Top Things to Watch this Week | Fed Policy, Commodities, Earnings and More

Posted: April 10, 2022, 11:13 a.m.

Market Expectations

"When the facts change, I change my mind." - Winston Churchill

Fed Policy and Commodities

The big elephant in the room is Fed policy and the extent to which the FOMC is going to combine QT with rate hikes in order to accomplish the committee's long term mandates around 2% average inflation as well as maximum employment. While there's one camp in the market that believes the Fed will pivot and reverse its hawkish policy stance, there's another group that thinks the FOMC has no choice but to break the back of inflation via a meaningful demand shock.

The issue in both cases is that 1.) underinvestment in the old-economy does not get resolved via monetary policy and 2.) tightening lending standards may further exacerbate a lack of financing for various commodity projects.

Time and again, capital markets have relied on the Fed to come to the rescue and create a win-win scenario across the risk curve; when economic conditions were poor, the Fed would increase accommodative measures; when conditions were favorable by themselves, the central bank would let markets do their job. The type of goldilocks environment markets have gotten accustomed to led to divestments from traditional cash-flow generating businesses while favoring lottery tickets with big promises. Interestingly enough, despite below-average returns in new-economy stocks recently, there appears to be an inherent inertia when it comes to flows of capital (specifically in hydrocarbons.) This dynamic isn't only visible in ETF flows, but also in CAPEX numbers across old-economy industries.

If we combine a lack of capital in the old economy with the inertia of capital shifting back into the space despite higher returns, a scenario of higher for longer becomes much more credible than "the cure for high prices is high prices" may suggest. In fact, as financing needs for working capital increase from commodity traders - Trafigura, Glencore, etc. - higher prices may further constrain supply on a volume basis.

Under the assumption of a resiliency build-up across nations, it will take time and capital to add capacity and ultimately resolve structurally driven inflation from the supply-side.

In the meantime, policy makers will have to resolve what they can and use demand destruction as a temporary solution to calm inflation. Just how far they will have to push the envelope will likely depend on market signals and the degree to which an increasingly hawkish rhetoric will get reflected in the prices of financial assets. Via a reverse wealth effect that is likely going to push down wages and therefore a substantial part of businesses' input costs, an inflation relief is very possible and most likely probable.

Average Hourly Earnings

Source: Bloomberg

While the Fed aims to engineer a soft landing, tightening cycles are rarely recession-proof. In the absence of extreme accommodation as a last-resort tool, longer term structural forces could dampen economic growth and leave us with much lower risk-appetite for longer.

Please reach out to info@Bluelinefutures.com or call 312-278-0500 with any questions. Our trade desk is here to help!

Financial Markets Are Not Cooperating

By year end, markets are pricing in a 74.4% likelihood that the Fed Funds target rate will be at 250-275bps or higher. In conjunction with quantitative tightening via a balance sheet runoff, financial conditions are expected to tighten materially from ultra-accommodative levels.

Fed Target Rate Probability | Dec. 14, 2022

Source: CME Group

Interestingly enough, financial markets have not cooperated to the degree one would have expected given the FOMC's current rhetoric. In other words: financial markets have remained fairly elevated given what bond markets have already priced in. It is paramount to remember that "priced in" is a relative term in that regard.

GS Financial Conditions Index

Source: Bloomberg

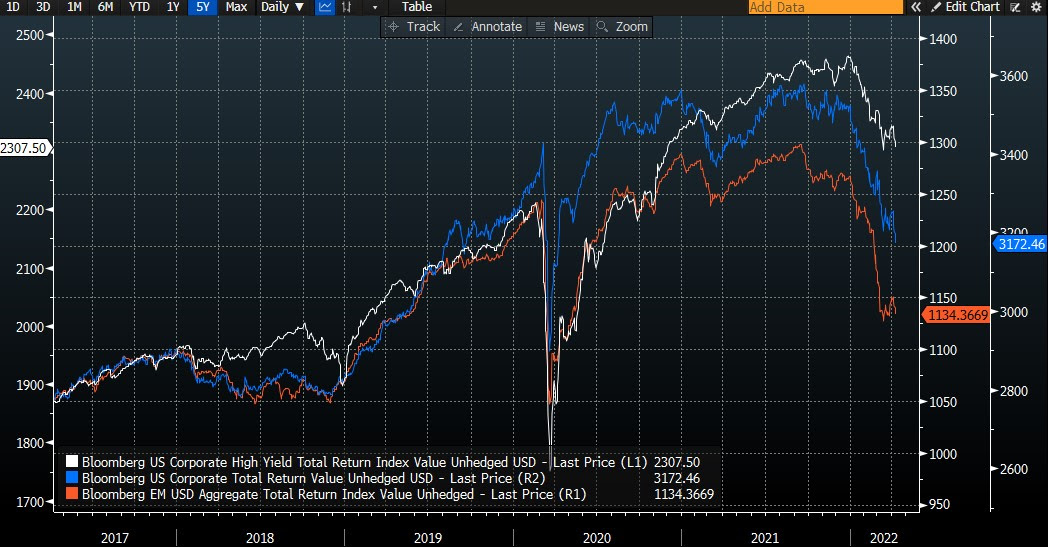

Markets and people alike are very fast to react at times and extremely reluctant to change at other instances. As former Federal Reserve Bank of New York president Bill Dudley mentioned during a Bloomberg TV appearance this week, it may take as much as the Fed shocking markets in order to bring risk assets down and tame inflation. The extent to which this is necessary will depend on the markets' "cooperation". We will not only monitor equities, but also keep a close eye on credit markets as a signaling mechanism for just how hawkish central banks need to be with setting new policies.

Bond Indices | HY OAS Spread

Source: Bloomberg

We are at the point where macro reality meets Federal Reserve policy. It will be upon risk assets to signal just how addicted they are to liquidity and therefore dictate what the Fed will do. According to a study done by Bridgewater, ~40% of US equities are highly sensitive to liquidity conditions. For the first time in 40 years, markets are facing structural price inflation that may cool down temporarily but stick around for much longer and therefore put a lid on economic growth.

Markets will remain irrational and move from one excess to the next. If we zoom out and take a look back on financial history, it proves nothing more than expressing this very mentality of fear and greed. The same financial history is likely going to rhyme in some form, which makes the study of it ever more compelling.

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (E.T.)

China

Data Release Times (E.T.)

Eurozone (decreasing importance of events from top - bottom)

Data Release Times (E.T.)

Food for Thought

Crude Oil Open Interest and Price

Source: Bloomberg

Gold Managed Money Positioning

Source: CME Group

U.S. 5yr 5yr Forward Breakeven

Source: Bloomberg

Earnings

Carmax (KMX) reporting before the open on Tuesday:

- Consensus: EPS est. $1.28; Revenue est. $7.67bn

Commentary on the following will be monitored:

- Used car prices and shortages in the new car market spilling over into availability of used cars in the future

- Consumer spending appetite

- Commentary on tighter central bank policy, lending and the broader macro picture

Delta Airlines (DAL) reporting before the open on Wednesday:

- Consensus: EPS est. ($1.33); Revenue est. $8.76bn

Commentary on the following will be monitored:

- Updated travel data and projections (particularly interesting will be business travel)

- Work from home and potential impacts as employees have a greater mobility

- Debt load and plans to de-lever the balance sheet

JP Morgan Chase & Co reporting before the open on Wednesday:

- Consensus: EPS est. $2.74; Revenue est. $31.22bn

Commentary on the following will be monitored:

- Lending in a higher rates environment

- Housing market with higher mortgage rates

- Commodity markets amidst geopolitical tensions

- Flat 2s-10s vs. steep 3m - 10yr

Taiwan Semiconductor (TSM) reporting before the open on Thursday:

- Consensus: EPS est. $1.27; Revenue est. $16.97bn

Commentary on the following will be monitored:

- Shortages in chips

- Order backlog and semi inventory cycle

- CAPEX outlook and production considerations in other geographics

Additional Earnings: Wells Fargo (WFC), Goldman Sachs (GS), Citigroup (C) and Morgan Stanley (MS) all reporting before the open on Thursday.

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial