges from a demographic perspective, higher living standards should continue to lead to more demand and a transition to a consumer economy that will need more of almost everything.

Be sure to check out prior writings of Top Things to Watch:

- Emerging Markets and Financial Conditions - July 3, 2022

- Commodities and Fed Dilemma - June 27, 2022

- Global Central Banks At The Crossroads - June 19, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

Earnings

Delta Airlines (DAL) reporting ahead of the open on Wednesday:

- Consensus: EPS est. $1.59; Revenue est. $12.25bn

Commentary on the following will be monitored:

- Consumer flight demand and outlook

- Jet fuel constraints

- Labor market

- Business travel

JP Morgan (JPM) reporting ahead of the open on Thursday:

- Consensus: EPS est. $2.93; Revenue est. $32,15bn

Commentary on the following will be monitored:

- M&A Activity

- Jamie Dimon commentary (anything adding to the 'hurricane' reference')

- Credit conditions

Morgan Stanley (MS) reporting ahead of the open on Thursday:

- Consensus: EPS est. $1.58; Revenue est. $13.31bn

Commentary on the following will be monitored:

- Credit conditions and cycle

- M&A Activity

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial