Corn

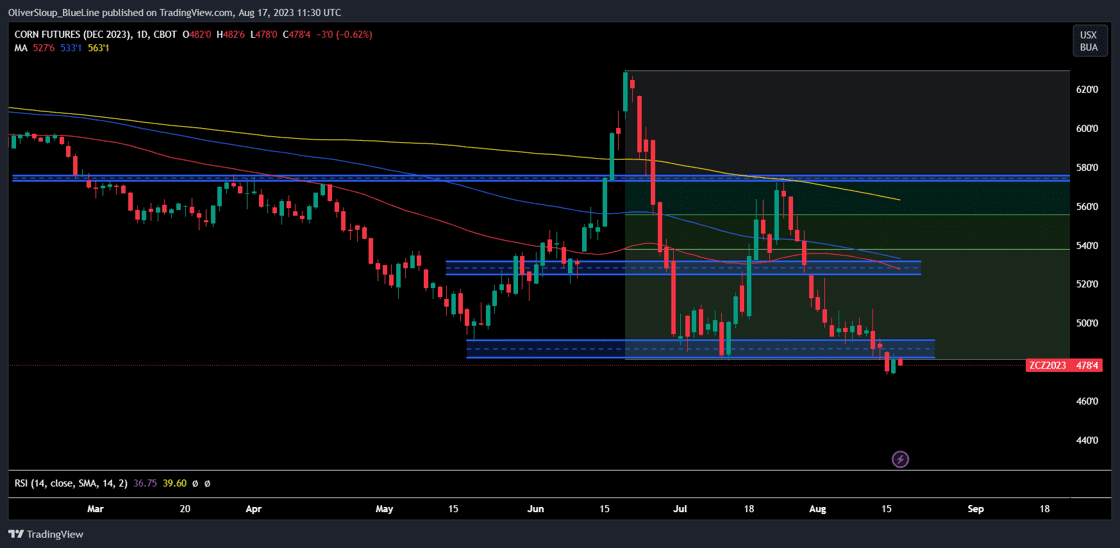

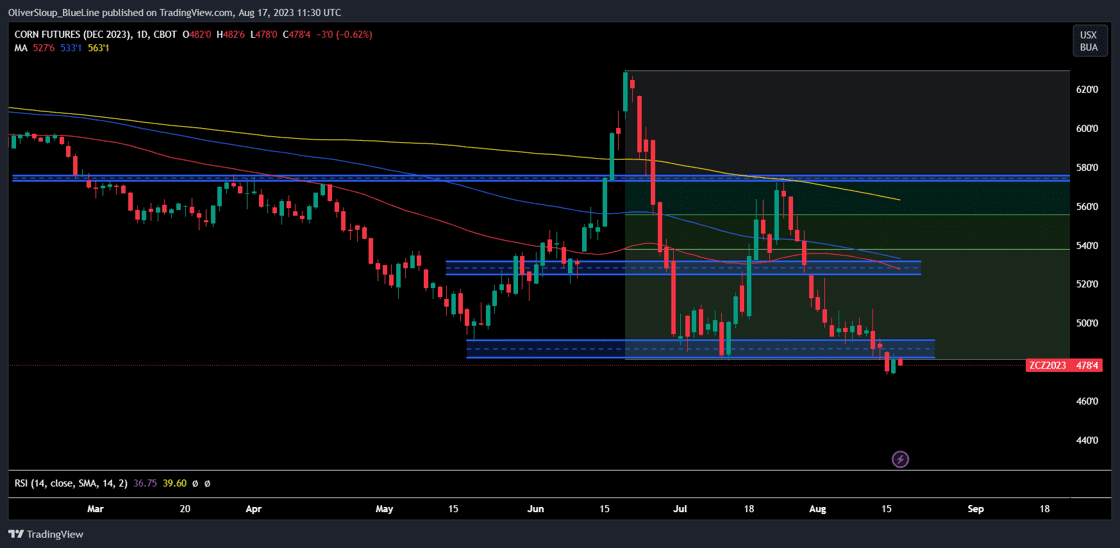

Technicals (December)

December corn futures managed to reclaim some ground yesterday, trading 6 cents higher at the close. As mentioned in yesterday's 2-Minute Drill, the Bulls need to see consecutive closes back above 480-482 to help encourage a bigger relief rally. A failure to do so keeps the Bears in control of the technical landscape. Below the chart is a look at the 5-year average price of December corn for this time frame. Recently this has been a time of year where the market has been able to consolidate and make an attempt at carving out a short term low.

News

Weekly Export sales will be out at 7:30am CT. Analysts are expecting to see old crop export sales from 0 to 250,000 metric tons and new crop export sales from 500,000-1,000,000 metric tons.

We will be on the eastern leg of the Pro Farmer Crop Tour next week. Be sure to follow us on YouTube, Twitter, and Facebook for the most up to date information.

Bias: Neutral/Bullish

Previous Session Bias: Neutral/Bullish

Resistance: 502-506 1/2***, 518-525 3/4****

Pivot: 480-482

Support: 472-476**

|

|

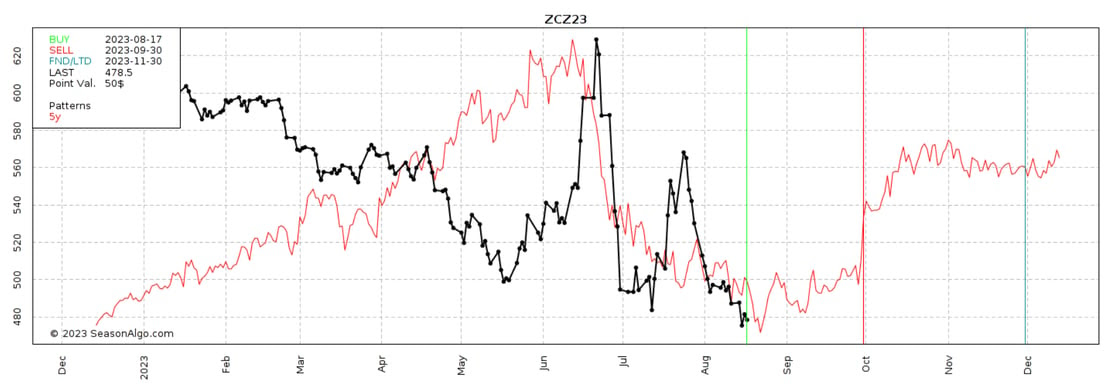

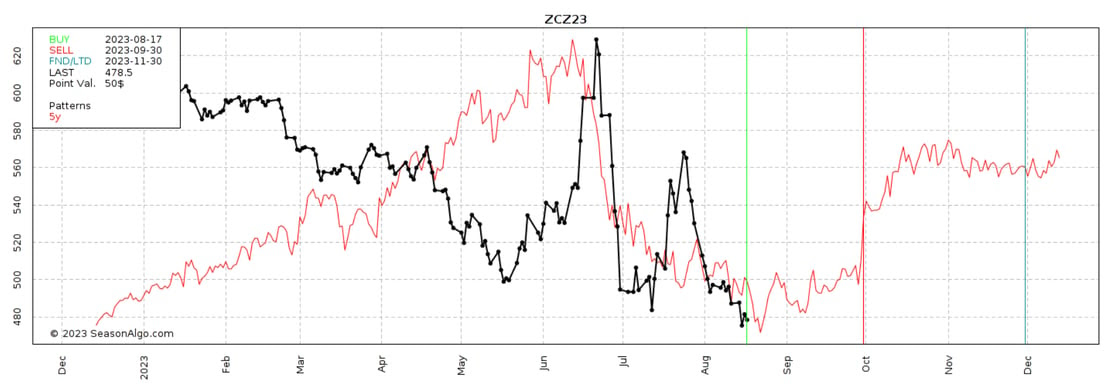

5-Year Average Tendencies

Over the last 5-years, this is a time of year where we've seen the market attempt to carve out a near term low. Whether or not that plays out this year is still TBD.

|

|

|

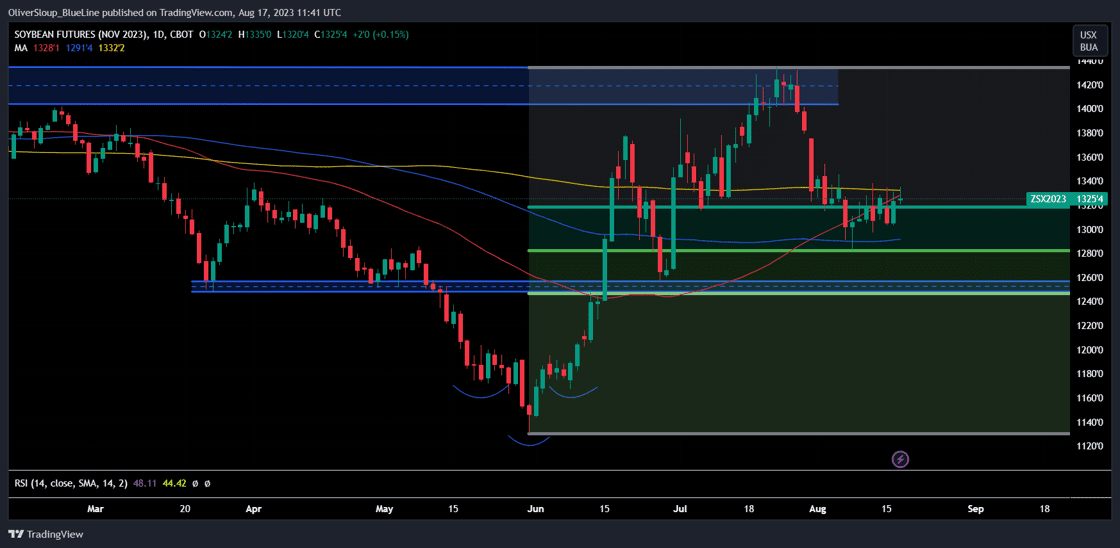

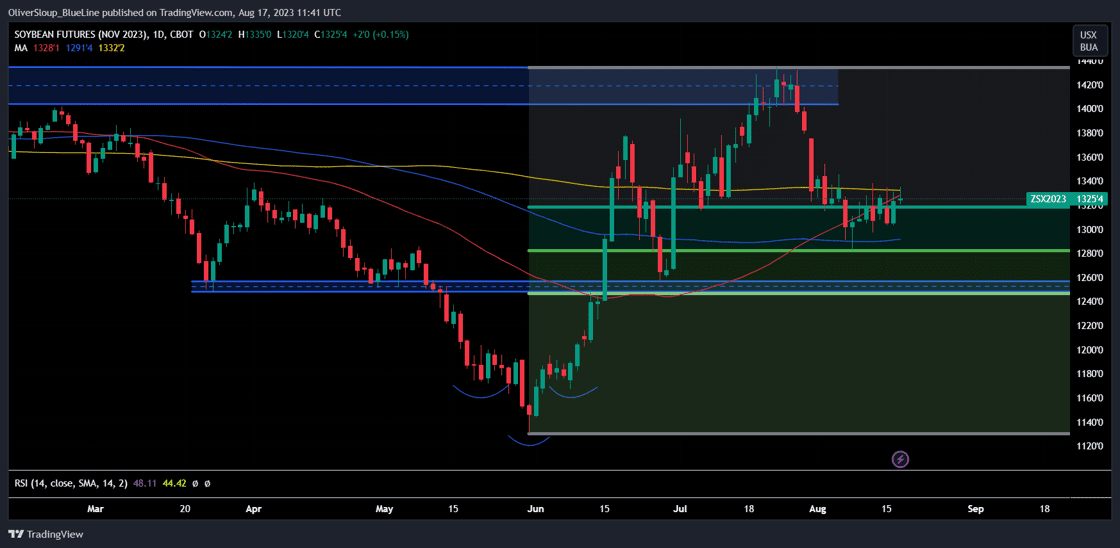

Technicals (November)

Soybean futures continue to linger and consolidate within our resistance pocket from 1324-1334. The sideways trade feels like the market is building up energy for a bigger directional move. With above normal temperatures and below normal precipitation in the forecast we like looking to the upside breakout. If the Bulls can achieve this, we could see an extension towards 1350-1355 with the next target above there coming in near 1370. A break and close back below our pivot pocket from 1291-1300 would neutralize that bias.

News

Above normal temperatures coupled with below normal precipitation levels could keep the market firm. The Pro Farmer Crop Tour will hit the road next week. Although it will be too early to get an estimated soybean yield it will give us a better look at the prospects.

This morning's weekly export sales report is expected to show old crop sales from 0 to 400,000 metric tons and new crop sales from 550,000-1,300,000 metric tons.

Bias: Bullish/Neutral

Previous Session Bias: Bullish/Neutral

Resistance: 1324-1334***, 1350-1355**

Pivot: 1291-1300

Support: 1282**, 1256-1260***

|

|

Wheat

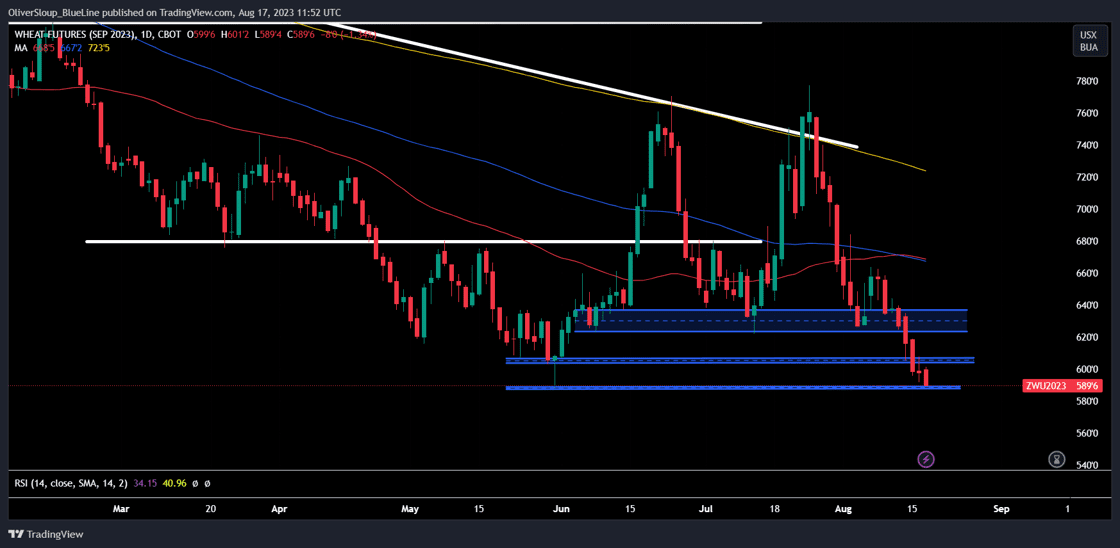

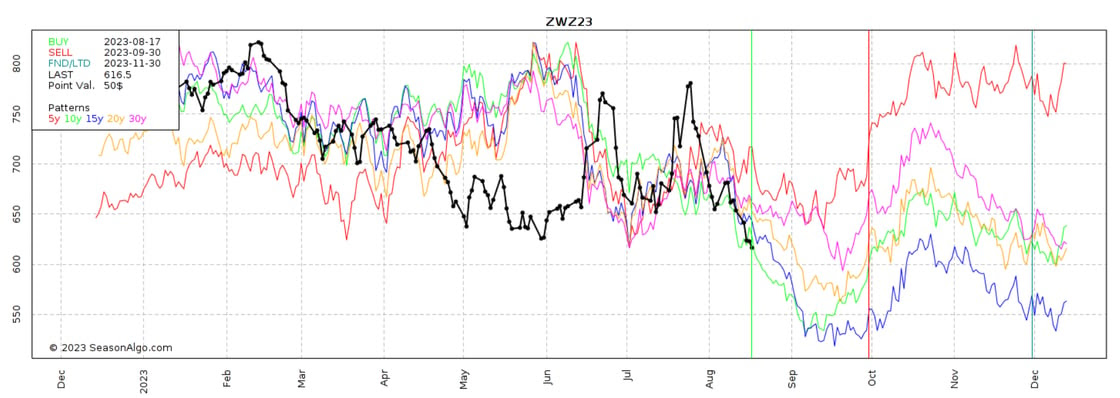

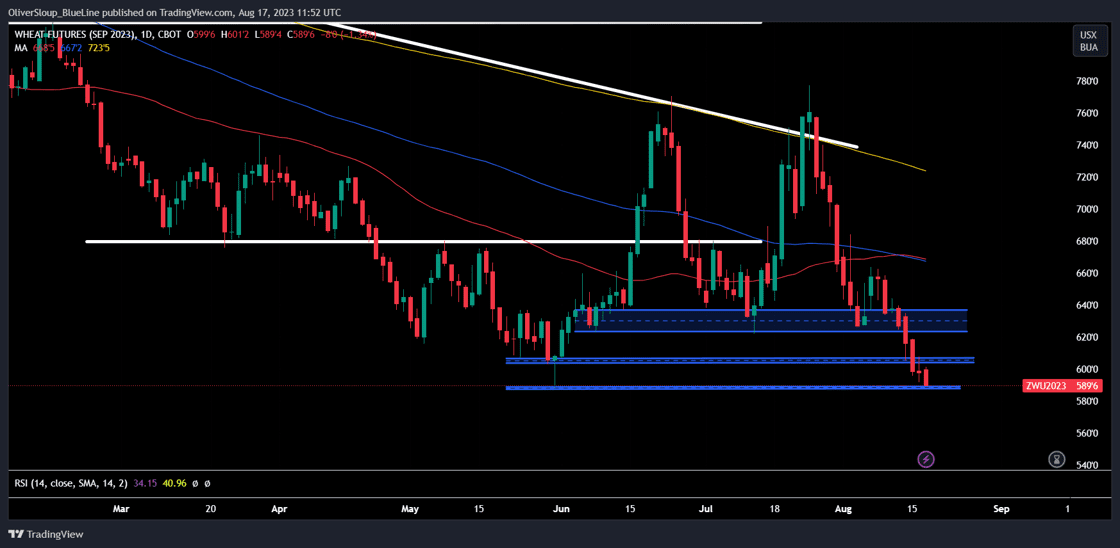

Technicals (September)

Wheat futures were more or less a dud in yesterday's trade, finishing the day fractionally lower while corn and soybeans were able to gain ground. That lackluster trade has spilled into weakness in the overnight and early morning trade, taking prices to retest the May 31st low. A break and close below here and we are in uncharted territory for this contract. Despite the threat of new contract lows, the RSI is only at 34, which is above what technicians typically refer to as "oversold". Funds seem to be more focused on seasonal tendencies than headline risk, we've outlined those historical patterns below the price chart.

News

India is in talks with Russia to import wheat at a discount to surging global prices in a rare move to boost supplies and curb food inflation ahead of state and national elections next year, according to four sources.

This morning's weekly export sales report is expected to show export sales from 200,000-525,000 metric tons.

Bias: Neutral/Bullish

Previous Session Bias: Neutral/Bullish

Resistance: 622-632***, 669-673***

Pivot: 603-607

Support: 587 3/4-591 1/2****

|

|

Seasonal Tendencies

Though the wheat market may be due for a relief rally, longer term averages for this time of year indicate potential for seasonal weakness into the first half of September.

|

|