The Capital Allocation Question Amid Regime Shifts | Top Things to Watch this Week

Posted: May 14, 2022, 9:55 p.m.

The Capital Allocation Question

"The market's very emotional but over time, doing something logical and systematic does work. The market eventually gets it right." - Joel Greenblatt

Path Dependency and Structural Changes

Over the course of the last few weeks and months, I've recurringly mentioned "Regime Change" as a guiding principle for what we may be in for across risk assets. A world in which onshoring and friend-shoring increases resiliency while capital remains relatively scarce in old-economy sectors.

Most of the time, financial assets and the world in general show a substantial degree of path dependency -- today is very much like yesterday. In and of itself, it makes market participants lean on past expectations and infer forward. That works until underlying fiscal, monetary and economic conditions undergo a structural change.

Structural changes leading to a shift in secular headwinds and tailwinds call for a questioning of present economic assumptions. How are markets pricing inflation expectations? How does money supply, credit and income affect how capital is channeled to various assets?

These are critical questions for the risk landscape going forward, which is why I want to start by pointing to expectations for the U.S. economy.

US Economic Projections

Source: Bloomberg

We see that the current forecast is that in 1.5 years from now, inflation will be back near 3% before settling in slightly above the Fed's 2% average inflation target in 2024.

It is precisely because of those expectations that 10yr breakeven rates remain below 3% and 5yr 5yr forward inflation expectations are very contained at 2.35%.

U.S. 10 year Breakeven | U.S. 5yr 5yr Forward Breakeven

Source: Bloomberg

Sidenote:

10yr breakeven rates are a measure for the required rate of return over the next 10 years in order to breakeven on inflation. 5yr 5yr forward breakeven rates are an expectation about the required rate of return on 5 year gov. bonds in 5 years from now in order to breakeven on inflation.

If one wants to extract an edge, we need to question the assumptions on which risk assets are currently priced.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Capital investment in asset-heavy industries has been lackluster to say the least. Devoid of sufficiently attractive rates to allocate capital to long-term, capital-heavy projects, investors preferred high-margin technology businesses over "old-economy" peers. That resulted in increased cost of capital for energy, industrial and material companies while future promises in tech were flooded with money.

We return to what has changed and what let's me question the assumption of a 2019-style economy beyond the current inflationary period (and the economic expectations that come with it.)

1.) Onshoring, Friend-shoring, Resiliency Build-Up and De-Specialization

The world has gone through a massive cycle of globalization ever since the 1980s, and at an accelerating rate since China's admission to the WTO in 2001. The labor arbitrage between countries has led to vast wealth creation in China and lower consumer prices in the west. Along with technology enhancing deflationary forces, the world has enjoyed comfort around the idea of producing where it's cheapest.

Increasingly so, nation states realize that partnerships and alliances with adversaries turn out to be much more fragile than previously assumed. Initially as a result of Covid and now enhanced by the bifurcation of trade zones due to the Russian invasion of Ukraine, nations are turning inward. Just-in-time (JIT) production is falling out of popularity while just-in-case (JIC) is gaining traction.

Two examples of increased protectionism of domestic interests:

- Indonesia's ban on palm oil exports

- India's move to not only step in to buy Russian energy, but also ban wheat exports in a move to secure domestic food supplies

The decentralization of manufacturing naturally comes with an increase in production costs and a need to retrain, rebuild and reinvest in forgotten areas of our economy. The widely understood principle of specialization falls away when countries around the world are putting more weight on independence.

2.) Returns Lead Capital

Similar to the profession of money management, companies have to put up a track record in order to attract capital. Over the last 12 years, we've seen 3 downturns in hydrocarbons and commodity returns too dismal to compete with other attractive areas such as tech.

As a result, companies themselves cut back on spending and have underinvested in new resources for the last 6-7 years. Only when capital returns and management teams have shown sufficient performance to start re-investing in the business will the economy experience some supply-side relief in resource-heavy industries.

Capital Spending in the Old Economy | Crude Oil, Copper and Aluminum

Source: Bloomberg Intelligence

3.) Protectionism and Wealth Gap

This is arguably a very hot topic as it spans across the societal discourse. It is also not a secret, however, and will set the stage for the preferences of policy makers going forward.

Coming off of a period of unionization, tariffs and domestic production, Reaganomics worked because 1.) the inflationary period of the 1970s got rid of a lot of debt and 2.) the western world deregulated and centralized production in the world's most efficient areas. As addressed, China as the global manufacturing hub only accelerated those deflationary dynamics.

As the pendulum moved towards increased specialization and a concentration of wealth, people around the globe have become increasingly concerned about their representation in the economy. As a result, populism is on the rise and policy makers around the globe ask themselves how they'll address what voters' concerns.

Inevitably, an increase in taxation, redistribution of resources and more regulation alongside dynamics #1 and #2 are again inflationary.

Income Inequality USA and China

Source: World Inequality Database

More importantly, though, we have to wonder what a redistribution of wealth and resources may mean for the flows of capital in the real economy. Unlike what we've experienced in the recent past, the lower income bracket tends to spend on hard assets (food, energy etc.) With initiatives to redistribute - or at least enhance the perceived economic well-being of the lower income class - also come enormous inefficiencies inherent to government involvement. Again, inflationary.

While much of this writing certainly addresses systematic inflationary pressures catalyzed by current world events, waves of inflation and disinflation will ebb and flow. We are likely undergoing a peak in nominal inflation, but may settle in at above-consensus estimates over the medium to long-run. A shift in those expectations will play out over time. The pendulum of decentralization of global supply chains will reverse in the fullness of time, at which point demographic headwinds will bring back fears over deflation. BUT. One step at a time.

The Fed will have to make a trade-off between demand destruction affecting the population vs. inflation eroding purchasing power. Insofar as they decide to engage in demand destruction and reduce wage pressures, markets will have to deal with a decline in the money supply as well as a shift in capital flows away from risk assets.

At points where the Fed steps off the pedal, we are likely going to see a sequence along the lines of:

- Treasury yields, breakeven rates and forward inflation expectations come off

- Tech bounces with hopes inflation is a lesser concern

- Natural resources accelerate on the upside

- The market course-corrects the Fed and the central bank returns to tightening

Be sure to check out prior writings of Top Things to Watch:

- Job Market, Credit Spreads and Inflation Expectations - May 7, 2022

- Bank of Japan, European Economic Cycle and the Fed - April 30, 2022

- Commodities and Commodity Cycles - April 17, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

China Credit Impulse and Money Supply

Source: Bloomberg

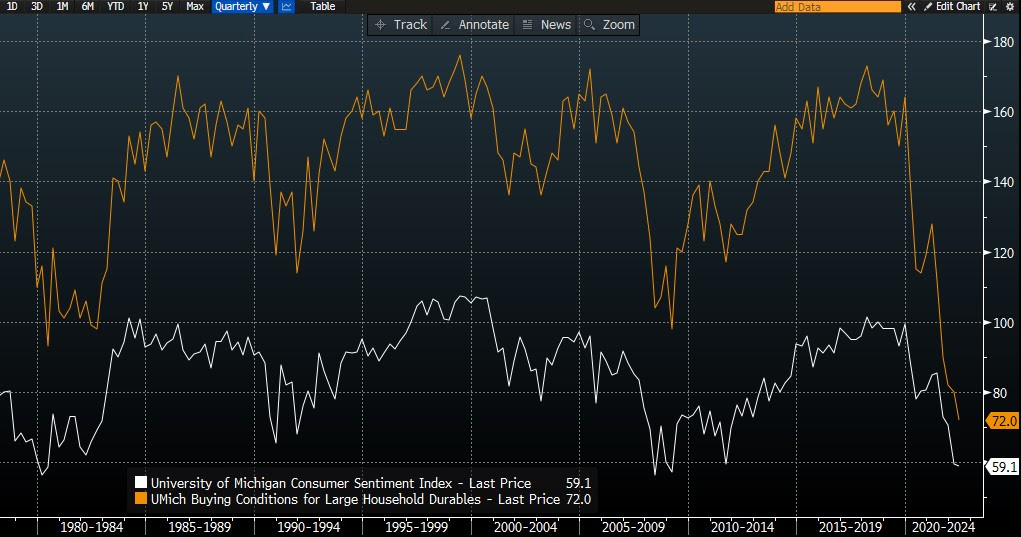

The U.S. Consumer

Source: Bloomberg

Credit Spreads

Source: Bloomberg

Europe - U.S. Natural Gas Price

Source: Bloomberg

Earnings

Walmart (WMT) reporting before the open on Tuesday:

- Consensus: EPS est. $1.46; Revenue est. $138.12bn

Commentary on the following will be monitored:

- Margins as input costs rise

- Pricing power

- Spending on durable goods and consumer appetite

Home Depot (HD) reporting before the open on Tuesday:

- Consensus: EPS est. $3.66; Revenue est. $36.36bn

Commentary on the following will be monitored:

- Housing market amidst rising mortgage rates

- Supply constraints in the face of China lockdowns restraining the global flow of goods

Target (TGT) reporting before the open on Wednesday:

- Consensus: EPS est. $3.00; Revenue est. $24.42bn

Commentary on the following will be monitored:

- Shape of the consumer

- Economic outlook as durable goods spending is expected to settle in (shift from goods to services)

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial