Global Central Banks At The Crossroads | Top Things to Watch this Week

Posted: June 19, 2022, 4:47 p.m.

Global Central Banks At The Crossroads

"I've made a lot of money over the years looking at things real simple." - Carl Icahn

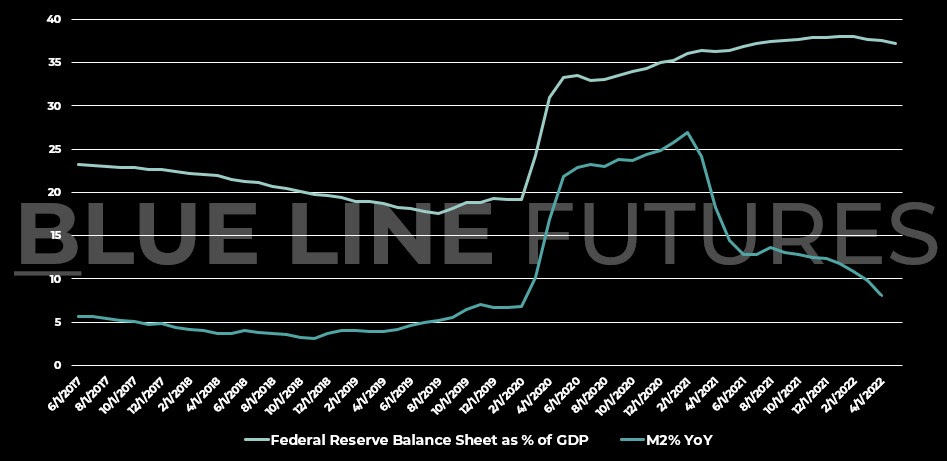

M2 Growth and Fed Balance Sheet Size

First things first, be sure to check out Macro Corner Episode #2 on your favorite podcast platform alongside the podcast's very first chart booklet. This week will follow with episode #3 and another free chart booklet you can access ahead of time here: Macro Corner Chart Booklet, Episode 3

This week, we will dive into the monetary framework going forward and how different central banks will have to find a balance between achieving low inflation and pulling the liquidity and economic support.

After coming off of record liquidity at 26.9%YoY M2 growth in February of 2021 and the Fed's balance sheet growing to 38% of GDP, the Fed is on a mission to combat 8+% inflation. Using history as a guide, inflation above 5% CPI has never come down devoid of the Fed Funds Rate exceeding CPI.

If we take the FOMC by its word, it is safe to say that liquidity will deteriorate further from the current 8% of YoY M2 growth and the Fed's balance sheet size of 37.2% of GDP.

Liquidity Conditions

Source: Bloomberg, BlueLineFutures

Different to the taper tantrum of 2018 and March 2020, financial stability appears to be further down the Fed's priority list. To recap (high to current):

- The S&P 500 is down 23.5%

- The Nasdaq 100 is down 32.8%

- Bitcoin down 73.7% (currently a levered Nasdaq bet)

- Bloomberg Agg Bond Index down 19.7%

Whether addressing liquidity conditions of financial assets solves high inflation is one question; the extent to which drawing liquidity from the system induces a negative wealth effect is another question.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Liquidity conditions affecting financial assets leads us to credit spreads, one of the Fed's primary indicators as it pertains to the functioning of the financial system. While contained for long after the sell-off in equities began, 5yr high yield credit spreads widened to 590bps this week (recession levels ~800bps). Is that sufficient to turn the Fed dovish just yet? Probably not. Is it enough to have them pay attention? Yes.

High Yield Credit Spreads

Source: Bloomberg, BlueLineFutures

It is important to remember that credit spreads ~250bps above non-recessionary levels are on the back of 175bps in rate hikes and QT in its very early innings. Looking at the indicated yield on Fed Funds, an additional 175bps are indicated with QT doubling on both treasuries and MBS starting in September. Will things break much before anyone's expectations?

Federal Funds Futures Indicated Yield

Source: Bloomberg, BlueLineFutures

Looking beyond financial indicators, the business environment in the real economy is rapidly getting worse and more likely than not set to result in layoffs. Employment as a lagging indicator to the economic landscape was one of the Fed's primary variables that allowed it to become incrementally more hawkish; as things turn around, however, are the risks skewed towards a dovish surprise?

Real Economic Indicators

Since the Fed can't print commodities or resolve structural underinvestment, the central bank aims to engage in demand destruction, bring people back into the labor force and normalize financial conditions from overly accommodative levels.

Given the anticipation of increasingly tightening financial conditions, the NFIB Business Outlook is hovering at all time lows (meaning below 08 or other recessions.)

NFIB Business Outlook

Source: Bloomberg, BlueLineFutures

A weakening economy wasn't only reflected in NFIB and Atlanta GDP Now, but also shipping rates coming off of record highs. Shipping rates decelerating aren't only reflective of demand destruction, of course; as the Chinese economy reopens and ports come back online, supply chain congestions ease and so do inflationary pressures.

Freightos Shipping Rates

Source: Bloomberg, Freightos, BlueLineFutures

As supply chain pressures ease, labor participation increases and the economy cools, we may have seen peak inflation. While peak inflation may relief monetary policy makers temporarily, longer term forces persist. However, one step at a time as a shift in inflationary and therefore monetary expectations can quickly move the price of financial assets and therefore tactical allocations.

Be sure to check out prior writings of Top Things to Watch:

- U.S. Debt Burden, Monetary Policy and the Consumer - June 12, 2022

- Commodities, Inflation and Labor Market - June 5, 2022

- Commodities and A Redistribution of Wealth Fueling Secular Inflation - May 29, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone

Data Release Times (E.T.)

Food for Thought

Japan & China U.S. Treasury Holdings

Source: Bloomberg, BlueLineFutures

European Bond Yields

Source: Bloomberg, BlueLineFutures

European Bond Yields I

Source: Bloomberg, BlueLineFutures

European Bond Yields II

Source: Bloomberg, BlueLineFutures

Earnings

KB Home (KBH) reporting after the close on Wednesday:

- Consensus: EPS est. $1.97; Revenue est. $1.63bn

Commentary on the following will be monitored:

- Housing market demand amidst rising mortgage rates

- Demographic tailwinds

- Demand divergences between locations

FedEx (FDX) reporting after the close on Thursday:

- Consensus: EPS est. $6.91; Revenue est. $24.57bn

Commentary on the following will be monitored:

- Increasing shipping costs as fuel costs rise

- Durable goods demand

- Activist campaign by DE Shaw and more aligned management incentives

Carmax (KMX) reporting ahead of the open on Friday:

- Consensus: EPS est. $1.54; Revenue est. $9.17bn

Commentary on the following will be monitored:

- Easing supply chain issues in the car market

- Demand picture amidst rising rates

- Car prices

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial