Emerging Markets and Financial Conditions | Top Things to Watch this Week

Posted: July 3, 2022, 4:52 p.m.

Emerging Markets and Financial Conditions

"Never let a good crisis go to waste." - Winston Churchill

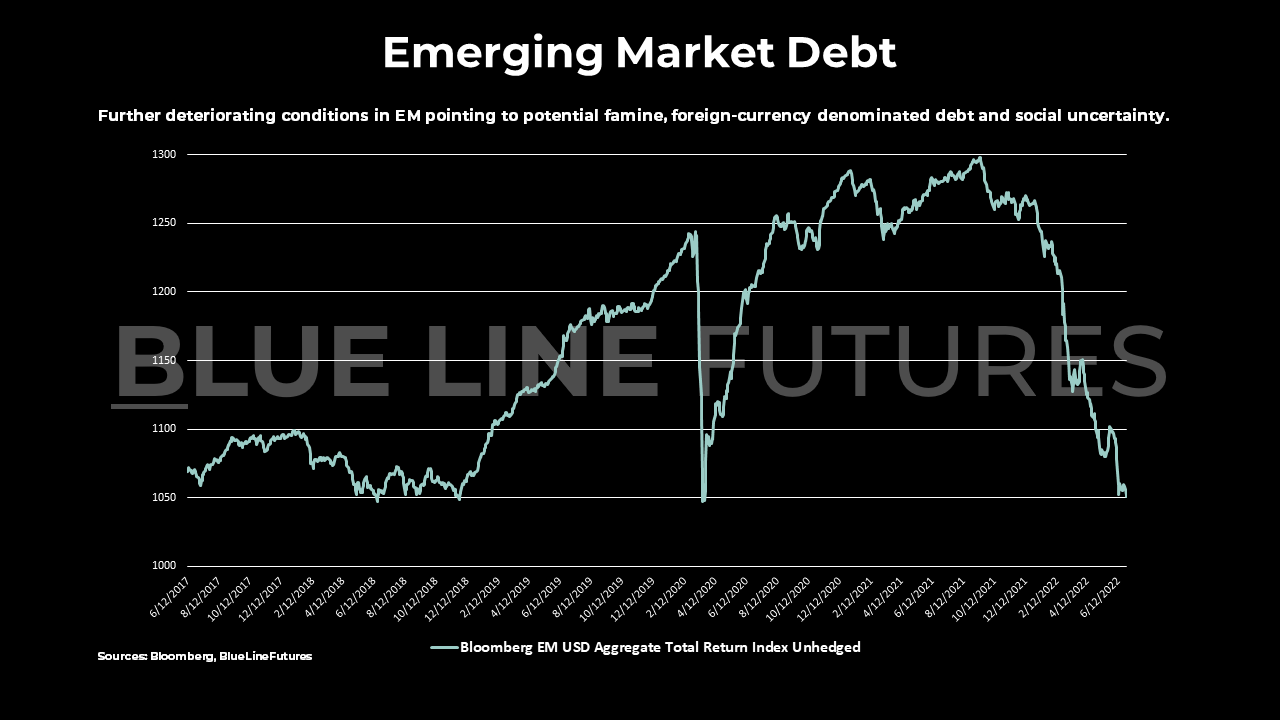

Emerging Market Debt

Happy 4th of July weekend and thank you for taking the time to read this! If you would rather listen to the weekly add-on in podcast format, be sure to check out Macro Corner Episode #4. For Episode #5, we have another chart booklet that you can access here: Macro Corner Chart Booklet, Episode 5

Last week and the week before, we talked about emerging markets and how a plethora of issues are facing a developing world that will increasingly be prone to 3rd parties stepping in and 'solving' issues. Remembering what happened during the Arab Spring, it was food shortages causing civil unrest and ultimately revolutionary movements. In a more fractured world, that implies less certainty when it comes to the supply of commodities as a reaction function to political instability.

In addition to domestic instability in EM nations, servicing debt in foreign currency is increasingly a challenge for debtors. Paying principal or interest on a loan whose currency you don't control - amidst relative domestic weakness - can drive a country to the brink of default.

Interestingly enough, it is the exception - not the norm - to see western central banks prioritize currency levels and their effect on EM (it is not their mandate.) In fact, during a panel discussion with Jay Powell, Christine Lagarde, Andrew Bailey and Carsten Augustin, the Fed Chair reaffirmed that despite the currency's externalities, the level of the Dollar is not one of the Fed's mandate. This is particularly true during a time where the FOMC is increasingly concerned about the potential long-term negative effects of higher for longer inflation.

Turning to data, the Bloomberg EM Total Return Index has sold off by a greater extent than during the initial Covid shock while the index's OAS spread remains very well contained. A contained OAS spread simply means that the premium the market demands over the risk-free rate for EM credit has not been blowing out -- in fact, OAS is 300bps below Covid-shock highs.

Now, if OAS is a measure of the degree of uncertainty, then whether EM deserves more repricing becomes an interesting question.

Not all of EM is created equal, however; depending on country-level circumstances, including credit history, resource-dependence and political (in)stability, investors decide to extend or not extend credit.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Brazil CDS, despite the country's resourcefulness, is setting new cycle highs.

EM financial conditions may become incrementally tighter as central banks continue to fight inflation. However, things don't move in a straight line as the job market - a lagging indicator - will more likely than not enter a more challenging phase. The Fed is 'able' to tighten as long as the financial system works reasonably well, the treasury is not yet 'screaming' and the labor market remains relatively tight (near maximum employment.)

Another factor important to consider: as the things evolve and central banks assess the post-Covid world, their own assumptions may well change and therefore impact how they view various economic indicators (labor force participation declining etc.)

One of the more interesting dynamics besides credit spreads blowing out across EM is the diametrically opposite behavior from China's markets. China went into recession before the rest of the world even got close and the Chinese stock market has outperformed U.S. stocks ever since April. The country may take advantage from reduced demand in the west and therefore underpin commodity prices for longer.

Be sure to check out prior writings of Top Things to Watch:

- Commodities and Fed Dilemma - June 27, 2022

- Global Central Banks At The Crossroads - June 19, 2022

- U.S. Debt Burden, Monetary Policy and the Consumer - June 12, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Food for Thought

Earnings

Levi Strauss (LEVI) reporting after the close on Thursday:

- Consensus: EPS est. $0.23; Revenue est. $1.43bn

Commentary on the following will be monitored:

- Retail inventory levels

- Consumer spending appetite

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial