Commodities, Inflation and Labor Market | Top Things to Watch this Week

Posted: June 5, 2022, 4:58 p.m.

Commodities, Inflation and Labor Market

"The man who acquires the ability to take full possession of his own mind may take possession of anything else to which he is justly entitled." - Andrew Carnegie

The Need For Commodity Capital Flows

For too long, commodities have been an underappreciated asset class touted as a low-margin, high capital intensity sector from an operations perspective. Instead, ample central bank liquidity in conjunction with global trade built around efficiency favored high-margin, low maintenance capital technology businesses.

Margins and CAPEX in numbers:

- Microsoft

- Gross Margin: 68.4%

- (EBITDA - CAPEX)/Interest: 38.8%

- Phillips 66

- Gross Margin: 6.1%

- (EBITDA - CAPEX)/Interest: 1.69%

Paraphrasing Howard Marks: my best investments began in discomfort. It is for that reason that contrarian inflection points can yield asymmetric payoffs.

Most importantly, though, underinvestment in old-economy sectors has led to shrinking capacity while demand kept growing. Just in the U.S., the number of operating refineries has decreased from 250+ in 1982 to less than 150 in 2019; and while efficiency gains allowed refinery capacity to only peak at ~19m bbd in April of 2020, it is now down to 17.9m bbd. According to Mike Wirth on Bloomberg, CEO of Chevron, refineries take up to 10 years and billions of Dollars to get built -- combined with the fact that the U.S. hasn't constructed one since the 1970s, distillate shortages leading to higher crack spreads may just be another secular state of higher for longer.

Symptomatic of the supply issues the world's facing in old-economy areas, we observe a plethora of factors that enhance existing price dynamics:

- OPEC+ announcing a net quota increase of 648k bbd in July and August is largely rhetoric and removes spare capacity from the future (a result of underinvestment.) Net-net, GS expects this change to "represent a 0.2 mb/d higher summer output level...with output simply brought forward from September." This week's announcements lets investors question the very ability of the oil alliance to raise output irrespective of price. Paraphrasing the CEO of Chevron on Bloomberg: supply decisions were made 2 years ago and today's decisions will take 2+ years to affect supply. In other words: structural forces underpinning prices take investment rather than rhetoric to get resolved.

- Confidence Game (what was the Fed Put in financial assets is the OPEC+ Put in hydrocarbons)

- Despite high and rising prices, NYMEX Crude Oil futures Open Interest is ~33% off of 2021 levels. For one, it reflects the degree of volatility in the market and people's willingness to step in front of large market moves. Secondly, though, corporate bonds of trading houses such as Gunvor and Trafigura continue to trade between 79-86 cents on the Dollar; both trading houses and its peers are critical to the movement of commodities globally -- as sanctions and counterparty risks increase, banks' willingness to extend credit as well as their own inclination to provide liquidity decreases. Thinner markets translate into higher price impacts from relatively less volume.

- The U.S. consumes ~19.78mbbl of Crude Oil daily and used to have ~726mbbl stored in its SPR (Strategic Petroleum Reserves); that's equivalent to ~36 days of reserves. Today, SPR is down to 566mbbl, which is equivalent to ~29days of reserves. By definition, the SPR is: "the world's largest supply of emergency crude oil ... established primarily to reduce the impact of disruptions in supplies." Given that the SPR is a strategic emergency tool, it is of utmost strategic importance -- if depleted as a result of a reaction function to structural issues, refilling the reserves may lead to a "SPR Put" beneath the market.

- Policy decisions enhancing structural supply issues are not contained to SPR, however. As reported by Reuters, the White House "weighs oil profits tax to fund consumer rebate." This news comes on the back of the UK's move to charge a 25% tax on the profits of oil and gas firms. Whether or not action follows rhetoric, if hydrocarbon producers were hesitant to drill due to net-zero, policy initiatives are only adding to that hesitancy. Quite interestingly, policies constraining the supply of electricity are not contained to hydrocarbons with rolling blackouts expected in large swaths of the country. As reported by The Hill, the nuclear power plant Palisades in Michigan "shut down on the same day that the North American Electric Reliability Corporation (NERC) issued a report saying the U.S. electric grid doesn't have enough generation capacity and that blackouts are almost certain to occur across the country this summer."

- As mentioned in last week's Commodities and A Redistribution of Wealth Fueling Secular Inflation, the current wealth gap in conjunction with supply issues fueling shortages have vast implications for fiscal policy; unlike the prior decade, the next few years are likely to encompass redistributive policies, thus fueling price inflation. Remember, central banks can print fiat currency, but they cannot print commodities and real assets. Redistributive measures won't only lead to competition for commodities in the very regions stimulus is implemented, but also result in inflation getting exported around the globe.

At the intersection of underinvestment and policy, the world's facing a critically important task with vast geopolitical implications. As bargaining power will continue to shift back to nations with commodities, monetary and fiscal policy makers will be working against strong structural forces; what is "don't fight the Fed" may be in the process of turning into "don't fight commodity trends" -- rather, embrace market signals by directing capital to the supply side.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Inflation

Commodities are certainly one part of the inflation equation at hand; geopolitics and a shift to more value-aligned trade systems provide us with another angle. One factor we've touched on in the past but not thoroughly explored is the tools by which the Fed and other central banks try to address inflation concerns. Clearly, they can't print commodities and are constrained by the current circumstances; the Fed knows that as much as we do.

As the economy shifts from above trend durable goods spending back to services, wages in the service economy are a key determinant of consumer prices. Only if the labor market cools off can the Fed counteract some of the current inflationary pressures (extremely tight with 11.4 million job openings and an unemployment rate at 3.6%.) More likely than not, they have a window in which favorable base effects allow the Fed to regain credibility and avoid a development in which inflationary concerns become ever more self-fulfilling.

As long as the job market continues to show strength in the official metrics, one of the CB's two mandates (maximum employment) is well taken care of; thus, good news on the jobs front is likely bad news when it comes to QT and rate hikes from a risk assets' perspective.

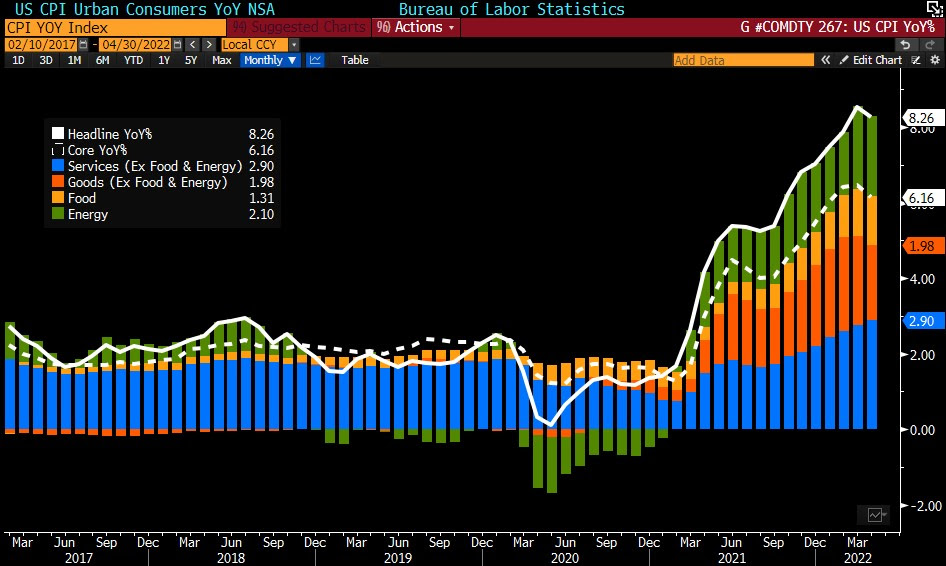

YoY CPI by Components

Source: Bloomberg

The Fed's aim to reduce labor market pressures via a negative wealth effect is one of their few tools that could temporarily ease pressures. After all, though, services disinflation primarily buys time and things may remain choppy until more investment flows to old-economy sectors.

US Personal Savings as % of Disposable Personal Income

Source: Bloomberg

As inflation continues to eat into the pockets of consumers, the Fed anticipates to see an uptick of labor participation. This is a balancing act between maintaining a healthy economic landscape while easing inflationary pressures to the extent that services can contribute to disinflation.

Nonfarm Payrolls

With an additional 390k jobs created in the month of May, the Fed does have a window of opportunity to keep tightening while the labor market remains strong. As we've talked about before, the job market is a lagging indicator -- until layoffs, that are increasingly making the headlines, find their way into the numbers, the FOMC's window of opportunity is open.

Job Market Composition

Source: Bloomberg

Be sure to check out prior writings of Top Things to Watch:

- Commodities and A Redistribution of Wealth Fueling Secular Inflation - May 29, 2022

- Price Distortions and Signal, Credit Cycle, Consumer, Job Market - May 22, 2022

- The Capital Allocation Question Amid Regime Shifts - May 14, 2022

- Job Market, Credit Spreads and Inflation Expectations - May 7, 2022

- Bank of Japan, European Economic Cycle and the Fed - April 30, 2022

- Commodities and Commodity Cycles - April 17, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

Japanese Yen and JGBs

Source: Bloomberg

DOE Hydrocarbon Inventories

Source: Bloomberg

NYMEX Crack Spread

Source: Bloomberg

Earnings

Dave & Buster's Entertainment (PLAY) reporting before the open on Tuesday:

- Consensus: EPS est. $1.16; Revenue est. $441.28 million

Commentary on the following will be monitored:

- Increasingly tough reopening comps vs. continued return to travel and entertainment

Signet Jewelers (SIG) reporting before of the open on Thursday:

- Consensus: EPS est. $2.29; Revenue est. $1.81bn

Commentary on the following will be monitored:

- Covid comparisons (same store sales comp of 106.5% in Q1, 2021)

- Durable goods spending trends

DocuSign (DOCU) reporting after the close on Thursday:

- Consensus: EPS est. $0.46; Revenue est. $581.71 million

Commentary on the following will be monitored:

- Upselling existing client base

- Spending on execution and sales productivity

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial