The Fed's Moment of Clarity | Top Things to Watch this Week

Posted: April 30, 2022, 11:34 p.m.

Mr. Market, Central Banks and the Fed's Moment of Clarity

"Only when the tide goes out do you discover who's been swimming naked." - Warren Buffett

Mr. Market Is An Extrapolation Mechanism

After taking a week off, we are back with Top Things to Watch and I could barely think of a better one to cover macro. With the Bank of Japan taking a "Whatever it takes" stance on JGBs, a negative GDP print earlier this week and a Fed meeting up next, let's dive into the macro flow chart of the days and weeks ahead.

Over the course of the last couple of months, we began writing about the increased probability of a shift from inflation to recession fears; the Fed tightening into a slowdown to begin with, commodities putting a lid on economic growth and margin compression as input costs rise. Coupled with a gradual shift away from global trade and fiscal dominating over monetary, the macro gods are painting interesting times ahead.

But let's start in March of 2020 in order to understand where we are right now.

On the back of the initial Covid shutdown in March of 2020, economies globally committed to record liquidity levels that would ultimately result in conditions unprecedented until that point. The one reality that didn't change: the expected return of an asset decreases as the price of the asset goes up. You either enjoy the return in the future or pull the returns forward; both things can not exist simultaneously.

Central banks and fiscal authorities made a decision and went with present returns over future expected gains. As is the case with most things, people are rarely aware of the water they swim in. This is ultimately what makes market forecasters and market participants alike extrapolate and assign an abnormal persistence to present conditions; as history teaches us, however, the mean price of an asset is rarely the mode. This leads us to the conclusion that there are few times in which the market sits at a happy equilibrium with supply forces being equal and opposite to demand forces. While "operating" around a longer term mean, prices mostly find themselves at the extremes.

Bank of Japan and Yield Curve Control

This is where we get into the first part of this piece today: the Bank of Japan's commitment to YCC (yield curve control.)

In an article published by the Banque De France back in March of 2021, the authors wrote that "there are no direct limits to the size of a central bank's balance sheet. The fact that the Bank of Japan's balance sheet now stands at 130% of GDP illustrates that point." Driven by the idea of modern day MMT and YCC, theoretical observations like these create normative worlds in which unintended consequences or a change in conditions do not exist. Critically, though, it is only normative.

Just to recall how MMT is supposed to work: via massive injections of liquidity - while taking on lots of debt, - economic benefits are supposed to trickle down to the populous of a country. Perhaps, this is a sound idea in theory, but there are 2 obvious flaws embedded here. 1.) Wealth disparity leading to populism around the globe has never been more pronounced (indicating that economic benefits are not getting distributed as broadly as one would have hoped) and 2.) taking on enormous amounts of debt works until inflationary pressures have to be combatted.

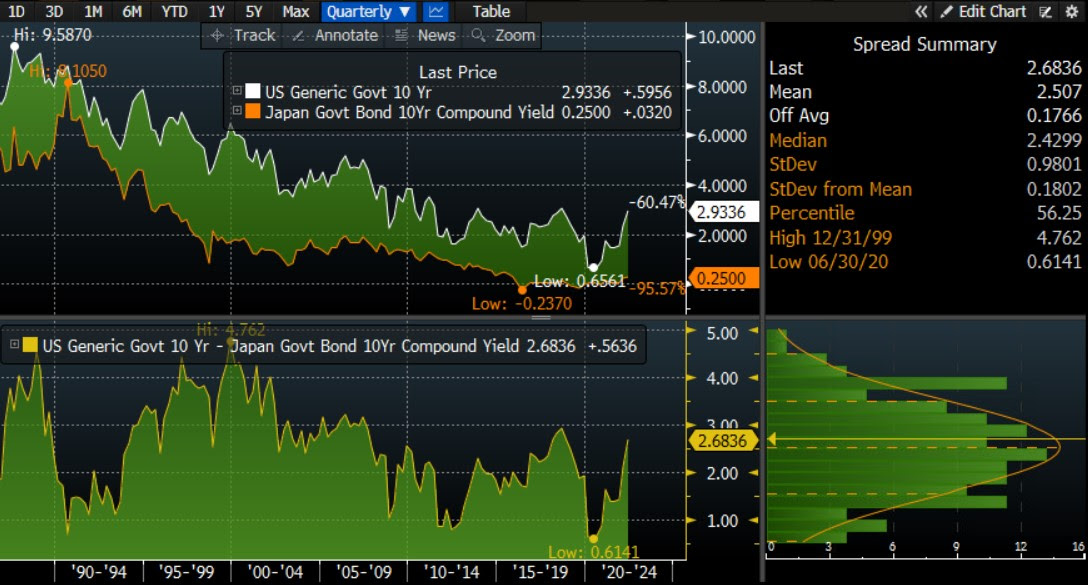

Fast forward a bit more than a year from that article, the yield differential between Japanese Gov. Bonds and U.S. Treasuries has widened as a result of increasingly diverging central bank policies. Given that Japan is burdened by extremely high debt levels combined with import inflation on energy goods, the BoJ was forced to choose between rising yields or a weakening currency -- they chose the latter as they now defend 25bps on the 10yr JGB.

What could bring some relief to the currency pair?

1.) The Bank of Japan starts becoming incrementally less dovish as global commodity inflation continues to burden the consumer and commits to fight the demand side.

2.) Externally speaking, the Fed could become incrementally less hawkish and therefore drive down the yield differential (putting a relief on the currency pair.)

For the time being, it is a question of confidence in the BoJ's ability to conduct policy.

BoJ YCC Statement | USD - JPY Currency Pair | 10yr Treasury Yield - 10yr JGB Yield Differential

Source: BoJ, Bloomberg

Some of these issues are not isolated to Japan, of course, and one has to proceed with nuance when thinking of the risks currently in the system; however, we can look at what is known.

Japan is one of the largest energy importers globally with close to 90% of the country's energy use dependent on imports (a return to nuclear could get it to ~80% dependency.) In fact, before China became the world's largest LNG importer, Japan held the #1 spot.

In addition to the country's own energy needs, Europe is now receiving LNG shipments from Japan as the continent is struggling to refill its inventories. The confidence game will continue as a weakening Yen has vast implications for Japan's large FDI investments (a weakening currency would ultimately lead to a lesser ability to invest abroad and collect coupons.)

Speaking of hard choices, lets turn to the European business landscape and how a potential oil embargo may impact Europe's largest economy Germany.

Oil Embargo Impact on German Econom

Similar to Japan, the ECB is yet again dealing with a multitude of different country dynamics, all of which are highly dependent on Russian energy. Choices were made over the course of the past decades and they are now going to impact consumers, trust in institutions and the CB's ability to set "appropriate" policy for the current environment.

Turning to Europe's largest economy, Germany, we observe that the German Bund has rallied from negative territory to 0.938% as of Friday's close. In order to understand this rally against the backdrop of deteriorating economic conditions, let's first take a look at April's IFO Institute surveys (sentiment across sectors in Germany.)

IFO Institute | April Survey Results

Source: IFO Institute

The German business climate has not been this bad since the depths of the Covid recession as Germany's industry is under the pressure of high energy costs and a slow Chinese economy. Despite the benefits of the EUR/USD pair trading at ~1.05 as of Friday's close, any gains from exports are offset by a global slowdown. Against this backdrop of deteriorating business conditions, Germany was the last domino to fall in its opposition against a Russian oil embargo. It is now expected that EU policy makers will move forward with a ban on Russian oil, which will further strain business and consumer confidence.

Bundesbank On Potential Economic Consequences Of The War In Ukraine

Source: Bundesbank

Unlike the BoJ, the ECB has not engaged in YCC despite a 150bps rally in the German Bund. Can the ECB afford to ease policy while Euro economies face the headwinds of heightened energy and food costs? At whatever 2nd and 3rd order costs this current war comes, it's hard to see winners outside those that own commodities and have the ability to lever hard assets in the future.

German Bund Yield | 10yr US Treasury Yield - German Bund Yield Differential

Source: Bloomberg

Over the last few decades, globalization has led to a preference of efficiency over resiliency. As geopolitical relationships strengthened and global trade blossomed, commodities played a relatively small role within the context of the aggregate GDP mix. That has changed and the question has become: for how long will commodities strain economic growth and put a floor under inflation?

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

A Moment of Clarity | Fed Policy Decision on Wednesday

In the face of the BoJ's YCC program alongside weak business sentiment in Europe, we will watch the Fed's rhetoric extremely closely on Wednesday. As reflected by an increasingly strong U.S. Dollar, the Fed has been incrementally more hawkish compared to other central banks and we will face a moment of truth as they announce next steps on the rate hike as well as QT front. While a 50bps hike is expected, it is all about the path forward from there.

If we turn to the shadow rate, which aims to quantify the effects of QT/QE, the Fed has already "hiked" 9 times and is anticipated to bring the Fed Funds rate up to 275-300bps by year end. While there is an argument to be made that those rate hikes are already priced in, I cast doubt at the idea that markets fully appreciate the implications of another 250bps of hikes.

We tend to think that they will shock the market initially and will increasingly face waning demand. As such, the probabilities are geared towards less hikes than currently "priced in".

Fed Shadow Rate

Source: Bloomberg

Fed Funds Rate Probabilities by December

Source: CME Group

Financial Conditions, Corporate High Yield Spreads, Money Market Assets

Source: Bloomberg

As we refer to Wednesday's Fed meeting as a Moment of Clarity, how committed are Fed Chair Powell and his colleagues in the fight against inflation?

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

Commodity Supercycles

Source: Wells Fargo

China Credit Impulse | Xi Address to Politburo

Source: Bloomberg

China Politburo (as reported by the SCMP):

- "By its nature, capital pursues profits, and if it is not regulated and restrained, it will bring immeasurable harm to economic and social development. Attention should be paid to ensure economic development is inclusive and the primary distribution [of income] is fair."

- "We will unswervingly follow the road of common prosperity for all the people,"

- "[We] should accurately detect the key areas and key objects that may bring systemic risks... to address and defuse risks at an early stage,"

- "The pandemic and Ukraine crisis have led to increased risks and challenges. Our economic development is becoming more complicated, severe and uncertain. We are facing new challenges in stabilising growth, employment and prices,"

Chinese Yuan

Source: Bloomberg

A weakening Yuan and improving credit conditions are going to help the Chinese economy (insofar as lockdowns will become less restrictive.)

Gasoline and Crude Oil Inventory & Inventory Level Seasonality

Source: Bloomberg

Airlines are expecting a record travel season ahead -- can refiners meet demand and ensure sufficient supplies?

Earnings

Marathon Petroleum (MPC) reporting before the open on Tuesday:

- Consensus: EPS est. $1.12; Revenue est. $32.06bn

Commentary on the following will be monitored:

- Refinery utilization rates amidst declining inventory levels in the U.S. and worldwide

- Export volume and energy security

- Margins

Advanced Micro Devices (AMD) reporting after the close on Tuesday:

- Consensus: EPS est. $0.90; Revenue est. $5.52bn

Commentary on the following will be monitored:

- Semiconductor inventory cycle

- Bottlenecks in the production cycle

Cheniere Energy (LNG) reporting before the open on Wednesday:

- Consensus: EPS est. $3.16; Revenue est. $5.12bn

Commentary on the following will be monitored:

- LNG demand and export volume

- Long-term contracts with Europe and Asia-Pacific

Cameco (CCJ) reporting ahead of the open on Thursday:

- Consensus: EPS est. ($0.02); Revenue est. $321.87 million

Commentary on the following will be monitored:

- Uranium demand as energy security moves up the priority list around the globe

- Spot vs. future prices (realization of gains in the context of ongoing hedges)

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial