Commodities and Fed Dilemma | Top Things to Watch this Week

Posted: June 27, 2022, 2:54 a.m.

Commodities and Fed Dilemma

"Courage isn't having the strength to go on - it is going on when you don't have strength." - Napoleon Bonaparte

Commodities Disinflation on Global Recession Fears

First things first, be sure to check out Macro Corner Episode #3 on your favorite podcast platform alongside the podcast's 2nd chart booklet. This week will follow with episode #4 and another chart booklet you can access ahead of time here: Macro Corner Chart Booklet, Episode 4

When I think of each week's 'plot' for this writing, it's always a balance between strong views held loosely and data that supports those views sufficiently. Without the data, my views would just be opinions anyone could have. So, while I want to write about all sorts of 'crazy' theories, this writing comes from a place of scrutiny in regards to my own ideas. Please don't steer clear of scrutinizing these yourself -- I very much appreciate your time to do so!

As I tried to rationalize last week, global central banks are approaching the cross roads of choosing between financial stability (treasury's ability to finance itself) and combatting inflation. While the Cleveland Inflation Nowcast shows us 10.03% YoY CPI, commodities from industrial metals to fertilizers have shown initial signs of recession fears/demand destruction. As Fed Chair Powell acknowledged in this week's congress appearance, there's a job to be done on the durable goods side.

Fertilizer prices:

- US Cornbelt Ammonium Nitrate Spot Price from $800/ton to $700/ton

- US Cornbelt Potash Granular spot price from $835/ton to $790/ton

- US Cornbelt Urea Granular spot price from $980/ton to $560/ton

While one has to be careful with inferring 'signals' from past prices, one has to realize that markets may have reached a temporary extreme based on a behavioral response to the war in Ukraine. Now, the attention turns to U.S. weather and crop conditions combined with the ability to withdraw grain stocks from storage facilities. Thus, a more fractured world may lead to price dislocations, but at varying degrees in different regions.

The story is not contained to grains and fertilizers, however, but runs the gambit across commodities. Crude Oil has come off of a high around $120/bbl and has settled in to $102/bbl on the lows this week. At the same time, the Bloomberg Commodity Index has turned south from $136+ to $121 as of Friday's close.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Adding to the Fed's window of opportunity - for a lack of a better term, - industrial metals have significantly deflated in price. Copper is off from ~$4.75/pound to $3.73/pound; aluminum has deflated from $3,875.5/metric ton to $2,450/metric ton.

Copper in particular has done so against the backdrop of significant underinvestment in new mines combined with green initiatives fueling demand for the go-to conductor. According to Goldman, less supply is expected in the 2nd half of this year, which should tighten up the supply-demand picture.

Now, one has to turn to things with a critical eye and ask: have we priced in a global recession at too quick of a rate, despite supply issues remaining unaddressed?

As an article by the Le Journal du Dimanche reads: "The price of energy threatens our cohesion", by the bosses of Engie, EDF and TotalEnergies

Commodity cycles tend to be long-lasting events consisting of multiple stages: 1.) Companies putting up a track record of favorable returns 2.) Capital starting to flow into old-economy sectors 3.) Capital has its effects on supply and demand outstripping supply reverts into supply exceeding demand.

Returning to the most important industrial metal, copper was faced with a massive decrease in demand due to a Chinese recession, but will increasingly benefit from China's credit impulse and its lagging effect on copper demand. In spite of demand destruction providing the Fed with what could be a temporary victory lap on inflation, commodities don't come out of the Fed printer, but require capital to increase supply.

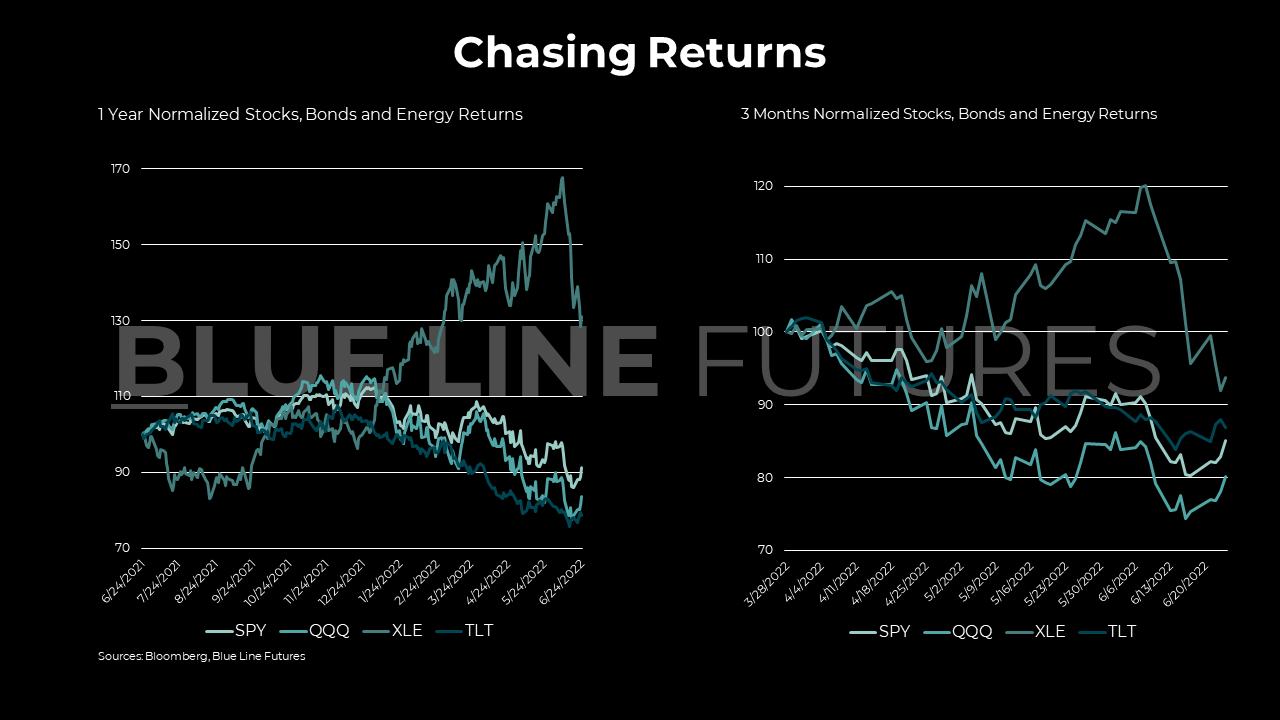

So, why have commodities deflated as drastically as they have since the beginning of June? I like to talk about things in relative, not absolute terms. For one, commodities have been the only asset class that has withstood the broader macro pressures. Secondly, tourists chasing returns in the sector were unwilling to withstand yet another 'shitco' experience and were quick to exit the space.

In the short term the stock market behaves like a voting machine, but in the long term it acts as a weighing machine. - Ben Graham

Along with stimmy checks, commodities at large are more likely than not retaining demand inelasticity and on top will benefit from persistent government threats. Without becoming gloomy, nationalization is likely the largest threat to prolonged positive free cashflow returns.

The Fed's Dilemma

Included in slide 8-10 of this week's chart booklet, the Fed is faced with an awfully challenging task of sticking to their mandate of stable prices (2% avg. inflation). At a total public debt to GDP level of ~124%, we far exceed fiscal conditions that Volcker had to deal with when debt was sub 40%.

More importantly, debt levels are projected to rise drastically as the MMT crowd is left with fewer & fewer answers. As the Congressional Budget Office projects, federal debt held by the public is expected to exceed 180% by 2052 (from sub 100% now.)

Debt levels are rising despite what were accelerating tax receipts that are now expected to roll over against a tougher economic backdrop. In the midst of deteriorating savings as a % of disposable income, industrial activity as well as consumer spending hangs up in the air.

Now, most of the aforementioned indicators are backward looking, but nevertheless valuable in what they tell us about the economic and social future. It is at the extremes of things that bottoms get formed and tops are made. Are we close to those levels just yet, or are secular forces much stronger than weekly trends?

After all, markets are as old as humanity itself. Supply-demand dynamics find expression in prices and it is upon us to take calculated risks in those markets.

Be sure to check out prior writings of Top Things to Watch:

- Global Central Banks At The Crossroads - June 19, 2022

- U.S. Debt Burden, Monetary Policy and the Consumer - June 12, 2022

- Commodities, Inflation and Labor Market - June 5, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

Earnings

Nike (NKE) reporting after the close on Monday:

- Consensus: EPS est. $0.81; Revenue est. $12.21bn

Commentary on the following will be monitored:

- Consumer spending appetite as stimulus checks have rolled off

- Retail inventory levels vs. sales

General Mills (GIS) reporting before the open on Wednesday:

- Consensus: EPS est. $1.01; Revenue est. $4.80bn

Commentary on the following will be monitored:

- Input costs vs. consumer inflation

- Pricing power

Micron Technology (MU) reporting after the close on Thursday:

- Consensus: EPS est. $2.46; Revenue est. $8.70bn

Commentary on the following will be monitored:

- Semiconductor inventory cycle (over-ordering by customers during the supply chain crisis)

- Outlook on availability of chips

- Chip demand

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial