U.S. Debt Burden, Monetary Policy and the Consumer | Top Things to Watch this Week

Posted: June 12, 2022, 10:50 a.m.

U.S. Debt Burden and Monetary Policy

"People who lose money always need someone to blame." - Jim Chanos

The Old Economy & Podcast Announcement

On Tuesday, we launched our very own Blue Line Futures Macro Corner podcast. In it, Paul Wankmueller and I talk about the topics I write about on a weekly basis and share some additional color on things in the process! If you have family and friends who look to garner macro information, please be sure to share the word as we will continuously improve the experience and wealth of knowledge being shared in a 10-15 minute weekly conversation.

The podcast is available across platforms:

In the podcast as well as last week's write-up, I mentioned the fact that the Fed knows as much as we do: monetary policy in response to structural supply issues presents a short-term fix, not a long-term solution. Devoid of capital returning to so-called "old-economy industries", consumers along with governments will pay the price for what appears to become a more fractured and less efficient global structure.

Since investing/trading is more about making an educated guess rather than seeking certainties in chaos, we need to deduce fundamentals from price and infer price from fundamentals. In other words: how will security prices be affected by a spectrum of macro probabilities and what do current prices tell us about often times unquantifiable fundamentals.

Gold, real assets and other safe haven securities have largely been disregarded by a large swath of market participants; hindsight helps us see why: stimulative risk conditions enabled by an increase in efficiencies due to globalization and enhanced by monetary policy led to a persistent shift in how risk gets quantified (shifting out on the risk curve.)

As a result, financial markets valued lottery tickets over cash-flowing businesses and raised the cost of capital for financially-disciplined management teams. Unsurprisingly so, management teams got incentivized by what markets rewarded at the time, increasing reflexive behavior. So, what should we pay attention to next?

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Debt Levels

The Congressional Budget Office's latest budget and economic outlook suggests that federal debt held by the public (% of GDP) will have reached 185% by 2052. That is ~87% above current levels and far exceeds the 1946 local high at 106.1%. Total Public Debt (% of GDP) at 124.7% in Q1 2022 is expected to follow a similar trajectory and raises a critical question in regards to interest outlay as a portion of Washington's fiscal budget. The Peterson Foundation noted at the beginning of May: "Ballooning interest costs threaten to crowd out important public investments that can fuel economic growth in the future."

Total Public Debt | Federal Debt Held by the Public (Projections)

Source: CBO, BlueLineFutures

The idea with debt is that future cash flows ultimately pay for the interest with excess money used to pay off the principal of the security. But what if demographics necessitate an ever larger pile of debt in order to finance defense, social security and the nation's health system? We have started to see initial signs of what an inflection from deflation to inflation with unfavorable demographics looks like in the case of Japan. Eventually, $24 trillion of U.S. debt matter. There's a gambit of variations as to how a "debt resolution" looks like, but what we can say: debt levels do impact the degree to which central banks can deploy their tools.

As David Einhorn suggested during his presentation at the Sohn Conference this week, the U.S. needs to roll $7 trillion of debt in the next year. Despite high and sticky inflation, the Fed is potentially unable and unwilling to combat price appreciation by rapidly raising rates.

Debt Retirement Necessitates New Treasury Security Issuance

Source: Sifma, BlueLineFutures

A rapid acceleration in treasury retirement as a result of an ever growing debt pile reduces the Fed's ability to increase rates and intervene with substantially tighter financial conditions -- the point at which things "break" shifts.

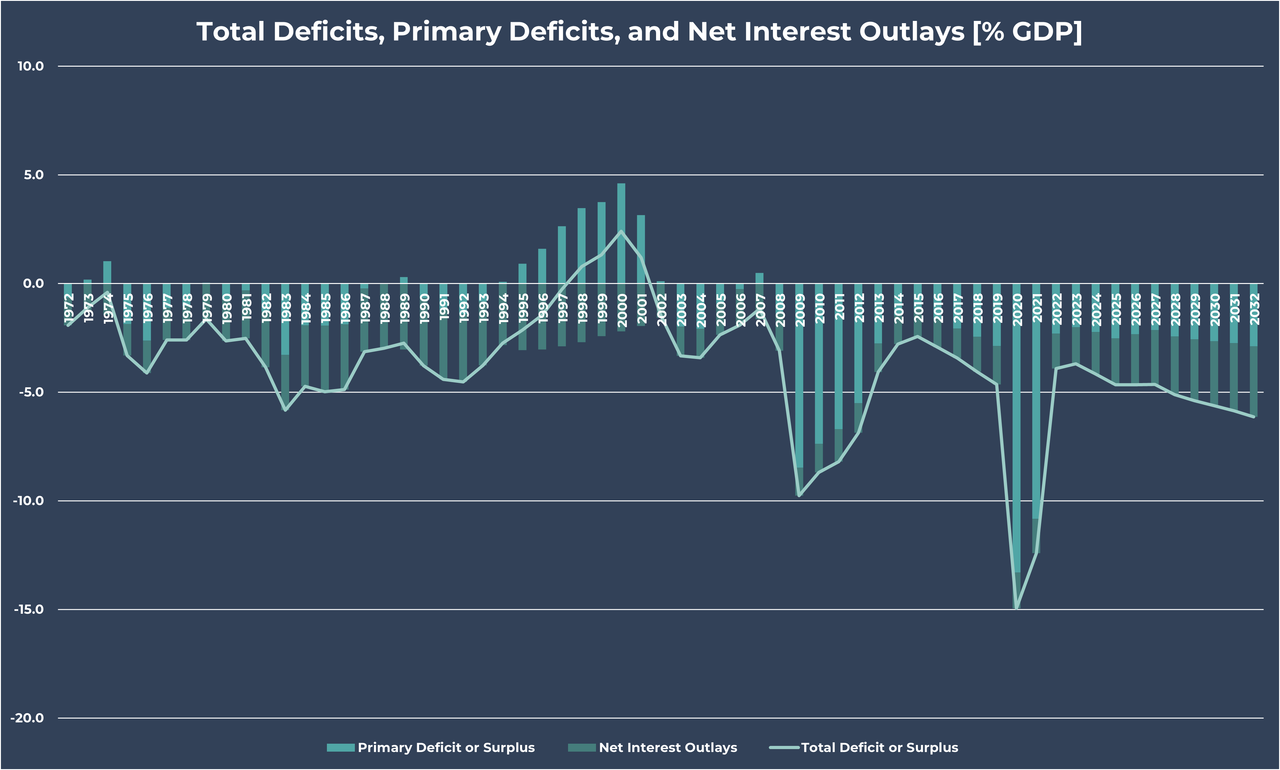

In fact, as the federal interest outlay is expected to increase from 1.6% of GDP in 2022 to 3.3% by 2032, the tools at the Fed's disposal become more constrained. The increase in interest outlay is also expected to be accompanied by an increase in the primary deficit that's estimated to go from this year's 2.3% to 2.9% by 2032. In sum, the total deficit is estimated to go from this year's 3.9% to 6.1% by 2032.

Total Deficits, Primary Deficits, and Net Interest Outlays [% GDP]

Source: CBO, BlueLineFutures

Thus, we are back to tradeoffs and policy makers choosing the lesser harm between high inflation resulting in a much weaker consumer vs. fiscal stress as a result of higher rates. Fiscal stress, in turn, affects the government's ability to direct support to those in need -- producing a reflexive event where higher rates paralyze fiscal, which leads to a weaker consumer, which results in a much weaker economy. Yes, this very much requires hard decisions.

CBO's Baseline Projections of Outlays and Revenues

Source: CBO, BlueLineFutures

The Consumer is Hurting

As inflation eats into the pockets of consumers - low income first and progressively upward, - economic indicators are reflecting slowing consumer spending ahead. With savings as a percentage of disposable income continuing to plummet, the consumer isn't only relatively worse off to peak savings, but also compared to prior downcycles. As consumers spend a larger portion of their income on food, energy and other life necessities, expensive credit is rapidly expanding.

Savings as % of Disposable Income & Consumer Credit

Source: Bloomberg

The same dynamic is also reflected in the Michigan Consumer and Conditions Indices.

Michigan Consumer Sentiment and Current Conditions

Source: Bloomberg

Next week, we will go from a top-down macro view to a bottom-up micro perspective (signals of different asset classes and how they affect the larger picture.)

Have a great week ahead!

Be sure to check out prior writings of Top Things to Watch:

- Commodities, Inflation and Labor Market - June 5, 2022

- Commodities and A Redistribution of Wealth Fueling Secular Inflation - May 29, 2022

- Price Distortions and Signal, Credit Cycle, Consumer, Job Market - May 22, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

Eurozone Bond Yields (1M) & Yield Curves

Source: Bloomberg

U.S. Population, by Age Group

Source: CBO

US Budget Balance (% GDP)

Source: Bloomberg

Gold & Bloomberg Global Agg Bond Index

Source: Bloomberg

Earnings

Oracle (ORCL) reporting after the close on Monday:

- Consensus: EPS est. $1.37; Revenue est. $11.65bn

Commentary on the following will be monitored:

- MySQL HeatWave technology

- Competition with AWS and Snowflake

- Cloud growth

Kroger (KR) reporting before the open on Thursday:

- Consensus: EPS est. $1.28; Revenue est. $43.22bn

Commentary on the following will be monitored:

- Grocery costs

- Expected global famine and implications for the consumer

Adobe (ADBE) reporting after the close on Thursday:

- Consensus: EPS est. $3.31; Revenue est. $4.34bn

Commentary on the following will be monitored:

- Creative Cloud customer adoption

- Competitive landscape

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial