Commodities and A Redistribution of Wealth Fueling Secular Inflation | Top Things to Watch this Week

Posted: May 29, 2022, 2:45 p.m.

Commodities and A Redistribution of Wealth Fueling Secular Inflation

"Don't be a hero. Don't have an ego. Always question yourself and your ability. Don't ever feel that you are very good. The second you do, you are dead." - Paul Tudor Jones

Fiscal Policy and Transfer Payments

It's a beautiful Saturday morning here in Chicago and on my way to the office, I listened to Howard Marks' latest memo "Bull Market Rhymes". In it, he talks about the "willing suspension of disbelief" that occurs when FOMO (fear of missing out) dominates over FOLM (fear of losing money). Despite its recurring nature, time and again people suspend critical thought and proceed without the necessary guardrails that investing requires.

I hope that this writing offers a positive contribution towards your own process and helps you question the very nature of the markets you transact in. With that, let's get into it.

In last week's writing titled Price Distortions and Signal, Credit Cycle, Consumer, Job Market, I tried to articulate the distortion of price signals in the credit space as well as the lagging nature of the job market in conjunction with a consumer trying to retain a stimulus-driven living standard. The Capital Allocation Question Amid Regime Shifts a week prior contained the existing wealth gap and how the pendulum of geopolitics will more likely than not increase the burden on the consumer. It is at the intersection of the two pieces that I would like to position today's article: a hurting consumer driving stimulus in a fiscally-dominant world.

Fiscal Response Amid Regime Shifts

Regime Shift is close to becoming an overused word in our Top Things to Watch, but the fact of the matter is that we are indeed living in interesting times. This week's headline 'UK Slaps 25% Windfall Tax on Profits of Oil and Gas Firms' is the beginning of what is likely going to turn into a plethora of government interventions (on a targeted basis.)

Whether or not you are a believer in targeted fiscal involvement, the process of government redistribution is inefficient by its nature. In economics, we call that a "Deadweight Loss" -- a cost to society when markets are out of equilibrium. Whenever an additional mark-up is imposed by governments, the very problem solving that free and open markets engage in gets distorted.

One has to get curious and ask what comes next and how is it going to impact financial markets? As we outlined two weeks ago, the wealth gap between the top 1% and the bottom 50% is as wide as it's been since the 1920s. In addition, commodity markets from industrial metals to hydrocarbons have seen a lack of investment over the last 7 years, which is now leading to demand outstripping supply.

But let's understand how the spending profile differs between income classes and how it may drive markets.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

U.S. Household Income and Spending Distribution

Jeff Currie, Global Head of Commodities at Goldman Sachs, has talked about this at length and I want to give credit where it's due. Low income consumers are driving commodity cycles while high earners drive financial asset inflation. That dynamic is easily observable when we turn to the portion of income that gets spent on food and energy by the top 20% vs. the bottom 20%.

Lowest vs. Highest 20% Household Income Spending

Source: API

If you zoom in, both food and energy spending is higher in the low-income bracket compared to the higher income bracket; that gap only widens further up the income ladder. Thus, targeted fiscal payments to low-income consumers will only reinforce existing dynamics of higher food and commodity prices at large.

Even more importantly, though, targeted fiscal payments - wherever governments have the institutions with which they can redistribute, - will inevitably lead to export inflation.

Geopolitical (In)Stability

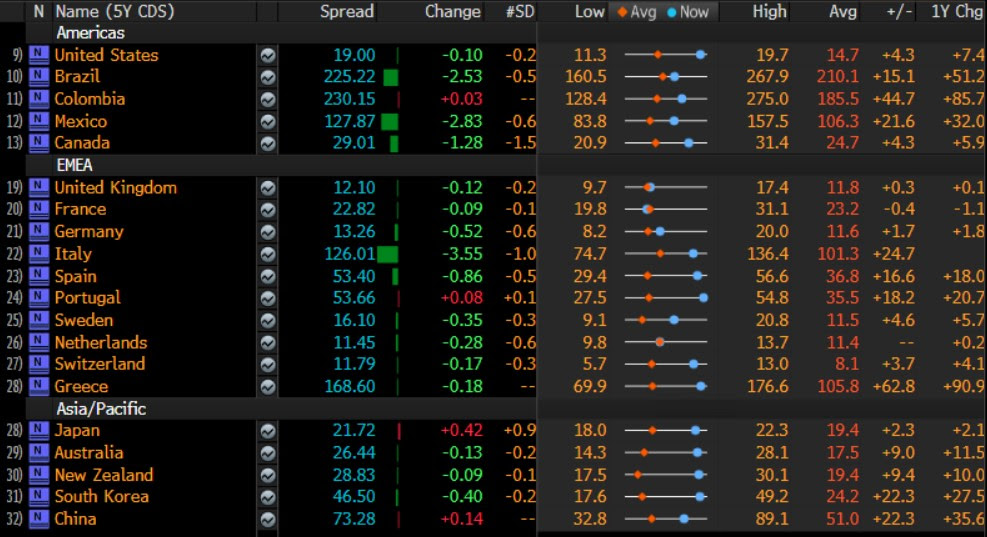

As competition for a limited set of goods leads to export price inflation, it will be interesting to watch country CDSs. Again, power in the hands of commodity exporters while importers will be scrambling to not only buy goods, but also keep internal stability in check.

Country CDS

Source: Bloomberg

One anecdotal piece of evidence that the flow of commodities is ultimately going to have a substantial impact on the way international relations work is this week's seizure of both Iranian and Greek oil tankers:

- U.S. seizes Iranian oil cargo near Greek island - Reuters

- Iran seizes 2 Greek tankers in Persian Gulf as tensions rise - AP

Hopefully, this short piece around how to think about fiscal policy - and the role commodities play in that framework, - provides a good overview on how it may impact financial assets.

Happy Memorial Day Weekend! Thank you to the brave men and women who have made the ultimate sacrifice.

Be sure to check out prior writings of Top Things to Watch:

- Price Distortions and Signal, Credit Cycle, Consumer, Job Market - May 22, 2022

- The Capital Allocation Question Amid Regime Shifts - May 14, 2022

- Job Market, Credit Spreads and Inflation Expectations - May 7, 2022

- Bank of Japan, European Economic Cycle and the Fed - April 30, 2022

- Commodities and Commodity Cycles - April 17, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

Financial Conditions

Source: Bloomberg

Interest Rate Trajectory

Source: CME Group

Earnings

Salesforce (CRM) reporting after the close on Tuesday:

- Consensus: EPS est. $0.94; Revenue est. $7.37bn

Commentary on the following will be monitored:

- Customer adoption and growth rates per product

HP Inc. (HPQ) reporting after the close on Tuesday:

- Consensus: EPS est. $1.06; Revenue est. $16.07bn

Commentary on the following will be monitored:

- PC market and hardware market at large

Chewy (CHWY) reporting after the close on Wednesday:

- Consensus: EPS est. ($0.13); Revenue est. $2.47bn

Commentary on the following will be monitored:

- General developments in the pets market

- Customer acquisition vs. life-time value

- Returns on CAC

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial